The initial public offerings of mainland Chinese technology firms propelled Hong Kong Exchanges and Clearing (HKEX) to its strongest-ever first half in terms of IPO proceeds, according tonew data from KPMG.

The blockbuster listings of five Chinese tech companies contributed two-thirds of the Hong Kong stock exchange’s IPO proceeds of $26 billion, a record high for the first six months of 2021 that represents a 54% increase from the same period last year.

TikTok rival Kuaishou Technology, a short-video platform, amassed $6.2 billion in its public debut on the HKEX in February. It was the world’s top-earning IPO in the first six months of 2021.

JD Logistics, the technology-driven delivery arm of e-commerce empireJD.com, raised $3.6 billion in its May debut.

Three secondary listings by Chinese firms also brought in large sums. In March, search engine giant Baidu netted $3.1 billion, while video platform Bilibili raised $3 billion that same month. Shanghai-based Trip.com, a travel booking platform, received $1.3 billion from investors in April.

Four of the five firms made the list of top 10 IPOs worldwide in terms of funds raised for the first half of 2021.

The outsize presence of technology firms on the Hong Kong bourse is not surprising, as markets pivot to “new economy” firms—namely, innovative, tech-first companies, says Louis Lau, partner in the capital markets advisory group atKPMGChina.

The trend in “homecoming listings”—or U.S.-listed Chinese companies that choose the HKEX for a secondary listing—that began in 2018 has also continued this year. The Hong Kong bourse is a natural choice for such listings, given domestic investors’ familiarity with Chinese companies’ brands and businesses, analysts say. Secondary listings in Hong Kong serve as a sort of backup option for U.S.-listed firms that are at risk of being booted from American exchanges should they violate U.S. audit review rules.

Fourteen Chinese companies have opted for a secondary listing in Hong Kong since 2018. Baidu, Bilibili, Trip, and online car portal Autohome staged homecoming listings in the first six months of 2021 andraised a combined$8.1 billion—approximately 31% of the city’s IPO proceeds.

“The ‘homecoming’ of U.S.-listed Chinese companies continues to lift the city’s capital markets…and [are] the hot trend of the Hong Kong IPO market. We expect this trend to continue,” says Lau.

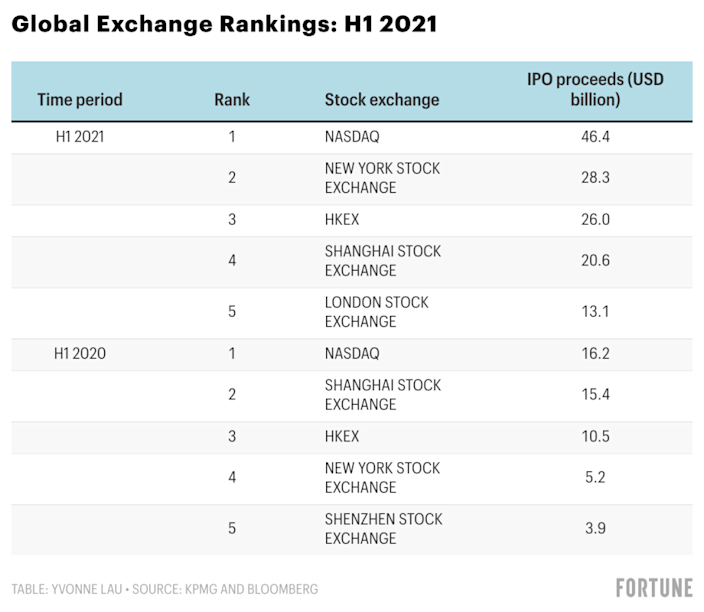

For the first half of this year, the HKEX ranked third worldwide in terms of funds raised, behind theNasdaqand New York Stock Exchange (NYSE), which raked in $46.4 billion and $28.3 billion, respectively. Funds raised in the global IPO market soared to $210 billion in the first six months of 2021, an increase of 66% compared with the same period last year.

HKEX in May announced it will raise its profit requirements by 60% for listing applicants starting in January 2022. It’s the first increase in almost 30 years for the bourse, which made the change to “enhance market quality and investor protection,”HKEX said in a statement.

Even with the higher profit threshold, the Hong Kong exchange will remain competitive, Lau says. The recent announcement may lead to a rush of IPO applications in the second half of this year, since the change takes effect in January. “However, the Hong Kong IPO market will not be significantly impacted in terms of funds raised,” he adds.