KEY TAKEAWAYS

- Analysts estimate EPS of $12.47 vs. $10.30 in Q2 FY 2020.

- AWS revenue is expected to rise at healthy pace YOY.

- Companywide revenue is expected to rise, but at a slower pace than recent quarters as analysts watch for the pandemic-induced boom in online shopping to slow.

Amazon.com Inc. (AMZN) has seen its earnings and revenue balloon amid the shift to online commerce and cloud computing triggered by the COVID-19 pandemic. Now, Amazon is facing perhaps the biggest management transition in the company's 27-year history. The second quarter was the final period with founder Jeff Bezos at the helm. In his place, Amazon veteran Andy Jassy, who helped build the giant cloud services business, will lead the company's growth as the new chief executive officer (CEO). Bezos stepped down on July 5.1

Investors will be closely watching Amazon's financial performance, and Jassy's plans for future growth, when the company reports earnings on July 29, 2021 for Q2 FY 2021.2Analysts expect both earnings per share (EPS) and revenue to rise, but at a much slower pace than in recent quarters.3

Investors will also be focusing on revenue generated by Amazon Web Services (AWS), the company's high-margincloud computingbusiness. AWS still comprises a relatively small share of the company's overall revenue, but it generates the majority of Amazon's operating income. Analysts are expecting AWS revenue growth to slow slightly in the second quarter.3

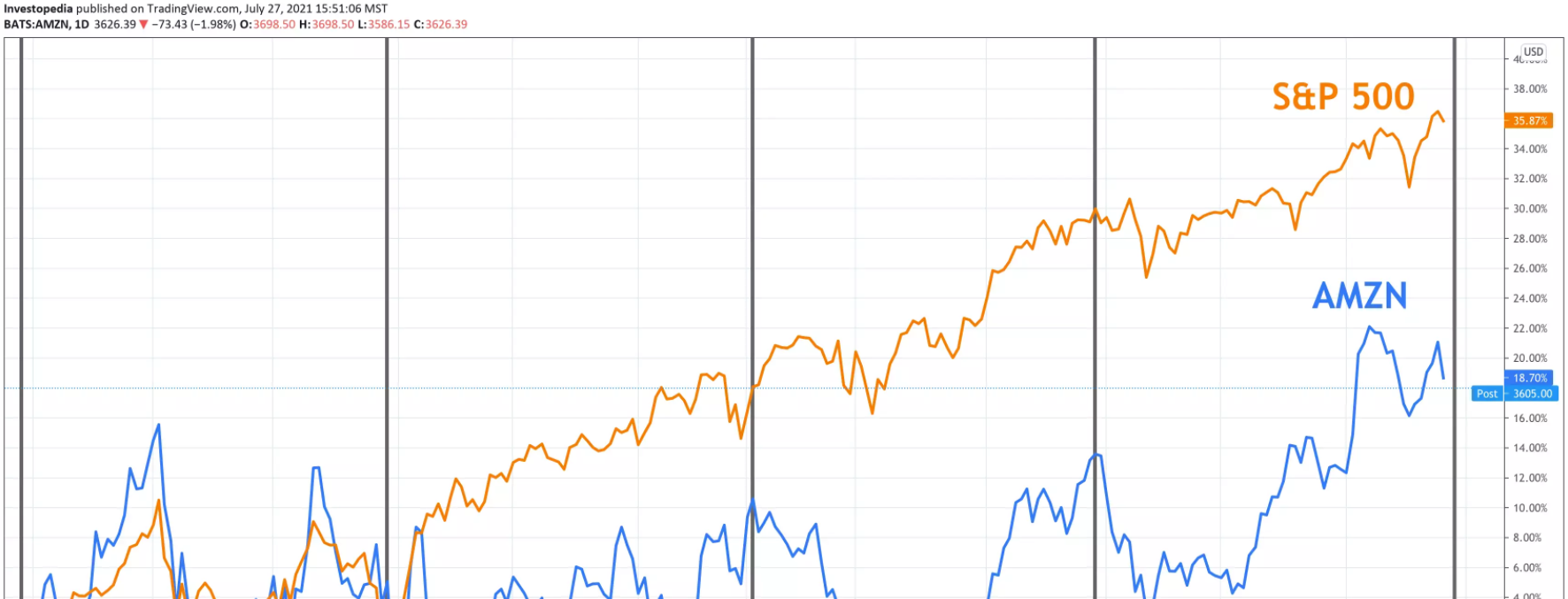

Amazon's shares have underperformed the broader market over the past year. The stock had been keeping pace with the market from the end of July 2020 until early November 2020. It then started to lag. But the stock has begun to narrow its performance gap with the market since early June 2021. Shares of Amazon have provided a total return of 18.7% over the past year, below the S&P 500's total return of 35.9%.

The stock tumbled in the days following the release of Amazon'sQ1 FY 2021earnings report in late April despite dramatically beating analysts' consensus estimates. It continued to sink until around mid-May. EPS rose 215.2%, bouncing back after declining 29.4% in the year-ago quarter. Revenue grew 43.8% year over year (YOY), marking the fastest pace of growth in at least 15 quarters.3

InQ4 FY 2020, Amazon crushed analysts' earnings expectations. EPS rose 117.7% compared to the year-ago quarter, marking the second fastest pace of growth since Q3 FY 2018. Revenue expanded 43.6% YOY, accelerating from Q3's pace of 37.4%.3The company announced in its fourth quarter earnings release that Jassy would be taking over the role of CEO from Bezos beginning in the third quarter of FY 2021. "Right now I see Amazon at its most inventive ever, making it an optimal time for this transition," said Bezos.4

Analysts expect Amazon to post another quarter of healthy earnings and revenue growth in Q2 FY 2021. EPS is expected to rise 21.0% as revenue grows 29.8% compared to the year-ago quarter. It would be the slowest pace of growth for both the top and bottom lines since Q1 FY 2020. For full-year FY 2021, analysts expect EPS to rise 35.9% while annual revenue expands 27.1%, slowing from last year's pace.

Amazon Key Stats

| Estimate for Q2 2021 (FY) | Q2 2020 (FY) | Q2 2019 (FY) | |

| Earnings Per Share ($) | $12.47 | $10.30 | $5.22 |

| Revenue ($B) | $115.4 | $88.9 | $63.4 |

| AWS Revenue ($B) | $14.2 | $10.8 | $8.4 |

The Key Metric

As mentioned above, investors will also be focused on revenue generated by AWS, Amazon's cloud-computing platform. AWS offers developers a range of on-demand technology services, such as compute, storage, database, analytics, machine learning, and other services.5These services are primarily used by start-ups, enterprises, government agencies, and academic institutions. The company's AWS business generates much higher margins than itse-commercebusiness. In FY 2020,Amazon'sglobal retail sales- and subscription-based business segments generated about 88% of the company's total revenue while AWS accounted for a mere 12%. However, AWS accounted for 59% of total operating income for the year, making it Amazon's main profit generator.6But investors won't want to ignore results for Amazon's e-commerce business, which has greatly expanded throughout the pandemic. Investors will want to see how much of the company's additional e-commerce sales generated during the pandemic will persist as more traditional brick-and-mortar shops begin to reopen again.

Growth in AWS revenue has consistently slowed over the past five years, despite a brief acceleration in FY 2018. In FY 2015, annual AWS revenue grew 69.7%. Last year, revenue for Amazon's cloud segment grew at a healthy, but slower, 29.5% pace. In each of the last three quarters of FY 2020, growth in AWS revenue ranged between 28-29% YOY. In Q1 FY 2021, growth accelerated to a pace of 32.1%. At the end of the first quarter, AWS led the $150-billion global cloud market with a 32% share, well ahead of both Microsoft Corp.'s (MSFT) Azure and Alphabet Inc.'s (GOOGL) Google Cloud.7Analysts expect AWS revenue to increase 31.2% in Q2 FY 2021, slightly slower than the previous quarter's pace. For full-year FY 2021, AWS revenue is expected to rise 30.3%, slightly faster than last year.