A risk-off day is looming as Ukraine's battle for survival against a Russian invasion enters its fifth day.

While the world holds out hope for a diplomatic solution, investors are waiting and watching headlines.

Our call of the day, from Miller Tabak + Co.'s chief market strategist Matt Maley, offers fresh levels to watch on the S&P 500 and Nasdaq Composite .

The strategist said a late bounce seen last week for those big indexes pushed them back above key support levels, but they remain vulnerable. "Thankfully, the support/resistance levels are still very well drawn," he told clients in a note late Sunday.

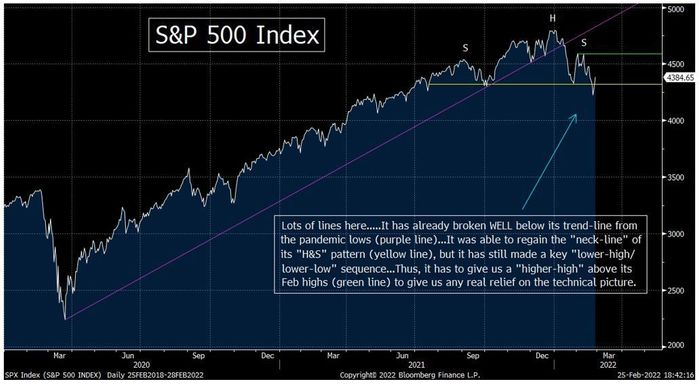

Sharp declines seen earlier last week took those indexes below the "necklines" of their "head and shoulders" technical patterns, a widely followed trend reversal pattern for stock charts. The bounce starting Thursday helped those indexes regain their "lines in the sand" by week's end.

However, the declines earlier in the week gave both indexes "lower lows" on a closing and intraday basis.

"Therefore, unless the bounces that began last week can see a lot more upside follow-through, last week's action was still something to be very concerned about," said Maley, who advises watching last week's closing S&P 500 low of 4,225.

"Any meaningful break below that line will take it well below the 'neckline' of its 'H&S' pattern...and that would be a very negative development," said Maley. But if the index can rally back and take out February highs of 4,590 "in any material way," that will usher in a solid "higher-high" and much needed relief," he said.

As for the Nasdaq, Maley said the technical setup is similar. Any "significant break" below last week's closing lows around 13,500 will give it a "lower-low" and take it below that neckline -- a bearish development. On the flip side, a break above February's high of 15,140 would offer up a "higher-high" easing a lot of market tension.

Maley also commented on the fact that a big washout decline for stocks, that can usher in an important bottom, hasn't happened. "We haven't seen a few days when the volume has been huge...and the breadth absolutely horrible," he said.

He isn't as worried because he said those washout moves, while compelling, can also cause investors to "miss the boat" by waiting for them to buy stocks. Maley said he would reassess the team's near-term stance if big indexes break above key resistance,