Summary

- After taxes and inflation, the real yield of most stocks and bonds is negative.

- Even then, high-yielding opportunities remain abundant in some beaten-down sub-sectors of the REIT market.

- We highlight two such opportunities that offer 6% dividend yield and high upside.

If you are an income-seeking investor or even a retiree, you have a big problem on your hands: treasuries, bonds, preferred shares, and regular common shares are all priced for negative real yields:

Treasuries (IEF) yield 1.7%, which turns into ~1.2% after taxes, and a negative -5% after inflation.

Corporate bonds (VCLT) are barely better, yielding 3.2%, turning into 2.5% after taxes, and a negative -3.5% after inflation. That's assuming there are no credit losses, despite historically high leverage and unprecedented uncertainty.

What about preferred shares? Many still offer a ~6% current yield, but again, remove taxes, and you are down to ~4%. Then remove inflation and you are back to negative -2%. Even worse, most preferred shares today are priced at a premium to par, which even further worsens future returns.

The broader stock market (SPY) yields only 1.5%, which is expected, but even if you favored historically higher-yielding sectors like utilities (XLU), you wouldn't get more than a 4% yield, which turns into a negative -3% after taxes and inflation.

Obviously, it's not sustainable for anyone to earn a negative real yield, regardless of how wealthy you are.

So what do you do in today's environment to earn superior yields in the 6-8% range with additional upside to make up for inflation?

That's the million-dollar question.

Some investors have moved their assets into crypto. Through staking on platforms like Coinbase (COIN), they manage to earn an attractive yield in addition to the potential upside. But it goes without saying that crypto is still in its early days and extremely speculative.

Others have moved to crowdfunding platforms like FarmTogether to invest in private farmland, a notoriously good inflation hedge with yields reaching up to 10%. However, you're again facing risks here, including illiquidity and concentration. Moreover, these deals are only reserved for accredited investors as of today.

While these alternative asset classes may deserve a place in a well-diversified portfolio, I'm investing the bulk of my portfolio in something else.

Enter REITs (VNQ)

REITs are publicly-listed real estate investment firms. Many of them are today priced at low yields and expensive valuations. However, others that temporarily suffered from the pandemic are still priced at exceptionally low valuations and high yields.

I'm particularly interested in those because ultimately the pandemic won't last forever, and as we slowly move past it, I expect these REITs to unlock substantial upside in addition to their large dividend payments.

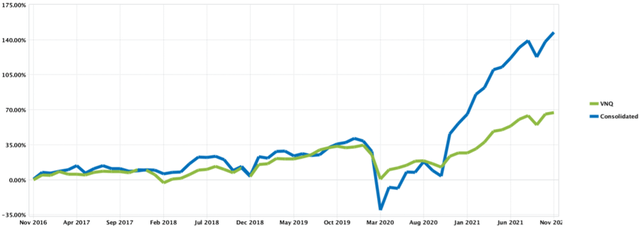

Based on this simple thesis, I have been heavily investing in beaten-down COVID-sensitive REITs since the beginning of the pandemic, and the results have been phenomenal so far:

Best of all, these opportunities remain abundant, and therefore we expect our strong performance to continue in the years ahead.

In what follows, we will highlight two undervalued REITs that offer a 6%-plus dividend yield along with significant upside potential. We own both of these as part of our Portfolio at High Yield Landlord:

Northwest Healthcare Properties (NWHUF/NWH.UN)

Most healthcare REITs suffered significant pain from the pandemic. Senior housing and skilled nursing facilities were already overbuilt prior to the pandemic, and suddenly, their cost went up significantly, even as revenues collapsed, forcing many tenants to stop paying rents.

As an example, Omega Healthcare(OHI), the largest skilled nursing REIT, reported in late 2021 that some of its tenants had stopped paying rents. Not surprisingly, its share price took a bit of a hit. We think that such REITs deserve to trade at discounted valuations because these sectors are truly challenged.

However, there are some other healthcare property segments that are doing just fine. I'm here referring to medical office buildings, hospitals, and life science buildings. Despite that, because they're considered to be "healthcare REITs," their market sentiment also took a hit as they sold off in association with the other challenged REITs.

Those are the kinds of healthcare REITS we are buying, and one of our favorite opportunities is Northwest Healthcare Properties(OTC:NWHUF). It is a Canadian REIT that owns a diversified global portfolio of hospitals and medical office buildings, and today, it's still priced at a 6% dividend yield that's safely covered and sustainable.

The market sees NWHUF as "yet another risky healthcare REIT", but in reality, it is a lot more resilient than average, and not even the pandemic disrupted its steady rental income.

NWHUF's resilience is the result of three things:

High rent coverage:Senior housing and skilled nursing facilities commonly operate on very thin margins with rent coverage ratios right around 1.2-1.4. This means that there is little room for error. However, hospitals and medical office buildings commonly operate at 3-8x rent coverage. The rent is a much smaller portion of the profits, providing more safety.

Very low risk of vacancy:Right now, NWHUF has 14 years left on its leases on average, and the yearly lease expirations are very limited. And even as leases expire, it is very difficult to move from one property to another if you operate a hospital or a medical office building.

International diversification:Unlike most healthcare REITs that only focus on one country, NWHUF has intentionally diversified across multiple continents and countries in order to diversify its risks. This is especially helpful in the healthcare space because you don't want to be dependent on a single country that may change rules/reimbursement plans from one year to the next.

NWHUF combines this consistent cash flow business with a rapidly-growing asset management business to boost its total returns.

In recent years, they began to manage capital for third parties in exchange for fees, and in just three years, they tripled external assets under management:

Building this asset management business led to some dilution in the near term as they structured new vehicles, sold assets into them, and incurred set-up costs, but going forward, it is expected to significantly boost the company's growth as they scale up these vehicles.

All in all, the management believes that they have a business model that has the potential to deliver 16%-plus annual total returns for shareholders:

Historically, they have "only" delivered a 10% average annual total return, but remember that this was before they really started to grow the asset management business, and the recent years were impacted by the creation of these vehicles, as well as the deleveraging of their balance sheet.

You would expect such a company to trade at a high valuation in today's 0% interest rate world, but contrary to all logic, it is currently priced at a 5% discount to net asset value, and a steep discount to peers based on P/AFFO:

We think that this is an opportunity and we are buying. While you wait for long-term growth, you earn a steady 6% dividend yield.

EPR Properties (EPR)

The pandemic also deeply affected all retail properties. For a long time, people could not visit these properties. To this day, many properties still have some restrictions in place which reduce the profitability of tenants, causing many to default on their rent payments.

EPR was particularly heavily affected early into the pandemic because it owns mainly "experiential" retail properties like movie theaters, golf complexes, water parks, ski areas, etc.

Some of EPR's biggest tenants include companies like AMC (AMC), Cinemark (CNK), and TopGolf:

As tenants stopped paying rents, EPR was forced to temporarily suspend its dividend, causing its share price to collapse. For a while, investors feared the worst and even questioned whether EPR could survive the crisis.

In hindsight, that was obviously an overreaction. As we explain in an article that we published early into the pandemic, EPR had a strong balance sheet with significant liquidity and could have survived years of disruption.

Since then, things have gradually returned to normal, rent collection rates have recovered, EPR reinstated a dividend, and even returned to acquisitions, taking advantage of the uncertainty to get great deals.

Despite that, EPR's share price is still nearly 40% below its pre-pandemic level, and the yield is 6.5%:

We think that this is an opportunity.

EPR is mainly feared due to its exposure to movie theaters, but the market fails to understand the resilience of this business.

EPR is the landlord, not the operator, and therefore, it earns steady rent checks from 10-plus year-long leases. Moreover, EPR's movie theaters are some of the most productive in the country, rent coverage is near 2x pre-crisis, and today, theaters are setting new box-office records.

For example, we've seen the new Spider-Man movie just enter the all-time Top 10, despite the global pandemic, restrictions, and lack of tourism. This clearly shows you that there is significant pent-up demand and the movie theater experience remains highly desirable.

The reality is that if you like blockbuster movies, then movie theaters will continue to be needed to monetize the majority of them. People simply don't pay as much for VOD and streaming.

We think that EPR is far more resilient than the market understands and as it returns to growth, we expect 30%+ upside on top of its 6%+ dividend yield.

Bottom Line

If you want to earn high yield in today's market, you need to become creative and look for opportunities where others aren't.

Right now, we find the best opportunities in the beaten-down sub-sectors of the real asset market that suffered from the pandemic.

Many of these stocks are unfairly discounted due to "temporary pain" that won't last for much longer and offer significant upside and high yield as they recover from the pandemic.

We have targeted these investments for most of the past two years, and here are our results so far. We expect more of the same in 2022.