$KWEB$

A relatively rare scenario has emerged: large orders chasing a rally, with a massive temporary addition of long call options, betting KWEB will rise to 40.

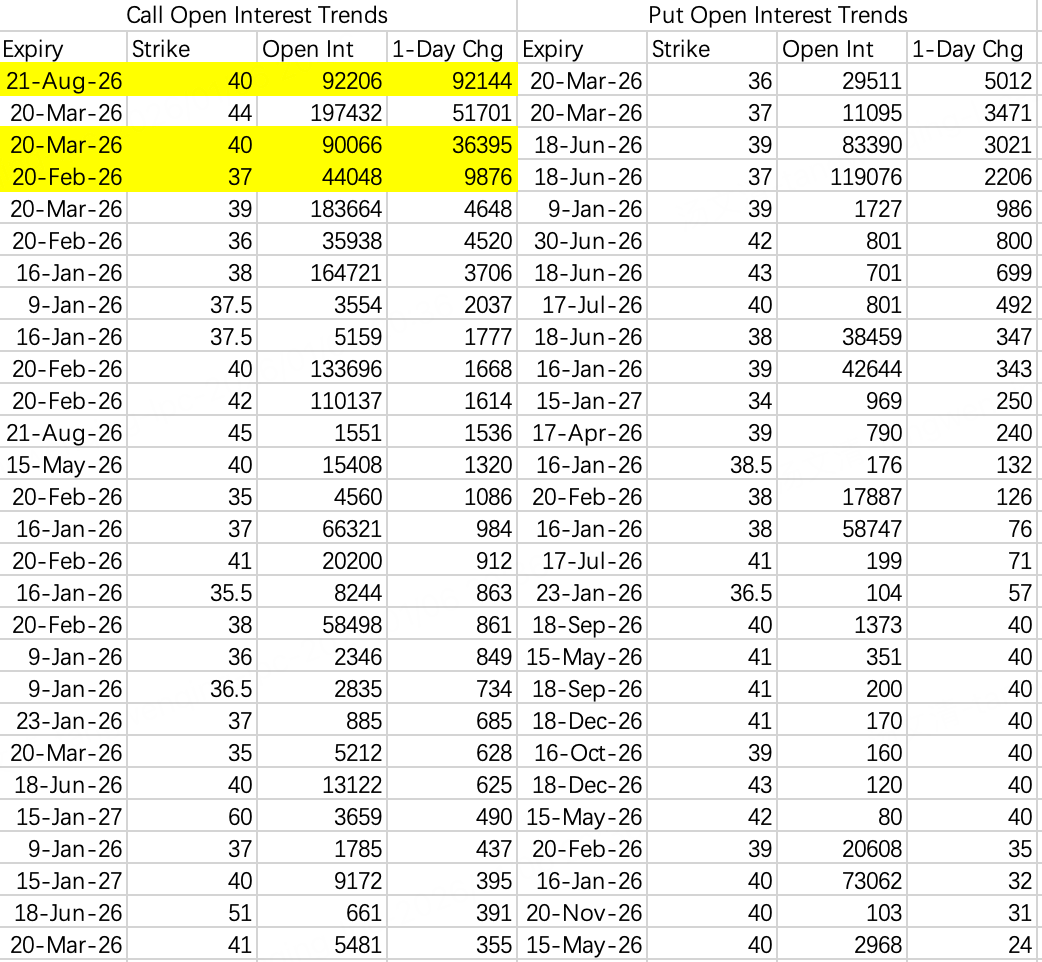

The main large bullish orders include:

$KWEB 20260821 40.0 CALL$ : August 21st expiry 40 calls, 92,000 contracts opened, direction buy, notional value approximately over $23 million.

$KWEB 20260320 40.0 CALL$ : March 20th expiry 40 calls, 36,000 contracts opened, direction buy, notional value approximately over $3 million.

$KWEB 20260220 37.0 CALL$ : February 20th expiry 37 calls, 9,876 contracts opened, direction buy.

100,000 contracts is a relatively rare scale of opening activity, uncommon even across all US stock options. Furthermore, the strike prices chosen are out-of-the-money, carrying high risk of expiring worthless, indicating the traders have a high degree of conviction about the price movement.

The whale's choice of August expiry for the 40 calls is partly to reduce the large order's impact on the stock price and to avoid being targeted. Therefore, despite varying expirations, the underlying forecast is for KWEB to reach 40 in Q1.

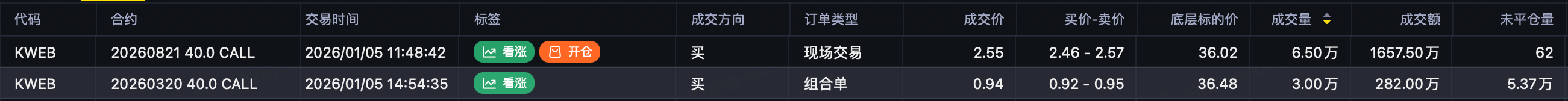

Given these large bullish orders, I believe a more prudent way to follow the rally is still to sell puts, such as $KWEB 20260109 36.5 PUT$ or $KWEB 20260116 36.0 PUT$ , selecting an at-the-money strike price.

$FXI$

Compared to KWEB's momentum chasing, FXI's openings are more conservative, favoring sell put strategies like $FXI 20260320 37.0 PUT$ .

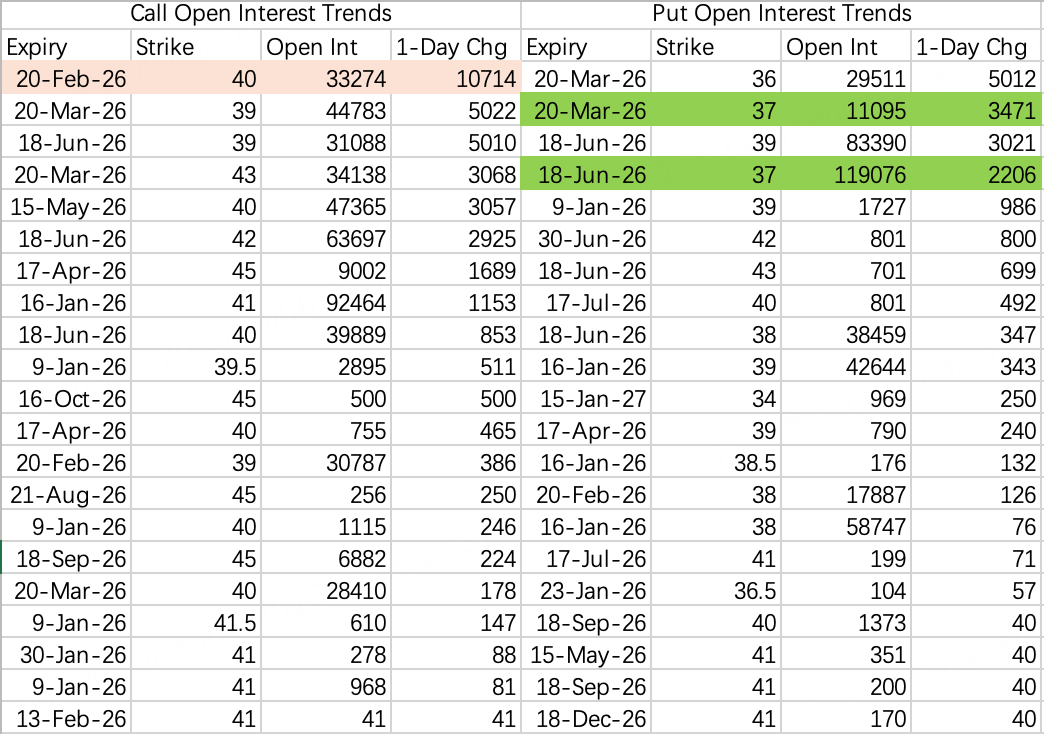

$BABA$

Alibaba's option activity also leans towards sell put operations, for example, sell put $BABA 20260116 143.0 PUT$ and sell put $BABA 20260109 149.0 PUT$ .

However, this week's put openings have formed a bearish ladder. If there's no upward push, the stock price has a probability of pulling back to 145.

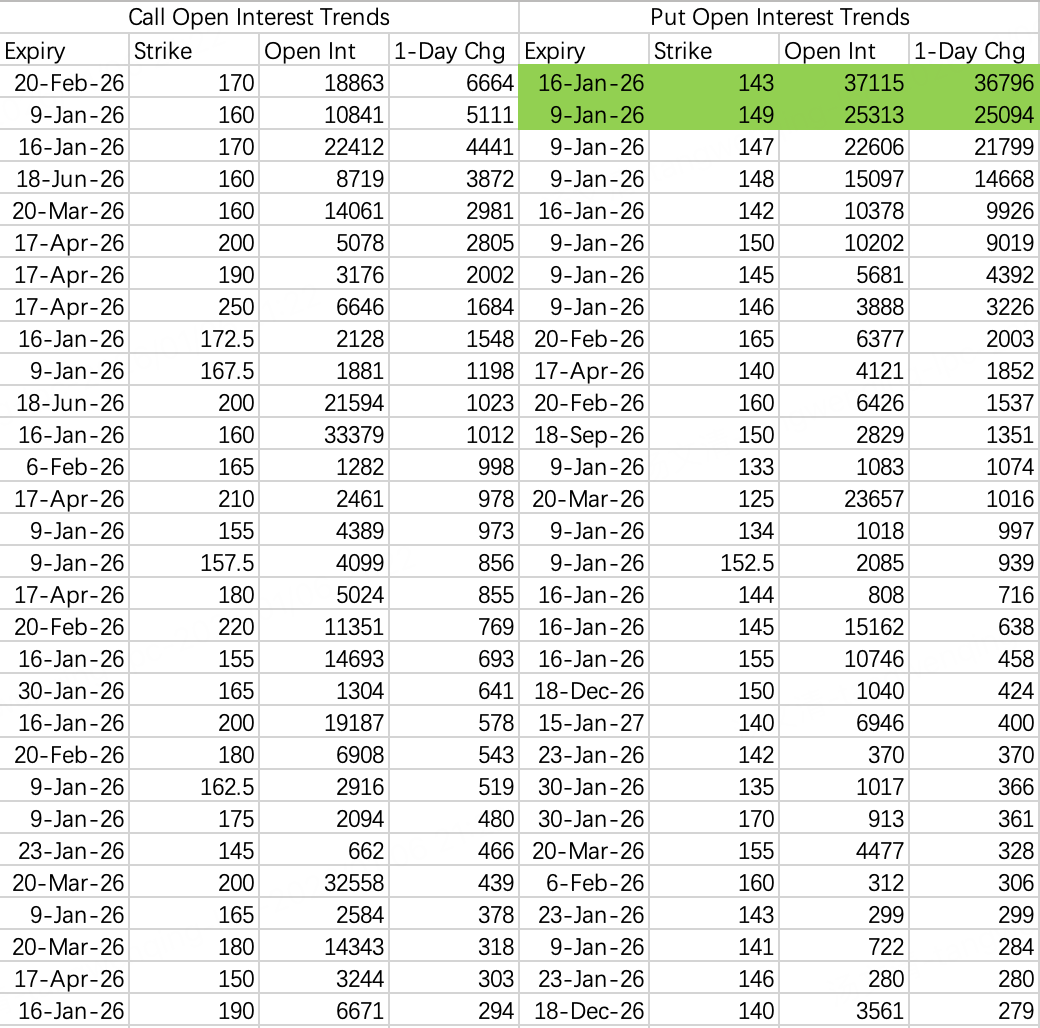

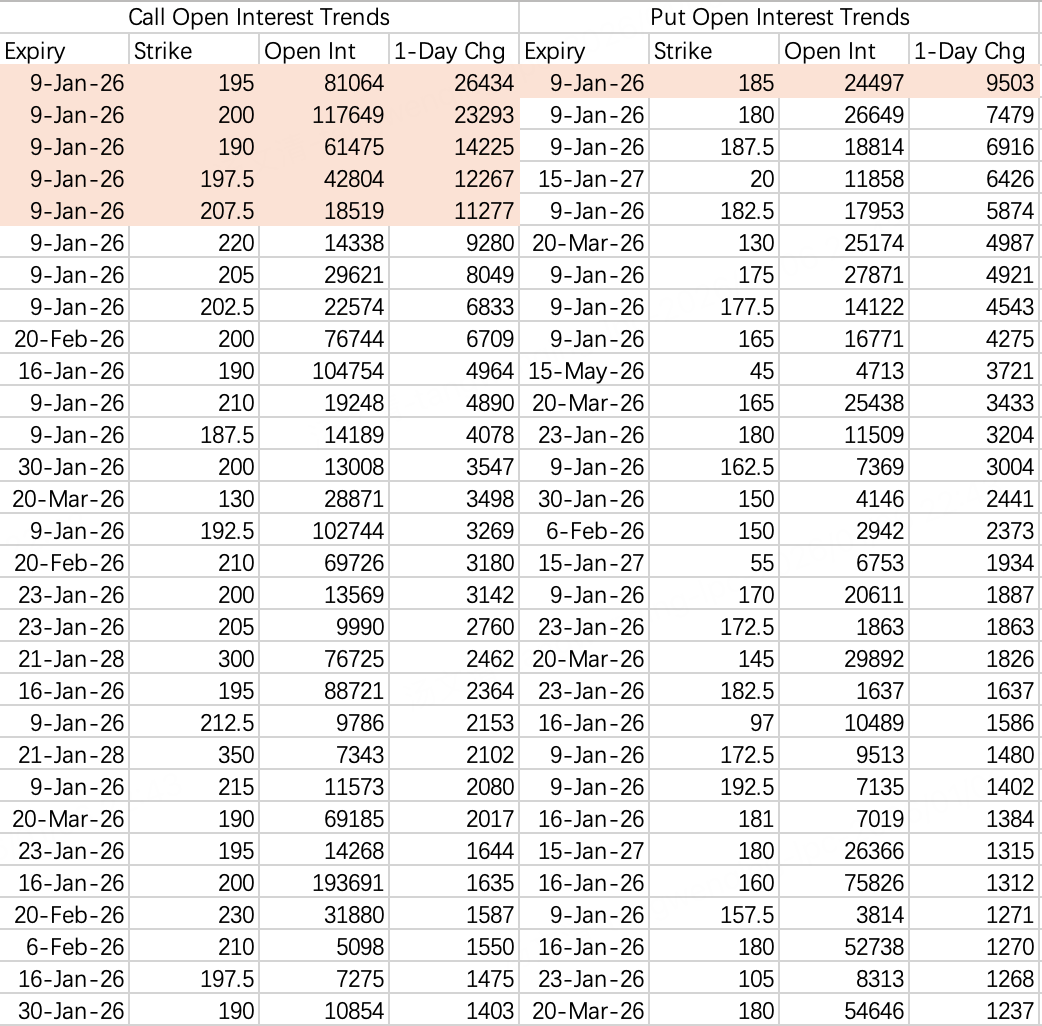

$NVDA$

CES provided only a modest boost for NVIDIA. However, this week's expiring call options saw a large volume of single-leg retail trades, with mixed directions. A breakout above 193.5 could easily trigger a gamma squeeze towards 200, though currently that opportunity seems limited.

While the current price is suitable for selling calls, one must still guard against a gamma squeeze. Alternatively, one could add a long call leg. However, the most stable approach remains selling the 180 put $NVDA 20260109 180.0 PUT$ .

Comments