Rising interest rates and faster inflation are positive for value strategies

Investing is all about being in tune with the trends. Here’s one to be aware of for 2022: Value stocks will most likely beat their growth counterparts.

The trend is already under way. Consider:

* The Vanguard S&P 500 Growth Index exchange traded fund is down 5.6% year to date, while the Vanguard S&P 500 Value Index fund is flat.

* Value groups including banks and energy stocks are crushing growth stocks like Ark Invest’s favorite names. The KBW Bank Index and the Energy Select Sector SPDR ETF are up 6%. In contrast, the ARK Innovation ETF has slid over 13%. That ETF is filled with growth darlings like Tesla, Coinbase Global, Teladoc Health and Zoom Video Communications.

Here’s a look at four forces favoring value over growth, followed by 14 value stocks to consider, courtesy of two value investing experts.

A lot of investors value stocks using the net present value (NPV) model — especially high-growth stocks that have expected earnings in the distant future. This means they discount projected earnings back to the present using a discount rate, typically the yield on 10-year Treasuries.When the discount rate goes up, NPV goes down.

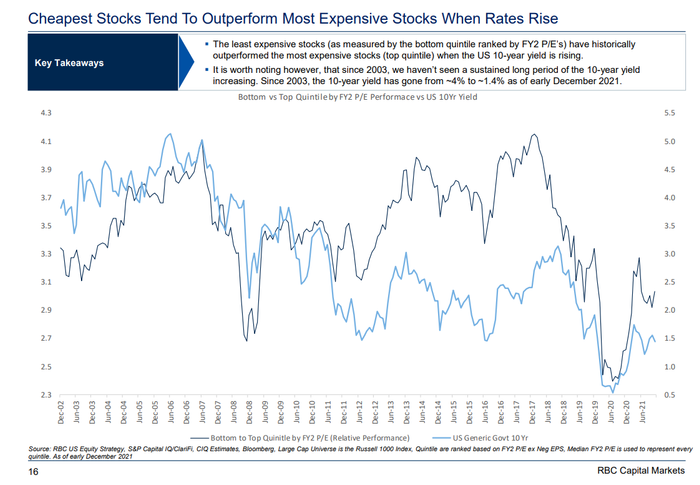

So naturally, when 10-year yields rise as they are now, expensive stocks in areas like tech underperform the cheapest stocks in areas like cyclicals, financials and energy, points RBC Capital Markets strategist Lori Calvasina.

Likewise, price-to-earnings (P/E) multiples of the most expensive stocks become inversely correlated with 10-year yields during Federal Reserve hiking cycles, she points out. The reverse is true for value stocks.

“The least expensive stocks have historically outperformed the most expensive stocks when the 10-year yield is rising,” she says.

Ed Yardeni at Yardeni Research projects the 10-year yield could rise to 2.5% by yearend, from around 1.79% now. If he is right, that suggests value outperformance will continue. Though there will be counter-rallies in growth and tech along the way (more on this below).

Here’s a chart from RBC Capital Markets showing that value historically outperforms as yields rise. The light blue line represents bond yields, and the dark blue line represents cheap stock performance relative to expensive stocks.

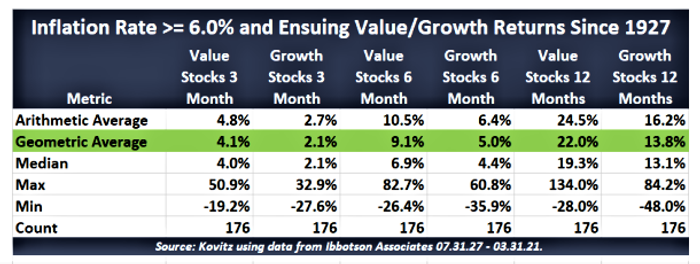

2. Higher inflation is positive for value strategies

This has historically been the case, points out John Buckingham, a value manager at Kovitz Investment Group who pens The Prudent Speculator stock letter. He expects a repeat now. Part of the reason is that inflation fears drive up the yield on 10-year bonds, creating the detrimental NPV effect for growth names (described above).

Inflation accelerated at the fastest pace in December since 1982, the government reported Wednesday. It was the third straight month in which inflation measured annually exceeded 6%.

But another factor is at work. During inflationary times, companies with actual earnings can boost profit margins by raising prices. As a group, value companies tend to be more mature, which means they have earnings and margins to improve. Investors notice this, so they’re attracted to those companies.

In contrast, growth names are characterized by expected earnings, so they benefit less from price hikes.

“Growth companies do not make money so they can’t improve margins,” says Buckingham. “They are paying employees more, but they are not making more money.”

Here’s a chart from Buckingham showing that value stocks historically outperform when inflation is high.

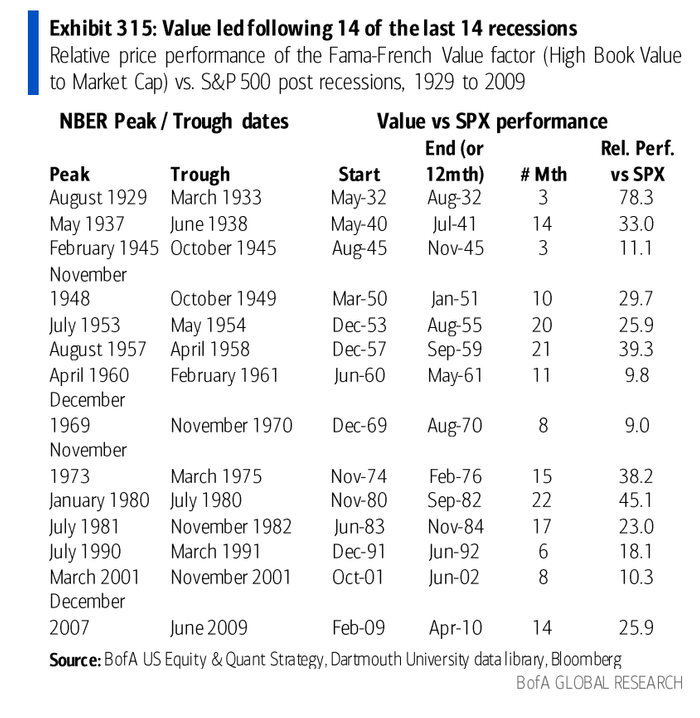

3. Value stocks do well after recessions

Historically, this has been the case, as you can see in the chart, below, from Bank of America. This is most likely because inflation and interest rates tend to rise during economic rebounds. Both trends are a negative for growth stocks relative to value, for the reasons outlined above.

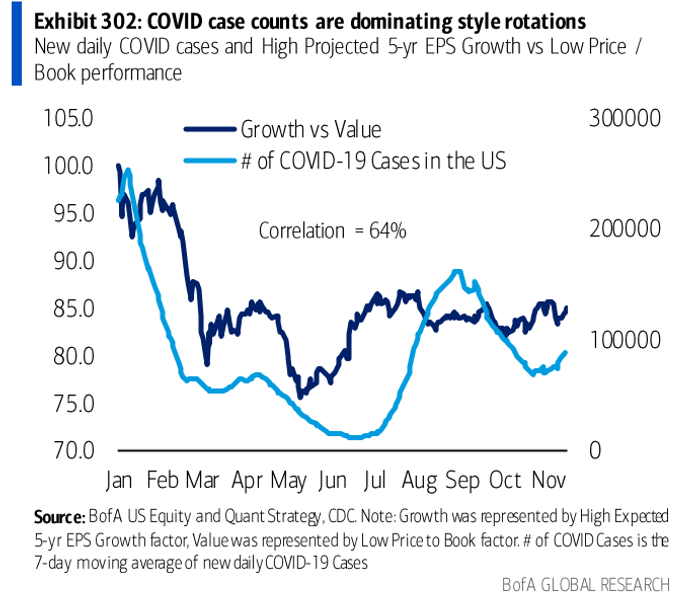

4. Value stocks do better when Covid cases decline

This has been the case throughout the pandemic, as you can see in the graphic below from Bank of America. This is probably because when Covid cases decline, the prospects for the economy improve, which suggests inflation and interest rates will rise — both of which make growth lag value, historically. Omicron is spreading so fast, the case count is likely to peak by the end of January. So this effect may kick in soon.

In the chart below, the light-blue line is the Covid case count. The dark-blue line is the relative outperformance of growth to value. When the dark-blue line declines, it means value stocks are doing better than growth stocks.

Which stocks to favor

Cyclical names, banks, insurance companies and energy businesses populate the value camp. So those are the groups to consider.

Buckingham suggests these 12 names, most of which are in the sectors above: Citigroup, CVS Health, FedEx, General Motors, Kroger, MetLife, Omnicom Group, Pinnacle West Capital, Tyson Foods, Verizon, WestRock and Whirlpool.

Bruce Kaser of the Cabot Turnaround Letter counts Credit Suisse in banking and Dril-Quip in energy among his favorite names for 2022. He’s bullish on value stocks now that the enthusiasm for “concept stocks” has broken.

“Concept stocks get way over bid, and that is when value does the best,” he says.

While concept stocks founder, value companies continue to grind it out and post actual earnings, so money migrates to them. This is what happened for a long time, after the tech bubble burst years ago.

“After 2000, value outperformed for a decade,” he says.

No doubt, there will be countertrend reversals along the way.

“These rotations tend to wind down as both sides of the rotation get overplayed,” says Art Hogan, the chief strategist at National Securities.

Here’s a factor that might temporarily cool the rotation, near term. Investors are about to learn that first-quarter growth is taking a hit because Omicron quarantines are hurting companies. This news on economic growth may reduce the fears about inflation and rising interest rates sparking the migration to value.

But Omicron is so contagious, it will probably go as fast as it came. That’s what we see in countries struck early on, like South Africa and Britain. Then factors like stimulus, an inventory build, and strong consumer and corporate balance sheets will revive growth.

This would mean the growth-value dichotomy will continue this year — since three of the four main forces driving the trend are linked to strong growth.