Summary

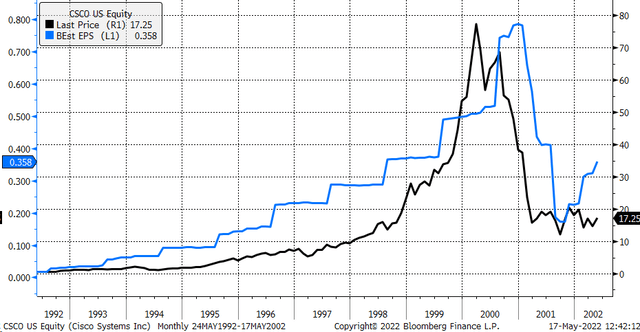

- Nvidia's stock has been following a very similar path to Cisco in the year 2000.

- The path laid out by Cisco more than 20 years ago may be sending us a message about what is in store for Nvidia down the road.

- That message may have a lot to do with Nvidia's future fundamental outlook.

About a month ago, I noted that Nvidia's (NASDAQ:NVDA)stock was likely to take a very profound turn for the worse. Since then, the shares have plunged dramatically and lost nearly a quarter of their value. If the analog mentioned in that story comparing Nvidia's technical path to Cisco's (CSCO) in the year 2000 continues to play out, then Nvidia's stock still has much further to fall.

I'm not here to say that Nvidia will continue to follow Cisco's footsteps. Nvidia trades of its own free will, and Nvidia's path could change at any point, breaking the pattern and changing its course. But that analog could help to explain why the stock is falling and why Nvidia looks so cheap compared to its historical trends.

I first pointed out the relationship between Cisco and Nvidia in December. At that point, Nvidia's stock was rising at a healthy pace. But it took a profound turn for the worse at the start of 2022, and now Nvidia's stock finds itself on the other side of the apex.

The pattern has shifted some, with Nvidia now falling faster than Cisco in 2000. So perhaps the analog has already diverted, but not by enough to suggest that the relationship has changed significantly.

Bloomberg

Many people may look at this chart and think that it implies Nvidia could decline back to $80 or $90. I'm not here to say whether it will or won't, but it could. It might seem completely unreasonable and impossible to imagine because Nvidia of today has nothing in common with Cisco. But one needs to remember that in 2000, Cisco was a rapidly-growing company and seemed bound to come out as a winner for years due to its strong positioning as a key provider in building out the Internet.

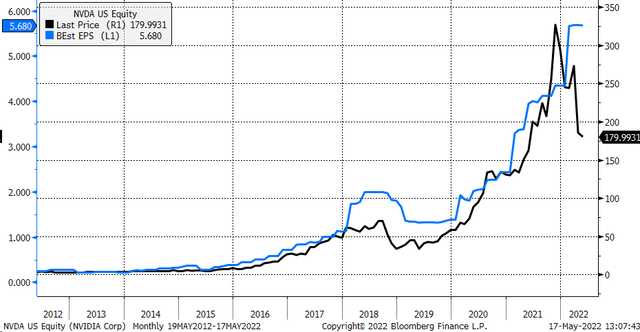

The problem for Cisco's stock in 2000 was that price led estimates, so every time Cisco stock fell, it looked cheap on a PE ratio basis, only for earnings estimates to be cut, making it no longer cheap. The stock price peaked a lot earlier than earnings estimates. The price can lead to declining earnings estimates during an earnings downgrade cycle as investors anticipate those estimates cuts.

Bloomberg

Now that has yet to happen for Nvidia, with earnings estimates for this year still holding pretty steady, but like Cisco, two things are currently happening to Nvidia. Multiple compression and a strong possibility that price is leading potential changes to future earnings estimates.

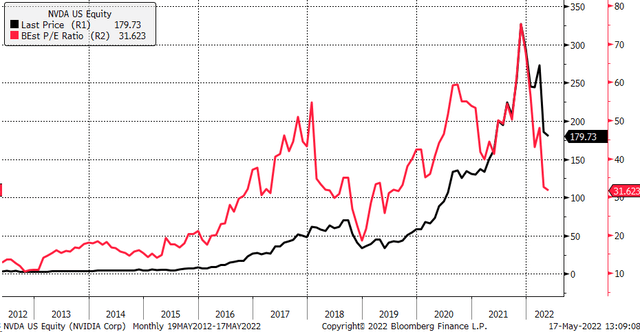

Bloomberg

Currently, the PE ratio for Nvidia has fallen sharply to 31.6. Based on historical trends and from where this stock is coming, that would seem to be a cheap PE. But if those earnings estimates start to decline, the stock may not be as affordable as it looks, which is presently the most significant risk for a stock like Nvidia.

Bloomberg

So while it seems improbable for the stock to continue to drop or see the significant declines that Cisco saw in 2000, it may be possible. If earnings for this fiscal year fell by 10% to $5.11 from current estimates of $5.68, the stock would trade for 35.2 times earnings, nearly 4 points higher than its current PE, which would mean the stock price would have to fall to $161 to get the price back to 31.6 times earnings.

Clearly, given the steep decline from its highs, there may be more than just multiple compression. It could very well be the case that the market's anticipating changes in future earnings estimates and suggesting the stock is not as cheap as it looks and that the potential for further losses exists. Not because of the analog with Cisco, but because the market is anticipating a decline in future earnings estimates for the company, just like the market did for Cisco 20 years ago.