Summary

- Berlin, Austin factories likely to start contributing in Q2.

- Materials inflation will impact the EV demand picture.

- Elon Musk and Tesla face numerous legal issues.

With Russia deciding to invade Ukraine recently, electric vehicle maker Tesla (TSLA) has received a lot of attention. With the prices of oil and gasoline soaring, consumers and global governments are looking toward a future of renewable energy and less ICE vehicles. While the overall craziness around Tesla from years back seemed to have settled down, the future of the company could actually be reaching a critical point rather soon.

Part of the bull case for last year was the opening of two new factories that would help with the company's next leg of growth. As we've seen with a number of past Tesla items, delays ensued, but things are finally progressing. The first deliveries from these factories should start in the coming months, although they aren't likely to make any meaningful contributions until much later this year. In terms of pure volume growth, the Berlin and Austin facilities are more important items for next year's delivery surge.

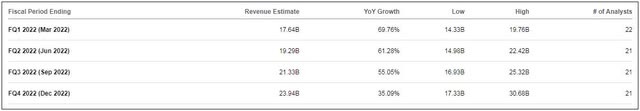

Now that these factories are starting to produce vehicles, I'm curious to see how street analysts react. As I've detailed in previous articles, the street has been extremely conservative with regard to Tesla in recent quarters. As the table below shows, one analyst even sees Q4 revenues this year coming in below last year's Q4 total sales figure. Most Tesla bulls see at least an extra 125,000 deliveries in this year's Q4, so how is it possible that the company report lower revenue? These extremely low estimates continue to drag overall averages down, which helps Tesla report delivery, revenue, and earnings beats that don't truly reflect the reality here.

Tesla Revenue Estimates(Seeking Alpha Estimates Page)

As for the current quarter, total revenues are expected to be down a little sequentially, implying flat to slightly higher deliveries. That implies around 310,000 deliveries for Q1, a bit below my current expectation for 324,000. We got decent numbers out of China for January, and we're expected to get February numbers rather soon. Perhaps good data on that front will get the street average up a bit to a more realistic expectation.

With gasoline prices soaring in recent weeks, the spotlight on electric vehicles has certainly increased. However, Tesla also faces a hit from the Russia situation as the country is a key nickel producer, and other commodity prices have also soared. Cobalt, copper, and lithium carbonate prices are on the rise as well, which could dent Tesla's margins in the coming quarters unless the company raises prices again. The consumers being hurt the most by rising energy prices can't just go out and buy EVs that start at $60,000, which will impact the ongoing shift to electric vehicles.

Since Tesla unveiled the Cybertruck, for instance, prices of copper have nearly doubled, while cobalt, nickel, and lithium prices have more than doubled. That's going to make it hard for Tesla to achieve that sub $40,000 price point, unless it wants to lose a bit of money. For those arguing about massive battery savings coming up, just remember that the Model 3 starts at nearly $45,000 currently, and that's a much smaller vehicle and one that has been in mass production for years. Tesla is currently estimated to have well over a million reservations for the Cybertruck, so it will be interesting to see how many orders are canceled if prices jump 10%, 25%, or more once the vehicle actually comes to market.

Perhaps the biggest risk for Tesla currently doesn't actually involve everyday operations, as there are a number of ongoing high profile lawsuits involving the company and or Elon Musk. As the company's10-K filing details, a decision on the lawsuit against the SolarCity acquisition is due in the coming months. A trial related to the 2018 CEO award is scheduled for April, while another case involving the $420 going private transaction is scheduled for trial in May. At the same time, the SECis reportedly looking into Elon and Kimbal Musk for alleged insider trading charges. These legal actions could have widespread ramifications for Tesla, its executives, and board members, but to what degree is uncertain at this point.

As for Tesla shares, they remain in a very interesting place currently. Despite all the positive potential news for EV and solar lately, the stock has been hit with the overall market. Monday's close below $805 puts the stock well below the average street price target of $958. As the chart below shows, shares have recently lost the 200-day moving average (orange line). Without a rebound in the near term, that sets up the possibility of the dreaded death cross over the next few months, as the 50-day moving average (purple line) could cross below its longer term counterpart.

Tesla Chart With Moving Averages(Yahoo Finance)

In the end, Tesla may be approaching a key point in its history over the next couple of months. The Berlin and Austin factories are set to start contributing to the growth story, coming at a time where consumers are feeling the pain of higher gas prices thanks to the Russian war in Ukraine. Unfortunately for the company, the shift to EVs may face a stiff headwind if commodity prices continue to soar and make these vehicles much more expensive. While many eyes remain on the business itself, I will really be watching the courtroom as Tesla and Elon Musk face a number of major lawsuits. Investors are hoping the growth story can push this stock to new highs moving forward, but the overall market weakness is limiting upside currently.