AMC, closely associated with recent short squeeze phenomena, saw a decline in short interest following the conversion of preferred units into common shares, which diluted the stock's float and lowered its share price.

Despite some remaining short interest, the current setup in AMC is less favorable for a short squeeze due to the stock's all-time low price, but high trading volume and technical factors contribute to ongoing volatility.

The Short Squeeze Setup

First of all, for a short squeeze to occur in the stock market, a heavily shorted stock must experience a rapid and significant increase in price. This forces short sellers to cover their positions by buying the asset, which in turn drives the price even higher.

While there's no guaranteed formula for triggering a short squeeze, certain conditions and setups can increase the likelihood of one occurring, such as:

High short interest: This means that a significant portion of a stock's float (the total number of shares available for trading) has been sold short by investors betting on a price decline. The higher the short interest, the greater the potential for a short squeeze.

Limited number of shares available: When there are not enough shares to trade or borrow to sell short, it can amplify the impact of a short squeeze. When fewer shares are available, it can be more difficult for short sellers to cover their positions without dramatically driving up the price.

Cost-to-borrow: A scarcity of shares available for borrowing generates higher fees for short sellers. When there is too much demand for short trades, borrowing fees can skyrocket, leaving short sellers more vulnerable to covering positions.

Technical breakouts: Stocks trading near support levels or severely oversold can attract both short-term and long-term traders, leading to increased buying pressure.

Liquidity and trading volume: These two factors lead to greater volatility in price movement, usually motivated by a specific catalyst that drives investor sentiment.

AMC's Current Setup

The recent phenomenon of short squeezes has been closely associated with stocks like AMC Entertainment due primarily to its immense popularity among retail investors during the meme frenzy that started in January 2021.

In fact, as outlined in the company's Form 10-K, this represents one of the principal risks associated with its shares:

“Volatility in our shares of our common stock by a 'short squeeze' in which coordinated trading activity causes a spike in the market price of our common stock as traders with a short position make market purchases to avoid or to mitigate potential losses, investors purchase at inflated prices unrelated to our financial performance or prospects, and may thereafter suffer substantial losses as prices decline once the level of short-covering purchases has abated.”

Until very recently this year, AMC met all the criteria indicative of a short squeeze setup. However, following the conversion of APEs (AMC preferred units) into common shares, which resulted in the dilution of the float and consequently pushed down AMC's share price, short interest has substantially declined.

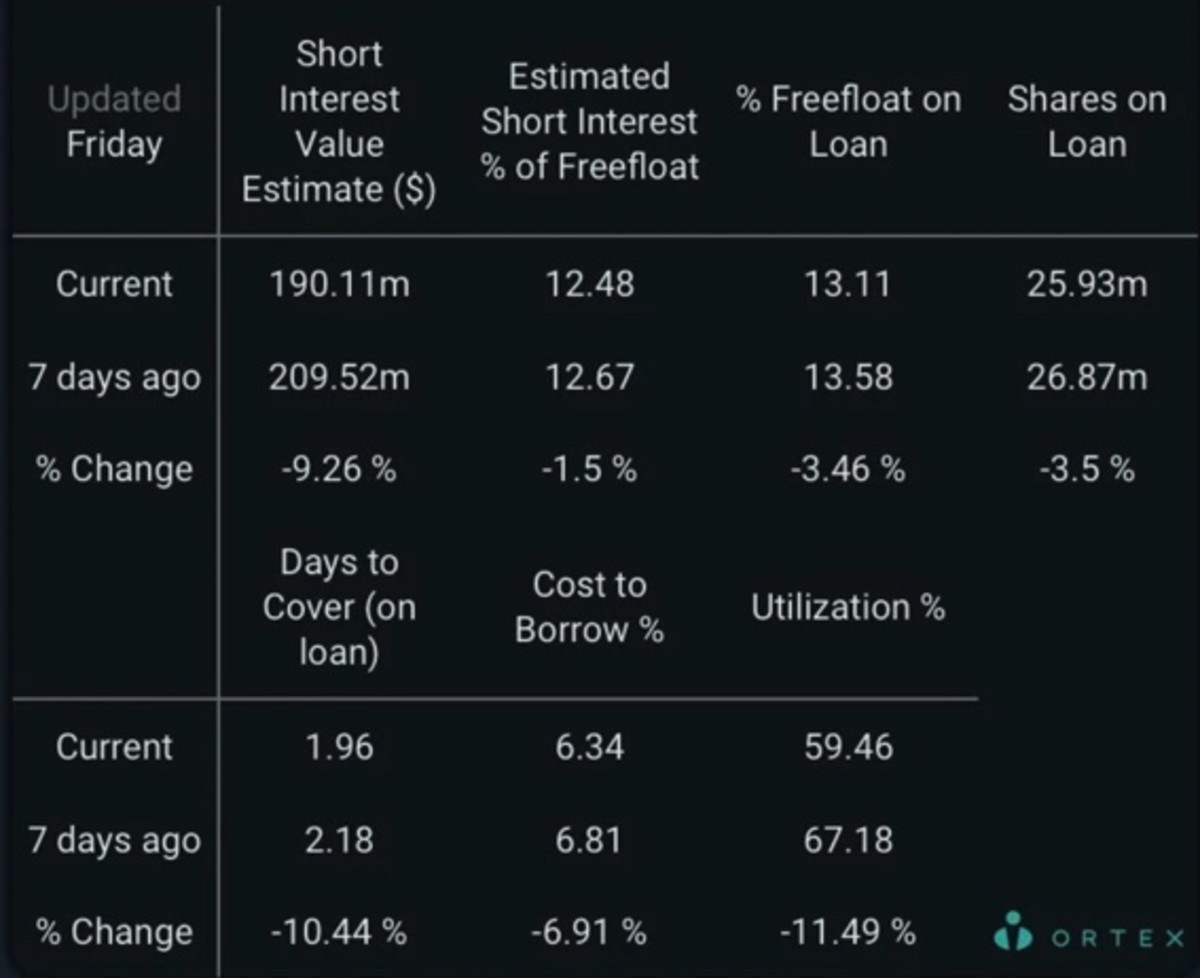

According to data from Ortex, approximately 12.5% of the free float is currently being shorted, with a cost-to-borrow of 6.3% and a utilization rate of 59%.

These figures are notably different from the period before the court approved the settlement for the execution of the APE conversion on August 11, when AMC had approximately 27% short interest and borrowing fees skyrocketed to an astonishing 1,000%.

The Bottom Line

A significant portion of the high demand for shorting AMC stemmed from arbitrage traders who were betting on the price convergence between AMC's common and preferred stock — with common shares being on the short end of the trade. As the conversion occurred, the value of AMC shares dropped, resulting in profits for short sellers.

Although there is still a significant level of short interest in AMC shares, the current setup is less conducive to a short squeeze. This is primarily because AMC has already reached its all-time lows, making further downside potentially less appealing to short sellers.

However, it's important to note that trading volume has remained consistently high throughout September (illustrated through the green and red bars in the chart below), suggesting ongoing volatility and persistent risks for short sellers. Additionally, technical breakout points indicate that AMC shares are deeply oversold, further adding to the complexity of the situation.

It's worth noting that the investment thesis regarding AMC has shifted toward a focus on the company's fundamentals rather than simply aiming to profit from crushing excess short demand.

The movie theater chain has bolstered its liquidity position by issuing new equity and has reported strong quarterly box-office results. These results are expected to lead the company back to pre-pandemic revenue levels in the near future.