Perhaps the best-known value investor of our time, Warren Buffett is an Apple stock bull. His firm, Berkshire Hathaway, owned a staggering 895 million shares of the Cupertino company as of the end of Q2, which were then valued at around $122 billion.

Looking at history may provide a clue into Warren Buffett and company’s future trades. Might Berkshire’s managers be willing to add to the firm’s AAPL position in Q3?

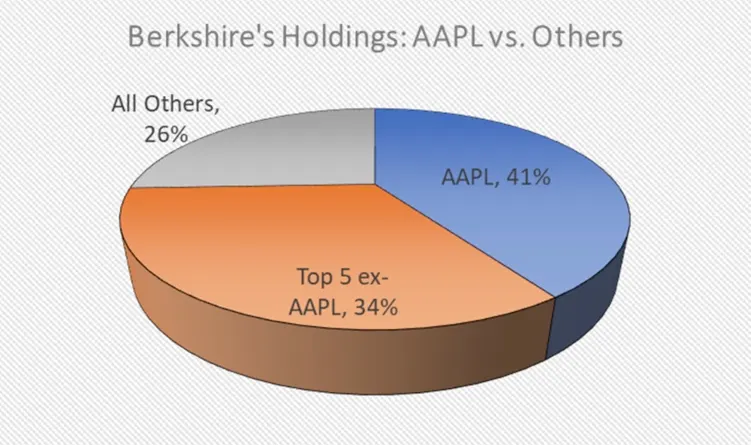

Berkshire’s concentrated portfolio

Berkshire allocates over 40% of its assets to Apple. Given such a large ratio, it is reasonable to think that the conglomerate might be reluctant to buy more AAPL shares now.

However, the portfolio has been highly concentrated into few names for the past many quarters, suggesting that Berkshire might not be too concerned about diversification. As of Q2, the top 5 holdings accounted for a whopping three-fourths (or 74%) of the firm’s assets. See below.

For reference, Berkshire Hathaway’s top 5 stocks ex-AAPL are, in descending order of allocation size: Bank of America (BAC) at 11%, Coca-Cola (KO) and Chevron (CVX) at 8% each, and American Express (AXP) at 7%.

Berkshire’s AAPL position: buy low, sell high

There seems to be one clear historical trend in how Berkshire adjusts its AAPL position. It helps to keep in mind that Warren Buffett is a classic value investor. Therefore, expect him to be a proponent of the “buy low, sell high” strategy.

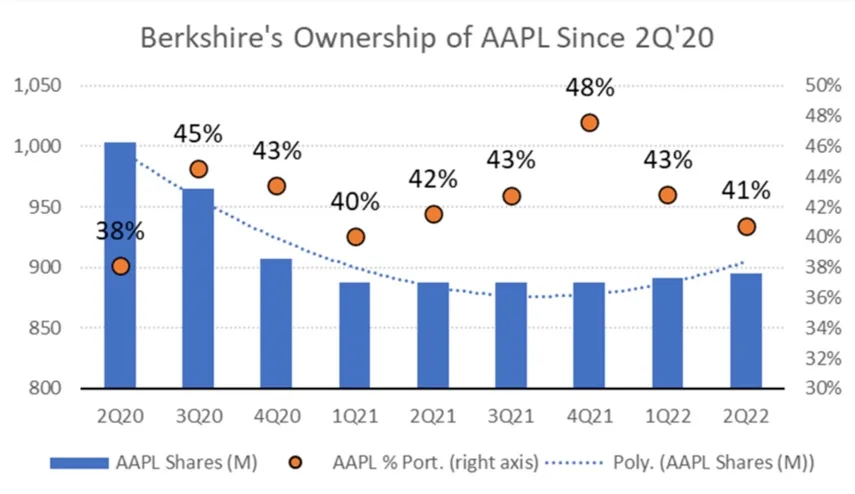

The chart below shows Berkshire’s stake in Apple stock each quarter since the June 2020 period. Notice how AAPL as a percentage of the firm’s portfolio has varied substantially from a low of 38% to a high of 48% — in part due to the fluctuations in the value of AAPL vs. that of the rest of the market.

But now focus on the more important blue bars below, which display the total number of AAPL shares that Buffett’s company has held in the past eight quarters.

Berkshire sold a large portion of its stake in the Cupertino company between mid-2020 and the first quarter of 2021. This period coincided with a sharp increase in AAPL price, from $91 in June 2020 to about $130 at the start of April 2021.

Then, as Apple shares stalled out in the second half of last year, Berkshire held its position steady. Once AAPL and the rest of the market began to unwind in 2022, Buffett and company jumped in to “buy the fear”. After three quarters of no additional purchases, Berkshire started to accumulate again in Q1 and Q2 of the current year.

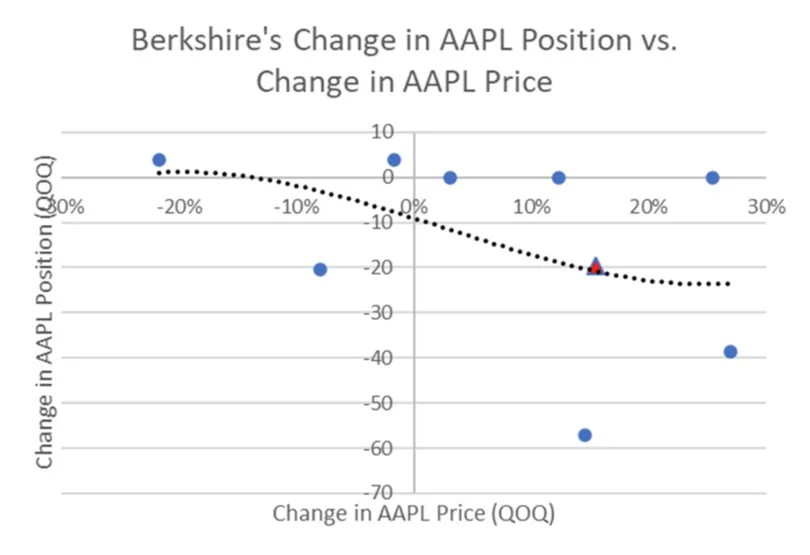

The chart below is a scatter plot that shows the inverse relationship between (1) the change in AAPL share price from quarter to quarter and (2) the change in AAPL shares owned by Berkshire Hathaway. In other words: Berkshire has consistently bought AAPL low, sold high.

Buffett: unlikely to accumulate AAPL in Q3

If history repeats, then it is unlikely that Buffett’s firm will add to its AAPL position in Q3. This is the case because, between the end of Q2 and now, Apple stock has appreciated 14%.

In the graph above, the red triangle shows what I estimate to be the change in Berkshire’s AAPL position as of now: down about 20 million shares, assuming that the historical trend is a good predictor.

Even if I am right, however, this is not to say that Buffett is less of an AAPL bull today. It merely suggests that, following the buy-low-sell-high playbook, the Oracle of Omaha might choose to lock in some of his profits this time instead of expand its ownership of the company.