Summary

- Alibaba and Amazon are both great companies in an industry that's experiencing temporary headwinds.

- E-commerce over-earned in 2020 and 2021 and is now paying the price for it.

- Alibaba is cheaper, more profitable, and faster-growing than Amazon.

- However, Amazon faces less political risk.

- In this article, I explore these and other factors to determine which of the two e-commerce giants is a better buy.

Alibaba(NYSE:BABA) and Amazon(NASDAQ:AMZN) are two of the undisputed leaders of the e-commerce industry. BABA is the top e-commerce platform in China by profit, while Amazon is#1 in the U.S.by revenue as well as profit. Beyond the fact that they have similar core businesses, both Amazon and Alibaba also have cloud computing segments. The cloud has been a big profit driver for Amazon, whose core e-commerce business isn’t always profitable, and Alibaba is making big moves in the space too.

Despite the similarities between Alibaba and Amazon, there are big differences as well. Amazon sells goods directly, while Alibaba relies almost exclusively on third parties. Amazon’s biggest market is the United States, Alibaba’s is China. Amazon’s cloud business is a huge profit driver, Alibaba’s e-commerce business subsidizes the cloud.

There are enough differences between Amazon and Alibaba to make the comparison less than “apples to apples.” However, these two companies are the biggest e-commerce players in the world’s first and second largest economies. So, they are worth comparing.

The comparison is fairly interesting, too. Alibaba has both a cheaper valuation and faster revenue growth than Amazon, which would theoretically make it a better buy. However, Amazon faces less political risk than Alibaba does, which justifies some sort of a premium. The question, then, is whether Amazon’s valuation premium relative to Alibaba is too large, too small, or just the right size. In this article, I will argue that it is too large, and that BABA is the better buy out of these stocks at today’s prices.

Amazon and Alibaba: Competitors?

The first thing we need to know when looking at Amazon and Alibaba side by side is whether the two companies are competitors. They’re in the same industry, but in different regions. So the degree of competition is hard to gauge.

Generally, if you search online for a list of Amazon competitors, you’ll see Alibaba listed among them. For example, a Shopify(SHOP) blog post names Alibabain its list of companies that compete with Amazon. Many other sources online report the same thing.

There may be some competition between Amazon and Alibaba in some markets, but it’s pretty limited. In the U.S., the two companies actually have a symbiotic relationship. Alibaba is a huge source of bulk goods that drop shippers sell on Amazon, Shopify and eBay(EBAY). So Amazon and Alibaba can feed off each other's success in the United States.

As far as China goes: there’s little meaningful competition between Amazon and Alibaba there. Amazon exited direct selling in China in 2019, and now only does cross-border shipping. Shipping from the U.S. to China takes11-20 business days for consumer packages, which creates a barrier to Amazon gaining significant market share in China.

Financials

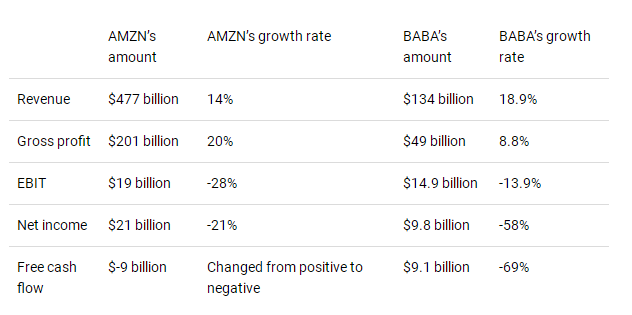

Alibaba and Amazon are both large, established tech companies. In recent years, BABA’s growth has been faster than Amazon’s, though it decelerated a lot in the last two quarters. Below you’ll find a table with some select financial metrics for Amazon and Alibaba side by side. As you can see, BABA generally has the higher growth rates of the two companies, but not by a lot.

As the table shows, BABA’s growth is faster than AMZN’s on the top line, and the decline is less severe on two out of four bottom line metrics. Although BABA’s earnings decline was more severe than Amazon’s, BABA managed to retain positive FCF in the TTM period, while Amazon didn’t. BABA also had the less severe decline in operating income/EBIT.

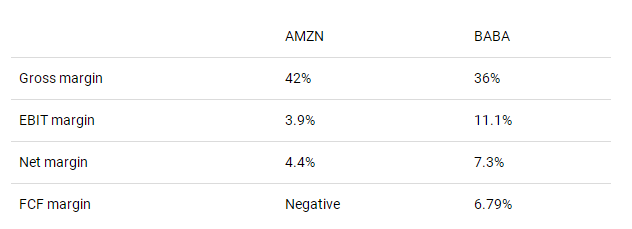

We can also calculate some profit metrics from the above figures. They are shown in the table below.

Again, the comparison favors Alibaba. Amazon only beats Alibaba on one profit metric (gross margin), but its win there is small. Meanwhile, BABA doubles AMZN’s EBIT margin, nearly doubles the net margin, and has a positive FCF margin. On profitability, Alibaba takes home the gold.

Valuation

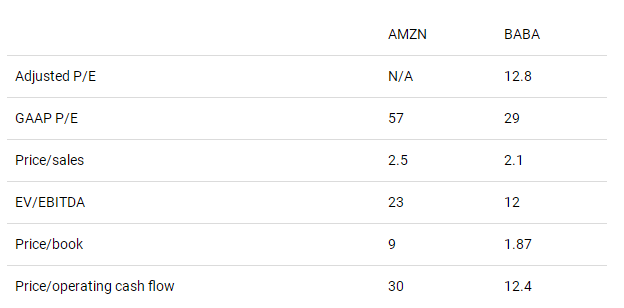

Having looked at Amazon and Alibaba’s financials, we can turn to their valuations. On this factor, there really is no comparison: BABA is cheaper than AMZN by a country mile. Its key multiples are all lower than Amazon’s, and it comes out with more upside in a DCF model.

In the table below, I’ve compiled some valuation measures for AMZN and BABA using Seeking Alpha Quant. BABA is cheaper than AMZN on every single one.

Not only are BABA’s multiples lower than Amazon’s, many of them are in true value territory. Earnings and cash flow multiples around 12 are not much higher than what bank stocks trade at, yet BABA is a tech giant with 40% five-year annualized revenue growth. It looks like a bargain, and the comparison to AMZN is favorable.

It’s also possible to compare Amazon and Alibaba using a discounted cash flow analysis. In a recent article, I did a DCF valuation of BABA using the 10-year Treasury yield as the discount rate, and got a $253 fair value. The yield hasn’t changed since I wrote that article, so that valuation still stands. I will say that Alibaba stock is generally considered risky, and if you throw a 3% risk premium on top of the discount rate I used, you only get $119. That’s still upside, but not a whole lot.

Amazon’s DCF valuation is a more complicated topic. If you use a 3% discount rate and assume that the 3-year CAGR earnings growth rate of 20% continues over the next five years before slowing to 0%, you get to $165. That’s upside to today’s price, but less upside than my BABA model, even though the BABA model assumes way less growth. If BABA goes to $250 it rises 140%. If AMZN goes to $165, it rises just 35%. So if we can use the same discount rate for Amazon and BABA, BABA is worth more, even with far more conservative growth assumptions. With that said, Alibaba is exposed to considerable political risk, so there’s a case to be made for using a higher discount rate for BABA than for AMZN.

Long-Term Business Outlook

Having looked at historical factors, we can turn to the long-term business outlook for Amazon and Alibaba. Everything I’ve written about these two stocks assumes that they can return to positive earnings growth in the future, so we need to gauge whether that’s the case.

First, we can look at industry prospects on a worldwide basis. Valuates Report forecasts that e-commerce will grow at 17.4% CAGR to 2028. Other forecasters offer similar estimates. That sounds nice, but it isn’t consistent with what's happening this year. Amazon, Alibaba, and Shopify all saw significant deceleration this year. Growth should pick up again in the future, but I’m not sure that Valuates’ rosy forecast will be hit. The COVID-19 pandemic was a huge tailwind for e-commerce firms in 2020 and 2021, pulling revenue growth forward. We can expect the industry to grow in the future, but not as much as in the recent past.

Next, we can look at growth in the markets Amazon and Alibaba serve. Both the U.S. and China have decent historical GDP growth, but China’s growth is faster. America’s10-year compound GDP growth is 2.1%. China’s is 6%. China’s growth could be cut in half, and it would still be faster than the U.S. So, BABA takes the nod on growth in the key market.

Alibaba and Amazon face similar amounts of competition. Amazon is up against Shopify, eBay and Walmart(WMT); Alibaba has JD(JD) and Pinduoduo(PDD). The number and size of major competitors is similar for both companies. Given the similarity of the competitive dynamics Amazon and Alibaba face, it looks like China’s edge in economic growth gives BABA an edge in long-term business outlook.

One Big Risk

All of the factors I’ve looked at so far favor Alibaba over Amazon. The former company wins on growth, profitability and valuation, the latter on none of the factors I’ve looked at. It seems like an open and shut case. However, there is one factor that does give Amazon an edge:

Political risk.

Currently, Alibaba is exposed to a rather enormous number of political risks, including:

Renewed fines.

A data leak that’s being investigated by China’s government.

The possibility of being delisted from the NYSE.

It’s impossible to put a numerical value on risks like these, but they are real. Fines, for example, took a $2.8 billion bite out of BABA’s net income in calendar 2021. So the risks aren’t idle talk: they are materializing, and affecting fundamentals.