Average bear market lasts a little under a year: LPL Financial

The S&P 500 averted a bear market Friday, trimming losses to finish flat after trading solidly below a key threshold. But history shows that when a bear arrives, it tends to stick around awhile.

The large-cap U.S. benchmark ended the session with a gain of less than a point at 3,901.36 after trading as low as 3,810.32. A close below 3,837.25 would mark a 20% pullback from the S&P 500's Jan. 3 record finish, meeting the traditional definition of a bear market, according to Dow Jones Market Data.

The Dow Jones Industrial Average erased a 617 point loss to end the day at 31,261.90. A finish below 29,439.72 would put the blue-chip gauge into a bear market.

To be sure, many investors and analysts see that 20% definition as an overly formal if not outdated metric, arguing that stocks have been behaving in bear-like fashion for weeks.

And note, that if the S&P 500 were to close below the threshold in the coming days, the start of the bear market would be backdated to the Jan. 3 peak. A bear market is declared over once the S&P 500 has risen 20% from a low.

OK, so what does history say about what happens once a bear market begins?

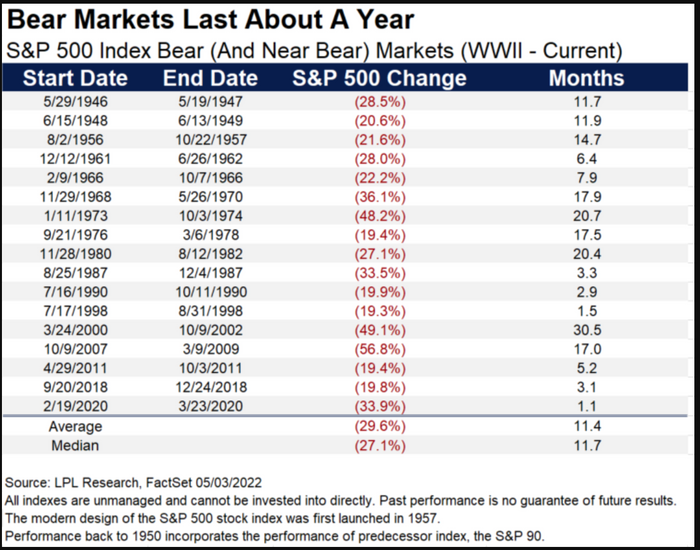

There have been 17 bear --- or near-bear--- markets since World War II, said Ryan Detrick, chief market strategist for LPL Financial, in a Wednesday note. Generally speaking, the S&P 500 has fallen further once a bear market begins. And, he said, bear markets have, on average, lasted about a year, producing an average peak-to-trough decline of just shy of 30%. (see table below).

The steepest fall, a peak-to-trough decline of nearly 57%, occurred in the 17 months that marked the 17-month bear market that accompanied the 2007-2009 financial crisis. The longest was a 48.2% drop that ran for nearly 21 months in 1973-74. The shortest was the nearly 34% drop that took place over just 23 trading sessions as the onset of the COVID-19 pandemic sparked a global rout that bottomed out on March 23, 2020, and marked the start of the current bull market.

The S&P 500 neared bear territory last week before a strong Friday-the-13th bounce that halved its weekly losses. Another strong bounce was seen May 17, but gains were more than erased in the following session after downbeat results from retailing giant Target Corp. underlined fears that inflation pressures were beginning to take a toll on margins.

The earnings from Target and, a day earlier, Walmart Inc. "have me concerned that bad things may be starting to happen in the U.S. economy," said Tom Essaye, founder of Sevens Report Research, in a Thursday note.

"Namely, that the length of high inflation has infiltrated the lower income cohorts of the economy, and they are now reacting, quickly. And as inflation stays high and the economy slows, that will creep 'up' the income distribution, and the concern is the margin issues TGT and WMT are facing will spread to other parts of the retail space and the market more broadly," Essaye wrote.

Mike Mullaney, director of global markets research at Boston Partners, worries that Wall Street analysts have yet to catch up to the danger. While earnings expectations for companies in emerging markets and the broader developed-markets indexes have turned down, that isn't the case for the S&P 500, he noted, in a Thursday interview.. That indicates that the analysts covering the S&P 500 are "behind the curve," which could be one of the last shoes that has to drop, he said.