Chinese EV maker, BYD Company (OTCPK:BYDDF)expects a net profit of RMB2.8B - RMB3.6B ($533M) in 1H22, up 138.59% - 206.76% Y/Y and after deducting non-recurring gains and losses, net profit to be RMB2.5B - RMB3.3B, up 578.11 % - 795.11% Y/Y.

BYD Group's NEV sales grew strongly and kept hitting record highs, leading the market share and achieving rapid year-on-year growth, despite many unfavorable factors including the macroeconomic downturn, Covid outbreaks, chip shortages and continuous increase in raw material prices.

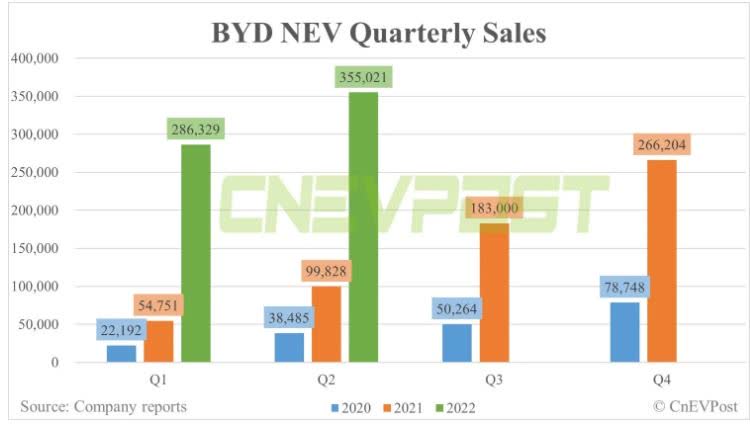

In the first half of this year, the company sold 641,350 NEVs, up 314.90% from 154,579 units in the same period last year.

As of early July, the company's undelivered orders had accumulated more than 700,000 units and if the production increase plan goes well, BYD's monthly production will reach about 300,000 units in August.

The company's June sales jumped 224.02% Y/Y and 16.61% M/M to 134,036 vehicles and Q2 sales jumped 255.63% Y/Y and +24% Q/Q to 355,021 NEVs.

Shares declined by double digits on July 12 on speculation that Berkshire Hathaway is reducing its stake in the company.