Nvidia (NVDA) Short/Medium/Long-Term Options Flow Summary

Let me recap the near/medium/long-term trading perspectives for Nvidia based on recent options flows. These views could shift if unexpected catalysts arise:

Short-Term Bounce: $100-110 trading range this week

Medium-Term Downside Risk: Jackson Hole/Earnings could catalyze a pullback to $70-125 area

Longer-Term Upside (1yr+): Bullish on continued AI growth runway, targeting $70+

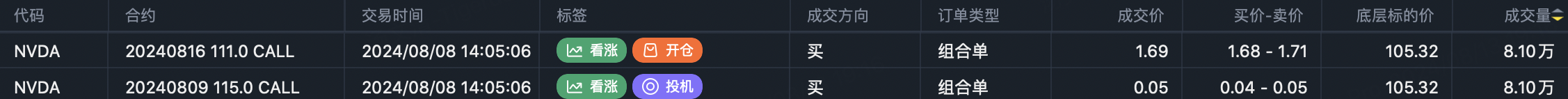

Short-Dated Flows (Expiries before 8/30 Earnings):

Expected trading range $90-110. Two main strategies:

Covered Call Writing: Selling NVDA 20240816 111 Calls

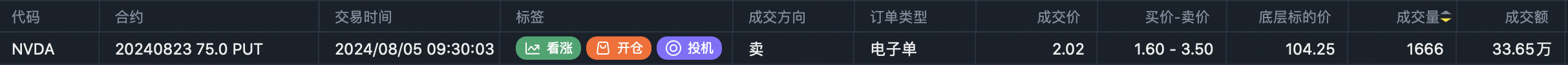

A common institutional overwriting strategy, heavy open interest helps define weekly upside caps.Put Selling/Shorting Vol: Selling $NVDA 20240823 75.0 PUT$

These 75 puts were sold on the August 5th gap down, representing outright short volatility positioning at that perceived "safe" price floor. Implies a $75 fair value target for institutions.

Medium-Dated Flows:

Bullish Strategies:

Note - doesn't necessarily imply directional upside, but rather profiting if stock stays within the defined range.

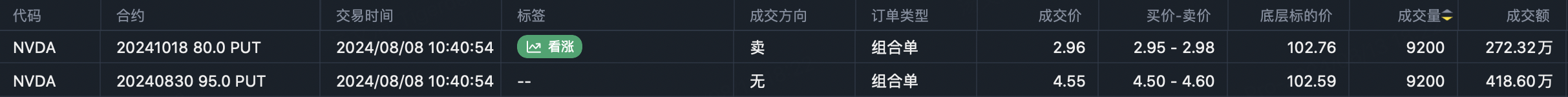

Defensive Put Selling: Selling $NVDA 20241018 80.0 PUT$

Initially a put buyer at 95 strikes in July, this trader flipped to selling 80 puts on August 8th as the stock rebounded.

"Fair Value" Put Selling: Selling $NVDA 20240906 100.0 PUT$

Morgan Stanley issued a report last week calling current valuations for big tech reasonable for buying. The 100 strike put sales likely align with that view and timeframe to hold through earnings.

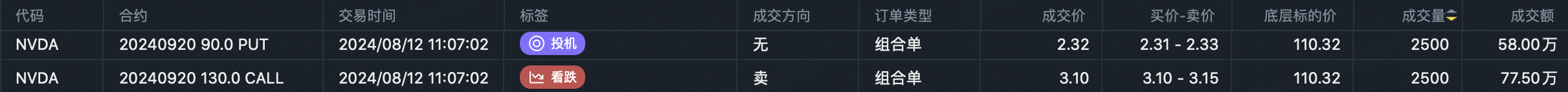

Collar Strategy: Selling $NVDA 20240920 130.0 CALL$ , Buying 90 Puts$NVDA 20240920 90.0 PUT$

Gaining downside protection by selling upside calls to finance protective puts below. I'm currently employing a similar collar strategy.

Bearish Strategies:

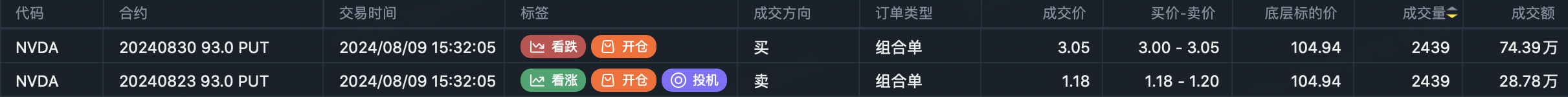

Calendar Put Spread: Selling $NVDA 20240823 93.0 PUT$ , Buying $NVDA 20240830 93.0 PUT$

This position seems bearish for earnings, while allowing for potential support ahead of the print to keep Nvidia >$93.

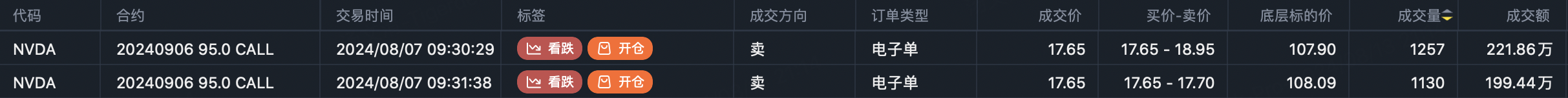

Short Call/Vol: Selling $NVDA 20240906 95.0 CALL$

Shorting both stock and implied volatility for post-earnings, with profits if Nvidia closes below $112.65 (95 strike + premium). Adding an out-of-the-money call leg could create a hedge.

Long-Dated Flows:

Most positioning is outright bullish for the longer-term, with some defensive put selling or put spread hedges likely targeting Jackson Hole as the catalyst rather than a multi-year meltdown.

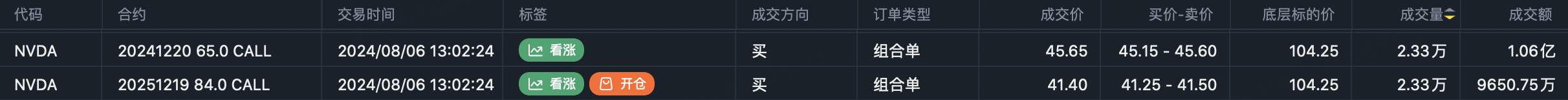

Bullish Call Buying: Buying $NVDA 20251219 84.0 CALL$

Deep out-of-the-money long call buying reflecting a multi-year bullish view on AI growth. Need the extended dated expiry to minimize time decay.

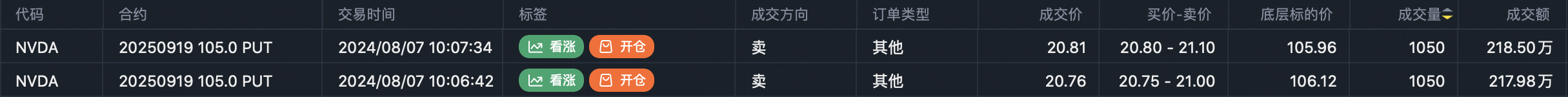

Defensive Put Selling:

Selling NVDA 20250919 105 Puts

Selling NVDA 20241220 83 Puts

Straightforward put overwriting strategies to harvest premium while providing downside exposure over the next 1-2 years.

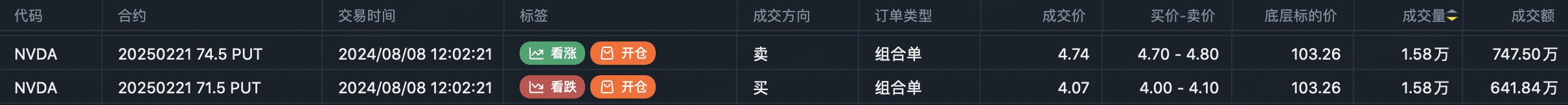

Defensive Bear Put Spread: Selling NVDA 20250221 74.5 Puts, Buying 71.5 Puts

Extremely defensive, likely reflecting a lower risk/premium yield enhancement trade by selling puts while adding a secondary protective put leg underneath.

Bearish Put Spread: Buying NVDA 20250221 76 Puts, Selling 73 Puts

Outright bearish positioning, potentially hedging downside risk of the upcoming Fed easing cycle over the next 1-2 years.

In Summary:

The flows capture the current near-term consolidation range and medium-term downside risks, while still reflecting longer-term optimism in the AI secular growth story.

I remain bullish, but can't ignore the potential Jackson Hole shakeout - hence the collar hedging strategy. That $70 level presents both risk and opportunity.

For Tesla and Apple, options activity has been relatively muted lately compared to Nvidia. Without Jackson Hole risks, the TSLA 180 and AAPL 200 put strikes could present some attractive selling opportunities.

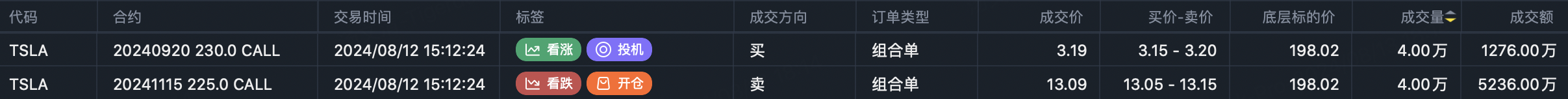

One large flow to note - a major institutional trader rolled their TSLA bullish positions earlier, closing their 230 calls for November 15th expiry and re-opening new 225 calls for the same cycle. If they are indeed net sellers of those 225 calls, it implies this firm expects a protracted period of market chop beyond my initial expectations.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- kimkimbing·2024-08-14Artikel yang bagus, apakah Anda ingin membagikannya?1Report

- KSR·2024-08-14👍LikeReport