Wall Street kicked off the last week of trading for 2021 with a pretty decent start to that Santa Claus rally, with more gains ahead for Tuesday, by the looks of it.

Still, there's little to explain the rise in stocks, given volumes are drying up, wrote Michael Kramer, founder of Mott Capital Markets. "You have to go back to late August to find lower trading volumes. It seems like a combination of volatility selling and lower market participants causing buyers to just trip over themselves," he said in a blog post.

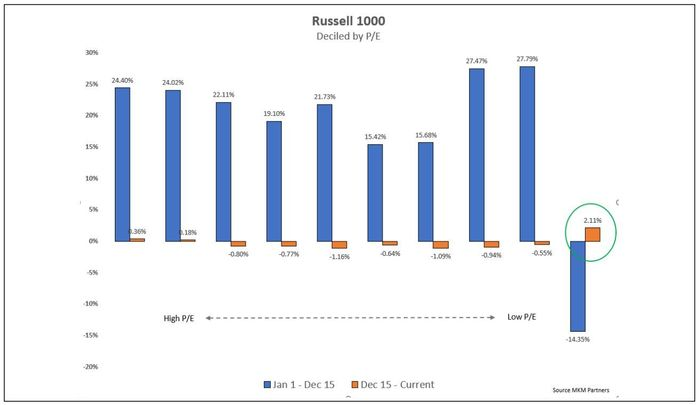

Our call of the day is about less tripping and more of a simple path forward for investors in 2022. "There has been a longer-term trend where managers start to rotate into cheap stocks (attractive valuations) at the start of each calendar year," wrote JC O'Hara, chief market technician at MKM Partners, in a note to clients.

"We ran a simulated trading model where we bought the lowest P/E [price/earnings] decile of stocks within the S&P 1500 and rebalanced each month. This simple strategy has outperformed the benchmark over the years. We found the returns were heightened over the first quarter of each year on average," said O'Hara.

And using a simple P/E ratio for the valuation measure, shows a rotation into "attractive valuation names" is clearly already under way, he said. "Cheap stocks saw very little inflow this year until recently. We believe this rotation will continue into 2022."

The research found attractively valued stocks within every sector, showing what MKM Partners found were attractive technical setups. So here goes a sampling of those stocks, sector by sector:

Consumer discretionary: Ford, Genuine Parts, SeaWorld, Six Flags Entertainment, Toll Brothers and Lowe's.

Consumer staples: There are plenty of cheap companies breaking out across the board within that defensive sector. Constellation, Walgreens, Kroger, Archer Daniels, Hostess Brands and Altria Group are just a handful of those names.

Energy. MKM has a equal-weight ranking on the sector, but sees plenty of upside in 2022. Halliburton, Chevron, Exxon Mobil, Devon Energy, Pioneer Natural and Murphy Oil are among a big list of stocks.

Financials. "Banks have been under pressure given the recent movement of yields. Other areas within this sector offer better charts in our technical opinion," said O'Hara. Wintrust Financial, Zions Bancorp, Fulton Financial, Hancock Whitney, People's United, Prudential and Provident Financial are among those highlighted.

Healthcare: The strategist said MKM is warming up to the sector amid expansion of "positive breadth" -- more stocks advancing than declining. AbbVie, AmerisourceBergen, Cigna, Allscripts and Supernus Pharmaceuticals are just a few of the mentions.

Industrials: Northrop Grumman, United Parcel Service, Quanta Services, Wabash National, Norfolk Southern, Knight-Swift and Boise Cascade.

Technology: While the sector is generally expensive, there are plenty of bargains, especially within chip and communications equipment makers, said MKM's O'Hare. Among the stock picks were Lumentum, F5, Arrow Electronic, Applied Material, Broadcom, Qualcomm, Micron Tech, Diodes and NetApp.

Materials: Look for strength in chemicals, said MKM, with AdvanSix, Huntsman, Mosaic, Avient, Arconic and Freeport-McMoRan.

Real estate: MKM has an overweight rating on the sector. Attractive valuation picks include Plymouth Industrial, Retail Value, Armada Hoffler, Apple Hospitality, Alexandria Real Estate, American Finance and Gaming and Leisure.

Finally, industrials, the worst performing sector year to date, noted O'Hare, but "with plenty of charts we feel comfortable owning into next year." Edison International, Entergy, One Gas, NiSource, Black Hills and Sempra Energy all get a mention.