Summary

- SPYD is a well-diversified ETF that tracks high yielding stocks of the S&P 500.

- Its performance has held up well against the S&P 500 in light of the rout in tech stock valuations.

- Meanwhile, it pays a high dividend yield, while charging a low expense ratio.

I like dividends of many different stripes and colors and over time, have added good number of issues across various sectors. It can be hard however, for some investors to dedicate the time and inclination to track individual stocks, and for them, itmay be much easier to just buy income-focused ETFs that take the guesswork out of trying to achieve adequate diversification from individual stocks.

This brings me to the SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD), which may be a good option for those investors seeking automatic diversification and high income to boot. Its pricing has fallen by 5% since the middle of this month, in reaction to general market weakness. In this article, I highlight why now may be a good time to layer in this quality ETF, so let's get started.

Why SPYD?

SPYD is an ETF that's issued by State Street (STT) Global Advisors and seeks to track the performance of the S&P 500 High Dividend Index, which is comprised of 80 high dividend yielding companies. The vast majority of the portfolio is fully invested in stocks, with 98.3% allocation to U.S. Stocks, 1.4% to international stocks, and just 0.4% sitting in cash.

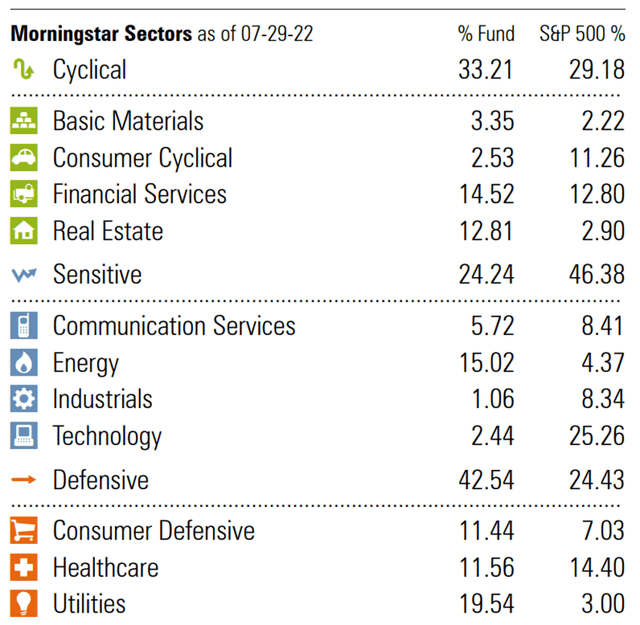

Key differences between SPYD and the S&P 500 (SPY) is its higher exposure to income generating categories such as real estate, energy, consumer staples, and utilities. As shown below, these categories far outweigh that of the S&P 500 index.

SPYD vs S&P 500 Sectors (Morningstar)

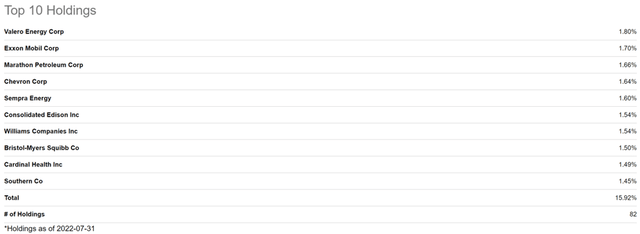

SPYD's top 10 holdings include familiar names such as Valero Energy (VLO), Exxon Mobil (XOM), Consolidated Edison (ED), Bristol-Myers Squibb (BMY) and Southern Company (SO). I also find SPYD to be well diversified. As shown below, the top 10 holdings comprise just 16% of the total portfolio, with the top name representing just 1.8% of the portfolio.

SPYD Top 10 Holdings (Seeking Alpha)

SPYD's performance gap widened with that of the tech-heavy S&P 500 in most of 2020 and 2021. However, this gap has narrowed quite a bit this year, as tech companies have faced a reckoning with growth investors. This was driven by higher interest rates, which growth investors use as the discount rate on future cash flows to present value. As one would expect, this results in a big downward revision on tech growth stocks.

SPYD Total Return (Seeking Alpha)

Looking forward, I would expect for the valuation gap between SPYD and the S&P 500 to further narrow itself. This is supported by recent hawkish comments from Jerome Powell in Jackson Hole, in which he warned of "some Pain" ahead as the Fed fights to bring down inflation. This strongly implies continued rate hikes that should put further pressure on stretched tech valuations of the S&P 500.

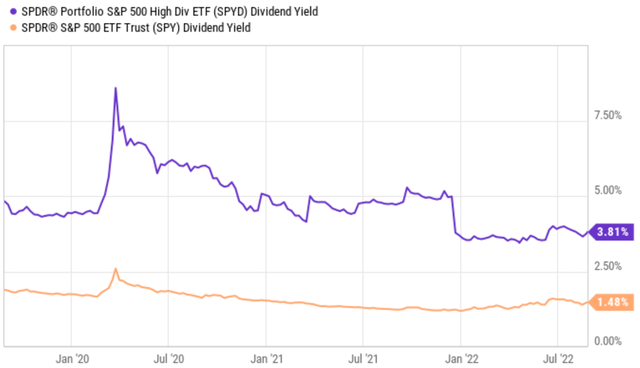

At the same time, SPYD's dividend yield is still meaningfully higher than that of the S&P 500, despite the narrower valuation gap. As shown below, SPYD sports a respectable 3.8% dividend yield, which is meaningfully higher than the 1.5% yield of the S&P 500.

SPYD Dividend Yield (YCharts)

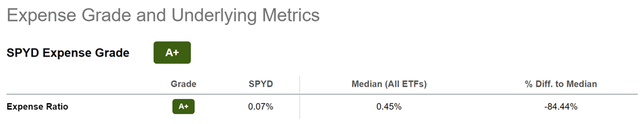

Meanwhile, SPYD sports a low expense ratio of just 0.07%, sitting well below the median 0.45% expense ratio across all ETFs. This helps SPYD to earn anA+expense grade.

Risks to SPYD include its exposure to oil & gas companies, which are currently enjoying a boom due to higher commodity prices. Many experts believe that fossil fuel prices should remain high for the foreseeable future, given ongoing energy shortages in Europe due to sanctions on Russian oil and gas. As such, I believe this segment should continue to enjoy high profitability and dividend growth, but investors should still be mindful of this exposure over the long run.

Investor Takeaway

SPYD is a quality ETF that offers investors automatic diversification and high income potential. Its valuation is holding up well against that of the S&P 500, due primarily to its lower exposure to tech companies.

Looking forward, I would expect for this trend to continue, considering the recent hawkish comments from the chairman of the Federal Reserve. With a near 4% dividend yield, I believe SPYD presents a solid option for income investors who seek diversification and long-term growth.