Economists expect headline consumer inflation to rise 8.1% Y/Y in September, easing from the 8.3% pace in August, when the Consumer Price Index report is released on Thursday. Meanwhile, core CPI, which strips out volatile food and energy prices, is expected to climb 6.5% Y/Y, faster than the 6.3% increase in the prior month.

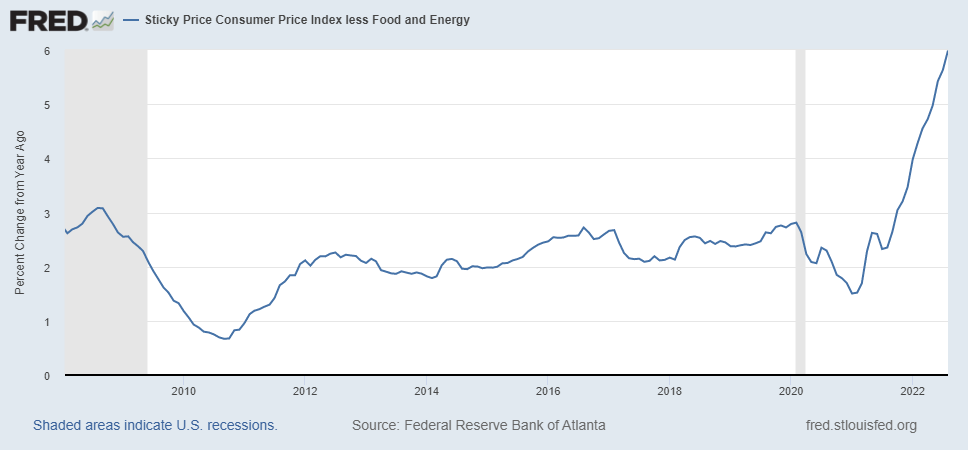

The economists expect the core number to outpace the headline number because the core CPI includes things like the cost rent or services, such as health care, that are "stickier." Once they go up, they're not likely to go down.

Unwanted visitors: Bankrate Senior Economic Analyst Mark Hamrick expects Y/Y CPI growth to stay elevated through the rest of the year. "There has been relief from high gasoline prices which tend to aggravate consumers the most, but elevated food and shelter prices appear to be sticking around for a while as unwanted visitors," he said.

While the core personal consumption expenditure index ("PCE") is the Federal Reserve's preferred inflation gauge, the central bankers do not ignore the PCI number.

"The Fed will be looking at the month-over-month percent change in core CPI," José Torres, senior economist at Interactive Brokers told Seeking Alpha. "Sticky and price-resistant categories where once price increases are registered, price decreases are hard to come by. Food away from home, shelter, transportation services and medical services will be top of mind."

September's CPI is expected to increase 0.2% M/M, up from 0.1% in August. The consensus for core CPI is 0.4% M/M, down from 0.6% in the previous month.

Leading indicator? Wednesday's Producer Price Index may give investors a clue of what to expect for the CPI, said Tuan Nguyen, an economist at RSM US, who analyzes high-frequency economic data

"In two of the past three reports, a higher-than-expected CPI number was registered after producer prices came in above expectations," Nguyen said.

The PPI increase "was in line with our expectation for a strong rebound of the overall economy in the third quarter, which will most likely grow by more than 2%," Nguyen added. The PPI numbers won't dissuade the Fed from its hawkish rate policy, he added.

Bears ready to rally? Interactive Brokers' Torres expects that any indication that prices are easing will lead lead to increased stock-investing. "The market is oversold and the burden of proof has shifted to the bears," he said.." Any moderate to positive news on the CPI front, even in-line results, a deceleration in services, rents, or good prices, can produce the next bear market rally."

Meanwhile, SA contributor Logan Kane looks to a Cleveland Fed econometric model, which expects core CPI to rise 0.51% M/M in September and 0.53% in October. "If these projections are right, these numbers are bad and worse than the market expects, showing that the Fed is nowhere near stopping inflation and that a hard landing is the only way down," Logan wrote Wednesday.