Warren Buffett’s Berkshire Hathaway has sold $7.4 billion worth of Apple stock in the fourth quarter of 2020. However, the Apple Maven does not think that investors should be too concerned.

Warren Buffet’s Berkshire Hathaway hasprovidedan update on its portfolio holdings, this time as of December 2020. Among other key changes that I will review further below, Apple stood out.

Between the third and fourth quarters, the Oracle of Omaha’s conglomerate shed about 57 million shares of the Cupertino company. At mid-February prices, the sale amounted to about $7.4 billion worth of the stock. Coincidence or not, Apple shares have been spinning their wheels at around $130, nearly 9% off January 2021 all-time highs.

But should investors care? Do Warren Buffett and his management team appear to be any less bullish towards Apple now than they were a few months ago?

More of a trim than a bearish move

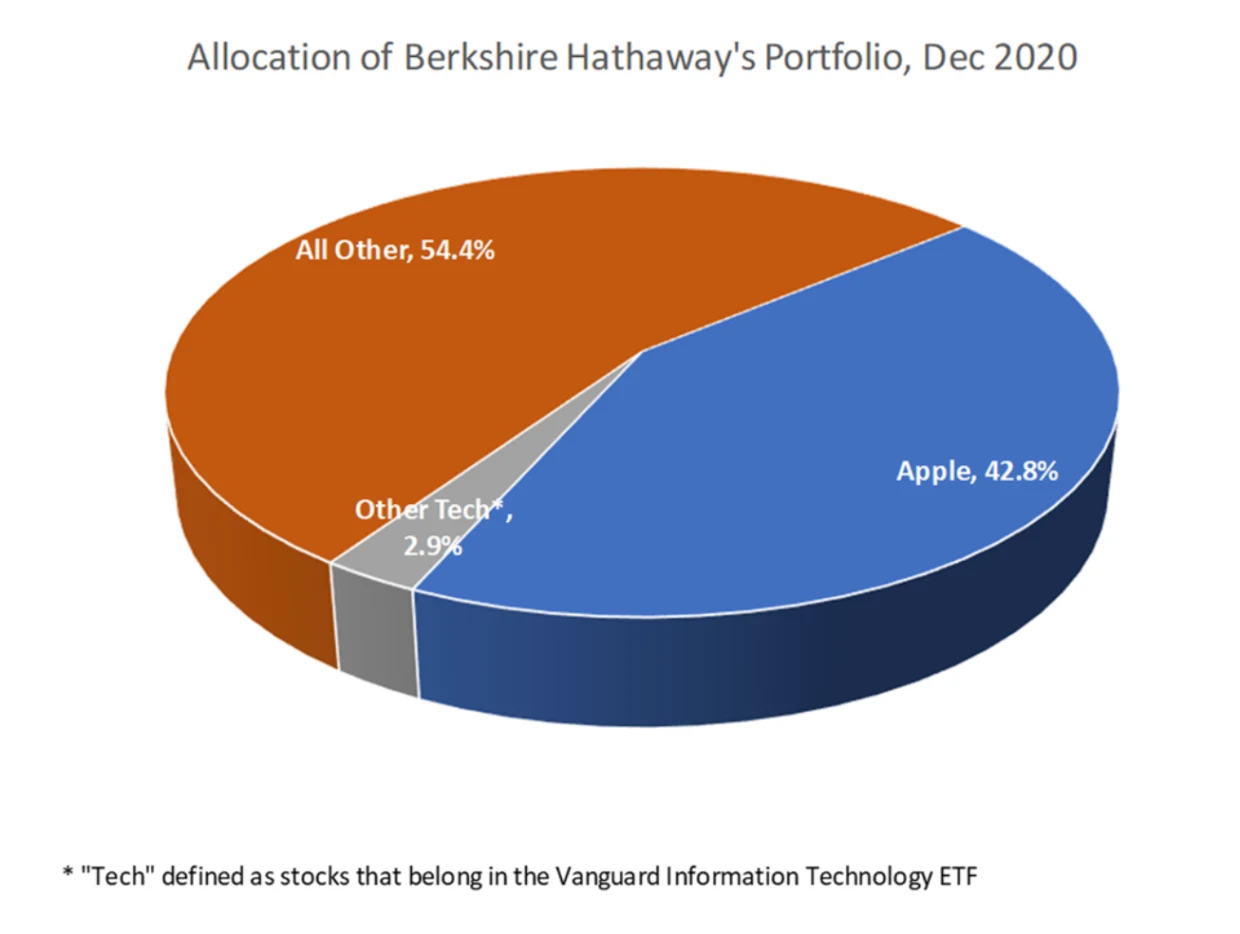

The sale of Apple shares in the fourth quarter led to Berkshire Hathaway allocating substantially less to Apple than about half a year ago, when nearly 48% of the portfolio was parked in this stock. As the chart below depicts, Apple now accounts for “only” 43% of the conglomerate’s capital.

But the Apple Maven is not too concerned about Apple losing the Buffett seal of approval, for two reasons.

First, 43% of $277 billion is still quite a bit of money. Note, for example, that Warren Buffett and crew barely invest in tech stocks. Apple is a sizable and meaningful exception to this rule.

Second, Apple stock was worth a whole lot more at the end of the fourth quarter compared to the third: $132 vs. $115 per share. Therefore, Berkshire’s total investment amount in Apple did not decrease between the two periods. In fact, it increased from $111 billion to $120 billion.

Considering how much Apple stock Berkshire owns, the Apple Maven thinks that it was reasonable for the conglomerate to trim a bit of its Apple position. Therefore, I still believe that Buffett and his companyremain a raging Apple bull.

New Berkshire bets

Apple was not the only stock to make the Berkshire Hathaway headlines. Below are a few noteworthy additions to the portfolio:

- Verizon: Berkshire now has a sizable 3.5% stake in the telecom giant, representing 3% of the conglomerate’s portfolio. Not much of a surprise, Verizon stock ended the Wednesday trading session up about 5%.

- Chevron: another large addition to the portfolio was the oil and gas supermajor. Berkshire now owns 2.5% of the company.

- Marsh & McLennan: this was the third and last new name to pop up in Berkshire’s 13-F filing. Buffett and co. now own 0.8% of the insurance and consulting company.