Stocks rallied this past week as investors bet that the Federal Reserve has reached peak hawkishness. That’s wishful thinking.

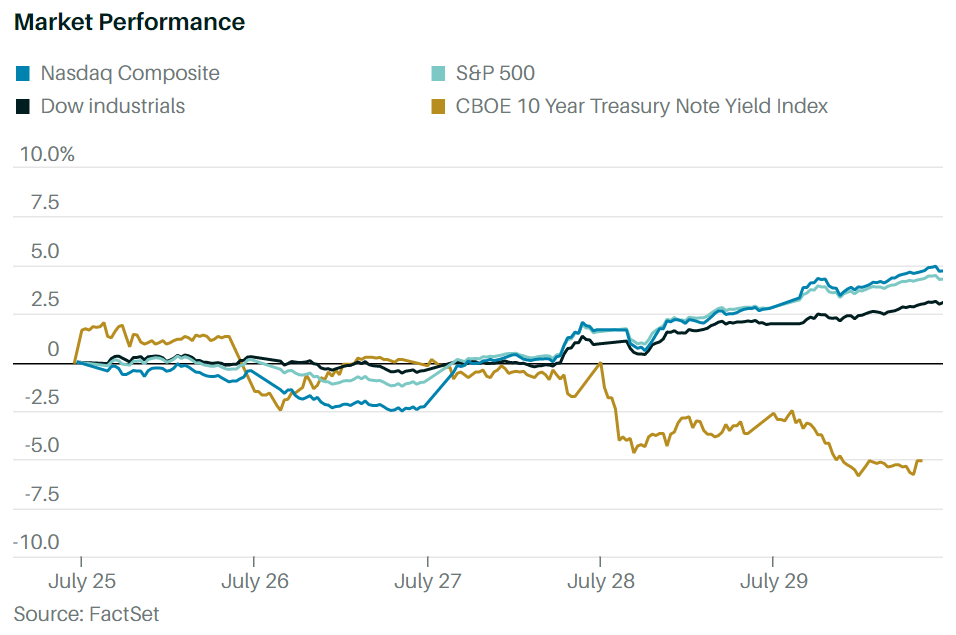

The Dow Jones Industrial Averagerose 3%, the S&P 500index added 4.3%, and the Nasdaq Composite surged 4.7%. All three had their best months since 2020. Even the premium paid for high-yield bonds over Treasuries narrowed considerably.

Yet it was a strange week for celebration. The U.S. economy saw back-to-back quarters of declining real gross domestic product in the first half of 2022, the Fed’s favored measure of inflation remained stubbornly high, and the central bank raised interest rates by another three-quarters of a point, making this one of the fastest hiking cycles of the past 40 years.

What did change are expectations for future rate hikes, hinging largely on two sentences from Fed Chairman Jerome Powell’s news conference.

“While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then,” he said. “As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.” Powell even said that interest rates, now at a range of 2.25% to 2.5%, are likely at “neutral,” meaning they are neither accommodative nor restrictive.

The market took that message to heart. Six weeks ago, interest-rate futures were pricing in a peak federal-funds rate target range of 3.75% to 4% in early 2023. Today, that peak is implied at 3.25 to 3.5% in December, just a point above the current target. Furthermore, futures pricing now implies two quarter-point rate cuts from February to July 2023. In other words, the market is betting the Fed will slow down the pace of its rate increases by the end of this year, then rapidly switch to easing policy.

Powell’s comments about the neutral rate also drew the ire of some well-known economists and investors. Former Treasury Secretary Larry Summers called Powell’s comment on the neutral rate “indefensible,” while Pershing Square’s Bill Ackman unleashed a late-night tweetstorm on the subject. “While 2.25 to 2.25% may be a neutral rate with 2% inflation, it is an extremely accommodative rate with inflation at 9%,” he wrote late on Thursday night, while isolating with Covid-19.

The implied rate path also seems highly unlikely—and almost certainly not good for the stock market. For it to develop, the Fed would have to either declare victory in its fight against rising prices—does anyone expect inflation to magically collapse to 2% by year end?—or give up the battle altogether to rescue an economy that is rapidly sinking into recession. So, while the pace of tightening may be moderating and inflation may have peaked—famous last words, we know—it’s far from a green light for investors.

Given a slowing economy, still-rising interest rates, and stock and bond indexes at or near short-term overbought levels, it might be time to sell the rally and rebalance into higher-quality or defensive areas.

“Credit spreads have continued to pull tighter…on a market narrative that a dovish pivot could be warranted,” wrote Goldman Sachs’ chief credit strategist, Lotfi Karoui, on Thursday. “We disagree, given the likely forward path of inflation, and would continue to fade the rally, using it as an opportunity to cut risk and rotate further up in quality.”

It’s too early to declare a Fed pivot and an all-clear for bullish investors. This inflation surge isn’t likely to be tamed that easily.