$TSLA$

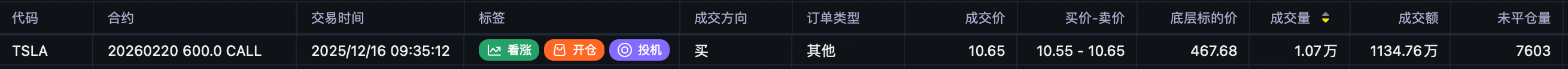

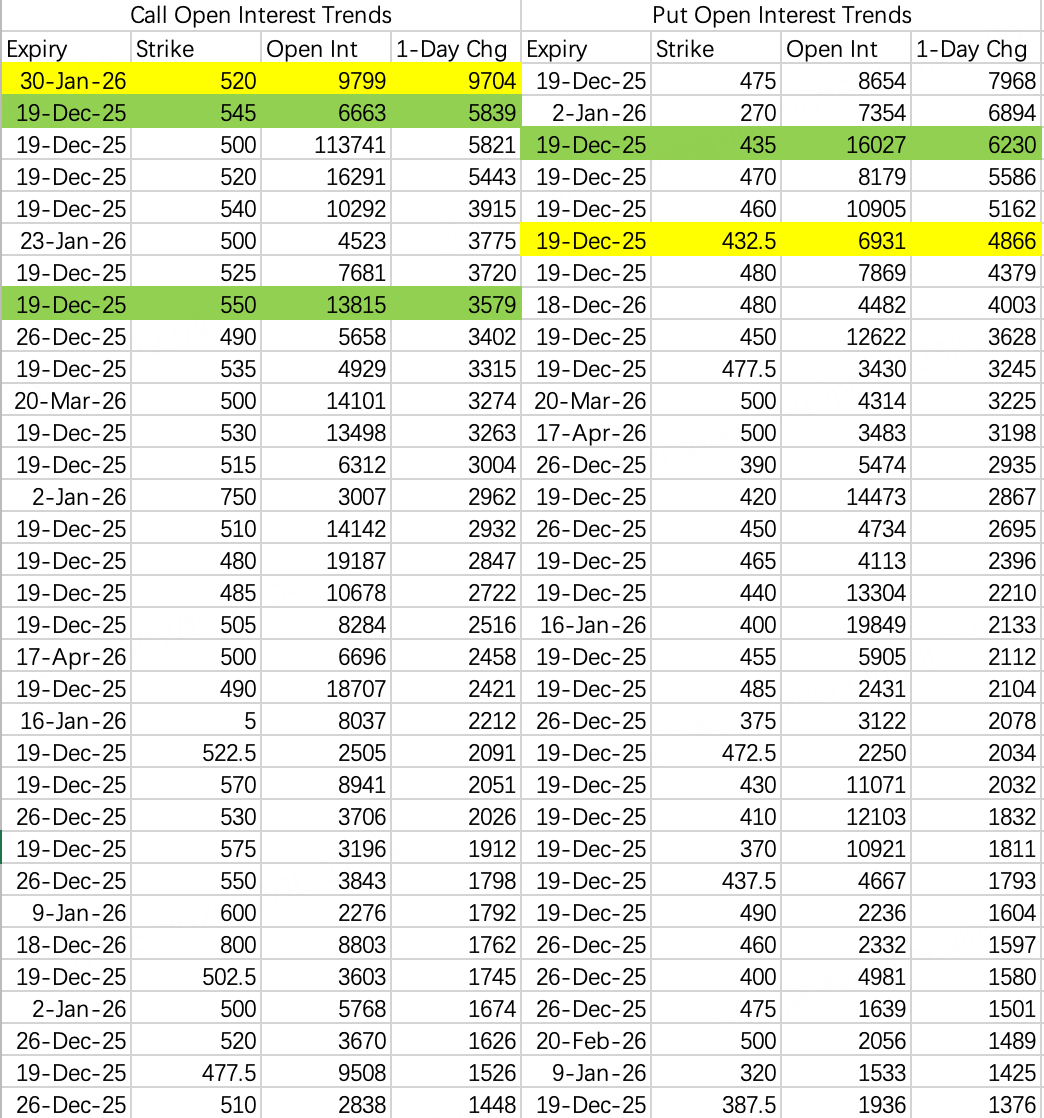

This week's 500 call has an open interest of 110k contracts, meaning Tesla will likely struggle to break above $500 this week. While this initially seemed ideal for selling calls, a massive block trade caught my eye: $TSLA 20260220 600.0 CALL$ – 10,000 contracts of the Feb 600 call traded, with a total premium of ~$11.34 million.

While the exact catalyst is unknown, looking at Tesla's call flow, the mid-term 520 call $TSLA 20260130 520.0 CALL$ saw 9,704 contracts opened, mostly on the buy side.

While $600 is uncertain, there's a strong probability Tesla reaches $500 by Christmas. For a conservative approach, consider selling the put: $TSLA 20251219 450.0 PUT$ .

$NVDA$

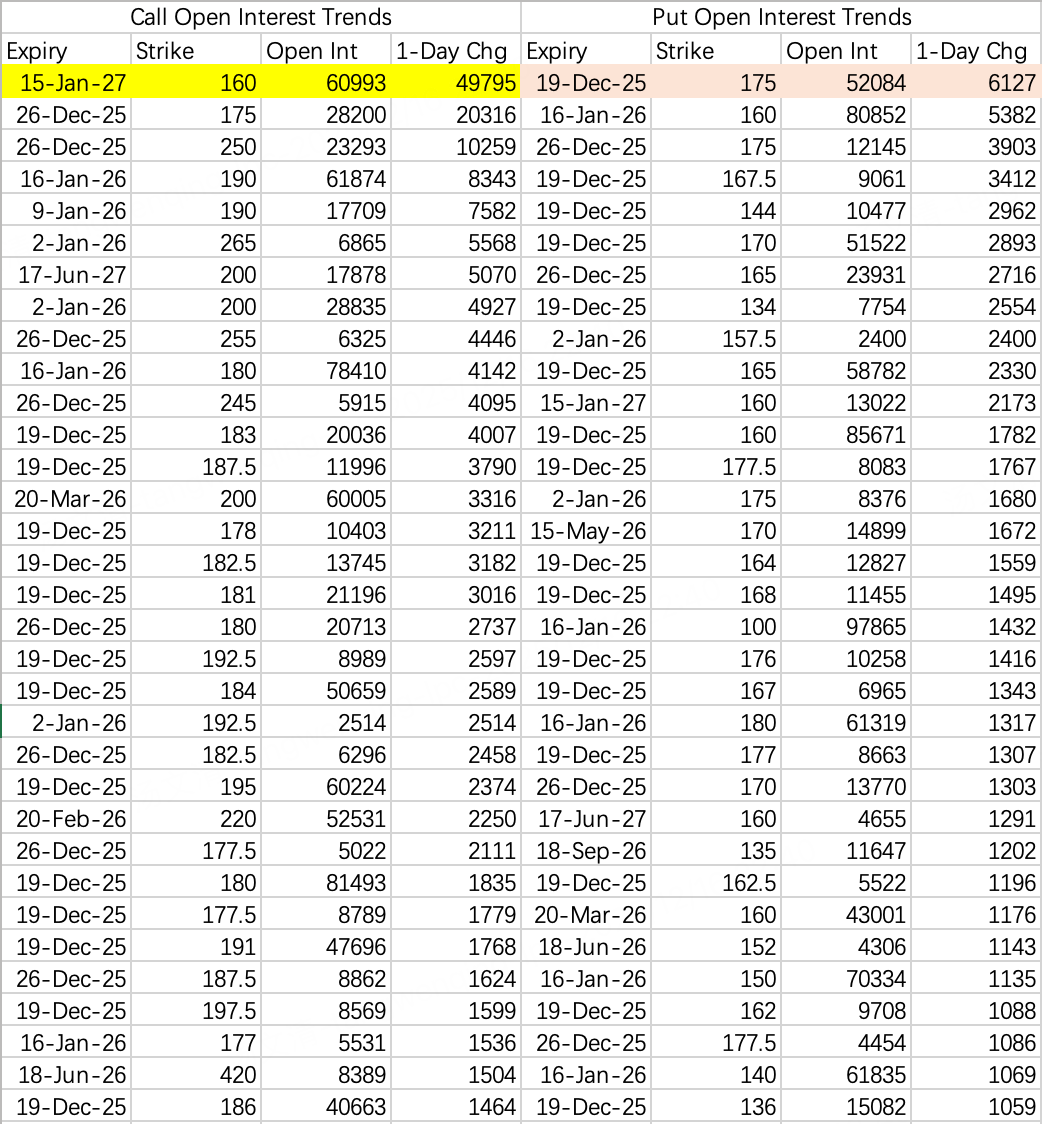

NVDA is likely to close above $175 this week.

Additionally, a large block bought long-dated 160 calls: $NVDA 20270115 160.0 CALL$ – 49,700 contracts opened, with a total premium of ~$225 million. Buying far-dated, in-the-money calls is a relatively conservative bullish strategy, different from buying near-term ITM calls, and falls into the "positive signal" category.

Consider following with a sell put strategy: $NVDA 20251219 170.0 PUT$ .

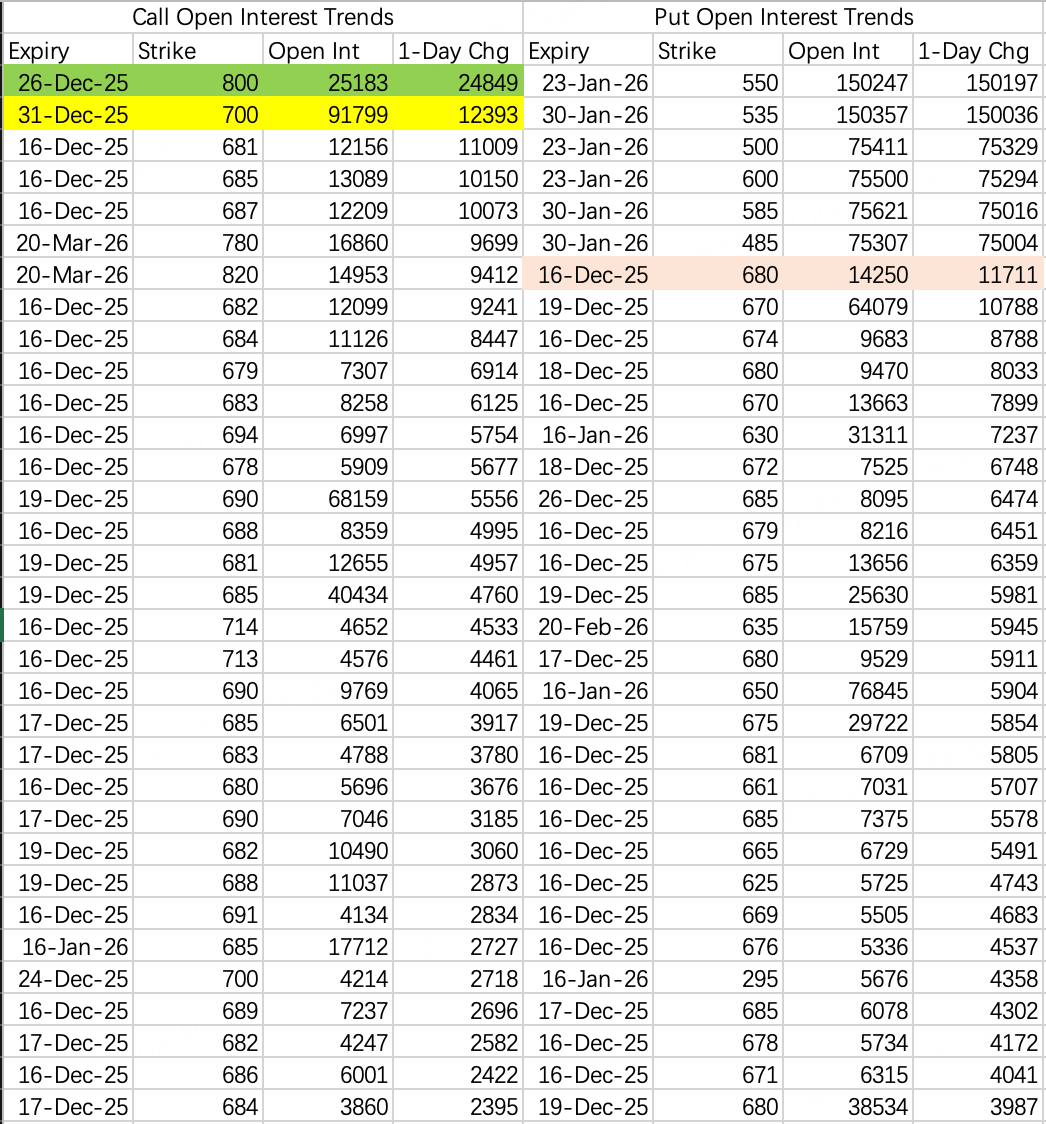

$SPY$

A large block bought calls betting on SPY reaching 700 by year-end. Expect continued churning between 670–690 this week, but anticipate sharp volatility after the New Year as the market preemptively hedges.

Comments