- Investors looking to buy and hold Apple stock in 2023 may be wondering if March is a good month to do so. Here are some key considerations for AAPL investors.

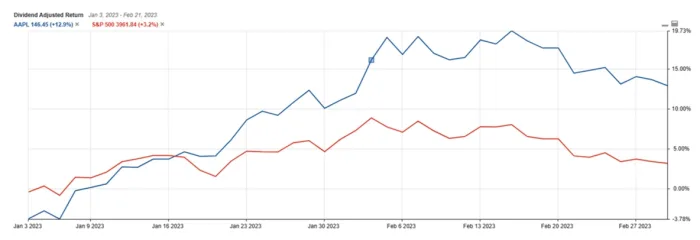

- Apple stock has performed very well so far in 2023, up 13% year-to-date against the S&P 500's 3% increase.

- March tends to be a good month to buy AAPL, although not one of the top ones. Historical analysis suggests that investors who buy now may be set up for solid returns in the next six months.

- While macroeconomic factors like inflation and interest rates could impact the stock in the near term, focusing on the longer-term bullish thesis for AAPL could be a better approach for investors.

AAPL in 2023: Strong Start

Two months out of the “new” year are now in the rearview mirror. So far, Apple stock has performed very well, up 13% YTD against the S&P 500’s more modest 3% increase. The chart below is provided by Stock Rover.

But the look-forward view is much more relevant for investors. In that regard, is March a good month to buy shares of the Cupertino company? Let’s start with a historical analysis.

Bullish Part Of The Year

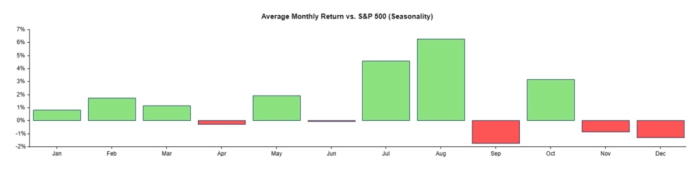

The chart below shows the seasonality in Apple stock over the past ten years. Notice the pattern: AAPL tends to outperform the S&P 500 in general, but more consistently so in the first eight months of the year.

A while ago, we talked about what most likely explains the seasonality phenomenon:

- AAPL benefits from the strong fundamentals of the company during most of the year.

- Between July and August, the stock rallies relative to the benchmark on expectations for the iPhone refresh, which usually happens in September.

- Traders and investors “sell the news” during the holiday period.

Notice that March tends to be a good month, although not one of the top ones. More importantly, and if history repeats in 2023, investors that buy AAPL today may be set up for a solid six months of returns ahead.

The Economy Will Matter

Looking at business factors, I don’t believe that much will happen in March to move Apple stock in either direction.

This is a quiet period for the Cupertino company: earnings season is over, and meaningful product launches are unlikely to happen for a while – unless Apple surprises by releasing its new mixed reality device earlier than expected.

This is not to say, however, that AAPL price will stay the same or move little. In the near term, macroeconomic factors can certainly have an impact on how Apple stock behaves.

Keep in mind that Apple has a beta of 1.28 and a high correlation with the S&P 500 of 0.63. In plain English, this means that AAPL is likely to magnify the movements of the broad market index, either up or down.

For now, inflation and the direction of interest rates are crucial topics of conversation. They help to explain why both the S&P 500 and AAPL dropped nearly 4% in the past three weeks after reports of a pickup in consumer prices and a more hawkish stance coming from Fed officials.

The Key Takeaway

In summary, and if history should be considered, March could be a good month to buy and hold Apple stock for at least six months. But timing entries and exits can be tricky.

The economy, for example, poses substantial downside risk in the short term. In my view, it is better for investors to look past the immediate threats and focus a bit more on the longer-term thesis, which I believe still leans towards the bullish side.