Wood says she's emboldened by bad news

There'a growing sense of unease emanating from equity markets in recent trade, despite, and perhaps because, of the Dow Jones Industrial Average and the S&P 500 index trading near record heights.

However, star investor Cathie Wood, who runs a suite of popular ETFs in Ark Investment Management, says that there's no reason to fear that the market is becoming too bubblicious.

As the Ark founder puts it: "I don't think we're in a bubble which is what I think many bears think we are," during a Thursday interview with CNBC near midday .

Her comments coming amid intensifying worries about a possible slowdown in economic growth as the delta variant of COVID-19 gathers momentum, creating headwinds for a fuller recovery from the pandemic that has gripped the globe for well over a year.

Investors also have been wringing their hands over the prospects of the Federal Reserve scaling back easy-money policies, notably the monthly purchases of $120 billion in Treasurys and mortage-backed securities, as anxieties grow.

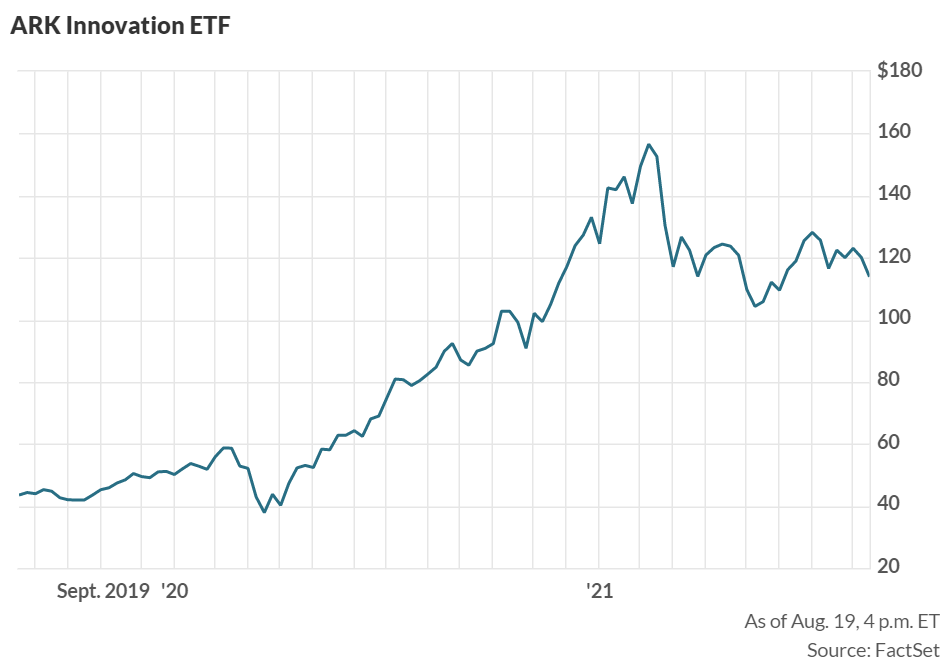

Wood's investment funds, highlighted by the flagship Ark Innovation, have been one area that has been cited as possibly overvalued and vulnerable to a dramatic swing lower if the market starts to deflate considerably from its current levels.

Ark Innovation ETF is down 5.2% so far this week and has lost 8.6% in the year to date, badly underperforming the broader market and coming after the fund rang up one-year return of 149%, FactSet data show.

By comparison , the Dow Jones Industrial Average is down 1.8% this week but up 14% this year, while the technology-laden Nasdaq Composite Index is off 1.9% on the week but has risen over 12.8% so far in 2021, and the broad-market S&P 500 index is off 1.4% in the week to date but boasts a nearly 17.3% gain for 2021.

Wood's view on the market, however, is that investors are acting much more sedately and prudently, compared with the euphoria that was characteristic of the late 1990s and early 2000s dot-com boom.

"In a bubble...and I remember the late '90s...our strategies would have been cheered on," she told the business network. "You remember the leapfrogging of analysts making estimates one higher than the other, price targets one higher than the other," she said on "Tech Check."

She also noted that negative sentiment in the market as a contra-indication, suggesting that growing pessimism may actually fuel further gains rather than inflating a bubble.

"I like bad news," she said.

"When I see such negative sentiment out there, especially when it comes to valuation and longer time horizons, investment time horizons, I actually feel a little more comfortable," Wood said.