$NVDA$

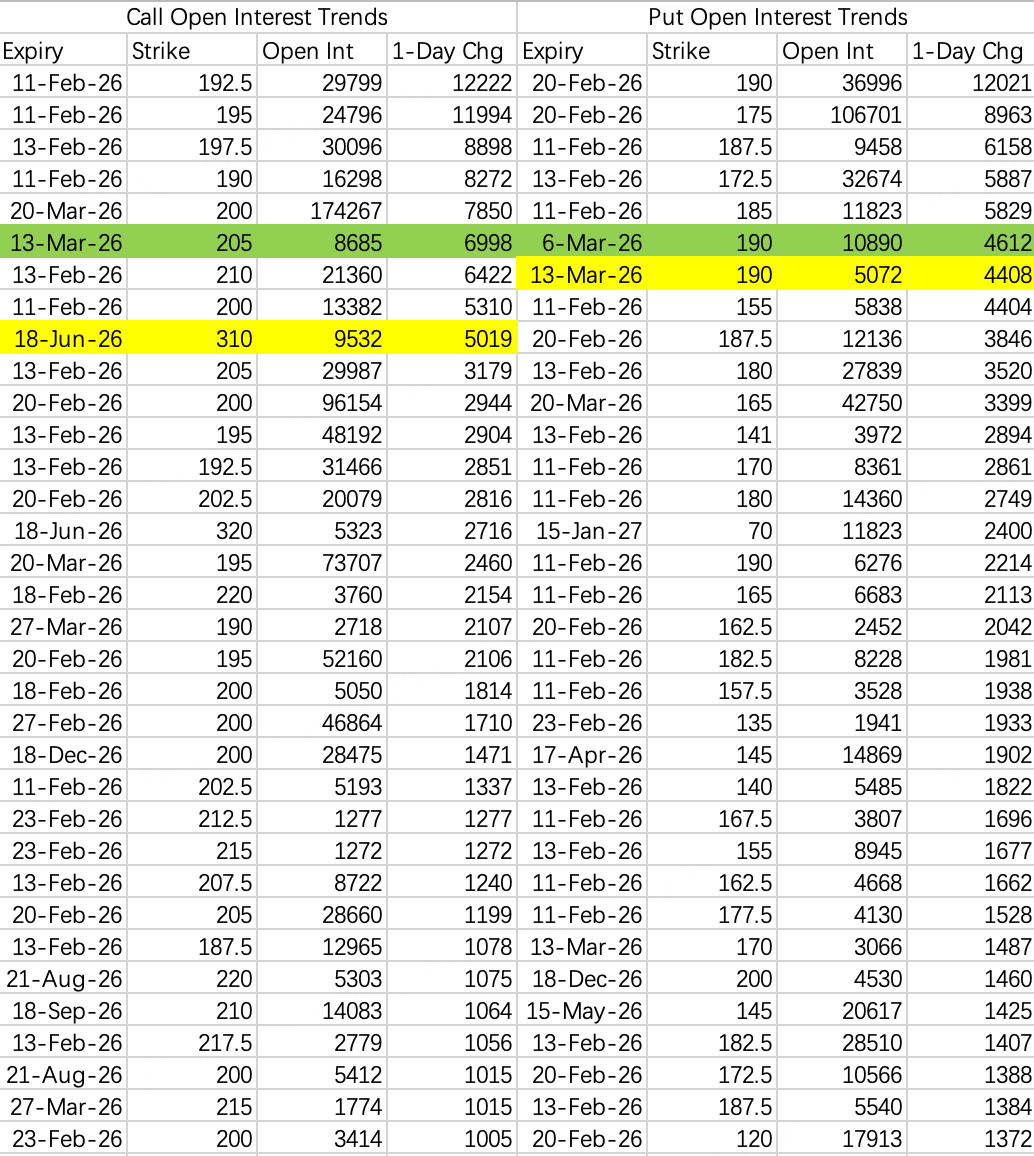

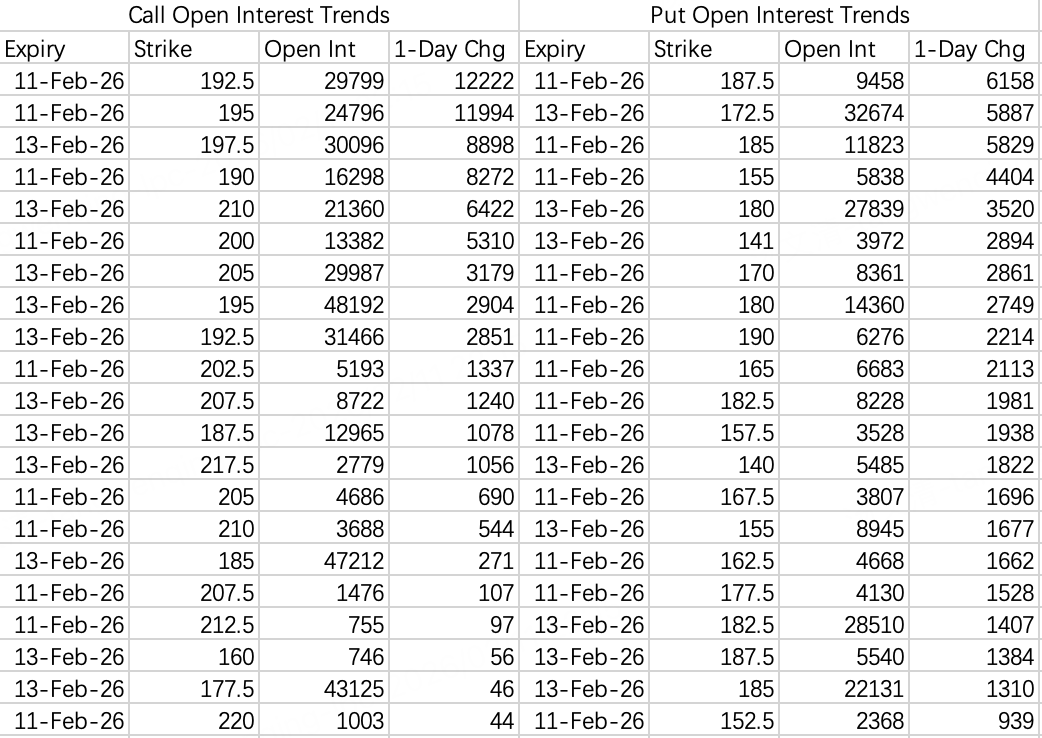

Looking at the option flows, NVDA's upcoming earnings next week don't seem to have any substantial impact on the stock's trend. Seeing that large sell call order at the 205 strike for March 13th $NVDA 20260313 205.0 CALL$ tells me the market still expects the top to hold.

The main issue is that the AI sector trend is too transparent—there are no major off-exchange catalysts to add fuel. What the market really needs is a groundbreaking use case or a significant leap forward. Anything beyond that is already priced in, just burning through valuation.

That said, with earnings approaching, implied volatility is picking up, which means more premium for sellers to harvest.

For now, the range holds through early March: 170–200 chop.

This week, expect NVDA to grind between 185 and 195. Since short-dated options were introduced, the structure of NVDA's option chain is starting to look more and more like SPY's.

$TSLA$

Tesla tends to chop in Q1 and rip in Q2. Could be something mystical—Elon's birthday, US Independence Day—who knows.

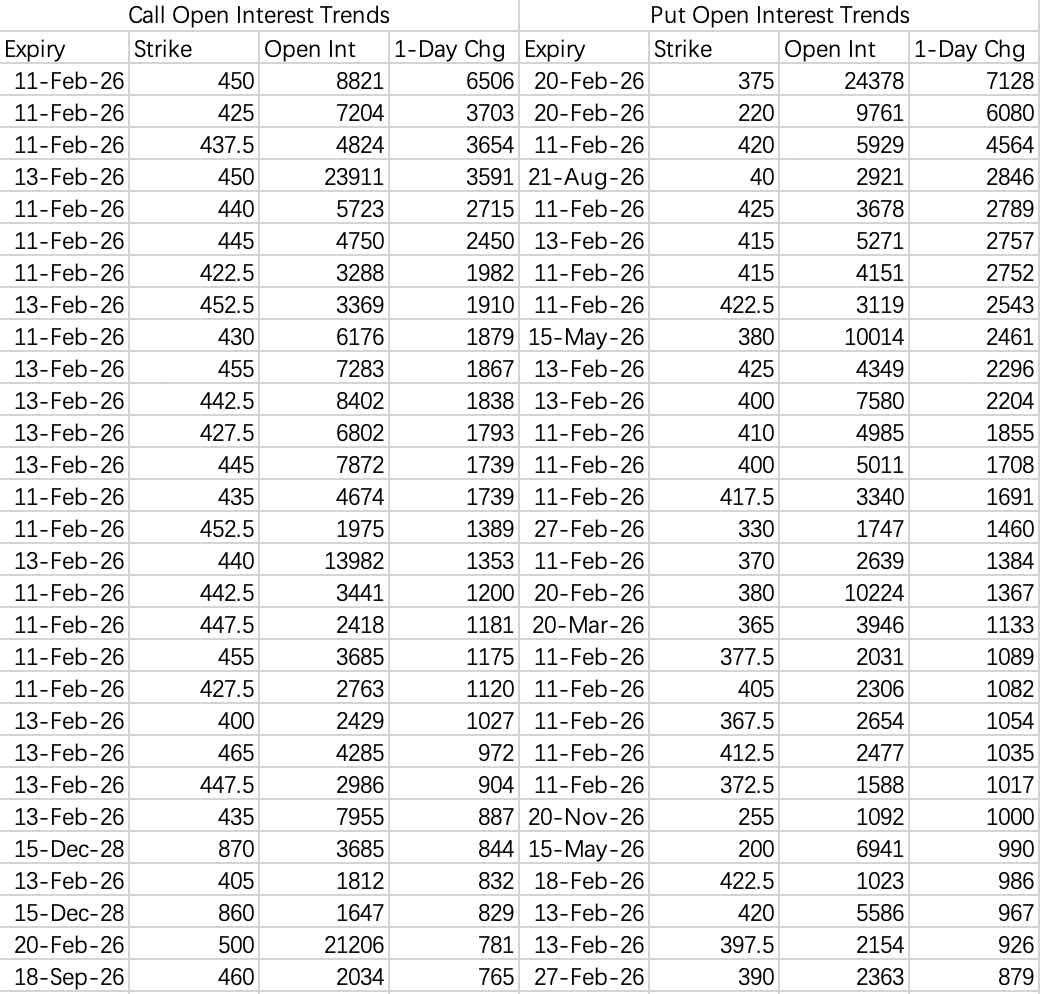

Either way, expect low-range consolidation between 400 and 450.

$SPY$

With the market in full rotation mode, SPY is decoupling from tech. Just know that there's no broad crash priced in for this week. That's enough.

$GOOGL$

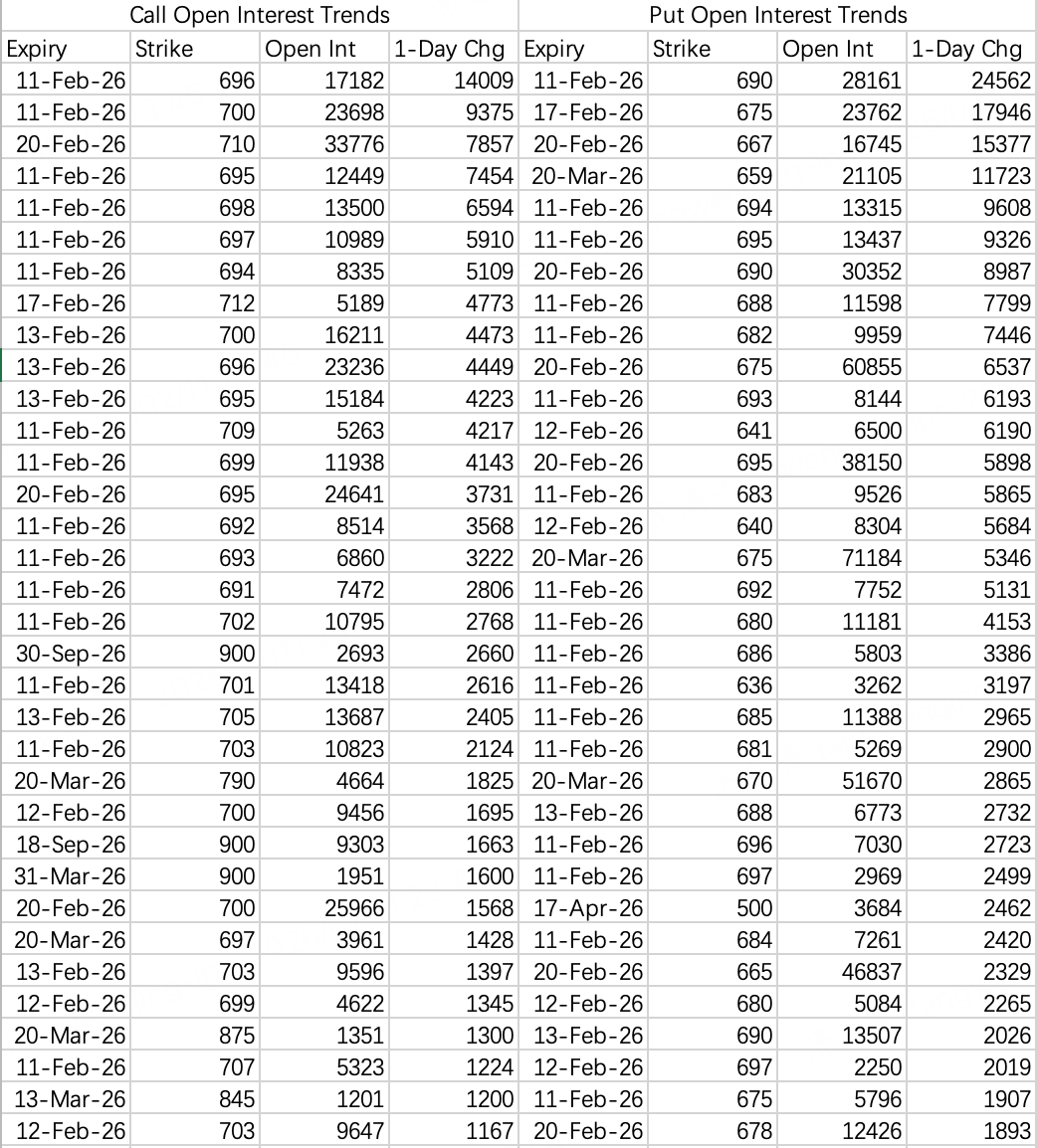

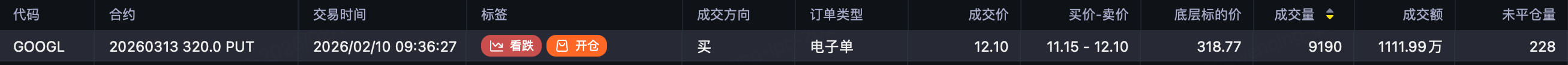

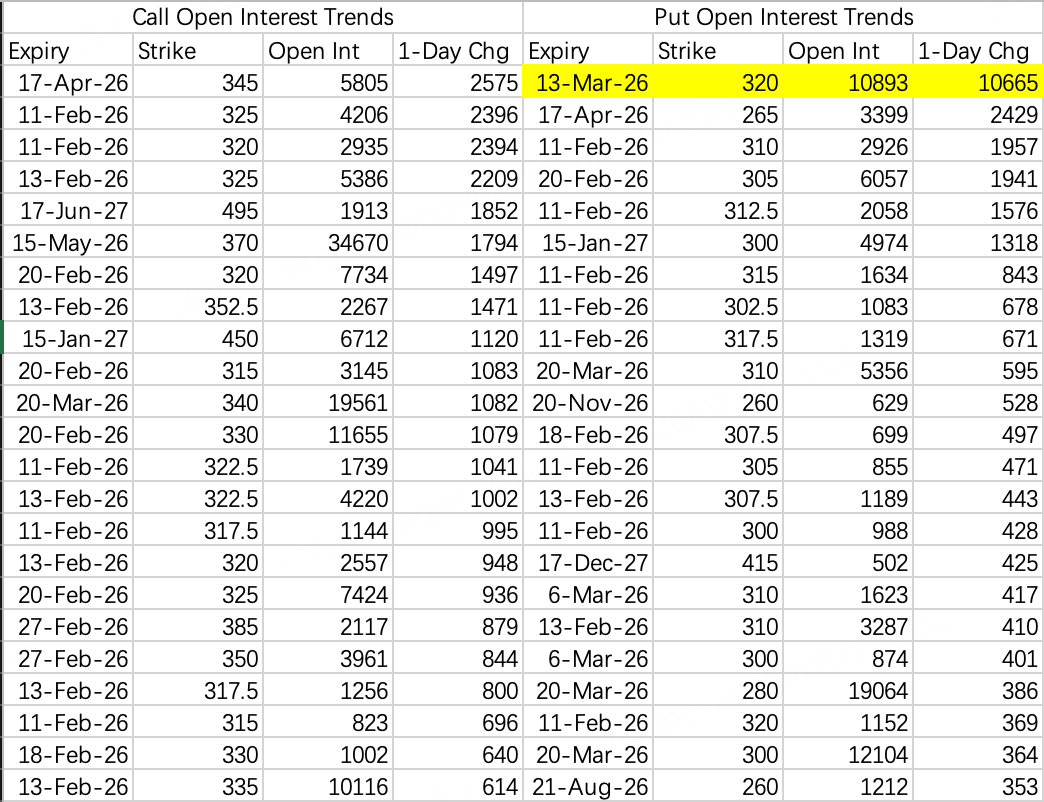

A large at-the-money bearish order went through—10k contracts sold to open on the March 13th 320 put $GOOGL 20260313 320.0 PUT$ , $11.1M notional.

Put flow suggests solid support around 300. So selling puts here is a clean play—strike 290 looks nice $GOOGL 20260220 290.0 PUT$ .

Or you can wait until Friday to see if the downside pressure fades. The March 13th expiry is still a month out, but this type of put selling is more of a weekly rhythm—bearish window is short.

$AMZN$

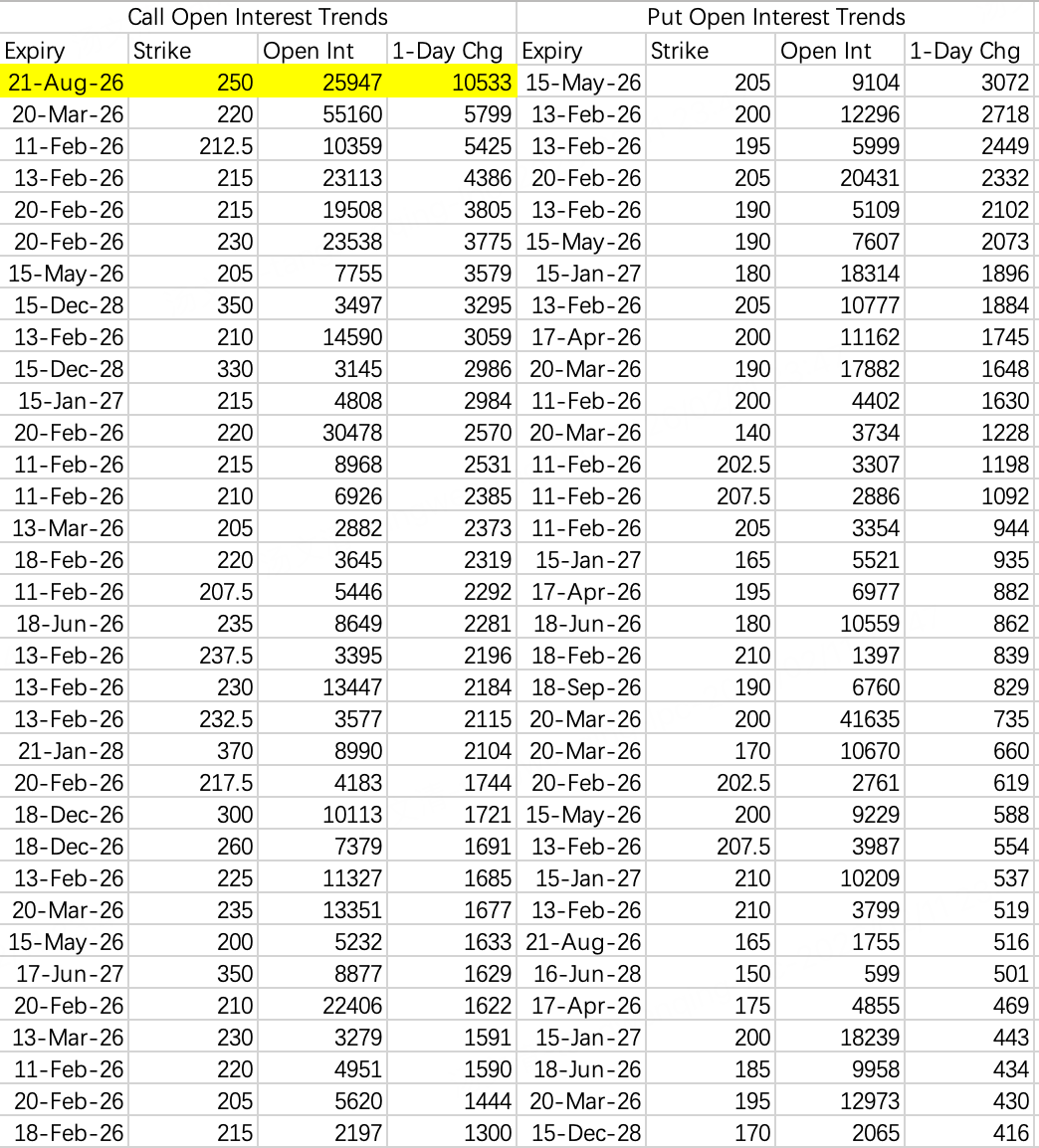

Amazon’s drop has actually opened up real value. Saw a large buy of the August 250 call on Tuesday $AMZN 20260821 250.0 CALL$ .

No need to be that aggressive though—just sell the 200 put and keep it simple $AMZN 20260213 200.0 PUT$ .

Comments