Previews on BOJ Meeting

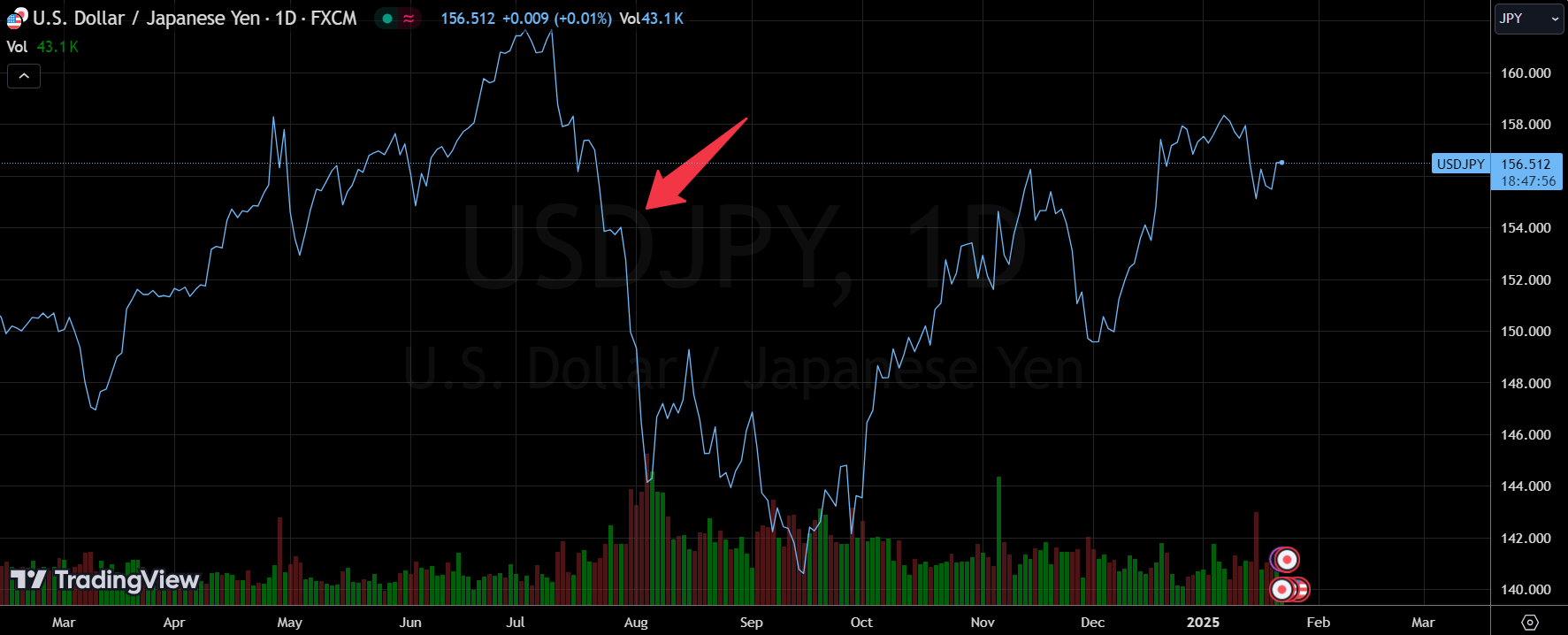

After the July 24 rate hike, the yen appreciated to around 140, when a large number of yen hedging trades were closed out, and the entire Japanese stock $iShares JPX-Nikkei 400 ETF(JPXN)$ and U.S. stock $SPDR S&P 500 ETF Trust(SPY)$ marketshave all seen a significant wave of pullbacks.

Just past the December meeting, the Bank of Japan kept its policy rate unchanged at 0.25% at its December meeting (with one dissenting vote), with hawkish member Naoki Tamura stating that upside risks to inflation were increasing and proposing a rate hike to 0.50%.

In the post-meeting press conference, Governor Ueda's statement was borderline dovish, which also caused the yen exchange rate to retreat further. $iShares MSCI Japan ETF(EWJ)$ $Japanese Yen - main 2503(JPYmain)$

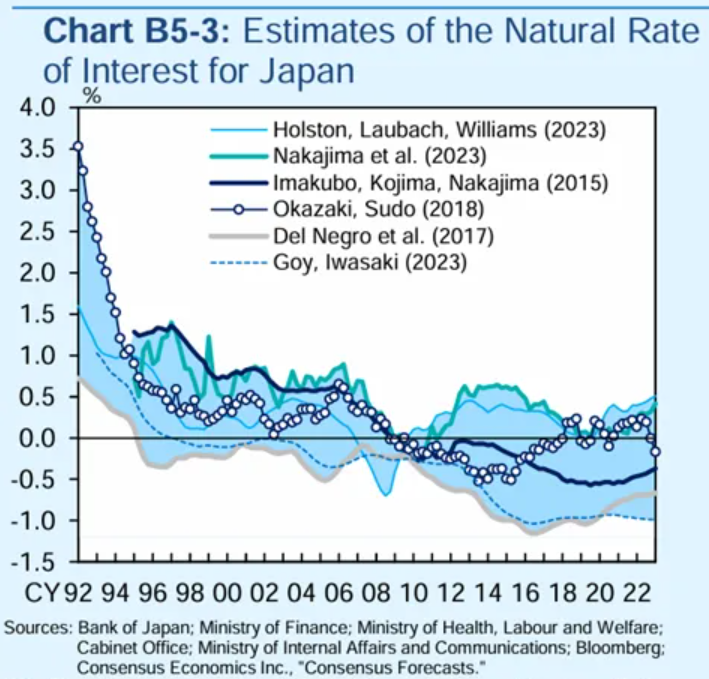

The market expects a rate hike of 25bps for the January '25 meeting or 25bps, but does not rule out the possibility of delaying the hike to the March meeting, meanwhile, regarding the terminal interest rate, the BOJ may raise its policy rate to near 1.0% from late 2025 to the first half of 2026.

January Meeting Outlook

The Bank of Japan is scheduled to hold a monetary policy meeting on January 23-24, 2025, with key points of interest:

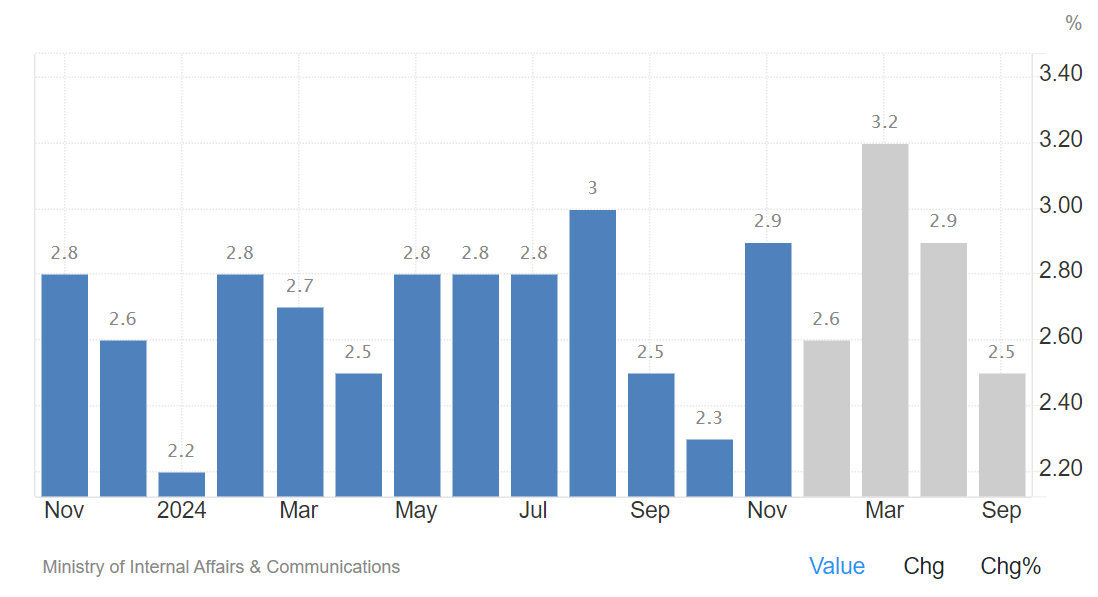

First, 25 bps rate hike expected.According to people familiar with the matter, the Bank of Japan will raise its key short-term interest rate to 0.50% from 0.25% this time, the first hike since July last year and the highest level of interest rates in 17 years (since 2008), reflecting Japan's growing inflationary pressures.

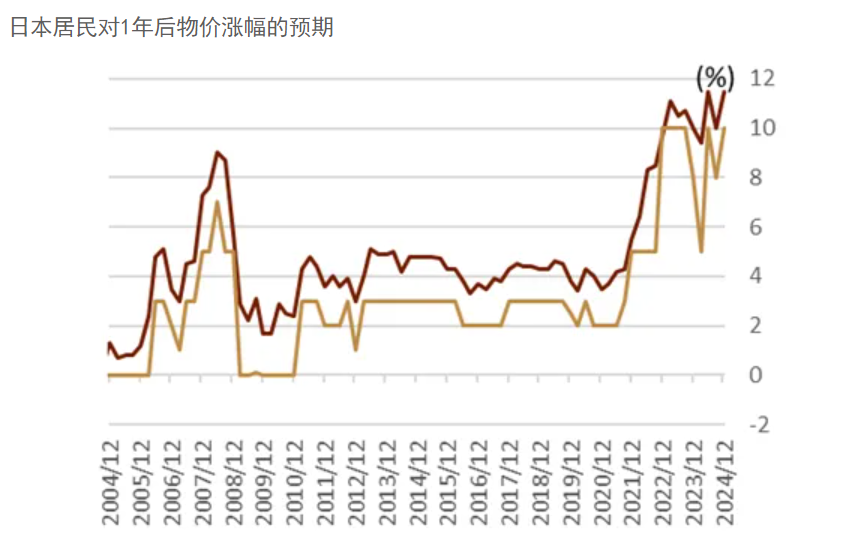

Second, market sentiment.Market expectations for this rate hike are growing, which is necessary given that persistent inflation since mid-2022 has exceeded the Bank of Japan's 2% target.The expected rate hike is in line with Bank of Japan guidelines, which indicate that rates will continue to rise as economic conditions change.

At the same time, Trump's inaugural speech including his tariff program was within the expectations of many market participants, paving the way for the BoJ to raise rates to their highest level in about 17 years.

Third, the economic backdrop inflation and wage growth: the decision to raise rates was influenced by ongoing inflationary pressures and expectations of wage growth during the upcoming spring wage negotiations ("Shundo").Analysts believe that sustained wage growth is critical to further tightening of monetary policy.

Fourth, global economic considerations.The Bank of Japan's decision-making will also be affected by external factors, especially during the Trump presidency, where increased policy uncertainty may affect the Japanese and global economy and financial markets.After past communication failures, the Bank of Japan is likely to take a cautious approach in its announcements to avoid unnecessary market volatility.A surprise decision to leave rates unchanged could lead to an initial sell-off in the Yen, although a stronger tone may help mitigate this risk.

Market Feedback Expectations

Regarding market volatility, will there be a repeat of the market volatility of the July '24 rate hike?For now, there are at least 3 differences:

Market expectations are sufficient.OIS market data shows that the probability of a rate hike at the January BOJ meeting is already very high at 90%.Not only that, the market has Price-in and prepared accordingly;

The net short position on Yen carry trade is limited: the yen is often used as a financing currency in arbitrage trading, and its volatility can have an impact on global markets. the yen's net short was over-accumulated in July '24, but the net short in the yen in January '25, and now it's not particularly extreme, at about half of what it was at that time, and the likelihood of a significant reversal is relatively small.

The US economy is stronger: in July-August '24, the market was anticipating a recession in the US and so there was a sell-off.However there is now a clear shift in the market's view of the US economy and attitudes have become more optimistic. $.SPX(.SPX)$ $.IXIC(.IXIC)$ $.DJI(.DJI)$

What happens if there is no rate hike?

The Bank of Japan has always been more cautious, if the January "accident" does not raise interest rates, it is also likely to take the market to stabilize the "wording", to take some of the hawkish remarks to calm the market.

Reduce the impact of exchange rate depreciation, although the data released on January 23, exports are still the main growth force, but the Bank of Japan does not want the yen exchange rate depreciation;

Keep an eye on inflation data, especially the need to observe the results after the "spring fight", and increase the implication of a rate hike in March.

Comments