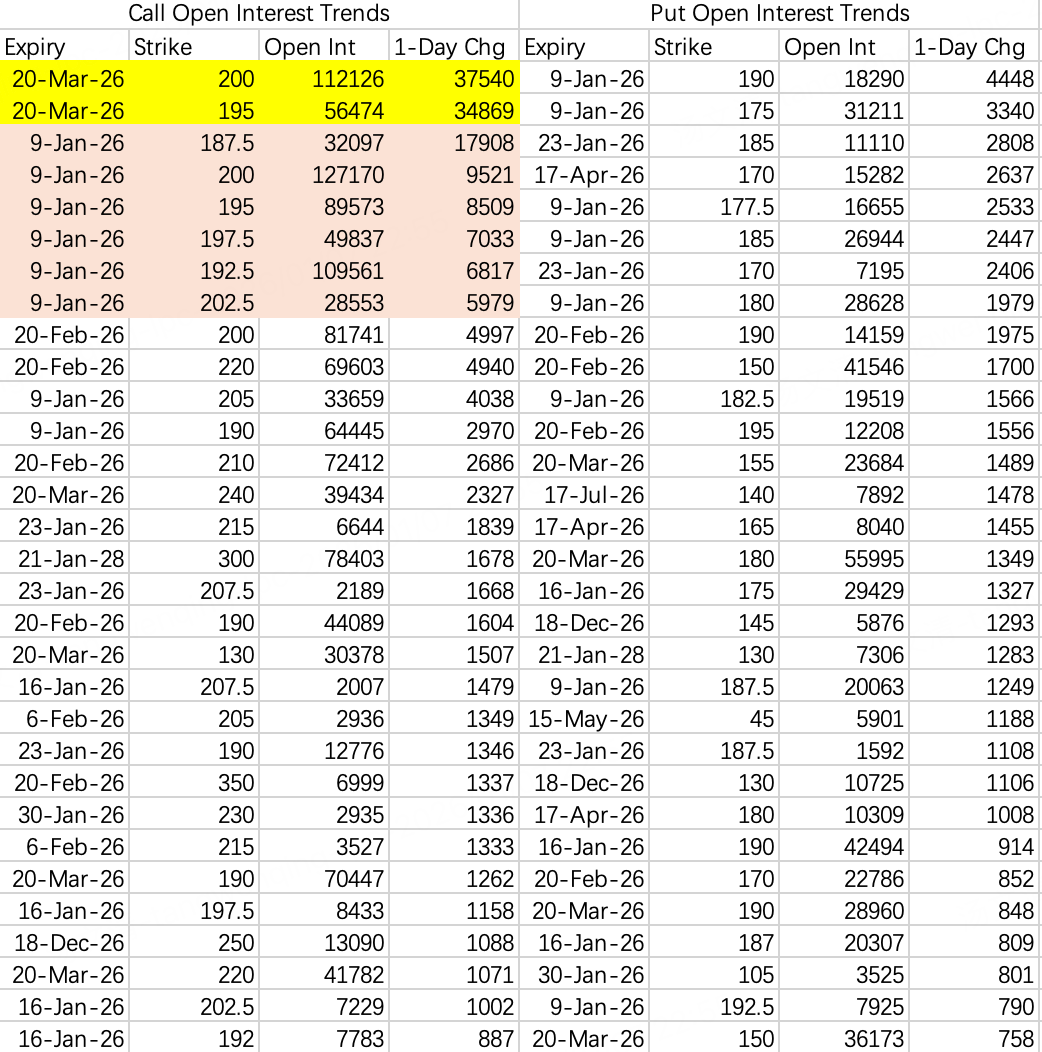

$NVDA$

There is renewed heavy call option buying concentrated in the 187.5 to 202.5 strikes expiring this week, increasing the likelihood of a short squeeze.

For selling puts, consider raising the strike price to 185. $NVDA 20260109 185.0 PUT$

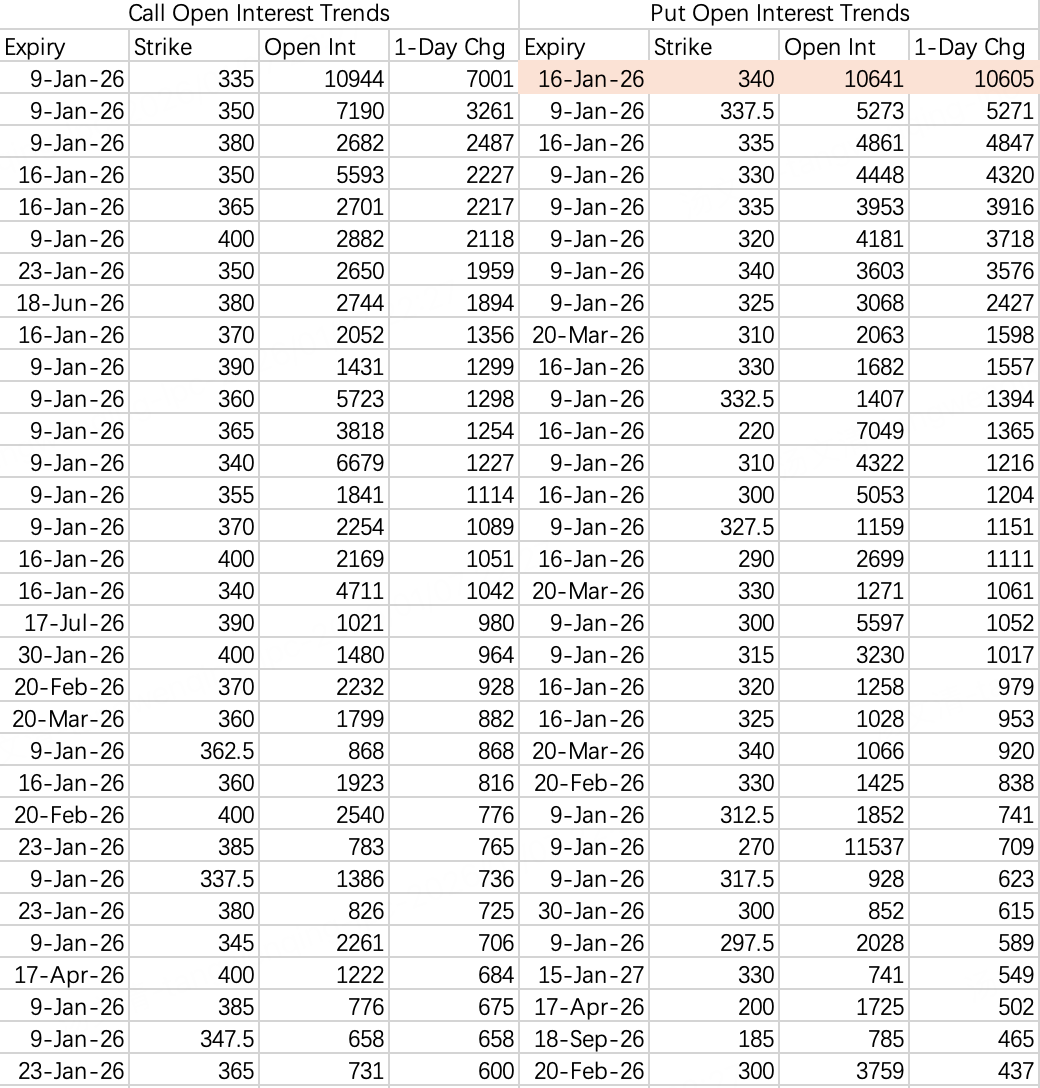

$MU$

Micron currently faces a similar issue as silver—it's difficult to pinpoint where the top might be. Bears have opened puts expiring this week, aiming to trigger a pullback to 320. It's uncertain if they'll succeed, but selling the 310 put this week seems relatively safe.

I have a theory: by referencing options trading volume, Micron might be nearing a top when its volume approaches that of the silver ETF SLV. That could signal the FOMO (fear of missing out) buying is exhausting itself. Currently, MU's daily options volume is around 600k contracts, while SLV's is about 1.75 million. SLV currently ranks 5th in total stock options volume, behind SPY, QQQ, TSLA, and NVDA.

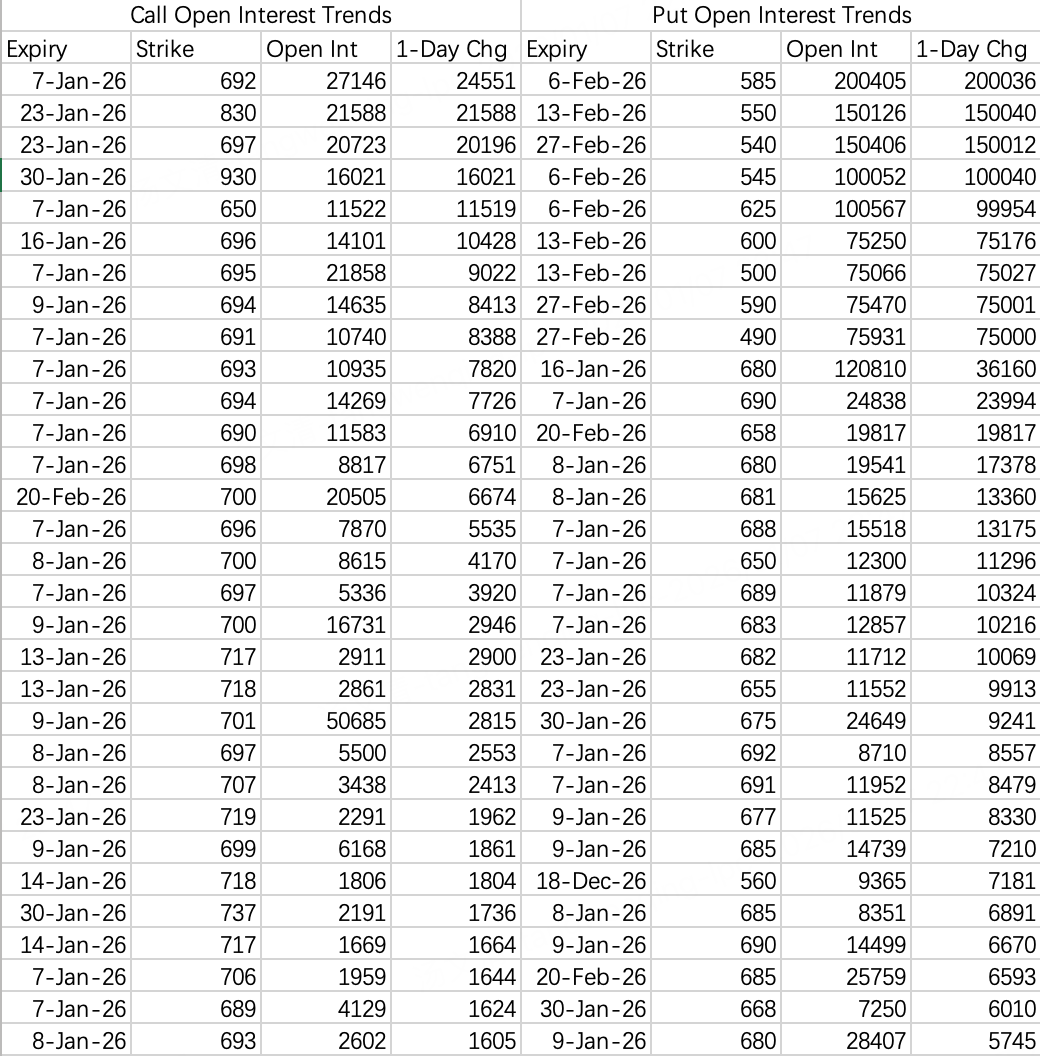

$SPY$

The current US broad market exhibits a similarity to the A-share market: it's hard to pinpoint exactly which sectors are leading, but the indices keep grinding higher day by day. SPY is steadily advancing toward 700.

Based on recent put option buying activity, there is an expectation for a potential market pullback in February.

Comments