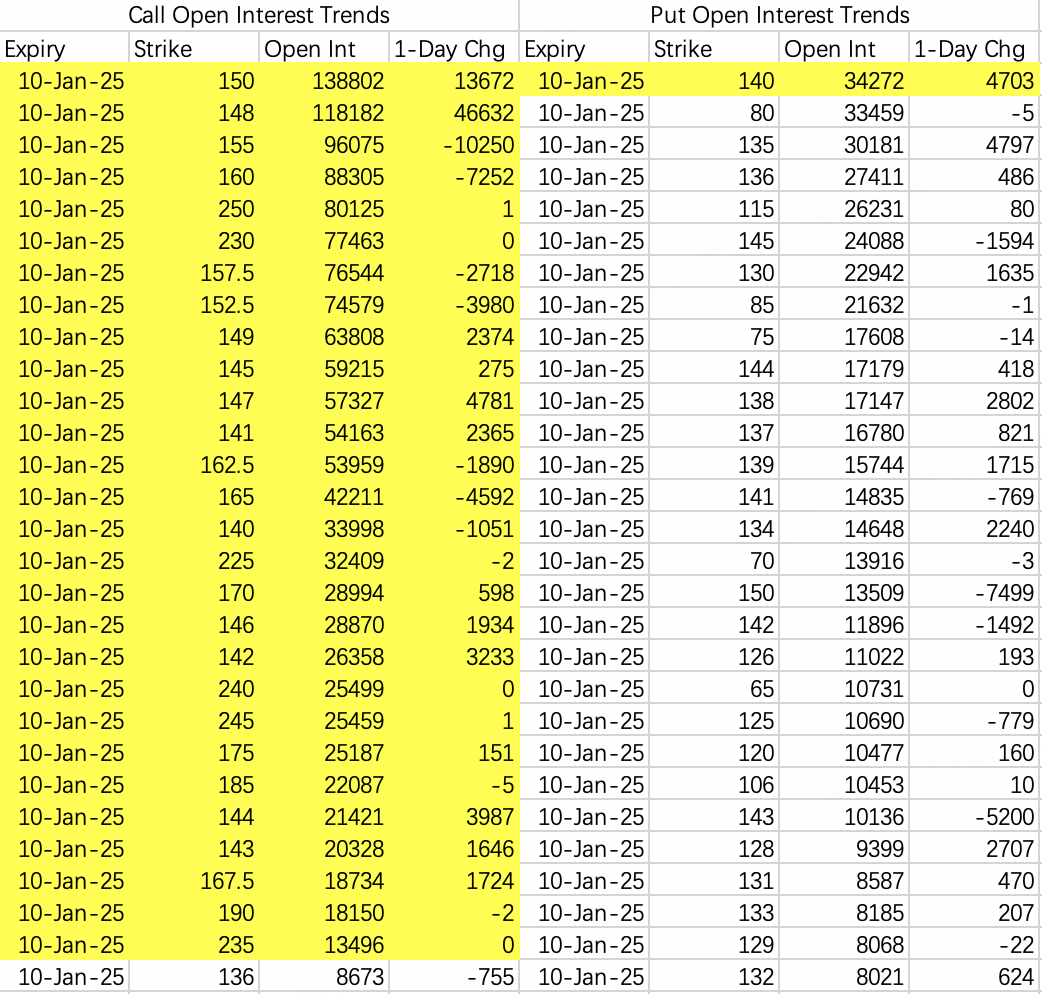

Nvidia opened 47,000 lots of 125 put options.

This Friday through next week looks dangerous.

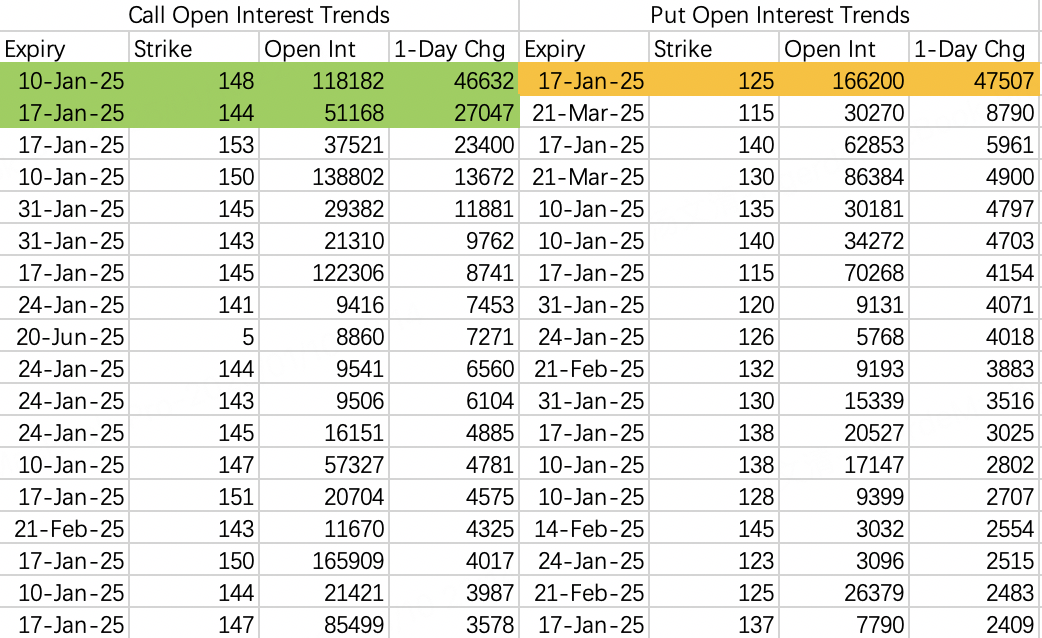

After killing the shorts last Friday (January 3rd) and the longs on Tuesday (January 7th), the shorts are striking again, opening 47,000 contracts of January 17 expiry 125 puts $NVDA 20250117 125.0 PUT$ .

This wasn't done through regular market trading; they likely placed direct orders due to good liquidity in next week's expiring options. From this order style, it seems the shorts aren't trying to hide their intentions, placing orders for whatever quantity was available, making it easy to spot in unusual activity screens.

On the bulls' side, institutions are implementing a call spread for next week, selling 144 calls against 148:

Sell $NVDA 20250117 144.0 CALL$

Buy $NVDA 20250117 148.0 CALL$

The reason they're not concealing their short intentions is likely because market makers also support a bearish view for the 17th.

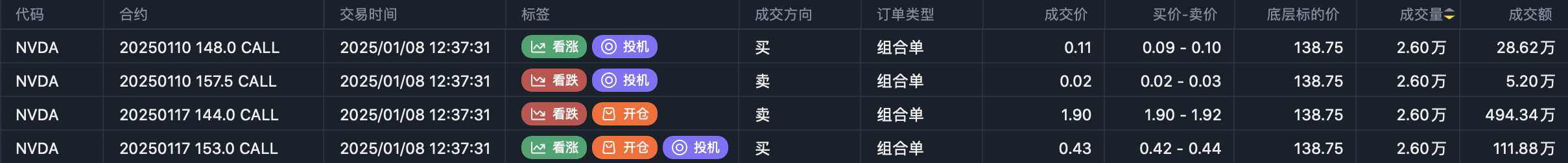

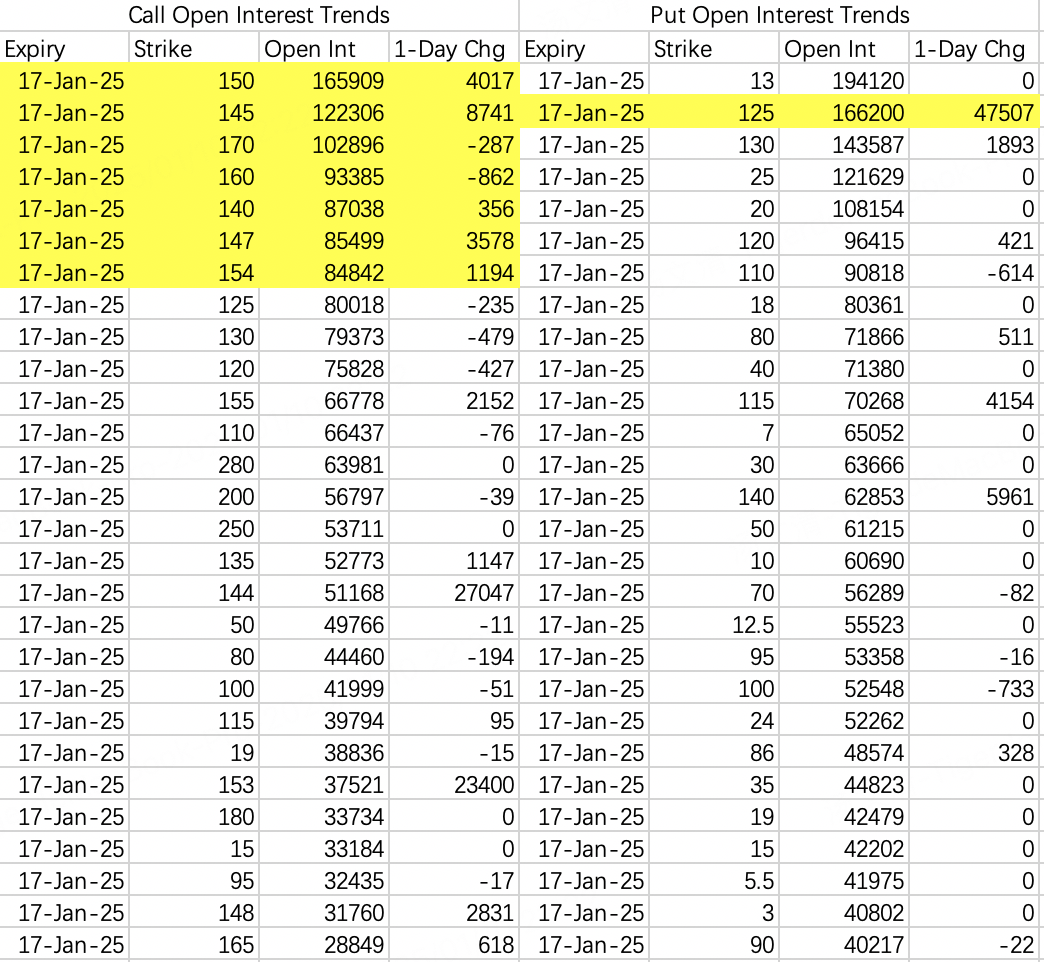

If today sees a sharp decline following Monday's low opening, according to January 10 expiry options details, all unclosed call positions above 10,000 contracts will essentially become worthless.

There are far fewer open put positions compared to calls, so they're not the primary target.

Then on the 17th, we might see a decline followed by a bounce, reaching above 130 but below 140, killing both bulls and bears.

So today might inversely mirror last Friday's pattern - falling on Friday, forced higher on Monday, continuing to fall before stabilizing. I also bought the 125 put $NVDA 20250117 125.0 PUT$ - it's cheap anyway, let's see where this goes.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.