China’s economic recovery likely strengthened last quarter while manufacturing and retail sales advanced in March, official reports this week may show

JD.com slides as some analysts turn more bearish on the stock amid heightened competition in the e-commerce industry

Hong Kong stocks were steady near a one-week high before government reports this week signalling China’s economy strengthened last quarter as manufacturing expanded. JD.com tumbled as some analysts warned of market-share loss.

The Hang Seng Index rose 0.2 per cent to 20,478.83 at 10.15am local time, adding to a 0.5 per cent advance last week. The Tech Index climbed 0.6 per cent while the Shanghai Composite Index advanced 0.6 per cent.

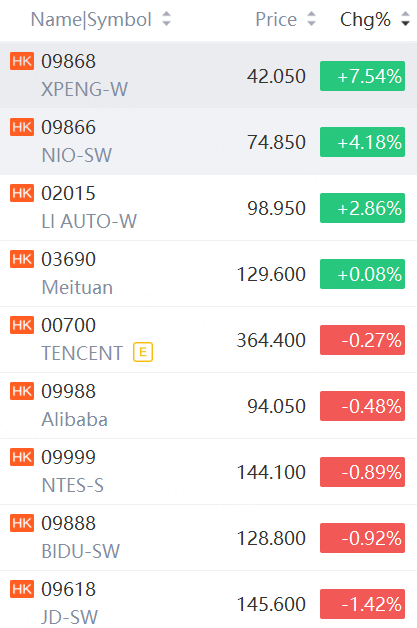

HSBC jumped 2.3 per cent to HK$56.90 while China’s top chip maker SMIC rose 3.1 per cent to HK$24.65. BYD led carmakers higher, adding 1.5 per cent to HK$230.20 while Xpeng rallied 7.4 per cent and Nio climbed 4.11 per cent.

Limiting gains, JD.com slumped 1.4 per cent as analysts including UBS and Blue Lotus Capital Advisors warned of weakening operating results in the short term amid heightened competition. Alibaba Group fell 0.6 per cent to HK$93.60 amid an internal reorganisation while Tencent slipped 0.4 per cent to HK$363.80.

Investors are keeping bets light amid geopolitical tensions as G-7 foreign ministers gather in Japan with China being front and centre of discussions.

Local stocks rose 0.5 percent last week, while global stocks advanced 1.3 per cent for a third week of gain in four after reports showing slowing inflation in the US.

Two companies began trading today. Industrial metal producer Farsoon Technologies surged 29 per cent to 24 yuan in Shanghai, while flooring manufacturer Anhui Sentai Group gained 28 per cent to 36 yuan in Shenzhen.

Elsewhere, most Asian markets were also steady. The S&P/ASX 200 in Australia added 0.4 per cent while the Nikkei 225 in Japan and the Kospi in South Korea were both little changed.