$GLD$

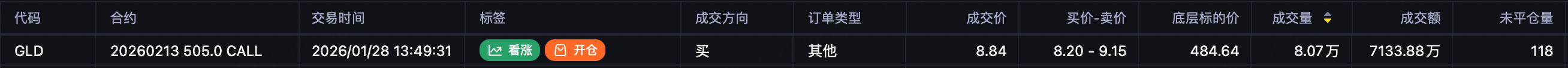

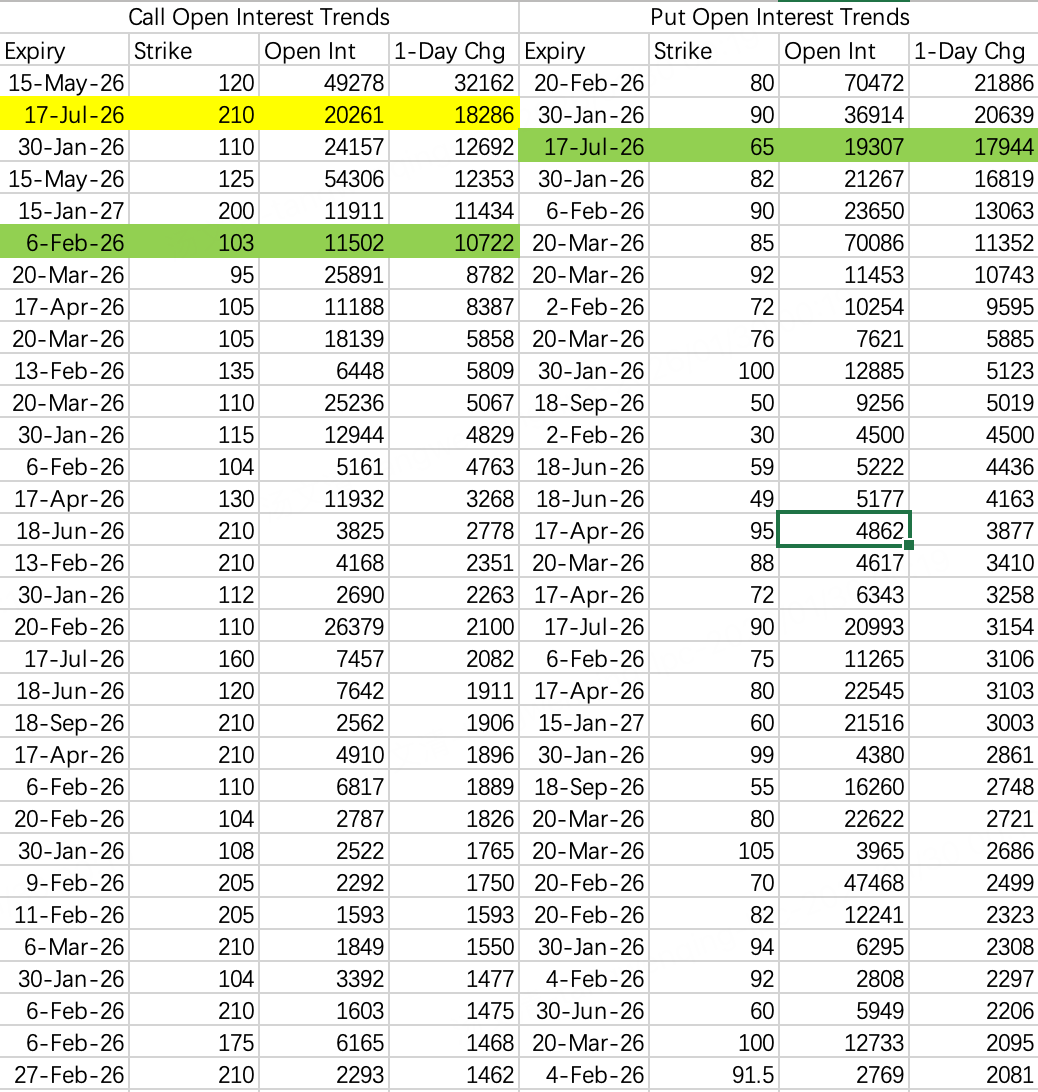

Today, scanning large orders, I was startled to see a massive call buy on the Gold ETF: $GLD 20260213 505.0 CALL$ , with 80,000 contracts traded for a total notional value of $71.33 million.

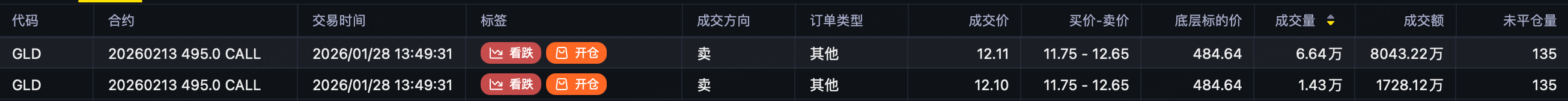

Later, I discovered an equally large sell call order. Placed simultaneously, they likely constitute a paired, combination order—specifically, a Bear Call Spread: Sell Call $GLD 20260213 495.0 CALL$ , Buy Call $GLD 20260213 505.0 CALL$ . This positions for GLD to be below 495 by February 13th, with the long 505 call serving as protection.

At this stage, the conviction behind a sell call order carries significantly more weight than a buy put order, given the extreme risk of a short squeeze for naked call sellers, even within a spread structure.

Subsequently, the price is expected to bottom out and consolidate between 460 and 470.

$SLV$

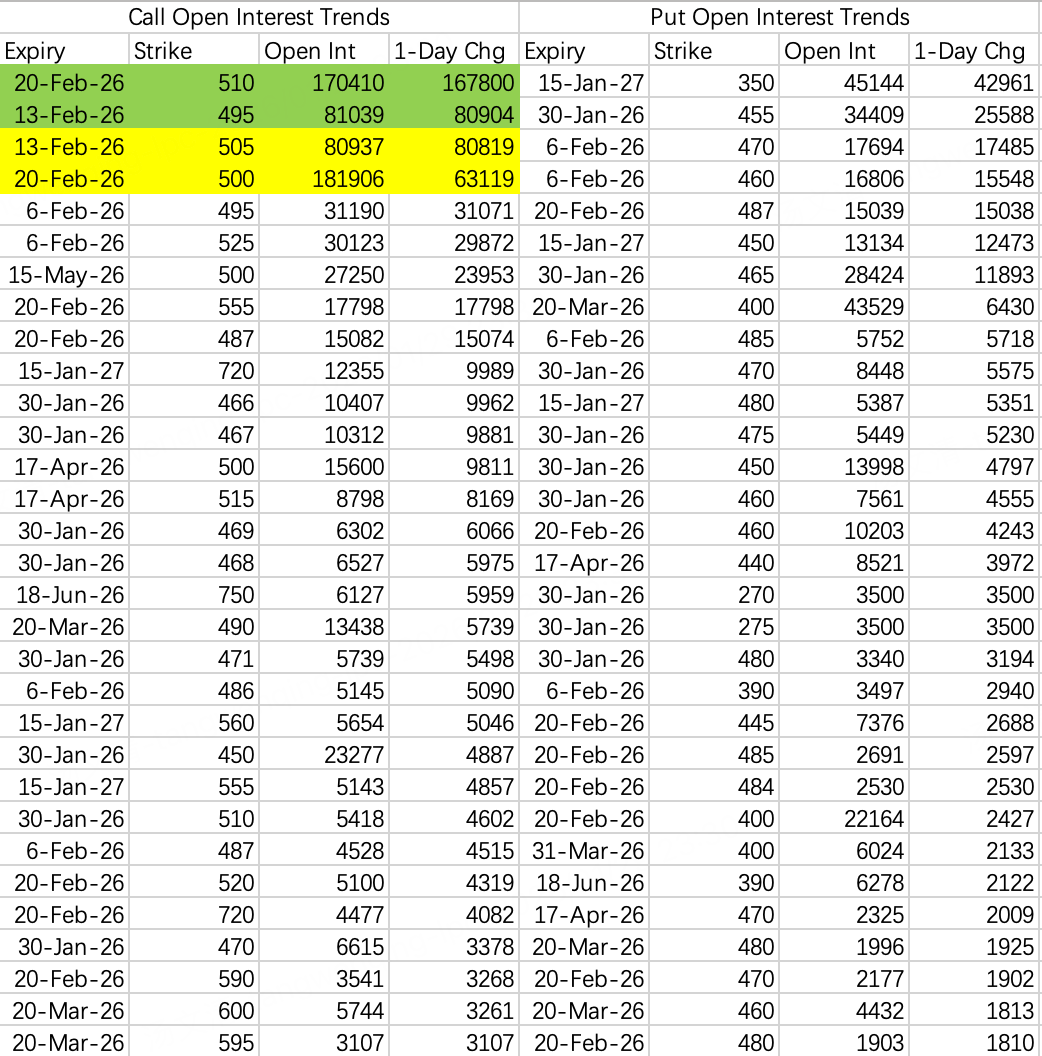

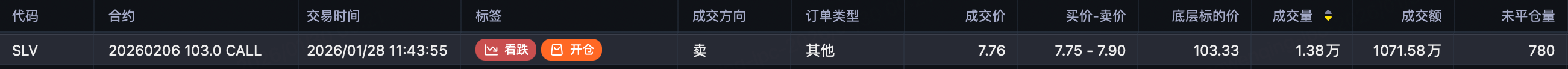

The Silver ETF also saw bearish sell call activity: selling the February 6th expiry 103 call $SLV 20260206 103.0 CALL$ , with 10,000 contracts opened.

This confirms that precious metals should quiet down for the next couple of weeks.

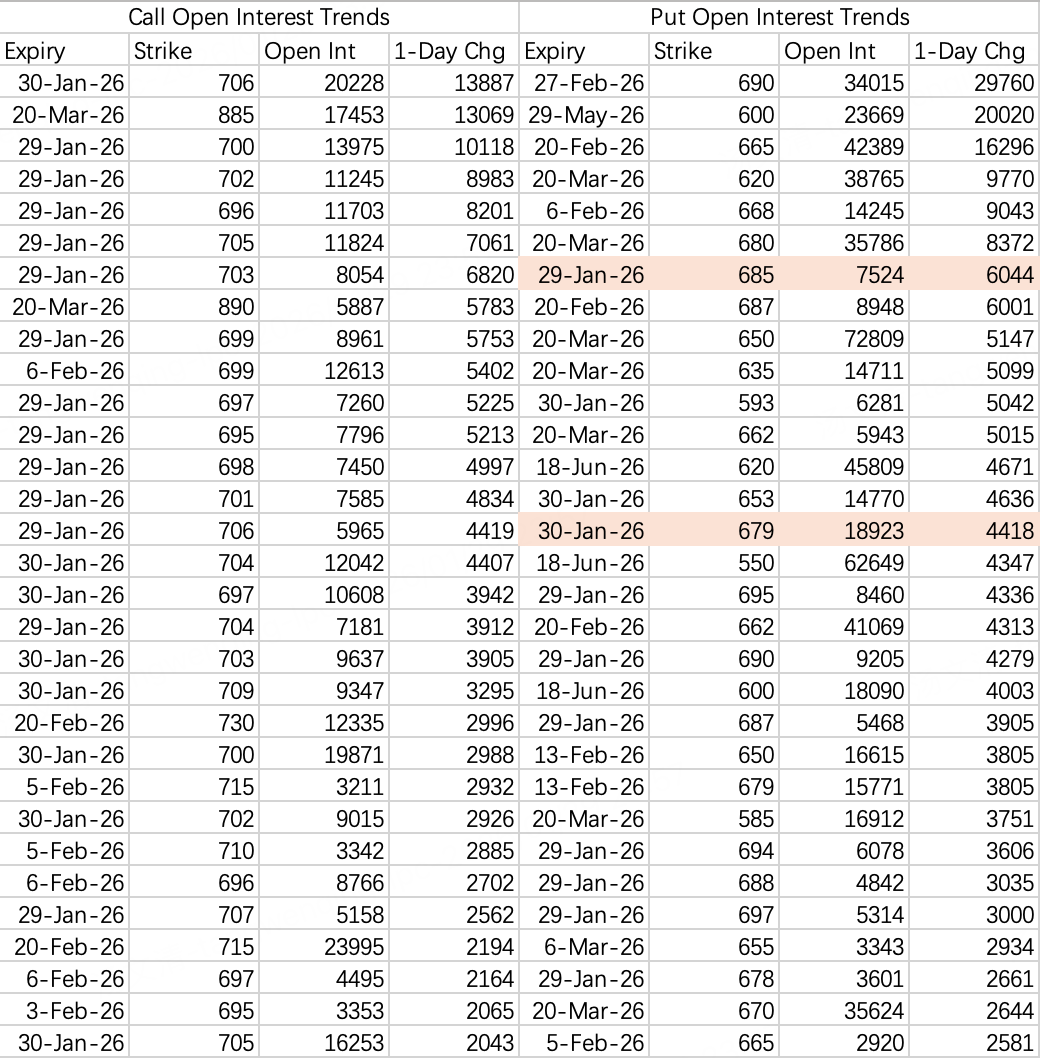

$SPY$

A confluence of factors is dragging down the broader market. The first pullback target is 685, the second is 680.

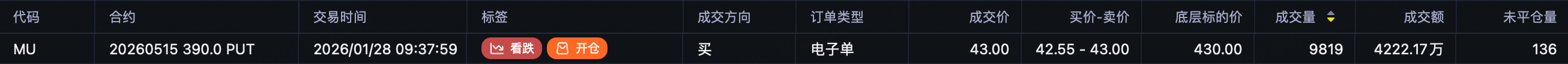

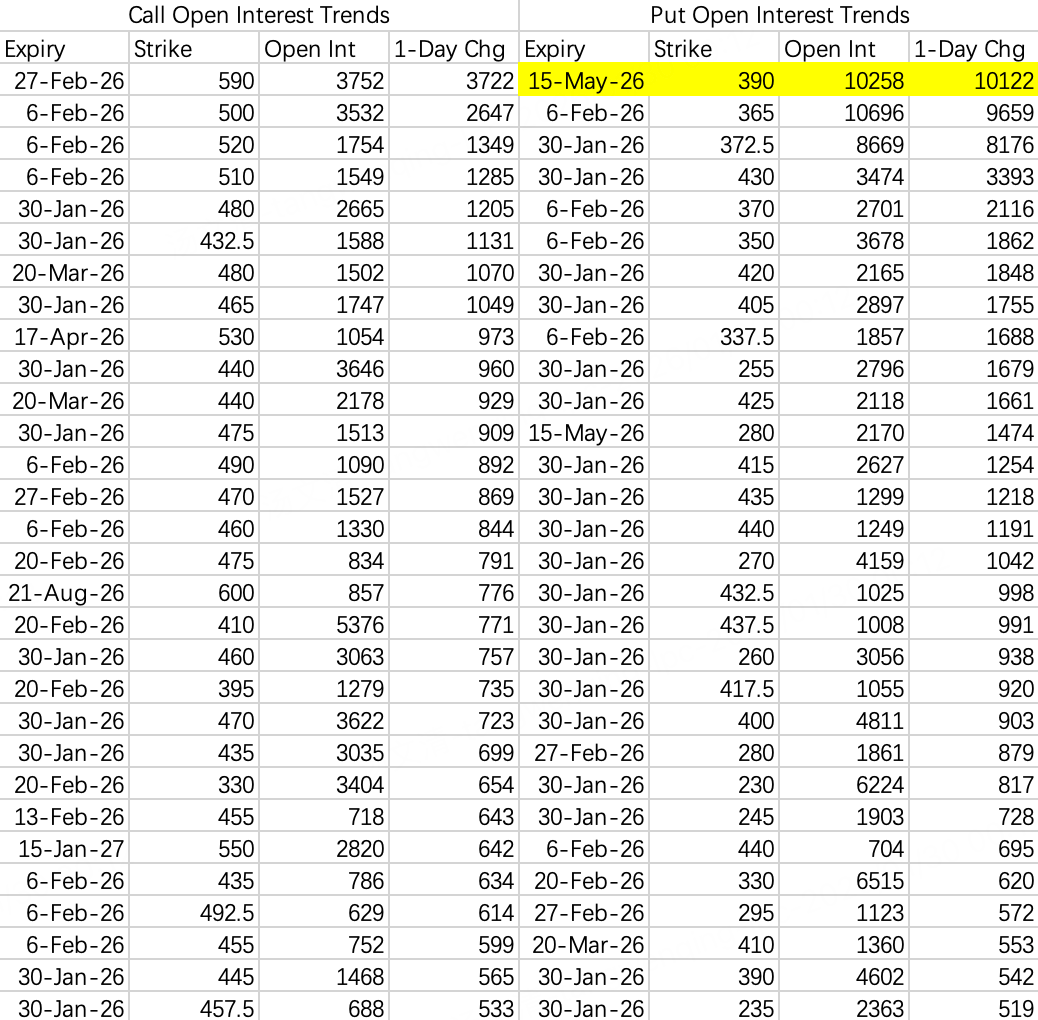

$MU$

A large bearish order appeared on Micron: the May 15th expiry 390 put $MU 20260515 390.0 PUT$ , with 10,000 contracts opened for a notional value of approximately $43 million.

There's no specific negative catalyst; it's simply due to the crowded, overextended rally. Once a healthy correction plays out, it will again present a solid opportunity for going long.

Comments