Summary

- Palantir is scheduled to report its Q4 results before markets open on Thursday.

- Its total revenue is likely to come in at $419 million for the period.

- Palantir's government revenue could remain muted.

- Other than revenue, investors may want to keep a close eye on the company's customer count, remaining deal value and its management's outlook for FY22.

All eyes will be on Palantir (PLTR) when it reports its Q4 results tomorrow before markets open. Investors would be curious to see if the company can post a significant enough revenue beat to stabilize its tanking share price and possibly also trigger a rally. But in addition to just tracking its headline revenue figure, investors may also want to monitor its customer count, deal value, segment financials and its management’s outlook for FY22. These items will better highlight Palantir’s state of operations and are likely to influence where its shares head next in coming weeks. Let’s take a closer look at it all.

Operating Metrics

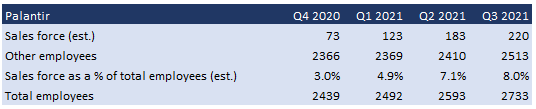

Bears routinely argue that Palantir is a consulting business instead of a technology business. Its sales personnel have to pitch their platform to enterprises and government agencies in order to win contracts. Then, its team of engineers has to sometimes, if not always, intervene in order to set up dashboards for their new customers. So, it’s understandable why many investors are skeptical about Palantir’s ability to scale. Fortunately, for Palantir's shareholders at least, the company discloses two operating metrics that reveal if it's scalability is at risk or if things are going smoothly.

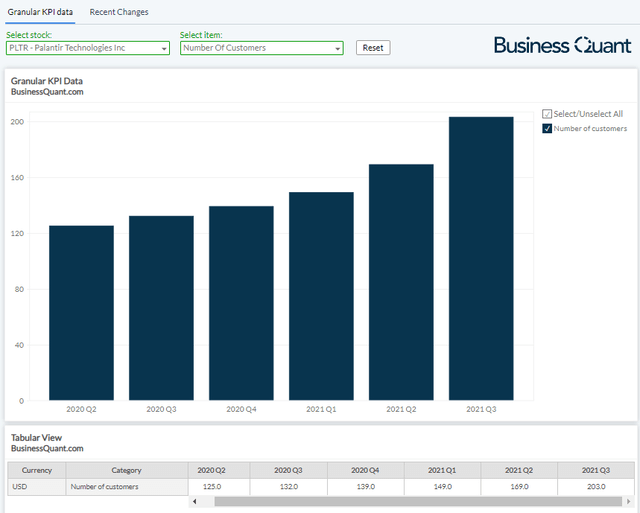

First method involves tracking Palantir’s total number of customers in its Q4 earnings report. If its customer onboarding process is starting to get bottlenecked due to human intervention, or if its target market is saturating, then Palantir’s customer count figure might as well plateau going forward. Any slowdown in growth here would point to operational difficulties in onboarding new customers and possibly also a subsequent financial slowdown. Conversely, a rapid increase in Palantir’s customer count would indicate that the company is still growing its business footprint with relative ease and it would also quash scalability-related concerns along the way.

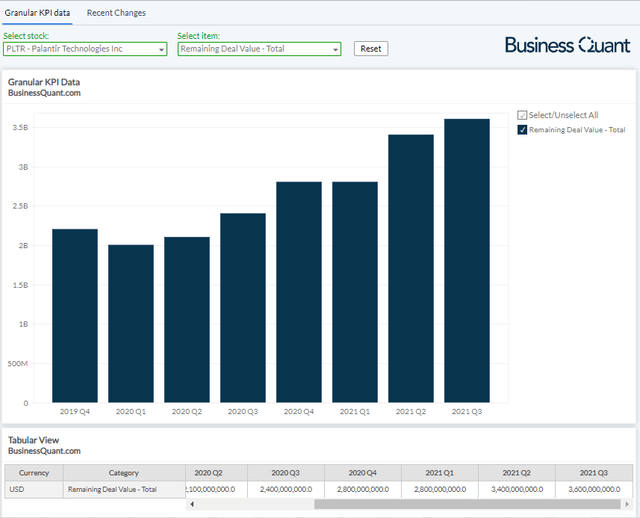

Secondly, investors may also want to monitor Palantir’s remaining deal value figure. It highlights the residual value of all the contracts booked with Palantir, that are yet to be delivered, from which revenue is yet to be recognized. It’s similar to the order backlog metric that engineering firms report but it’s prone to customer cancellations due to far lower contract termination fees. Generally speaking, a growing remaining deal value figure indicates a growing project pipeline that can potentially drive Palantir’s revenue in the years to come.

Very few investors might know this but Palantir has significantly expanded its sales team over the last four quarters. With this heightened focus on direct sales now, the company is likely to have bagged new customers and contracts during the quarter. This means its customer count figure as well as its remaining deal value of contracts, are well poised to further increase sequentially in the company’s upcoming Q4 earnings report.

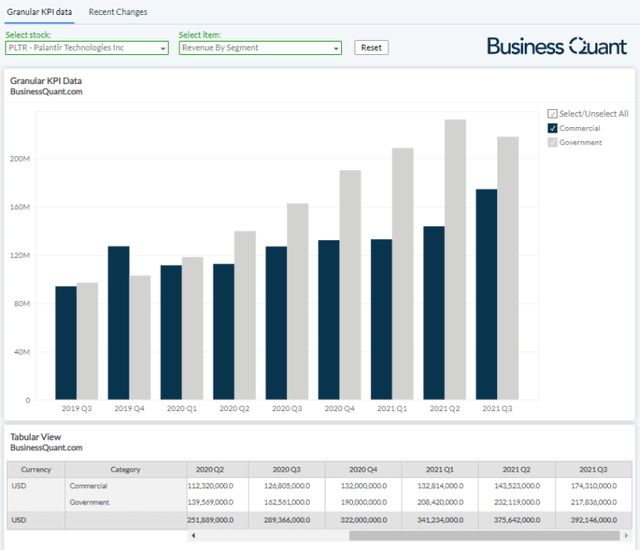

Moving on, Palantir classifies its revenue under two reporting segments namely, government and commercial segments. Its commercial revenue stream has grown at a rapid rate over the past few quarters and it accounted for about 45% of the company’s total revenue last quarter. Now that most of the major markets across the world have eased their travel restrictions, Palantir’s expanded sales team would have been able to travel more freely during the quarter and bag new orders. So, I’m expecting its commercial segment to post a low-double-digit (~12%) revenue growth on a sequential basis, with the actual figure coming in around $195 million for Q4.

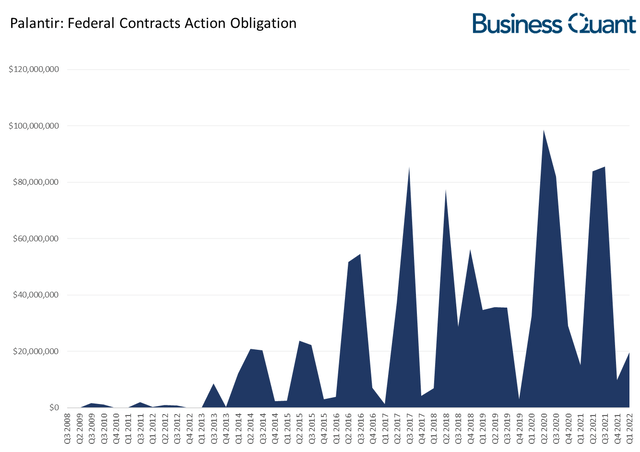

On the other hand, I expect Palantir’s government segment to post lackluster results in Q4. The company won very few contracts from the US government during quarter which is bound to put a pressure on this revenue stream. Palantir would have had to strike more deals with international governments agencies in order to offset and mitigate the recent decline of new orders from the US government, but that’s easier said than done. So, I’m expecting its government revenue to, at best, grow at low-single digits (~3%) in Q4, with the figure amounting to around $224 million.

Overall, I’m estimating Palantir’s revenue to amount to $419 million during Q4 FY21. This would mark a growth of approximately 30% on a year over year basis, and 7% sequentially. Coincidentally, my revenue estimate happens to be in the vicinity of the Street’s revenue estimates for Palantir’s Q4, which are averaging around$417 million.

Having said that, investors should also pay close attention to Palantir management’s revenue outlook for FY22. They had issued a rather conservative revenue growth outlook for FY21 in last year’s Q4, which eventually caused a selloff in its share for the majority of the past year. But now that Palantir’s number of customers has increased 46% since Q4 FY20, its management should be in a better position to issue a higher revenue growth forecast for FY22.

Also, there has been a marked deceleration in new order wins from US government during Q4, as evident in the chart above. So, investors should listen in on Palantir management's comments on how they plan on navigating through this situation. Specifically, do they think that this is a one-time drop, that's mired by delays in awarding the contracts, or if this the new normal? If it’s the latter, then what is Palantir management’s strategy to offset the potentially declining government business?

Investors Takeaway

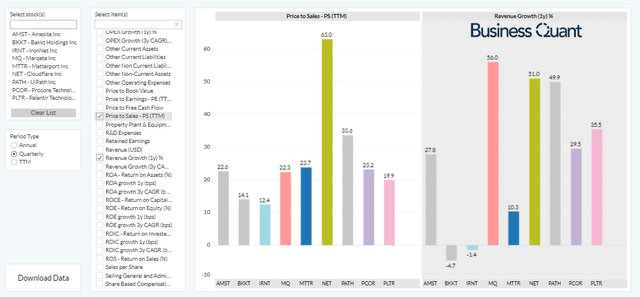

Palantir’s shares have corrected by more than 40% over the last 6 months alone and they’re attractively valued at current levels. In contrast, other rapidly growing companies operating in the software infrastructure space are trading at significantly higher price-to-sales multiples. So, investors with a long-term time horizon may want to consider adding Palantir’s shares while they’re still discounted.

As far as its Q4 earnings report is concerned, investors should closely monitor Palantir's customer count, its remaining deal value, segment financials and its management’s outlook for FY22. These items stand to better highlight Palantir’s state of operations and the longevity of its growth momentum. I remain bullish on the stock due to its attractive valuations and a host of growth-related initiatives (as outlined here,here and here). Good Luck!