Positive news from OpenAI, with monthly growth rate recovering by 10%, directly ignited a short squeeze on Monday, crushing the bears. However, subsequent market action will likely continue with sector rotation.

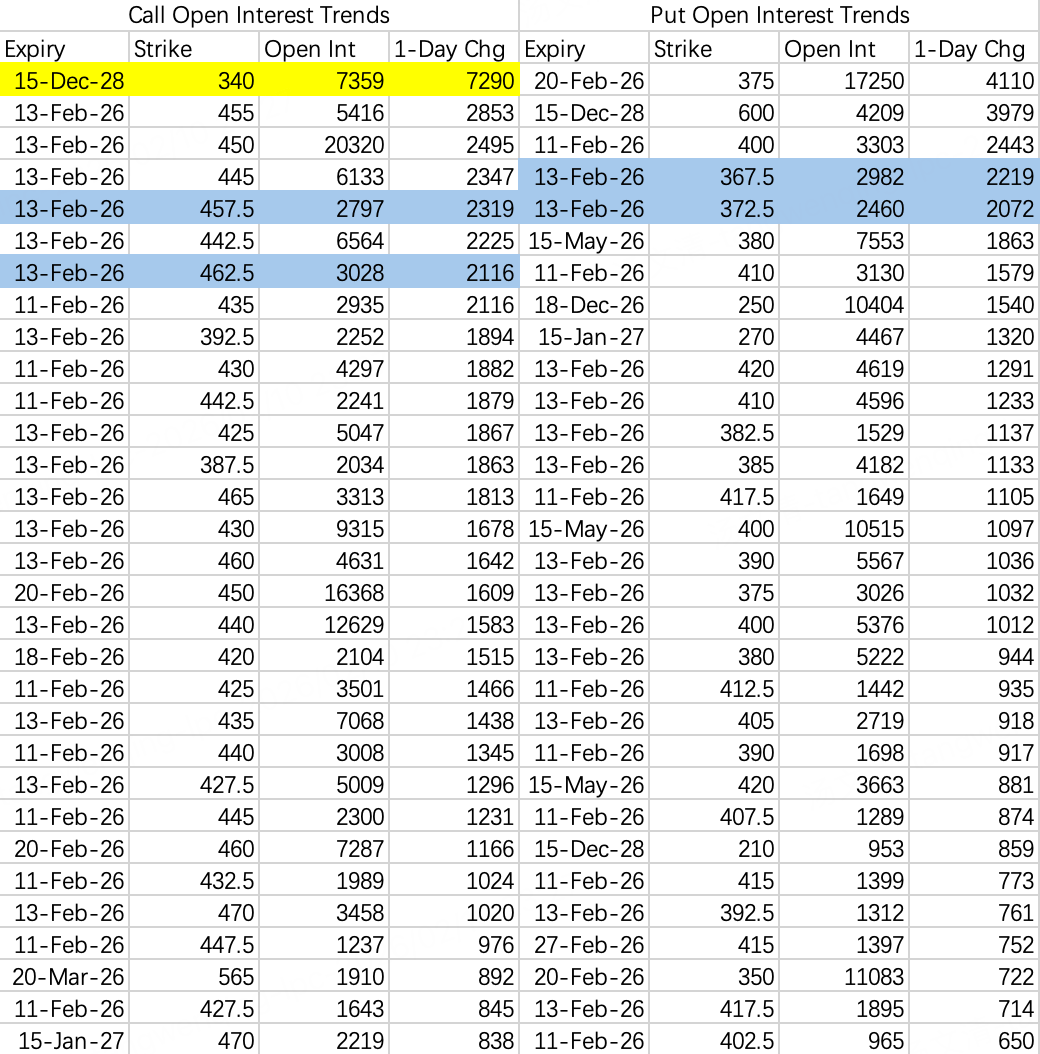

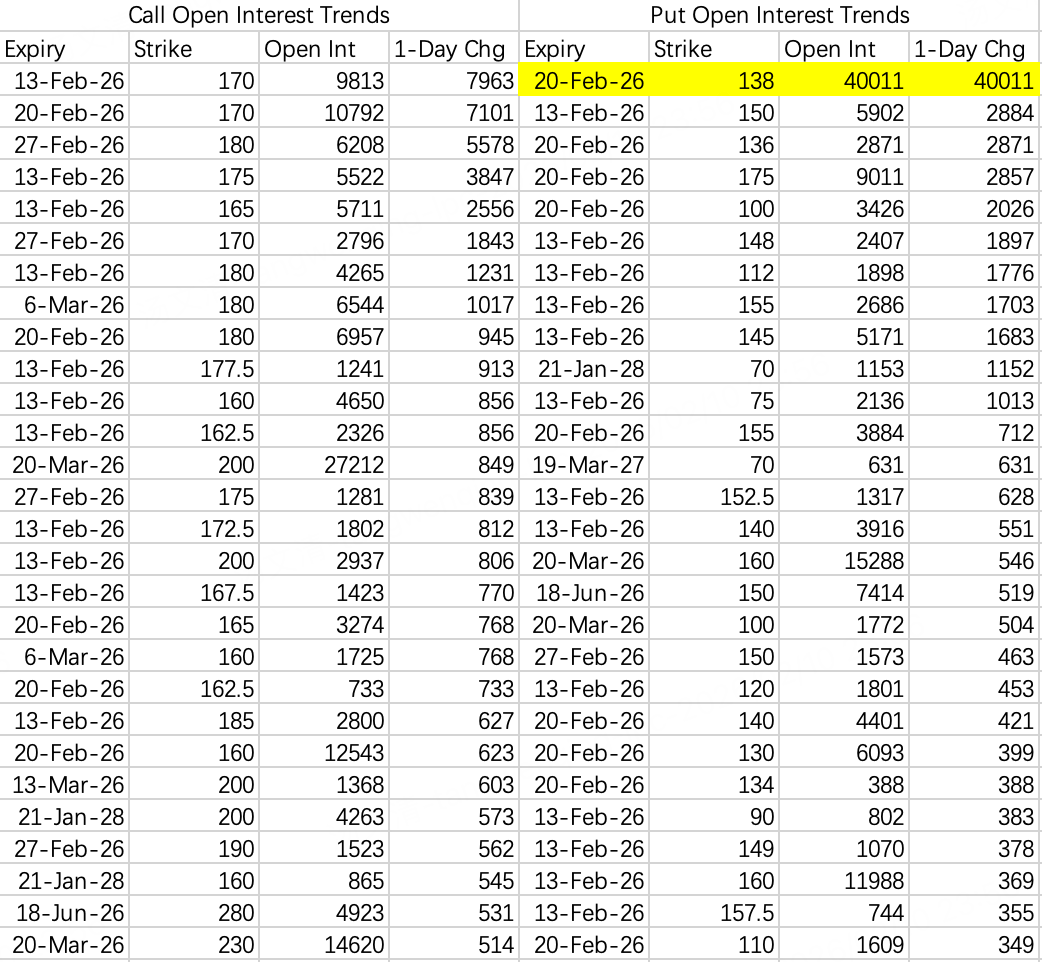

$NVDA$

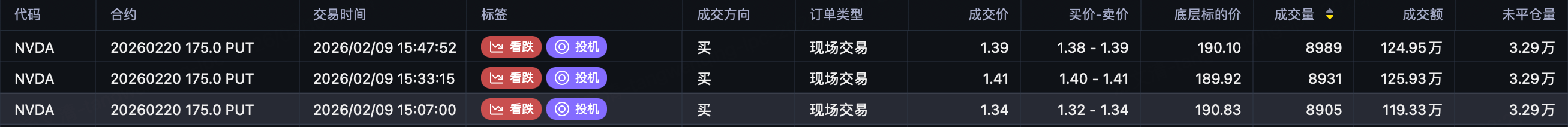

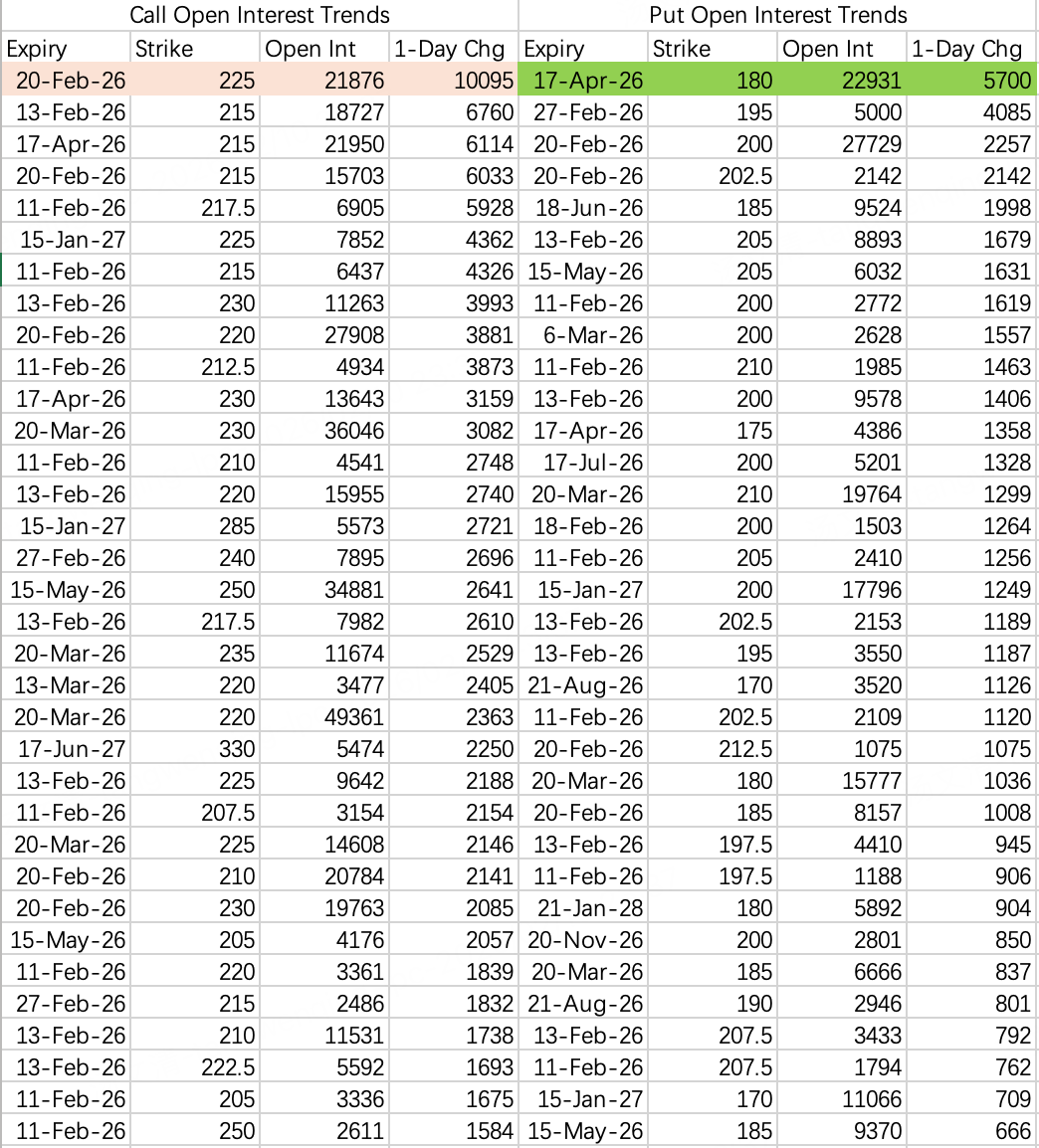

Both large bullish and bearish single-leg orders appeared (not a spread):

-

$NVDA 20260220 175.0 PUT$ , 64,000 contracts opened.

-

$NVDA 20260220 207.5 CALL$ , 78,000 contracts opened.

Based on the overall opening activity, the price is highly likely to continue oscillating within the large 170-190 range from this week into next. Therefore, the 207.5 call is quite intriguing; currently, it seems difficult for the price to break above 200 even with earnings at the end of February.

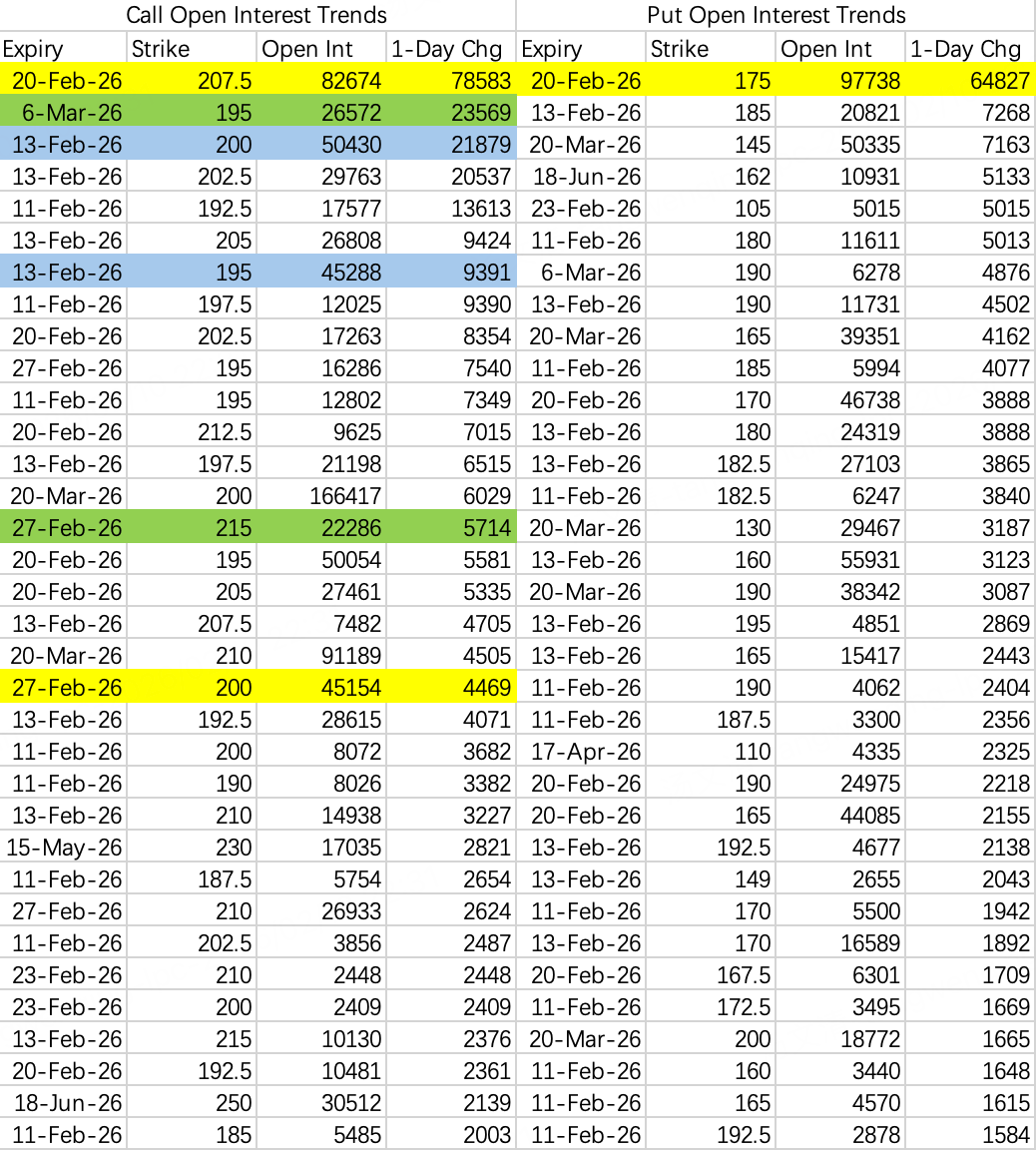

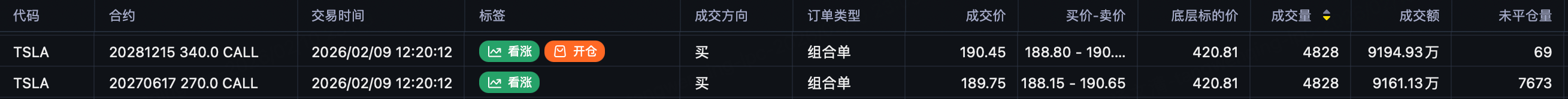

$TSLA$

The long call bought during the April 2025 dip $TSLA 20270617 270.0 CALL$ has been rolled to the December 2028 340 call $TSLA 20281215 340.0 CALL$ . The clever part is the strike increased while the trade price remained flat—continuing to bet big on Tesla.

Tesla is expected to remain range-bound this week. A large bullish call spread order involves selling the 457.5 call $TSLA 20260213 457.5 CALL$ and buying the 467.5 call $TSLA 20260213 467.5 CALL$ . The current price level is more suitable for selling calls.

$AMZN$

The opening activity is very clear, with consistent price targets. Expected to oscillate between 200 and 220. Strikes around 200 are suitable for selling puts. A conservative choice would be 180, where there's a large sell put order: $AMZN 20260417 180.0 PUT$ .

Amazon's e-commerce business is being weighed down by its cloud segment. Meanwhile, Walmart's chart looks very strong, though a bit expensive; comparatively, Amazon offers better value.

$MSFT$

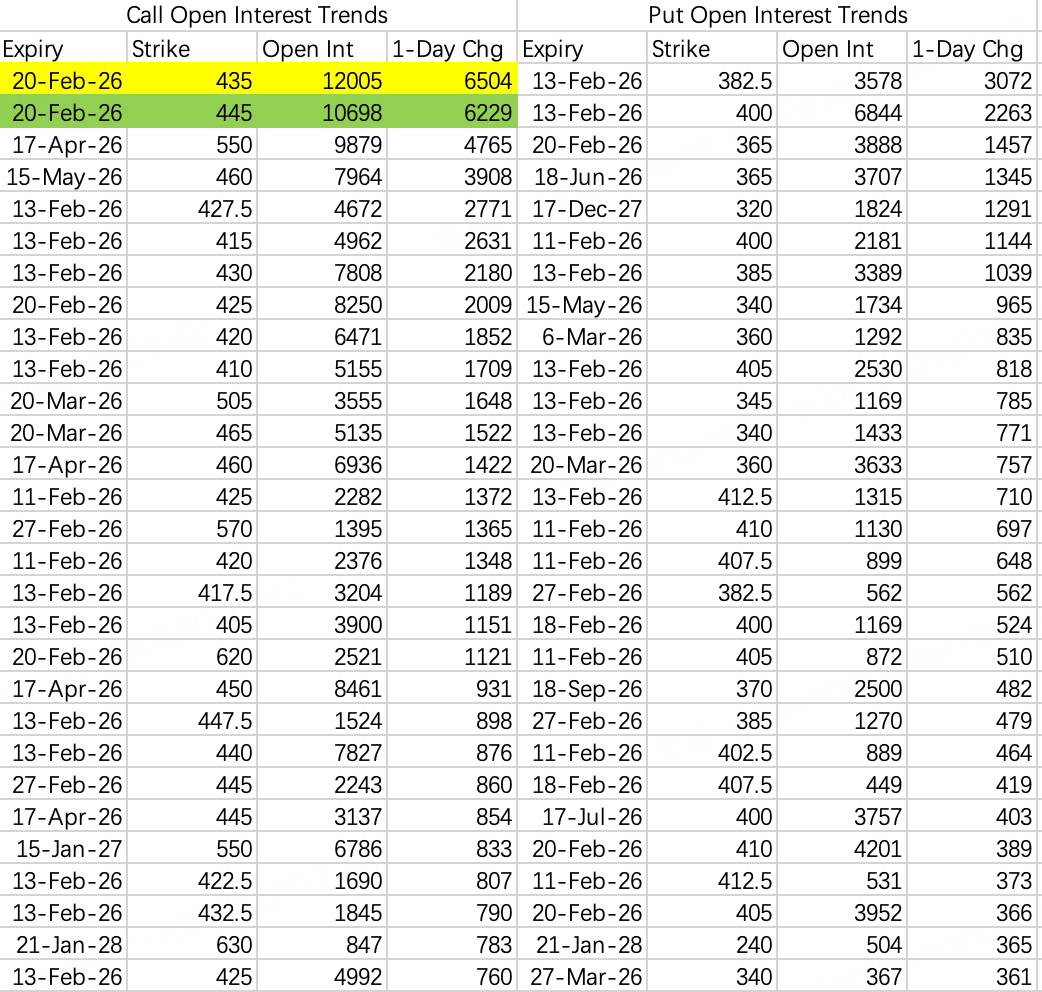

Microsoft is also consolidating around a round number, though the support expectation at 400 isn't as strong as Amazon's round-number support.

However, a short-term bullish call spread order $MSFT 20260220 435.0 CALL$ $MSFT 20260220 440.0 CALL$ suggests the stock is in a rebound phase. Selling puts in the near two weeks should be fine.

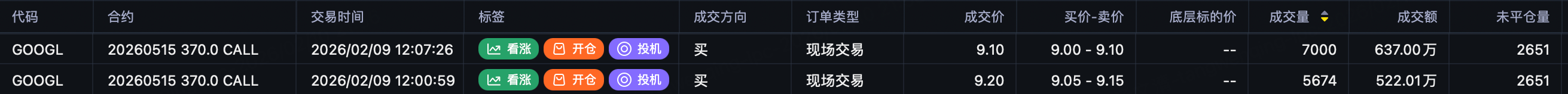

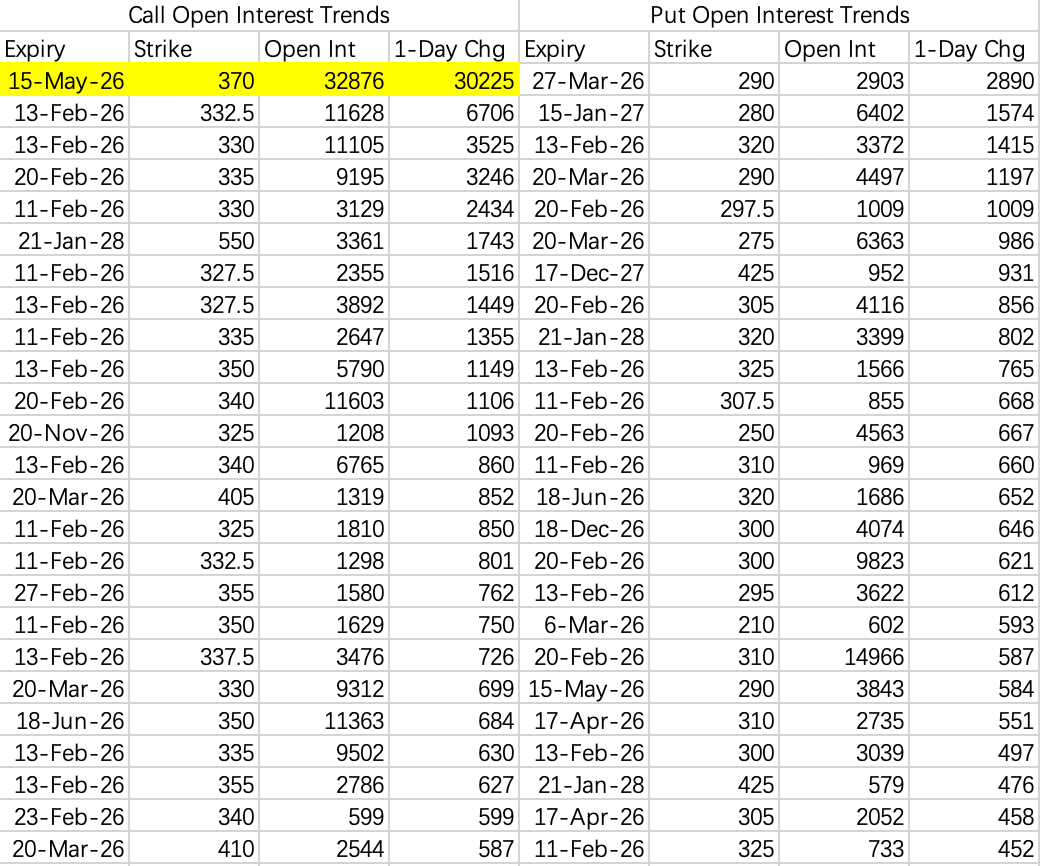

$GOOGL$

A medium-term large bullish order opened: 30,000 contracts of the 370 call $GOOGL 20260515 370.0 CALL$ .

I believe Google's stock price will continue to consolidate. Compared to aggressive call buying, selling puts is more appropriate, with strikes like 300: $GOOGL 20260213 300.0 PUT$ .

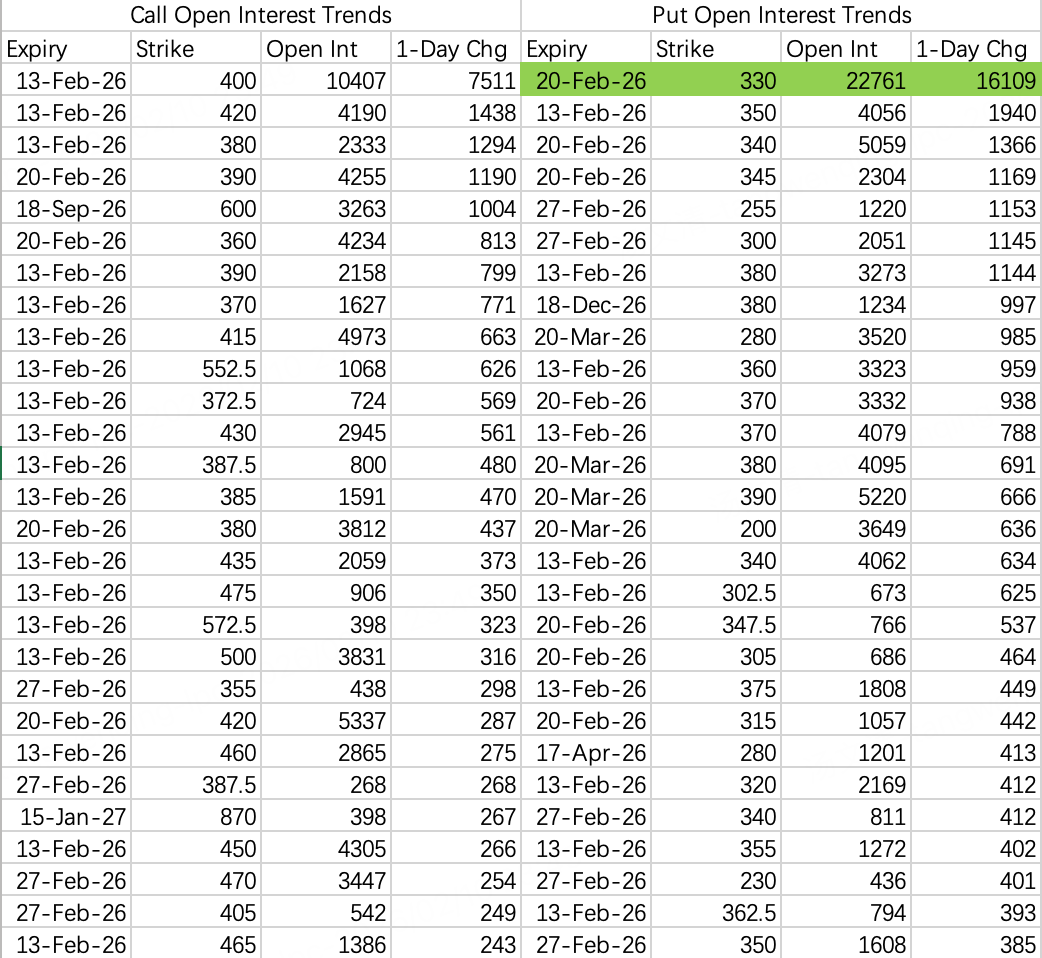

$MU$

It appears Micron is also entering a range-bound consolidation phase. There's a large sell put order: selling the 330 put $MU 20260220 330.0 PUT$ , with 16,000 contracts opened.

Micron's main issue is being too crowded. A normal correction for a typical stock could trigger a stampede in MU.

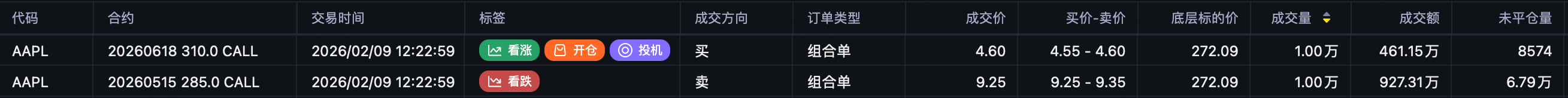

$AAPL$

The biggest beneficiary if Micron corrects, as the market might perceive memory prices dropping (even if they haven't actually decreased), which would be a cost benefit for consumer electronics.

The dip-buying large call order has been rolled to the June 310 call $AAPL 20260618 310.0 CALL$ . Judging by the trade size, it's playing the tail end of the move.

Apple's price has stabilized. Most put option strikes opened are between 260 and 270. It's a good time to sell puts: $AAPL 20260213 265.0 PUT$ .

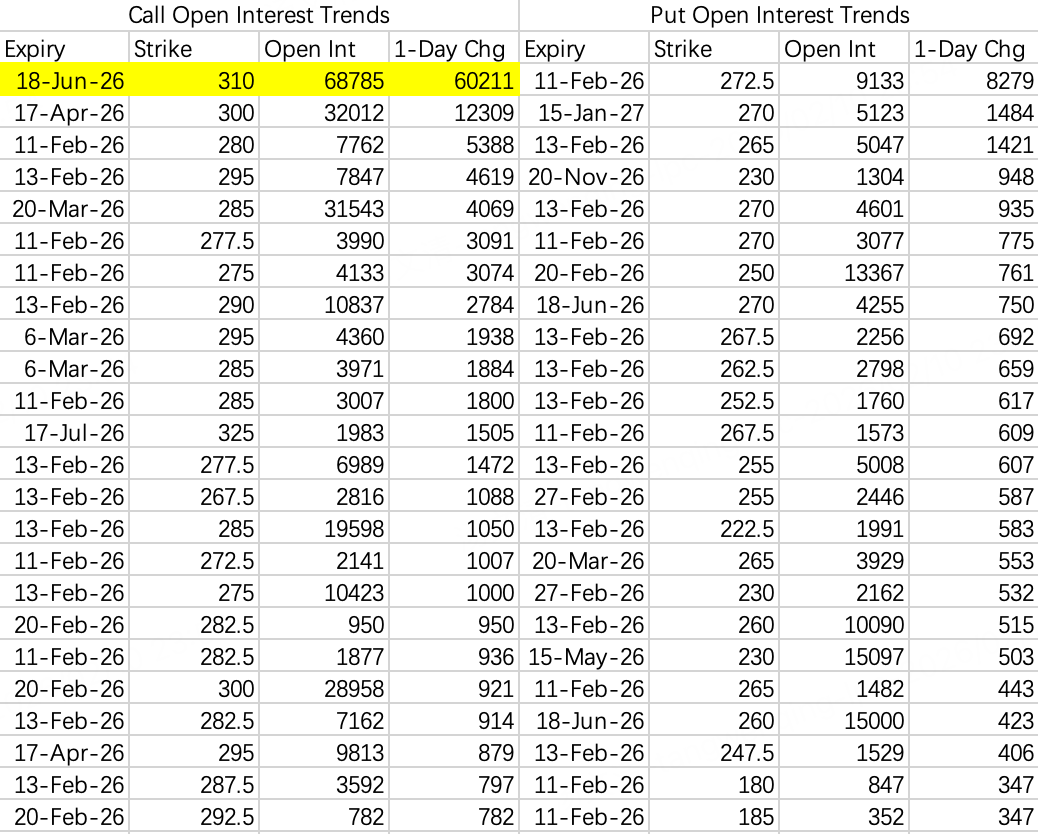

$ORCL$

Another correction cannot be ruled out. The 138 put $ORCL 20260220 138.0 PUT$ saw 40,000 contracts bought.

$TSM$

A large bearish order for TSMC: the February 20th expiry 325 put $TSM 20260220 325.0 PUT$ , with 16,000 contracts traded.

Comments