Paysafe Limited (“Paysafe” or the “Company”) (NYSE: PSFE) (PSFE.WS), a leading specialized payments platform, today announced its financial results for the second quarter of 2022.

Second Quarter 2022 Financial Highlights(Metrics compared to second quarter of 2021)

- Total Payment Volume of $33.4 billion*, increased 3%

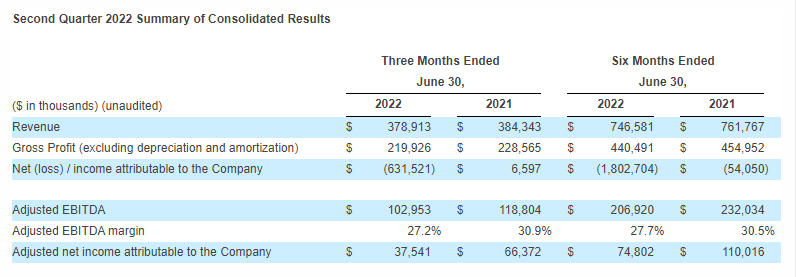

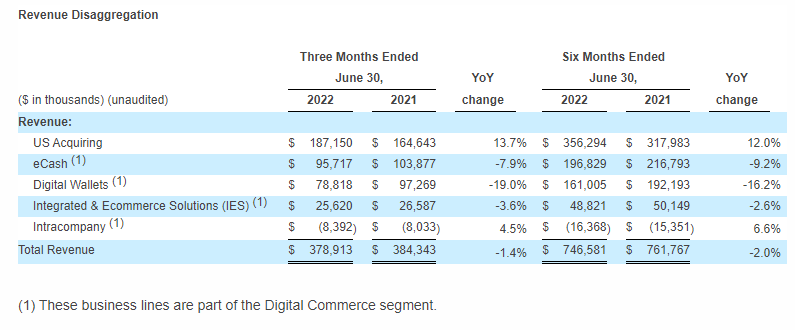

- Revenue of $378.9 million, decreased 1%; Revenue increased 3% on a constant currency basis

- Net loss attributable to the Company of $631.5 million, compared to net income attributable to the Company of $6.6 million, and inclusive of a non-cash impairment charge of $676.5 million

- Adjusted net income of $37.5 million, compared to adjusted net income of $66.4 million

- Adjusted EBITDA of $103.0 million, decreased 13%; Adjusted EBITDA decreased 9% on a constant currency basis

Bruce Lowthers, CEO of Paysafe, commented: “Through the first half of the year, Paysafe has delivered financial results in line with our overall expectations, marked by double-digit growth in the US SMB market. I remain very excited to be at the helm of Paysafe as we drive transformational change to unlock our full growth potential with a laser focus on accelerating sales, innovative product delivery and operating at speed. While strong execution has enabled us to absorb headwinds from foreign exchange rates and a soft European gambling market, at this time we believe it is prudent to adjust our outlook to reflect the current macroeconomic environment.”

Recent Strategic and Operational Highlights

- Announced Rob Gatto as chief revenue officer to transform Paysafe's sales engine and ensure exceptional client experiences

- Continued strong growth from US Acquiring – Q2 revenue increased 14%

- Launched with additional iGaming operators in Ontario’s new private market – Paysafe is now live with or onboarding 14 operators

- Won ‘Payment Innovation’ Award at SBC Awards North America, recognized for Skrill USA upgrades to support instant funding of deposits and payouts plus VIP player program

- Entered Arkansas iGaming market with BetSaracen

- Integrated Mastercard Send into Paysafe's platform, enhancing payout capabilities in the UK and EU

Impairment of Goodwill

Due to a sustained decline in Paysafe’s market capitalization, as well as current market and macroeconomic conditions, Paysafe recognized a $676.5 million impairment of goodwill during the second quarter. The non-cash impairment charge will not have any impact on the Company’s compliance with its debt covenants, cash flows or liquidity. Additional information about the results of the goodwill impairment test and related disclosures will be available in the Company's interim financial report on Form 6-K to be filed with the SEC.

* Volumes exclude embedded finance related volumes of $13.5 billion.

Net loss attributable to the Company for the second quarter was $631.5 million, compared to net income of $6.6 million in the prior year period, largely reflecting the aforementioned impairment charge.

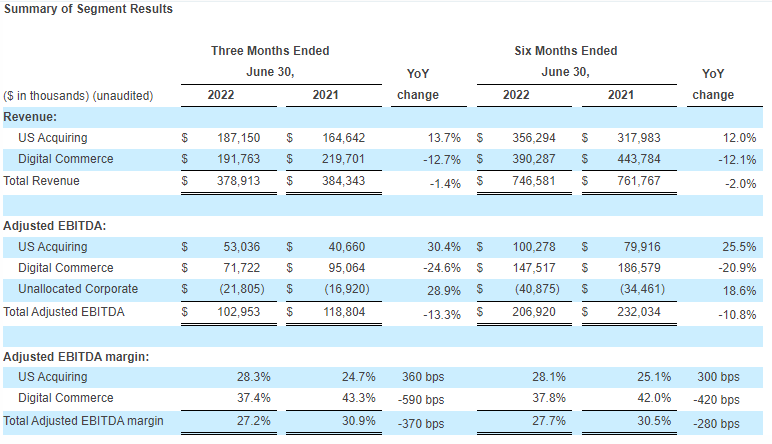

Adjusted EBITDA for the second quarter was $103.0 million, a decrease of 13%, compared to $118.8 million in the prior year period. Excluding a $5.1 million unfavorable impact from changes in foreign exchange rates, Adjusted EBITDA decreased 9% compared to the prior year period. Adjusted EBITDA margin decreased to 27.2%, compared to 30.9% in the prior year period, primarily reflecting business mix.

Adjusted net income for the second quarter was $37.5 million, compared to adjusted net income of $66.4 million in the prior year period. The change in adjusted net income was largely attributable to the same factors impacting Adjusted EBITDA as well as an increase in depreciation and amortization expense, excluding the amortization of acquired intangibles, and higher interest expense, excluding the impact of the acceleration of deferred debt financing expense.

Second quarter net cash inflow from operating activities was $875.6 million, compared to $7.7 million net outflow in the prior year period. Free cash flow was $39.7 million, compared to $54.6 million in the prior year period.

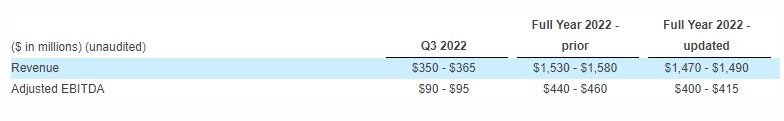

For full year 2022, Paysafe is now anticipating revenue and adjusted EBITDA to be in the ranges provided below. These revised expectations reflect the impact of foreign currency as well as macroeconomic uncertainty. Excluding the impact of movement in foreign exchange rates, Paysafe anticipates mid single-digit revenue growth for full year 2022.