After 20 years in the shadows, the Taliban have returned to power in Afghanistan, raising questions about stability in the Middle East and stoking some potential unrest in U.S. financial markets, amid a weekend that was rife with political developments.

However, the impact to the stock market, with the Dow Jones Industrial Average , the S&P 500 index and the Nasdaq Composite Index trading at or near record highs , is unclear.

"It's a terrible situation for those U.S. folks who are still there," J.J. Kinahan, chief market strategist at TD Ameritrade, told MarketWatch in emailed comments on Sunday.

"As far as the markets go, we'll have to wait and see on the longer-term implications," he said.

Futures, however, were tilting lower, with those for the S&P 500 , the Dow and the Nasdaq-100 all showing modest declines, but hardly indicating that the market's bull run amid COVID-19 was in jeopardy.

The benchmark 10-year Treasury note yield was at 1.27% late Sunday in New York, attracting some haven bids, with prices of government debt rising and yields moving in the opposite direction.

Taliban fighters took over Kabul , fearing retaliation in the new regime.

President Joe Biden has rushed 5,000 troops to Kabul .

The U.S. presence in Afghanistan, spanning the tenures of Presidents George W. Bush, Barack Obama, Donald Trump and Biden, started following the Sept. 11, 2001, attacks on the World Trade Center and the Pentagon, and is now considered the U.S.'s longest military conflict, surpassing World War I, World War II and the Korean War combined .

Biden's decision to remove troops from Afghanistan came after Trump's concessions to withdraw U.S. forces , had made the case that it would destabilize the tenuous Afghanistan leadership, leaving it vulnerable to insurgent groups.

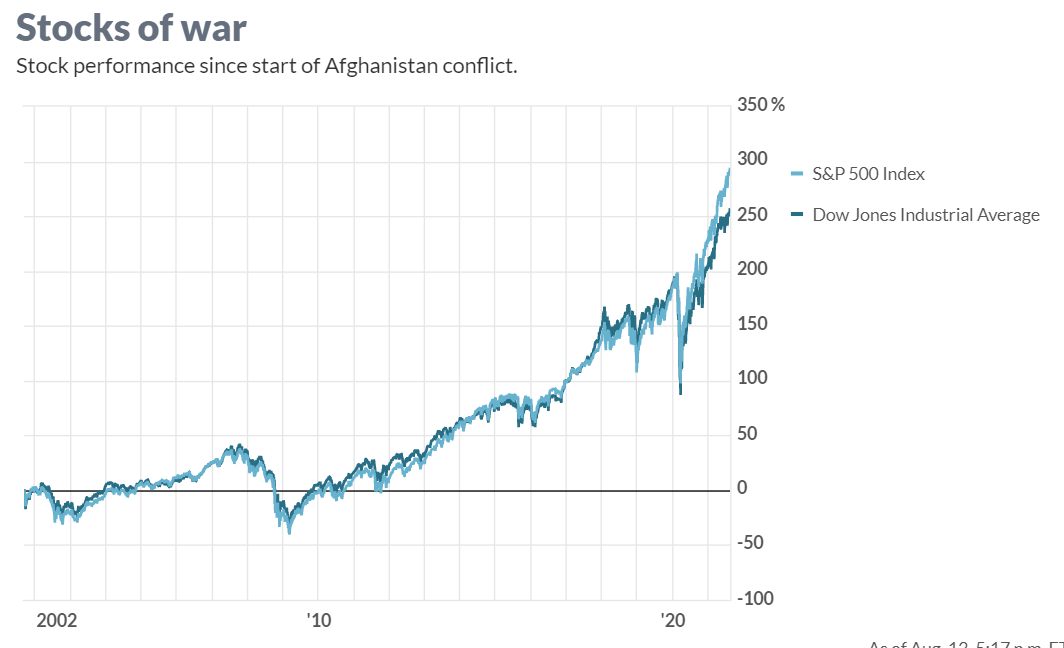

For the most part, stock-market investors have been mostly sanguine amid the long-running conflict that has cost an estimated $2.261 trillion, according to research from Brown University's Watson Institute of International Public Affairs , which also estimates that 241,000 people have died as a direct result of the war.

The Dow is up by nearly 270%, the S&P 500 has gained more than 300% and the Nasdaq Composite has climbed more than 700% since the fall of 2001.

It's worth noting that the benchmark 10-year was yielding between 4% and 5% around that time.

Historically, military conflict doesn't always have an impact on stocks, and war's influence, if any, on investors' psyches isn't always clear-cut. The context and economic and market environments are often a bigger driver.

The U.S. was already in the throes of a recession when the attacks of 9/11 hit and the market initially dipped sharply after the attacks.

Markets currently are attempting to claw back from the hit caused by COVID-19 and the spread of the delta variant, with questions about the policy plans by the Federal Reserve, and other central banks, at the front of investors' minds.

Still, military aggressions may result in some investors turning to bets on defense contractors, which could see a boost if the animosities flare up.

Northrop Grumman Corp.'s stock $(NOC)$ is up nearly 880% and Lockeed Martin Corp.'s shares $(LMT)$ are up 834% since 2001, while Boeing Co. $(BA)$ is up 439%, and General Dynamics Corp. $(GD)$ is up over 422%, all of which outperformed the broader market during that period.

So far this year, Lockheed's stock is underperforming the broader market, up 0.9%, as is Boeing's, which has gained 9.5% in the year to date.

One popular way to play defense contractors broadly is the iShares U.S. Aerospace & Defense $(ITA)$ exchange-traded fund, which was created in 2006 and is up 13.7% in 2021 thus far. The SPDR S&P Aerospace & Defense ETF $(XAR.UK)$, which kicked off in 2011, is up 7% year to date.

Overall, strategists had already been warning about the possibility of a correction as concerns about peak earnings and economic growth grow and many analysts see the Afghan escalation as simply adding to a wall of worry.

TDAmeritrade's Kinahan said that we "should see a lift in volatility, and perhaps some fixed-income purchasing, as this puts an element of uncertainty into the market."

But don't be surprised if the market's reaction to the possibility of military tensions is counterintuitive, as Ben Carlson, portfolio manager at Ritholtz Wealth Management LLC, has written in the past about the market's sometimes odd reaction to war , summing it up thusly.

"Markets don't always respond to geopolitical events the way you think."