$GOOGL$

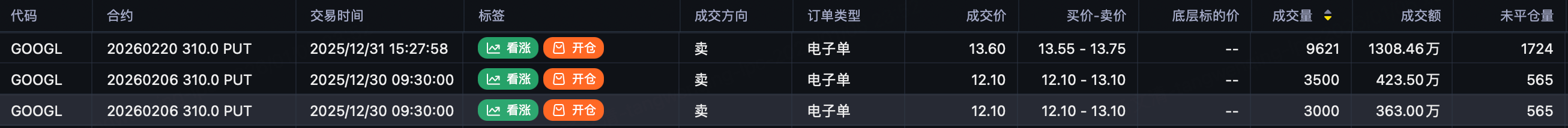

The past two months have been a consolidation phase. Trading in this environment can be tricky, but seeing this large order might clarify things:

Sell Put 310 $GOOGL 20260220 310.0 PUT$ , 9,684 contracts opened.

Sell Put 310 $GOOGL 20260206 310.0 PUT$ , 10,000 contracts opened.

The message is: don't overcomplicate. Sell puts on dips; don't chase rallies. If you accidentally sell puts at a high level, don't panic and close for a loss immediately. Consider whether you're willing to take assignment—the price might rebound after you do.

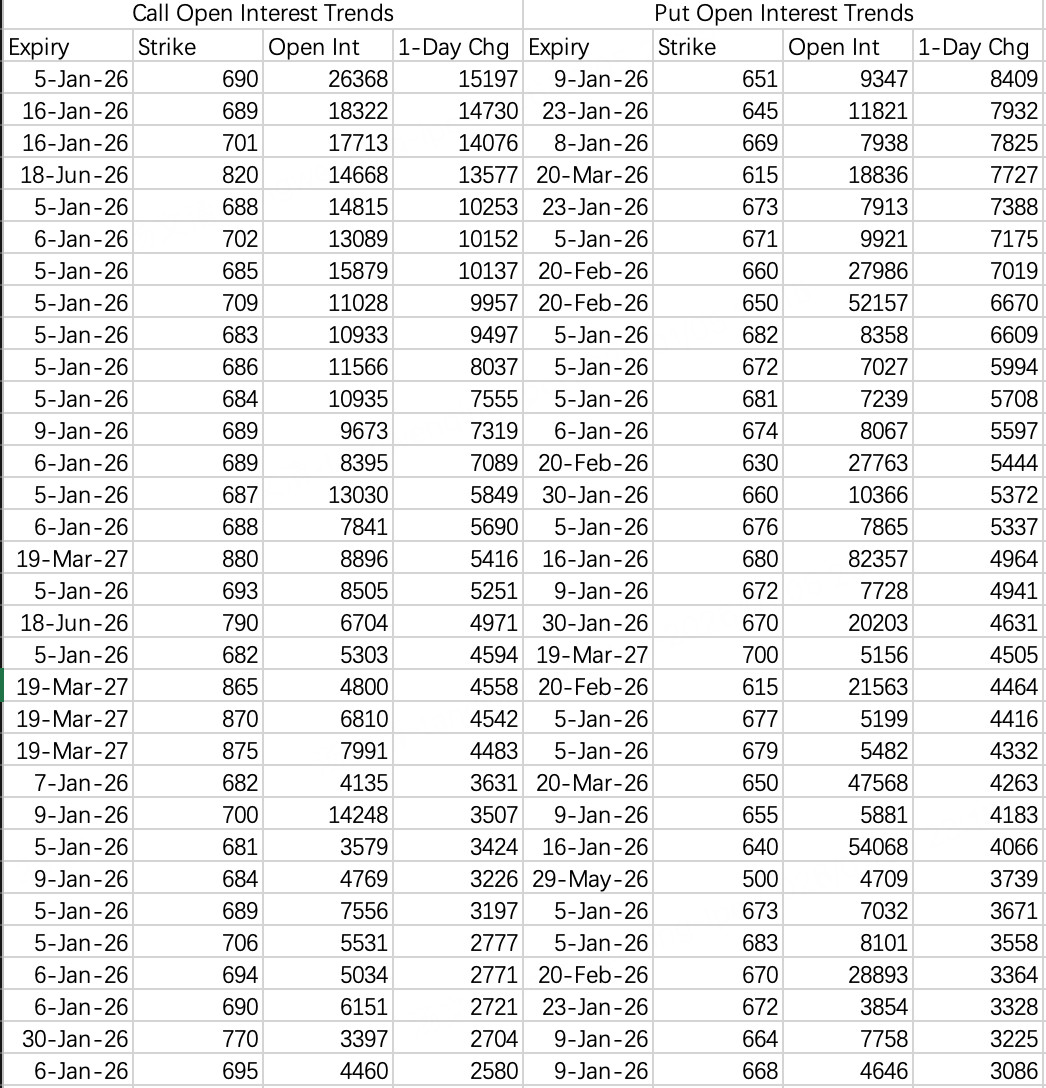

$NVDA$

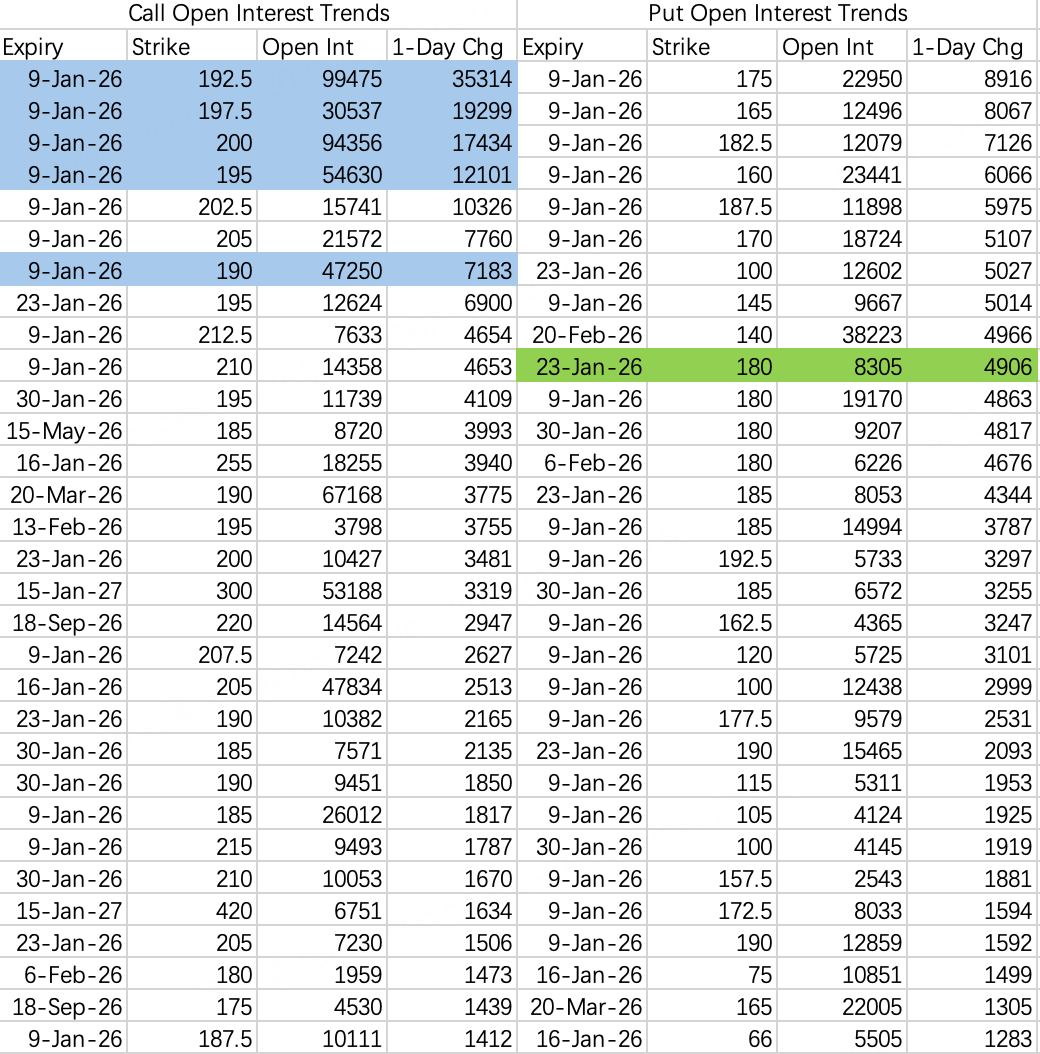

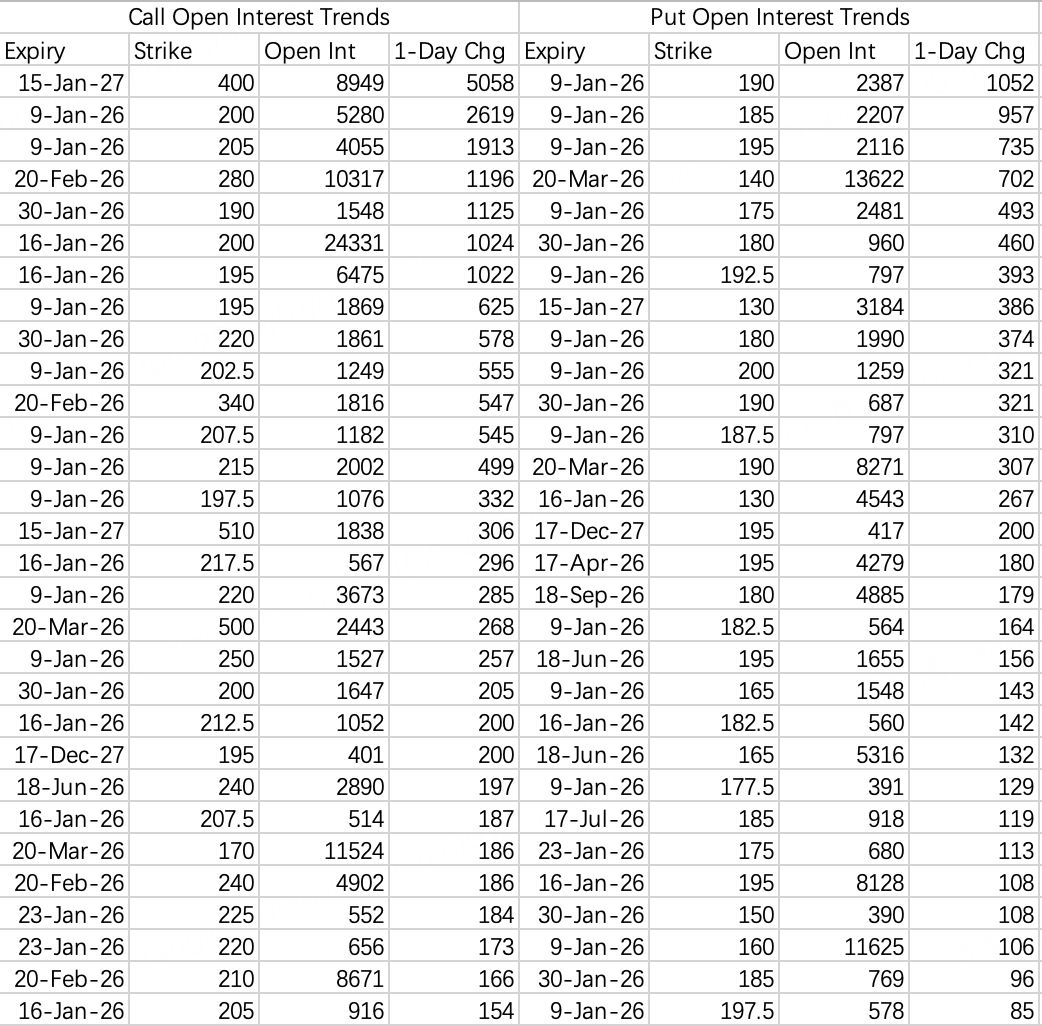

Institutions' primary bullish spread strategy for shorting is focused on the 192.5–197.5 range $NVDA 20260109 192.5 CALL$ $NVDA 20260109 197.5 CALL$ . The expectation is that breaking above 192.5 will remain difficult this week.

If NVDA still cannot break above 193 after Huang's speech tomorrow, it will be very hard for the price to surpass 190 before the January monthly expiration, given the 99k open interest in the January 16th 190 calls. However, if it does break through, a move directly to 200 is possible.

A relatively stable strategy for this week is Sell Put 180 $NVDA 20260109 180.0 PUT$ .

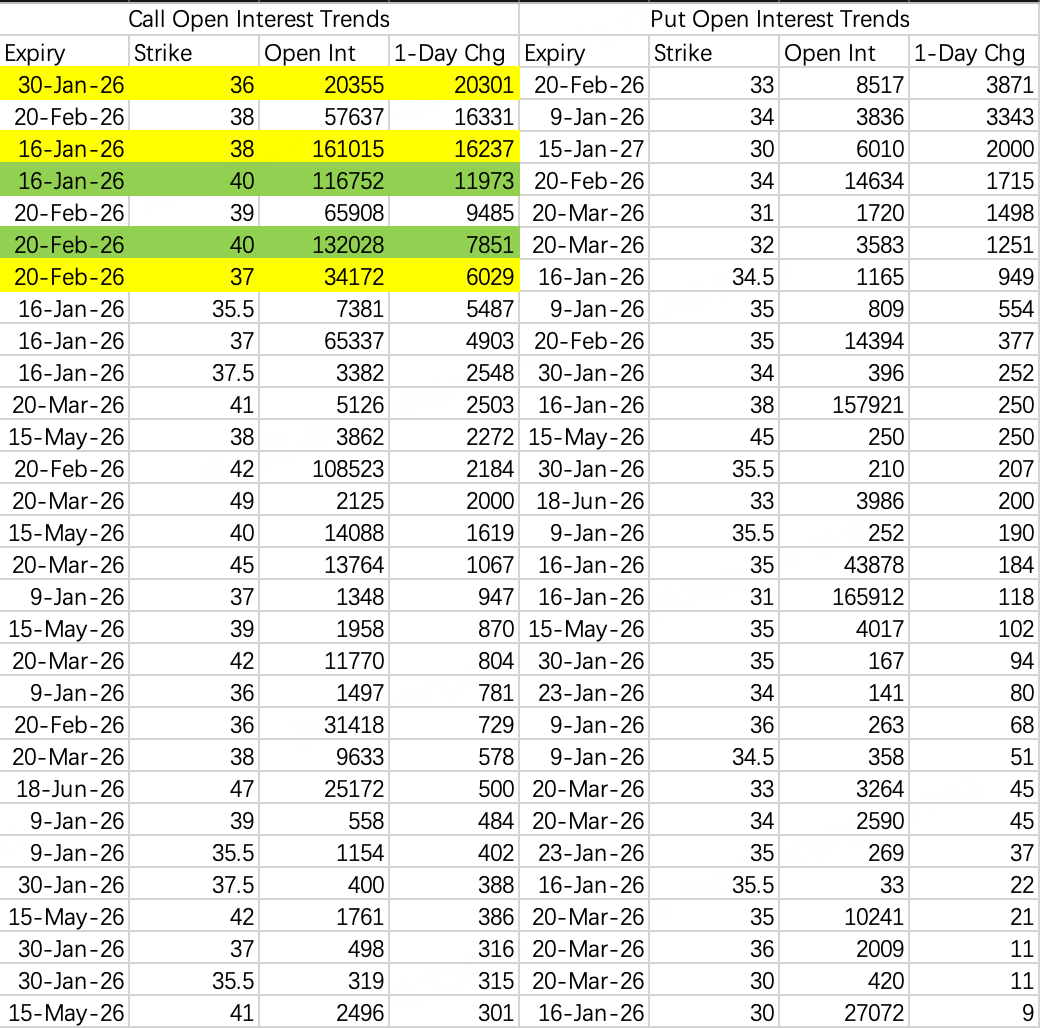

$KWEB$

Chinese stocks, especially tech stocks, are expected to maintain relative strength in January-February, making them suitable for selling puts.

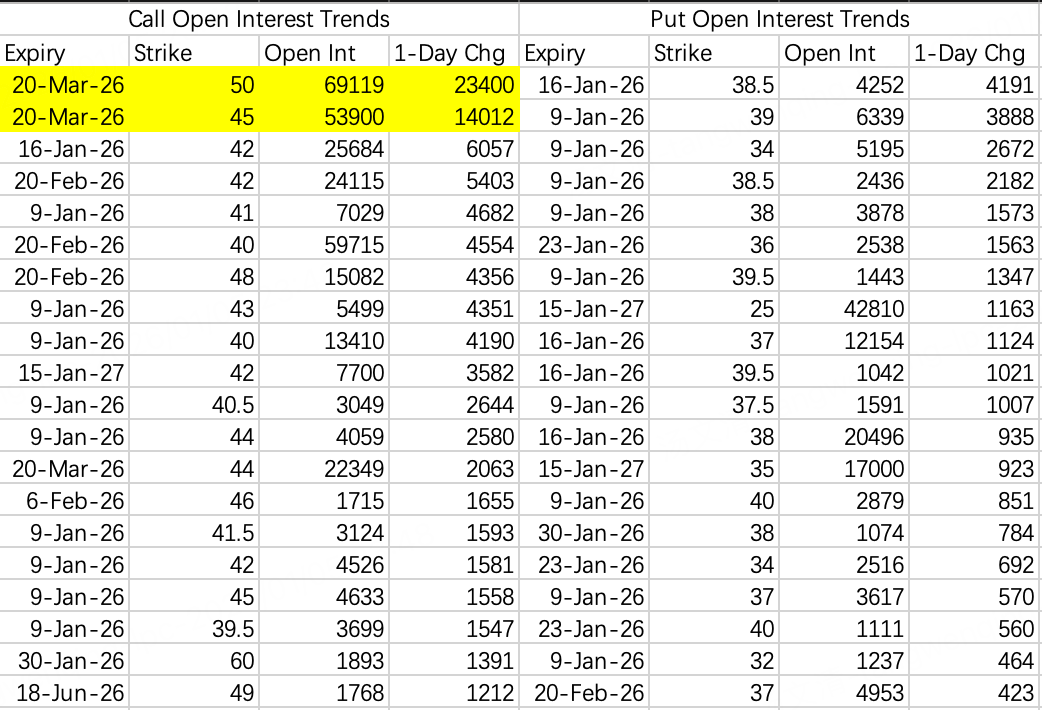

Call option openings have increased significantly. Institutions rolled March 36 calls into buying January 30th 36 calls $KWEB 20260130 36.0 CALL$ .

Additionally, there are various bullish spreads, such as Buy 37 Call $KWEB 20260220 37.0 CALL$ , Sell 40 Call $KWEB 20260220 40.0 CALL$ . The price is expected to reach 38 in January.

Note that breaking above 38 before January 16th is quite challenging due to the 160k open interest in the January 16th 38 calls.

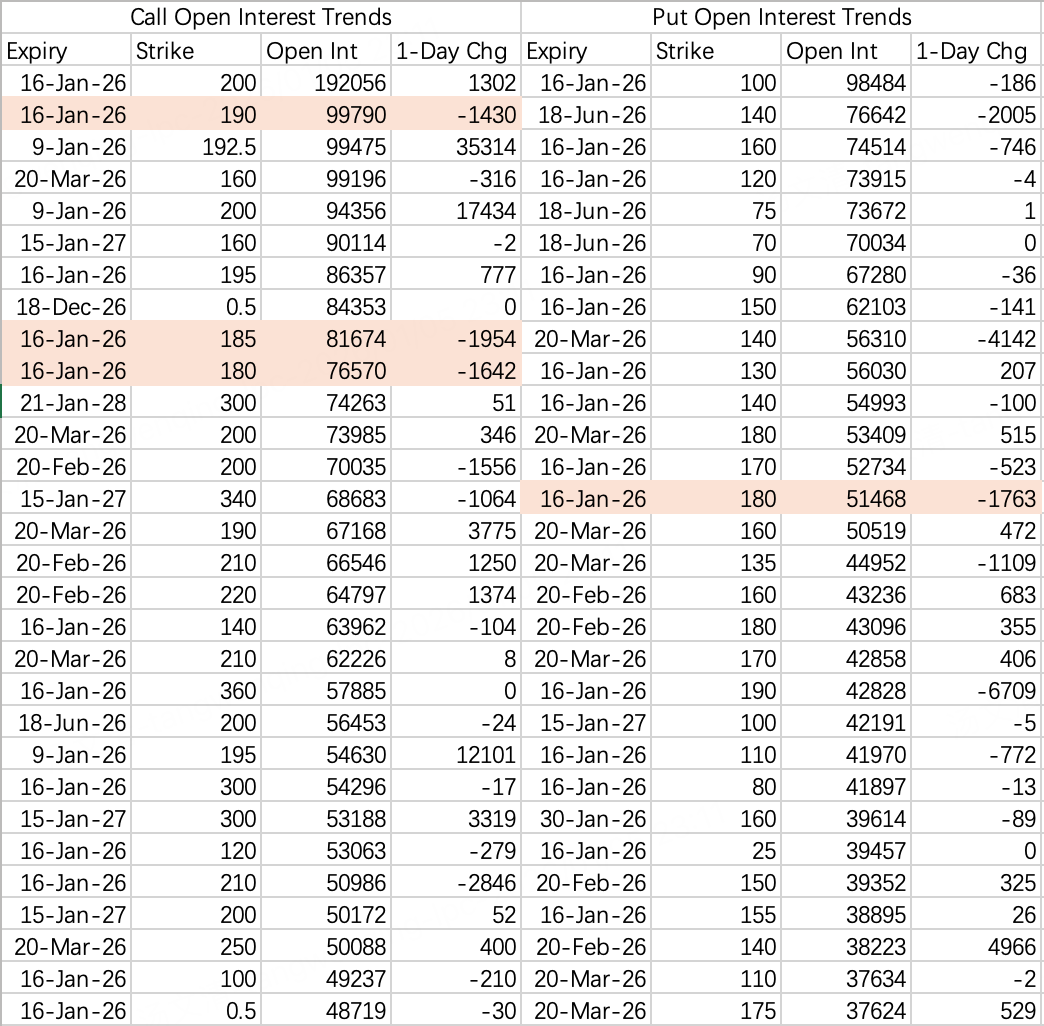

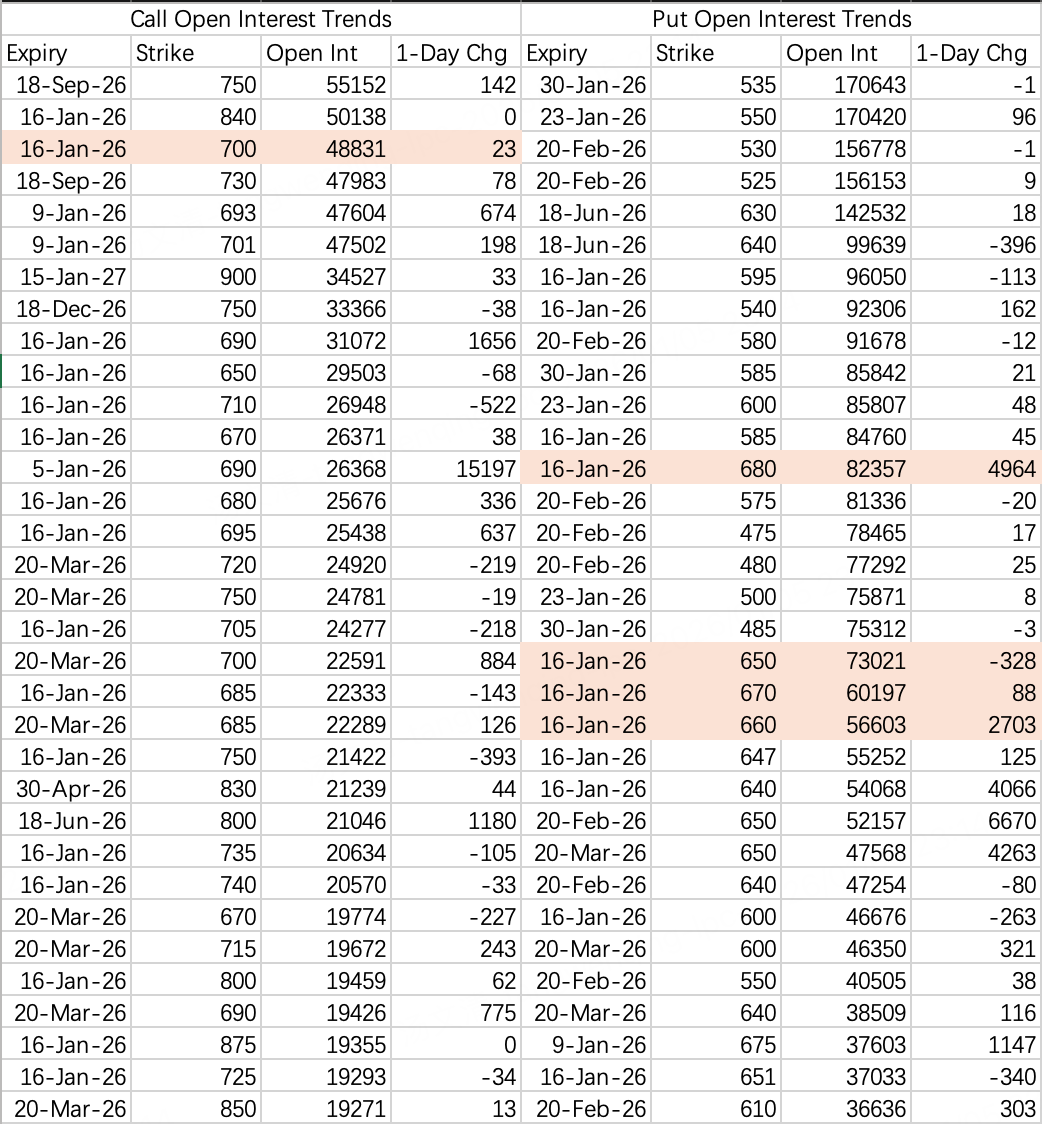

$SPY$

Based on overall open interest data, it's difficult for SPY to break above 700 or fall below 680 before the January 16th expiration.

However, based on Friday's opening data, put options are betting on a pullback to 670 after the monthly expiration.

$TSLA$

Tesla is back in its familiar 440–470 consolidation range. Theoretically, 400 would be the best price for a dip buy, but this would require significant negative news or a major market correction—both low-probability events based on the recent two weeks. For weekly trades, consider Sell Put 430 $TSLA 20260109 430.0 PUT$ .

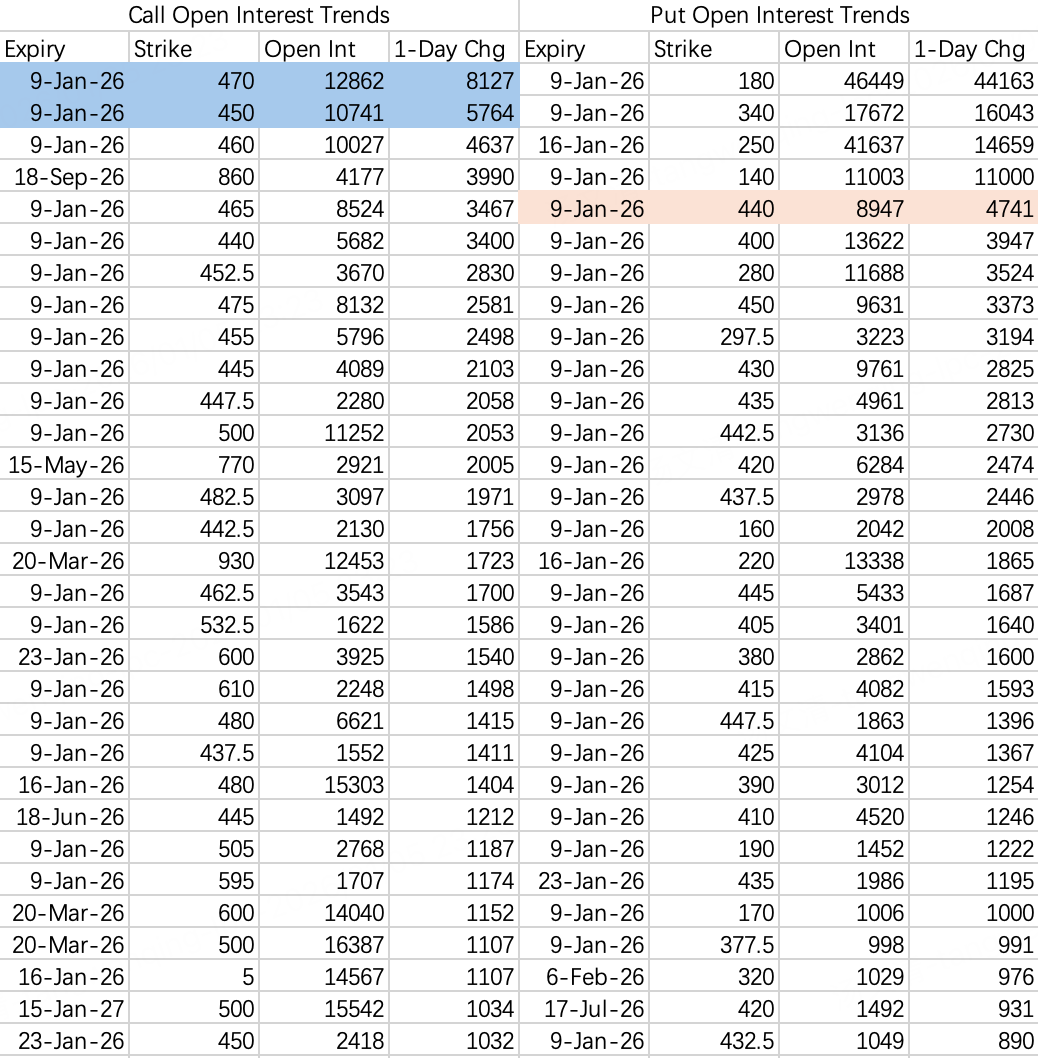

$MU$

Based on option openings, the market sees a not-insignificant probability of Micron pulling back towards 300.

A large bullish order opened a call spread: Sell Call 315 $MU 20260116 315.0 CALL$ , Buy Call 330 $MU 20260116 330.0 CALL$ .

There's also a large bearish spread order: Buy Put 280 $MU 20260109 280.0 PUT$ , Sell Put 270 $MU 20260109 270.0 PUT$ .

My sense is similar to the recent trend in silver—lots of FOMO money. More conviction-based bulls might consider Sell Put 300.

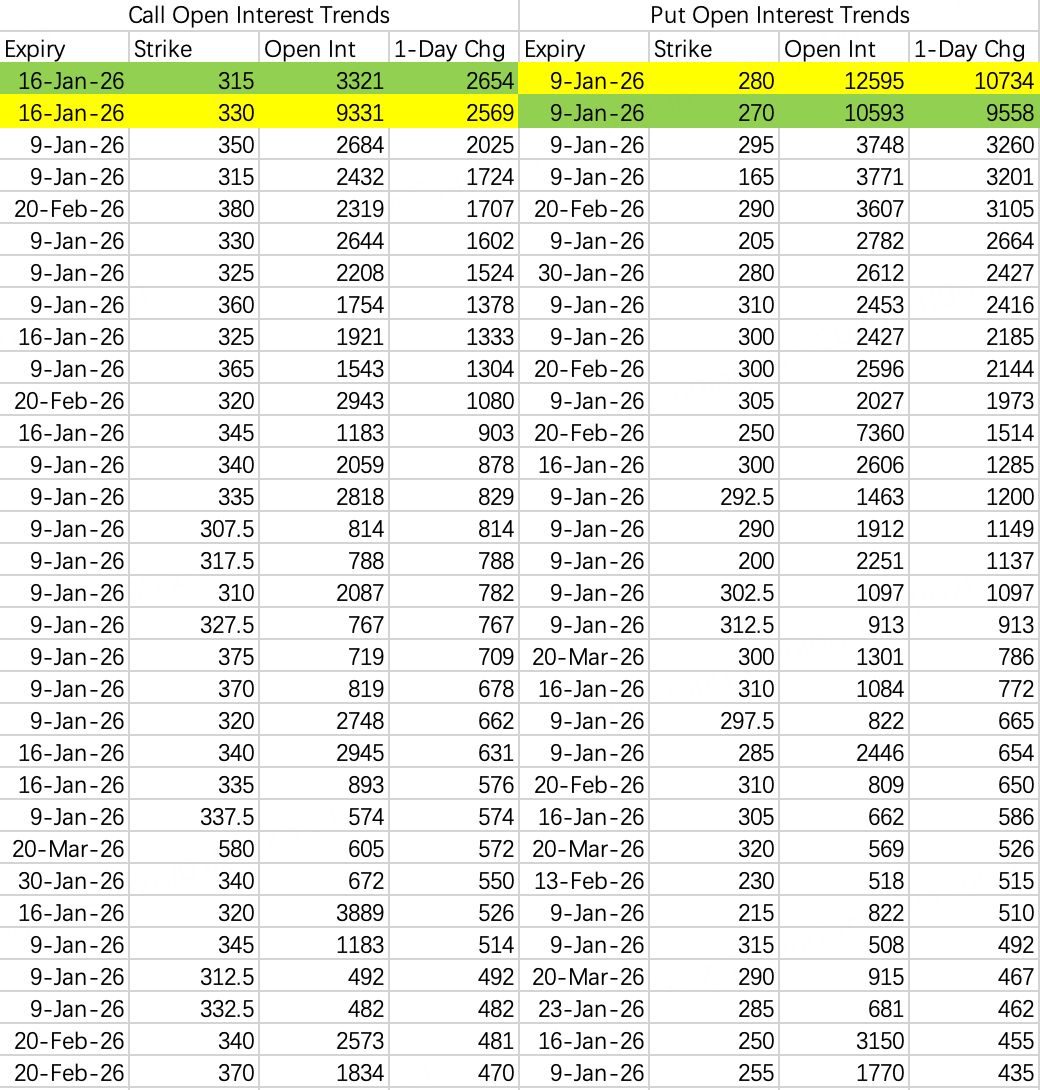

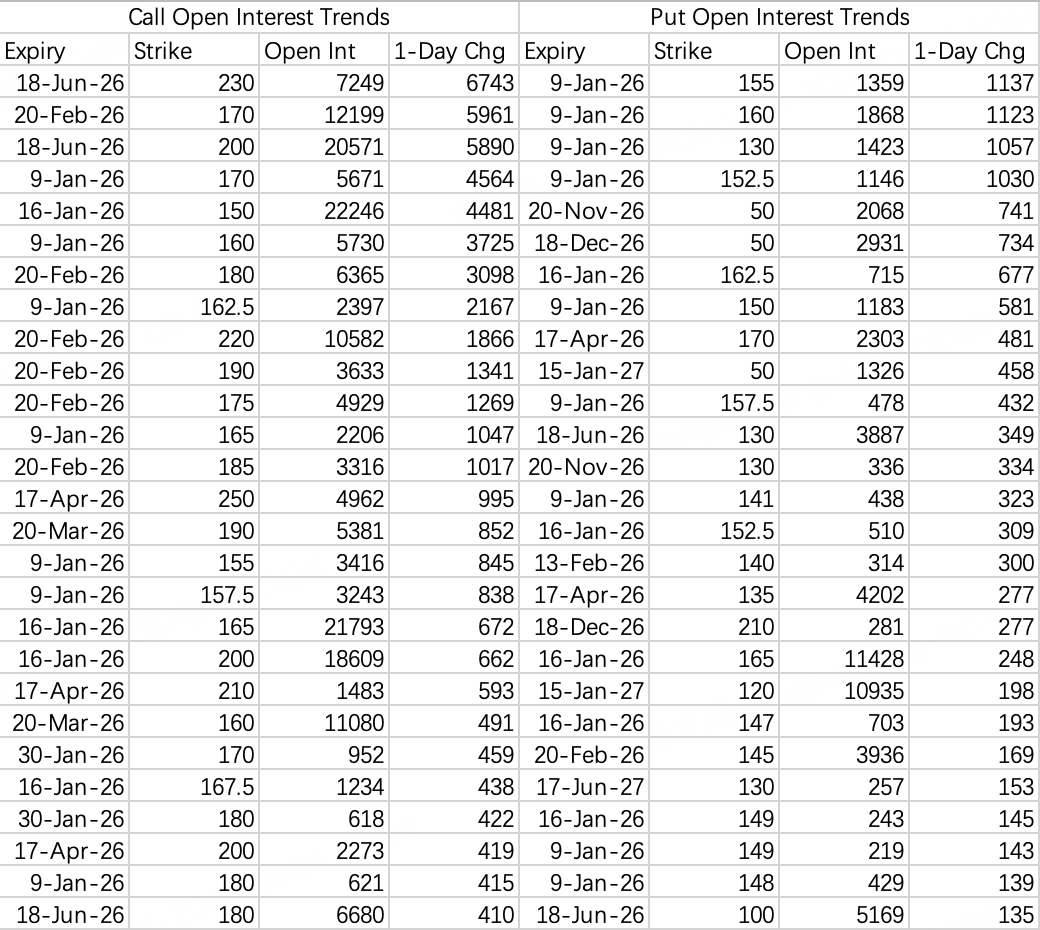

$ORCL$

After writing the WBD arbitrage strategy, I re-evaluated the Ellison family and, consequently, Oracle's political standing.

Despite Wall Street's skepticism and comprehensive risk warnings, this is a de facto "presidential concept stock," given its involvement in the TikTok carve-up. The perceived risks seem exaggerated.

The current price is suitable for selling puts. Based on recent option activity, the expected range for the next two weeks is 180–200. Consider Sell Put 180 $ORCL 20260109 180.0 PUT$ , or 190 is also viable.

$INTC$

I call Intel an ATM, but not my personal one—I don't have that skill. We all know whose it is.

The recent move has a clear target of 45. Friday saw large call openings at 45 and 50 $INTC 20260320 45.0 CALL$ $INTC 20260320 50.0 CALL$ . I think reaching 50 is less likely; 45 is probably the ceiling.

$BABA$

Given the KWEB trend, Alibaba is suitable for Sell Put 145 $BABA 20260109 145.0 PUT$ .

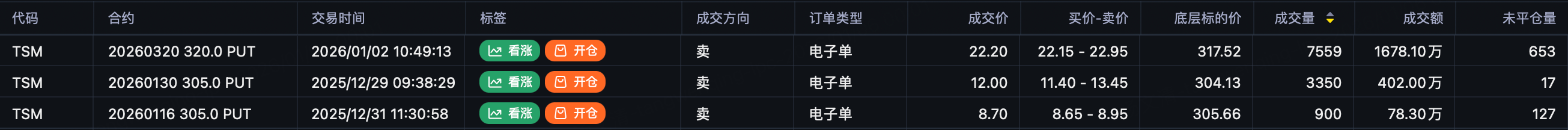

$TSM$

Large order: Sell Put 320 $TSM 20260320 320.0 PUT$ . This conveys the same message as the Google trade at the beginning of the article. Despite analysts' hype, institutions prefer selling puts to navigate Q1, opting for selling in-the-money puts rather than more aggressive call buying.

Comments