The Fed shifts its attitude? Here are such trading opportunities

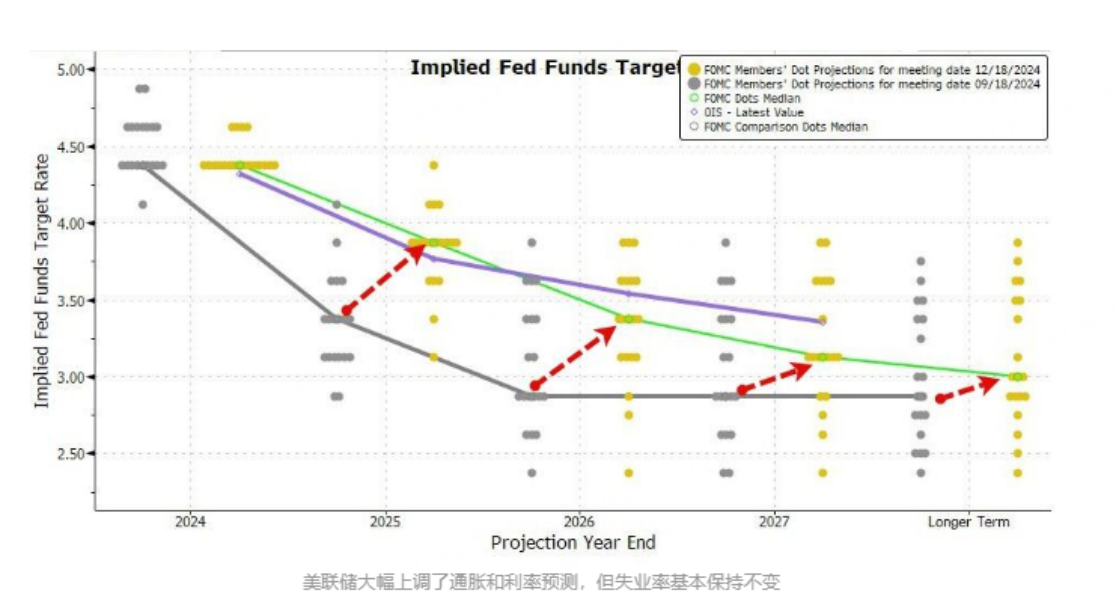

Last week's Federal Reserve decision had no variables in terms of interest rates, and the interest rate cut of 25 basis points was in line with market expectations. However, at the press conference after the meeting, Chairman Powell gave the expectation of only two interest rate cuts in 2025, which was regarded as an eagle statement, so the market showed an obvious overall general decline. Although the short-term decline is obvious, for some trending varieties, the bad news is likely to bring better entry opportunities.

From the news point of view, both the dot plot and the Fed's statement hint at an upward trend in medium and long-term interest rates. But it should be noted that the Fed is not much better at predicting the long-term economy than most market participants. This means that the current Fed's forecast may also be adjusted in the face of next year's actual economic data. Of course, no matter what, we can think that this resolution itself is negative.

After the resolution, the troika we have been introducing before-U.S. stocks, gold and Bitcoin, experienced a three-line decline. The last time a similar situation occurred, it was traced back to the Bank of Japan's coquettish operation. Regarding gold, it has been said before that the head has been built and I will not go into details. Although there will be repetitions in the US stock market, the current high level also lacks operability. Only Bitcoin, in this event-driven event, has the possibility of low-level intervention.

After the U.S. election, Bitcoin launched the main rise of this round of market at a speed visible to the naked eye. It only took more than a month to go from 70,000 to nearly 110,000 US dollars, completely eliminating the continuous consolidation between the second and third quarters. The haze was swept away. This upside rate usually doesn't directly reverse the trend because of a single message. Therefore, whether it is a second peak or a new high (I personally think this is more likely), as long as there is a reasonable profit-loss ratio, it is worth participating.

From the current adjustment strength and point, it is obviously still in a slightly awkward position. According to the calculation of technical analysis, it is roughly expected that the final high point of this round will be around 12-12W. Then if you participate at a price of 90,000 +, although the return ratio is there, it is not sufficient. In addition, the last key technical position is around 86,000, so from the perspective of trading, waiting for another 8-10% callback before intervening will be a strategy with high security and large space.

However, there is also a problem now, that is, the Grand Cross low point that appeared on 12.5 may also build a platform low point of around $90,000. If this is the case, there is a certain possibility of stepping short. One of the alternative strategies is to build a bottom position first, and then gradually increase the position. The other is to place orders in the form of strategic half positions at two positions, which may make less money, but the risk of completely shorting will be reduced a lot.

As for the stop loss point, the standard reversal level is below 6.6 W. This price can meet the profit-loss ratio of 2: 1. Moreover, in the actual trend, we expect that the low point will be above 7.9 W with a high probability. Therefore, if more than one transaction is completed later, the stop loss point can be adjusted according to the market landing market.

Furthermore, considering that the previous big level of correction seems to be a zigzag, this round should be a double bottom/platform structure adjustment. If you are worried about catching the flying knife, you can also wait patiently for the arrival of the second low position, so that you can better determine the potential stop loss point.

$NQ100 Index Main 2503 (NQmain) $$SP500 Index Main 2503 (ESmain) $$Dow Jones Index Main 2503 (YMmain) $$Gold Main 2502 (GCmain) $$WTI Crude Oil Main 2502 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.