The Federal Reserve’s efforts to tame runaway inflation appear to be working, but there is still a long way to go.

Investors rejoiced on Tuesday, sending stocks higher after the release of a fifth-straight monthly consumer-inflation reading that showed diminishing price gains. Expect Fed Chairman Jerome Powell to temper the market’s enthusiasm, however, when he speaks on Wednesday after the conclusion of the Federal Open Market Committee’s two-day policy-setting meeting.

The FOMC will release its latest interest-rate decision at 2 p.m. ET. At a press conference scheduled for 2:30 p.m., Powell is likely to emphasize that the central bank’s fight against inflation is far from over, and that monetary tightening will continue. Key to watch: Fed officials’ predictions for future interest-rate hikes.

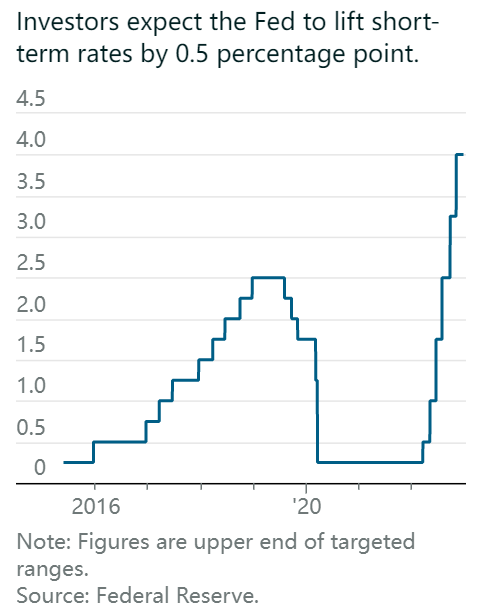

The Fed is widely expected to lift its federal-funds rate target on Wednesday by 0.50 percentage point, to a range of 4.25% to 4.50%, following four consecutive hikes of 0.75 percentage point.

The central bank will also release its latest “dot plot” of FOMC members’ economic and interest-rate forecasts. The September dot plot showed a median fed-funds rate of just below 5% next year. After Tuesday’s cooler—and cooler-than-expected—inflation print, futures pricing moved to imply a peak rate further below that level around the middle of next year, after recently moving to slightly above 5%. Any movement in the dots—whether by consensus or not—should be the biggest driver of the markets’ reaction on Wednesday.

Inflation looks to have peaked in June with an annual increase of 9.1% in the government’s consumer price index, or CPI. Tuesday’s CPI report from the Labor Department showed a seasonally adjusted 0.1% rise in November, versus the consensus forecast for a 0.3% increase. The CPI was up 7.1% from a year earlier, versus a 7.7% increase through October.

November’s rise was the smallest annual change since December 2021, although inflation remains uncomfortably high. The Fed has a target inflation rate of 2% annually, consistent with a 0.17% monthly increase. Based on November’s reading, it would take just six more months of similar monthly readings to get the annual figure below 2%, as the much higher year-ago CPI prints roll off.

That’s far from a done deal, though: Commodities and goods inflation are down, but other, stickier components of the CPI are still climbing fast.

“It is important to note that today’s results were driven by a precipitous decline in goods inflation from 5.1% to 3.7%, the result of previous pandemic distortions and supply chain challenges,” wrote Jonathan Golub, Credit Suisse’s chief U.S. equity strategist, on Tuesday. “While today’s revelers are focused on better-than-expected headline and core readings, services remained sticky/unchanged at 6.4%. Unfortunately, elevated services and wages will make it harder for the Fed to pivot than many investors are discounting.”

The FOMC next’s rate decision will be out on Feb. 1, after the release of another month of inflation and jobs numbers. Fed officials have promised a “higher for longer” policy environment, with the fed-funds rate peaking around 5% in the first half of next year, and plateauing near that level for some time.

Should inflation continue to fall and the labor market show signs of weakness—not just slower hiring—that outlook could soften. But Powell will keep up the tough talk on Wednesday, even if he acknowledges the recent progress.

“With this second straight encouraging CPI in hand, we think he will be hard-pressed to justify going after inflation (and the backdrop at large) in the same over-the-top hawkish approach he took last time,” wrote RBC Capital Markets chief U.S. economist Tom Porcelli on Tuesday. “Job growth and inflation are slowing.”

There may be more dissent in the FOMC ranks, however, about the future course of policy. That could be evident in this year’sfourth and last Summary of Economic Projections, to be issued on Wednesday. The dot plot shows the 19 FOMC members’ estimates for economic growth, unemployment, inflation, and interest rates in the coming years.