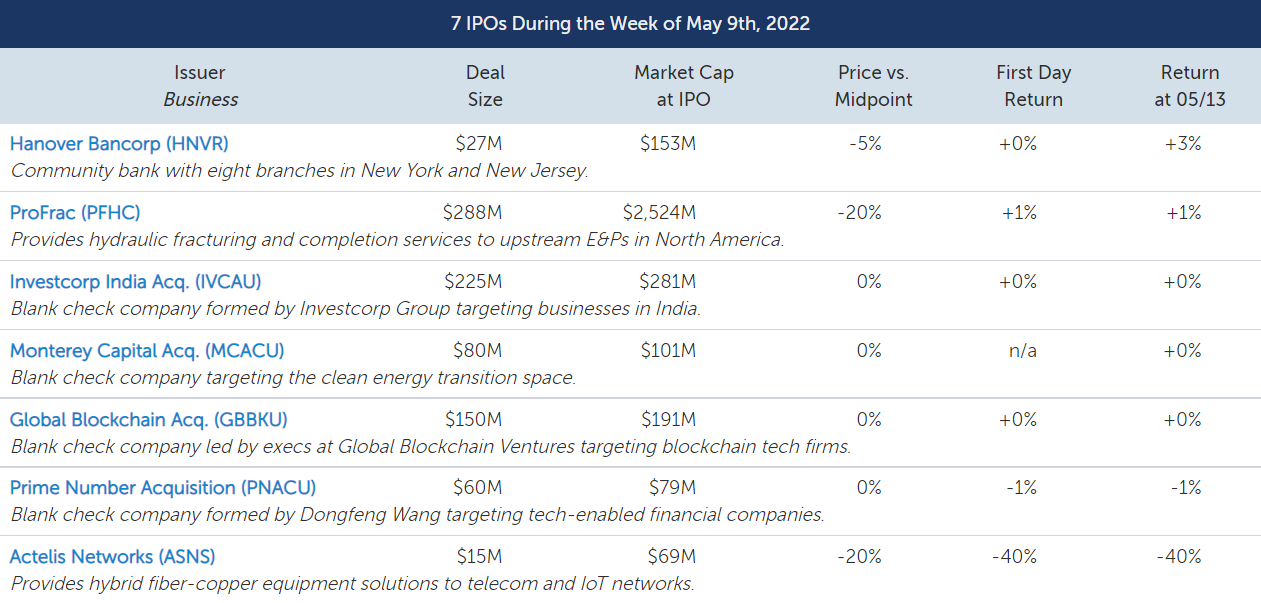

Three IPOs raised $330 million this past week, led by energy play ProFrac Holding(PFHC), which delayed its pricing by a day. The fracking services provider was joined by a bank and an IoT networking solutions micro-cap, as well as four SPACs.

ProFrac priced well below the range to raise $288 million at a $2.5 billion market cap. Operating in thesolidly-performing energy sector, ProFrac believes it is the largest privately owned provider of hydraulic fracturing services in North America by hydraulic horsepower. There are several related party transactions and connections with the founding Wilks family, who indicated on 41% of shares in the offering. ProFrac finished up 1%.

New York bank Hanover Bancorp(HNVR) downsized slightly and priced at the low end to raise $27 million at a $153 million market cap. Hanover primarily serves small and medium-sized customers through eight branches, concentrated in the NYC area. As of 12/31/21, the bank had total assets of $1.5 billion, total deposits of $1.2 billion, and total stockholders' equity of $129 million. Hanover finished up 3%.

Actelis Networks(ASNS), which provides hybrid fiber-copper equipment solutions to telecom and IoT networks, priced at the low end to raise $15 million at a $69 million market cap. The micro-cap finished down 40%.

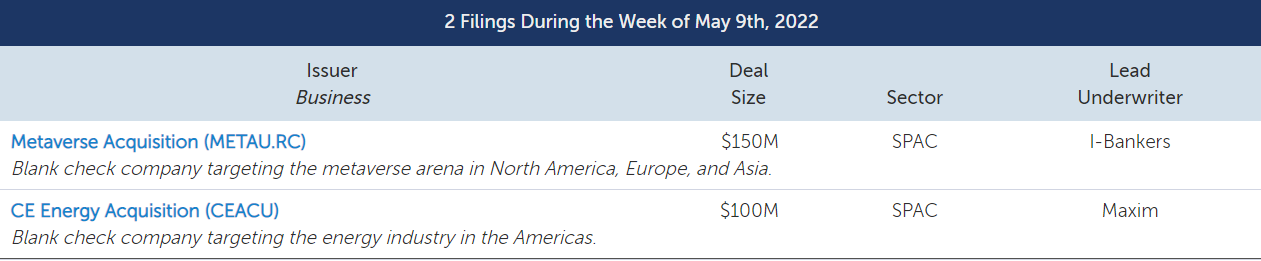

Four SPACs also priced, led by Investcorp India Acquisition(IVCAU), which raised $225 million to target opportunities in India. The SPAC market has continued to crumble in 2022, with terminations on the rise amid poor de-SPAC trading. Withdrawals are also expected to continue asunderwriters retreat from the space due to changing regulations.