While most analysts and traders were digging through Goldman's investment banking and trading results - of which the former came in stellar while trading, especially in FICC, was mediocore...

... when the bank reported itssecond best quarter on record, there was some more notable slide in the bank'sQ2 earnings presentation, and it had to do with what Goldman is doing for its own prop, or "asset management" book.

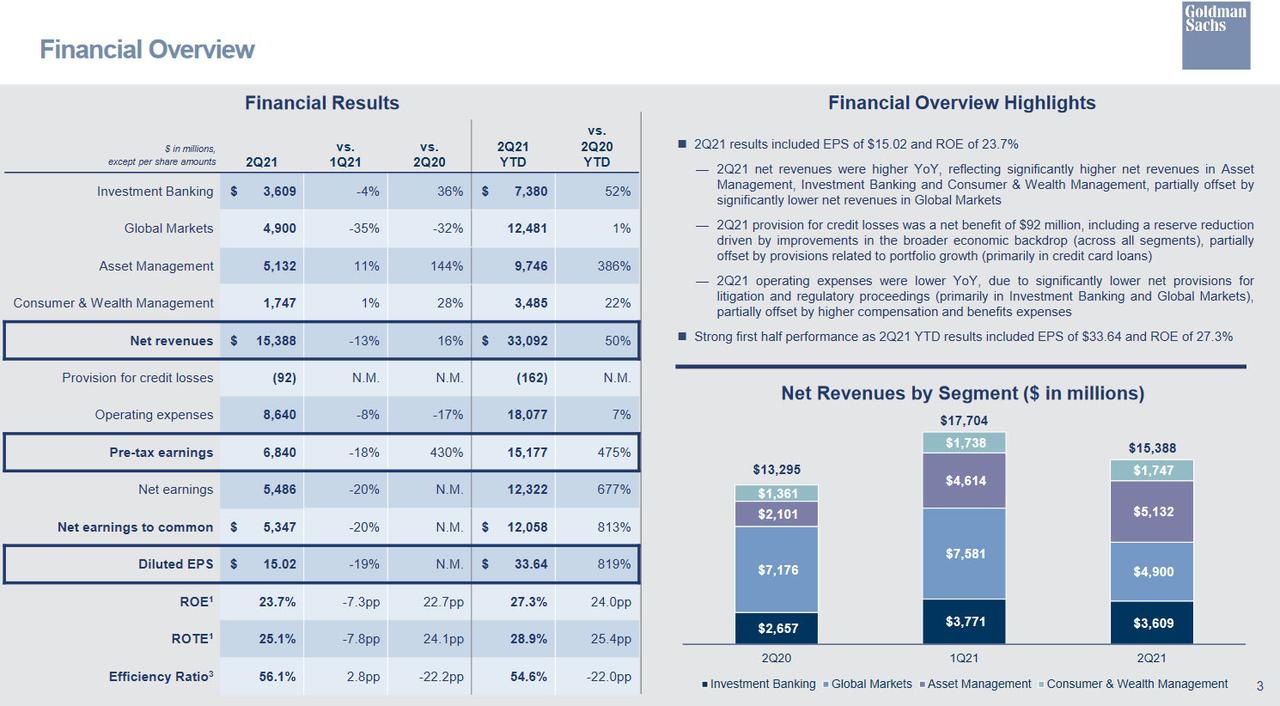

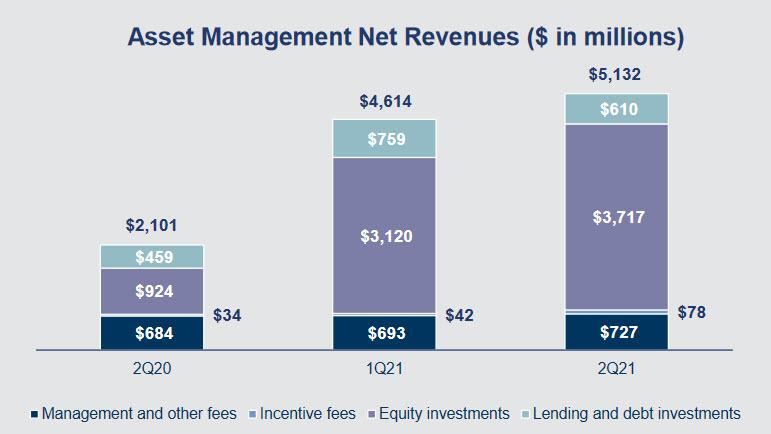

As shown in the table below, Goldman's Asset Management (F/K/A "prop") also had a stellar quarter, generating a record $5.1BN in net revenue, more than double the year ago quarter.

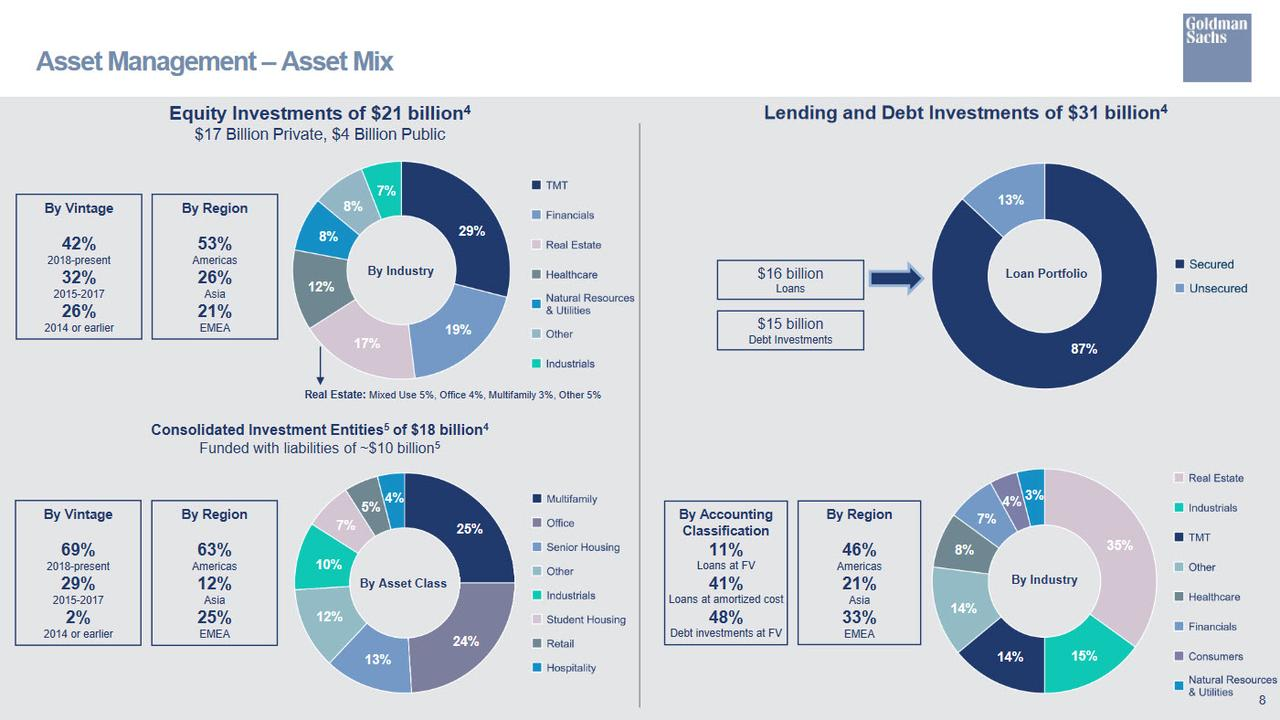

The bank then breaks down the asset mix of its prop traders, which as of Q2 had some $21 billion in equity investments spread across various sectors, vintages and geographies (mostly the US).

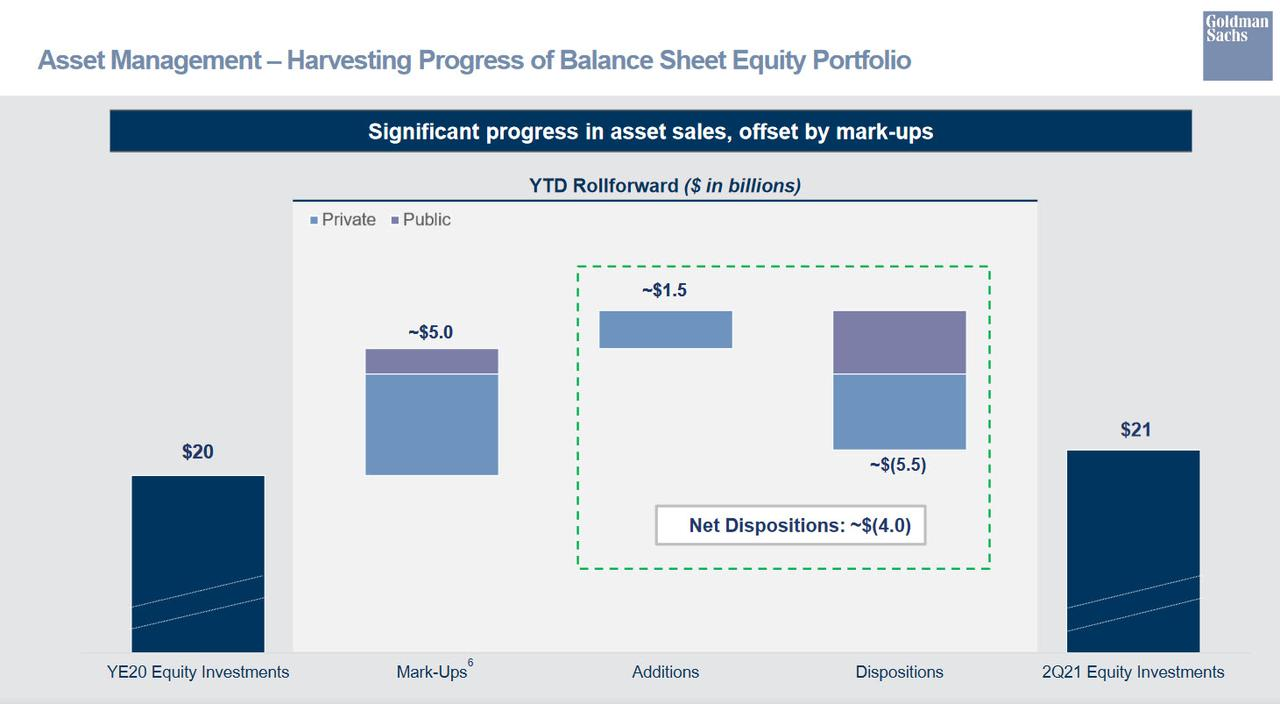

Which brings us to the punchline: a chart showing what Goldmanhad donewith its equity investments in 2021. Here the bank pulls no punches, making it clear in the title that it has been busy "harvesting" its balance sheet equity portfolio. Which, of course, is another word for selling.

What is even more remarkable is just how much Goldman has harvested so far in 2021: as shown below, having started with a $20BN equity portfolio which has enjoyed a $5BN increase in market prices,Goldman dumped a whopping $5.5 billion of its equity assets so far (excluding a modest $1.5BN in purchases) or more than a quarter of its entire portfolio as of Dec 31.

Who is Goldman selling to? Anyone who will buy, but here we would wager thatretail investors - who have been on tilt buying in 2021 - have been the proud recipients of billions in Goldman sales.This, in the financial literature is called the "distribution phase."

The sales were so extensive that the topic was brought up on Goldman's earnings call earlier today. In response to a question about Goldman's efforts to reduce its equity investment portfolio, the bank said that it it has "made progress on improving its capital efficiency and is moving 'aggressively' to manage equity positions, especially since the environment is supportive."

What does that mean in English? Simple: Goldman is "aggressively" dumping its positions in an environment that is "supportive", i.e., in which the dumb money is providing a constant bid into which whales such as Goldman can sell.

The last time Goldman was "aggressively" selling into a "supportive" market? Well, we have to go back all the way to 2007 and 2008 when Goldman was busy creating the very CDOs which its prop desk would then "aggressively" short. We all remember how prophetic that particular move turned out to be...

Related:

- Goldman Sachs: Q2 GAAP EPS of $15.02beats by $5.07.

- Revenue of $15.39B (+15.7% Y/Y)beats by $3.22B.

- Reversal of credit losses of $92M.

- On July 12, 2021, the Board of Directors of The Goldman Sachs Group, Inc. approved a 60% increase in the quarterly dividend to $2.00 per common share beginning in the third quarter of 2021.