Dec CPI Preview: SPX could surge/plunge more than 2%?

Key PPI Data for January 14th:

Monthly Change: 2024 The Producer Price Index (PPI) rose 0.2% in December.This was lower than the 0.3% expected and lower than the 0.4% increase in November.

Annual change: wholesale prices rose 3.3% y/y, up from 3.0% in November, while this figure also remained relatively high.

Core PPI: excluding food and energy prices. unchanged in December, up 3.5% y/y.

December CPI Comes: Options to Trade a Volatility Short Strategy?

Why 5% Matters for the 10-Year Treasury! Which Industry Will Impact The Most!

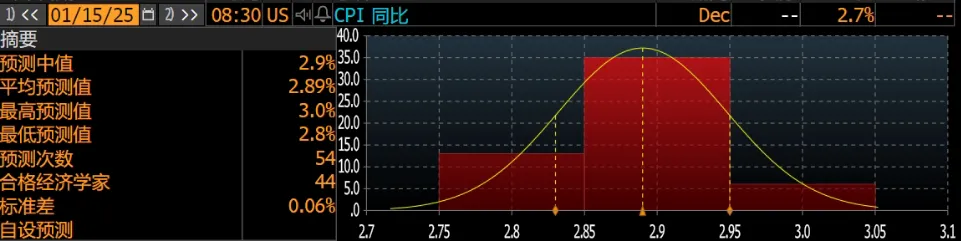

January 15 CPI Index Expectations:

The current consensus market expectation for December is:

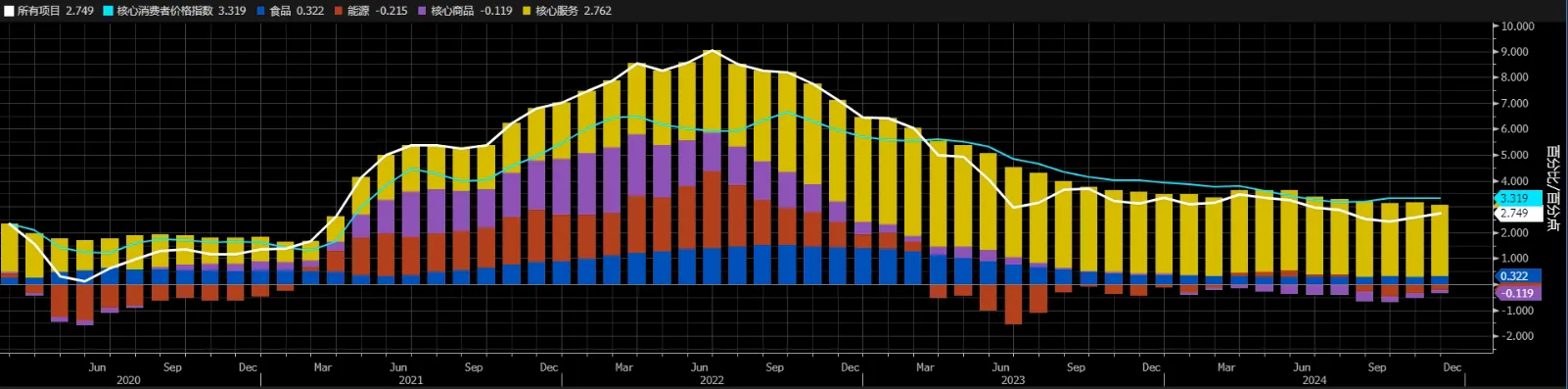

Headline CPI rose 0.4% from a year earlier, up from 0.3% in November, and increased 2.9% from a year earlier, above the Fed's 2% target and up from 2.7% in November.

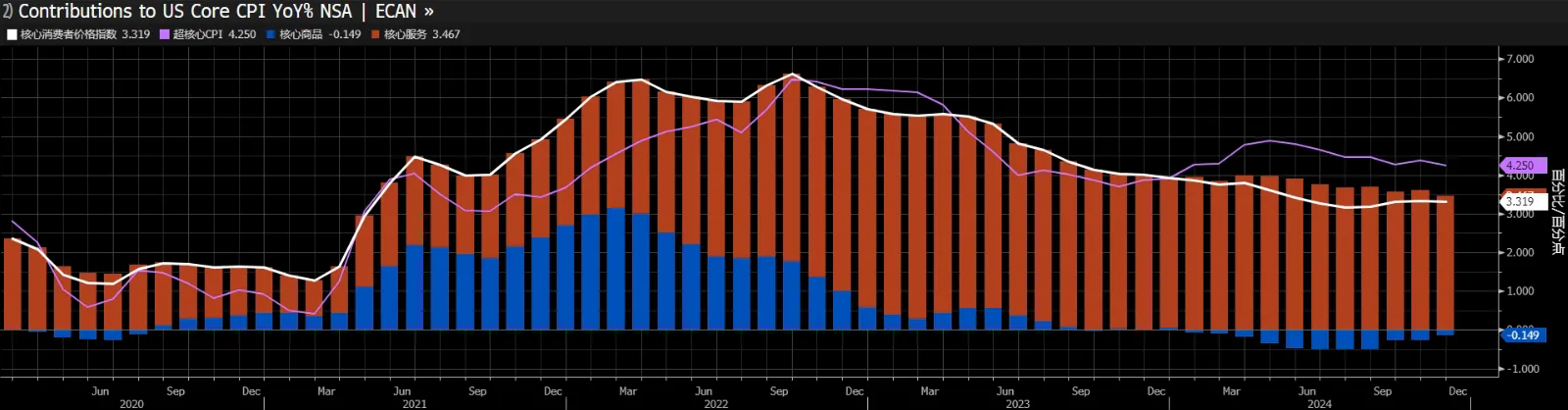

Core CPI rose 0.2% from a year earlier, down from 0.3% in November, and rose 3.3% from a year earlier, still above the Fed's 2% target and unchanged from the previous three months.

Discussion by Scenario

In a bad scenario, CPI exceeds expectations and the market goes down.

If the inflation numbers are higher than everyone expects, the market will speculate that the Fed may reduce its expectations for rate cuts or even raise interest rates.Once that happens, interest rates will become higher for both consumer loans and business loans.Higher borrowing costs have a negative impact on both corporate profits and consumer spending.And since corporate profits and consumer spending are especially critical to stock market performance, inflation numbers that are too high could have a bad effect on the stock market.

$.SPX(.SPX)$ could fall as much as 2% if core CPI increases by more than 0.3% in December from a year earlier, a scenario that has only a 5% chance of happening.

In a good or neutral scenario, the market expects CPI to ease, but caution remains, so stocks could move sideways or slightly higher.If the December core CPI increases between 0.17% and 0.23% YoY, it could push the S&P 500 up between 0.3% and 1%.In addition, if the year-over-year increase is less than 0.1%, the S&P 500 could jump 1.8% to 2.5% and $Cboe Volatility Index(VIX)$ would fall.

Longer term, inflation expectations are currently holding steady, although many election policies could put upward pressure on inflation.

The recent rebound in inflation is mostly due to base factors mostly expected, such as the rebound in CPI from September to November from 2.4% to 2.7% y/y. The core services subcomponent is solid, with the equivalent rent OER weight of 27% dropping to 0.2% YoY, driving the core services YoY down to below 0.3%.

The strength of tariff impositions in 2025 is unknown, and when inflation constraints are taken into account, assuming Trump moderately restricts entry of immigrants and tariffs are phased in, the shock to the US own CPI is less than 0.5%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- vibzee·01-15Exciting journey1Report

- AndrewWalker·01-15Possible outcome1Report