Summary

- BBBY stock surges on an apparent short squeeze.

- Bed Bath & Beyond's financials continue to weaken.

- Look for the bubble to burst yet again.

One of the key takeaways from 2021 in the market was the rise of the meme stock. Retail traders would post comments on forums like Reddit about highly shorted names that were bad businesses, and theirstocks would soar in a matter of days. Bed Bath & Beyond (NASDAQ:BBBY) was one of those names that has seen a number of these sharp spikes in recent years, and just like previous times, investors have to be extremely careful with the latest madness.

I discussed the potential for a major short squeeze in this name back in late 2020 for a couple of reasons. At that time, roughly 60% of the outstanding share count was short, making the company one of the most shorted names in the market that had a valuation of at least $1 billion. The company was also planning on buying back significant amounts of its own shares, which seemed like a very positive catalyst. With management reducing the share count at a meaningful rate along with shorts needing to cover, the stock did surge in the first major meme stock rally.

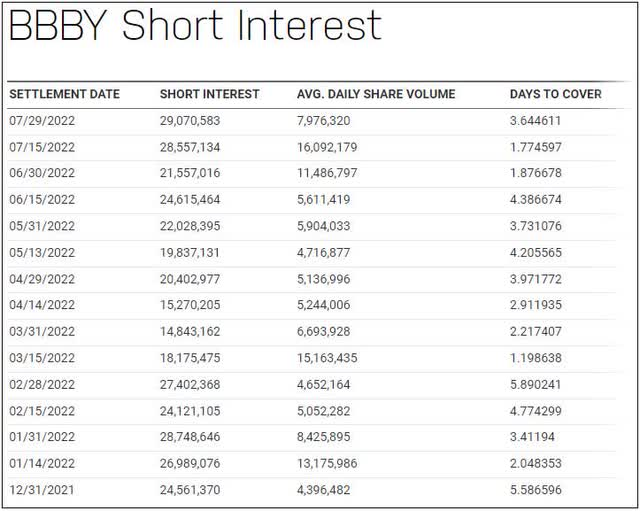

Since then, short interest has been roughly halved, down to about 29 million shares at the end of July. However, as the graphic below shows, that was the highest reported bi-monthly figure from NASDAQ during 2022 so far. The company's outstanding share count is also now below 80 million, and float data shows a figure under 70 million. This means that yet again, Bed Bath & Beyond has become one of the most shorted names in the market, making it ripe for another squeeze.

The business, however, is in a much different place now than it was back in late 2020. Revenues continue to decline from their pre-pandemic quarters that were over $3 billion, due to a combination of brand divestitures, store closings, and general retail weakness. Back in late June, the company announced terrible Q1 results, featuring a more than 25% year-over-year drop in revenues, with both top and adjusted bottom line results badly missing street estimates.

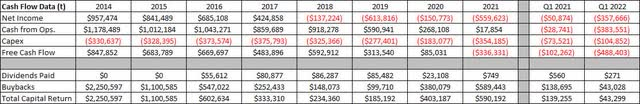

As the company's sales have dropped in recent years, management has been unable to bring down expenses to more realistic levels. This is likely part of the reason why we saw a CEO change announced at that last earnings report. Last year, losses ballooned to more than $559 million as you can see in the table below, and it wasn't just due to one-time charges or write-offs. This has also resulted in the company going from a cash flow juggernaut to one that's now burning cash at an alarming rate.

Fiscal Q1 saw almost half a billion dollars of cash burned, and yet the company still spent money on share repurchases. With last year already deeply in the red, one must wonder how much more cash is really needed to run this business over the next year or two. At the end of May, Bed Bath & Beyond reported just $107.5 million in cash on the balance sheet, but it also had nearly $1.38 billion in total debt. Right now, the company is just losing so much money that even if it reduces inventory or improves other working capital items, it may still burn through a bit of cash. Borrowing via credit facilities will only make the net losses worse as it will result in more interest expenses, which isn't great given how interest rates have risen quite a bit so far this year.

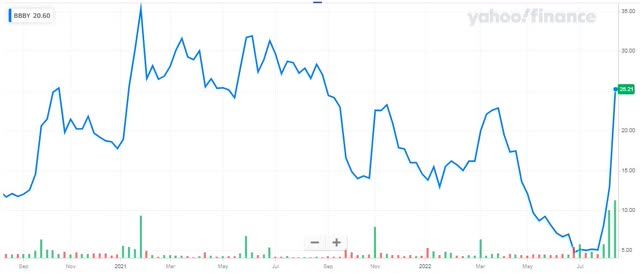

That gets me to where shares are now. They started the month under $5 a share, but we've seen another dramatic rally to more than $26 on Tuesday, and that price itself was a couple of bucks off the day's high. Of course, the average price target on the street is just $4.24 currently, implying tremendous downside from here. CNBC host Jim Cramer has been demanding that management sell equity here, and he certainly has a point with how bad the balance sheet and cash flow situation is. As the chart below shows, these sharp rallies usually end rather quickly, and the end result is a lower and lower price over time.

In the end, Bed Bath & Beyond shares have soared again, but that doesn't mean investors should pile in on the long side right now. This is a company that's in a bit of financial trouble currently, as revenue declines and large losses are leading to significant cash burn. While shorts have been squeezed recently, there is no major buyback catalyst this time around, and we might actually see the company sell some equity if it can. Like many of the past rallies, I expect this one to end badly, and the Street certainly agrees with analysts calling for this stock to plunge from here.