After being on the spotlight for latching on to his pessimism over Apple stock, even following strong quarterly results, famed bear Rod Hall at Goldman Sachs threw in the towel and changed his position on AAPLfrom sell to neutral. Last week, he gave an interview to CNBC and further elaborated on his decision.

The Apple Maven takes a closer look at this bear’s journey from highly skeptical to timidly optimistic about Apple shares.

iPhone at the center of the bear case

At the core of Goldman Sachs’ sell rating on Apple stock was the Cupertino company's challenges at meeting iPhone sales growth metrics going forward. Rod Hall explained it:

“Apple continues to show strong execution, but we see fundamentals more likely to disappoint in 2021 as the long-anticipated 5G iPhone fails to meet optimistic consensus expectations and services revenue growth slows.”

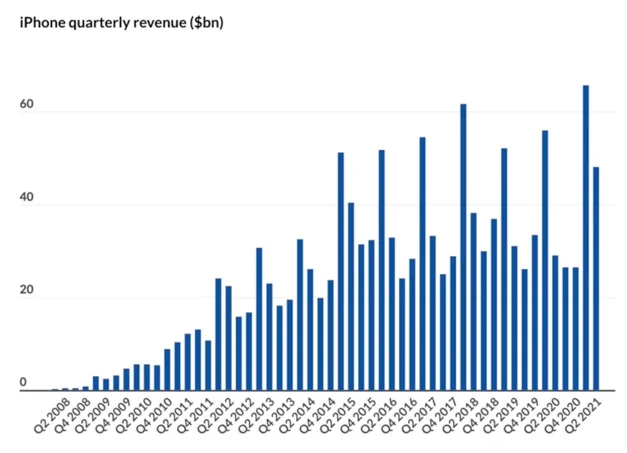

To be fair, Apple’s most recent financial results had been far from exhilarating ahead of Goldman’s stock rating upgrade. The Cupertino company's main revenue generator, the iPhone, had produced timid results in 2020, making some wonder if smartphone sales would disappoint at the start of the 5G cycle.

The plateauing in smartphone sales preceded the pandemic year. Based on data from third party-research companies Gartner and Strategy Analytics, 187 million iPhones were sold in 2019, fewer than the 217 million of 2018. And from 2019 to 2020, there was an unprecedented decrease in iPhone revenues: from $142 billion to $138 billion last year.

Therefore, and based on recent trends, Rod Hall’s bearishness towards the iPhone seemed reasonably justifiable. What had been missing to tip Apple stock over, in the analyst’s view, was a negative catalyst. He believed that the COVID-19 pandemic could be it.

When Goldman Sachs fell off the horse

Goldman’s rating change on AAPL came in April, after the Cupertino company crushed expectations and released a blowout earnings report. Fiscal second quarter 2021 marked a turning point in iPhone 12 sales, after Apple faced delays in the launch of the new device.

Apple reported iPhone revenues of $47.9 billion versus Wall Street’s consensus $41.5 billion. Year-over-year, the top-line increase was a staggering $19 billion, representing growth of 65%.

These numbers probably caught Goldman’s Rod Hall flat-footed.

How Goldman Sachs sees Apple going forward

According to Goldman, the neutral position on AAPL is justified by one key metric: revenues per user. The analyst believes that growth in this metric should be in line with U.S. GDP. He points out that Apple's revenues per user have remained static in recent years, only rising during the pandemic due to stay-at-home trends.

On the bullish side of the argument, Rod Hall sees the importance of privacy, and thinks that Apple could benefit from increased demand for being an advocate of user data protection. On the bearish side, the analyst remains skeptical that the services segment will grow as much as expected, and that only about 20% to 25% of active users will pay for Apple services.

The Apple Maven's take

Rod Hall has not been the first and will not be the last on Wall Street to be proven wrong on a stock rating. Goldman Sachs' position was contrarian, and bold for the same reason. Yet, the Apple Maven believes that Rod Hall’s cautious stance could still be a bit too conservative.

While stay-at-home trends may have distorted fiscal 2020 and early 2021 results, the 5G cycle, the M1 architecture, the expansion of the services portfolio and resilient consumer spending in general may still help to boost Apple's revenue-per-user metric – Goldman’s key concern.