Palantir Just Posted a Monster Quarter… and the Market Shrugged

One of the most controversial names in the entire U.S. equity market—and a true outlier in the global data analytics and AI applications space $Palantir Technologies Inc.(PLTR)$ reported its Q4 2025 earnings after market close on February 2.

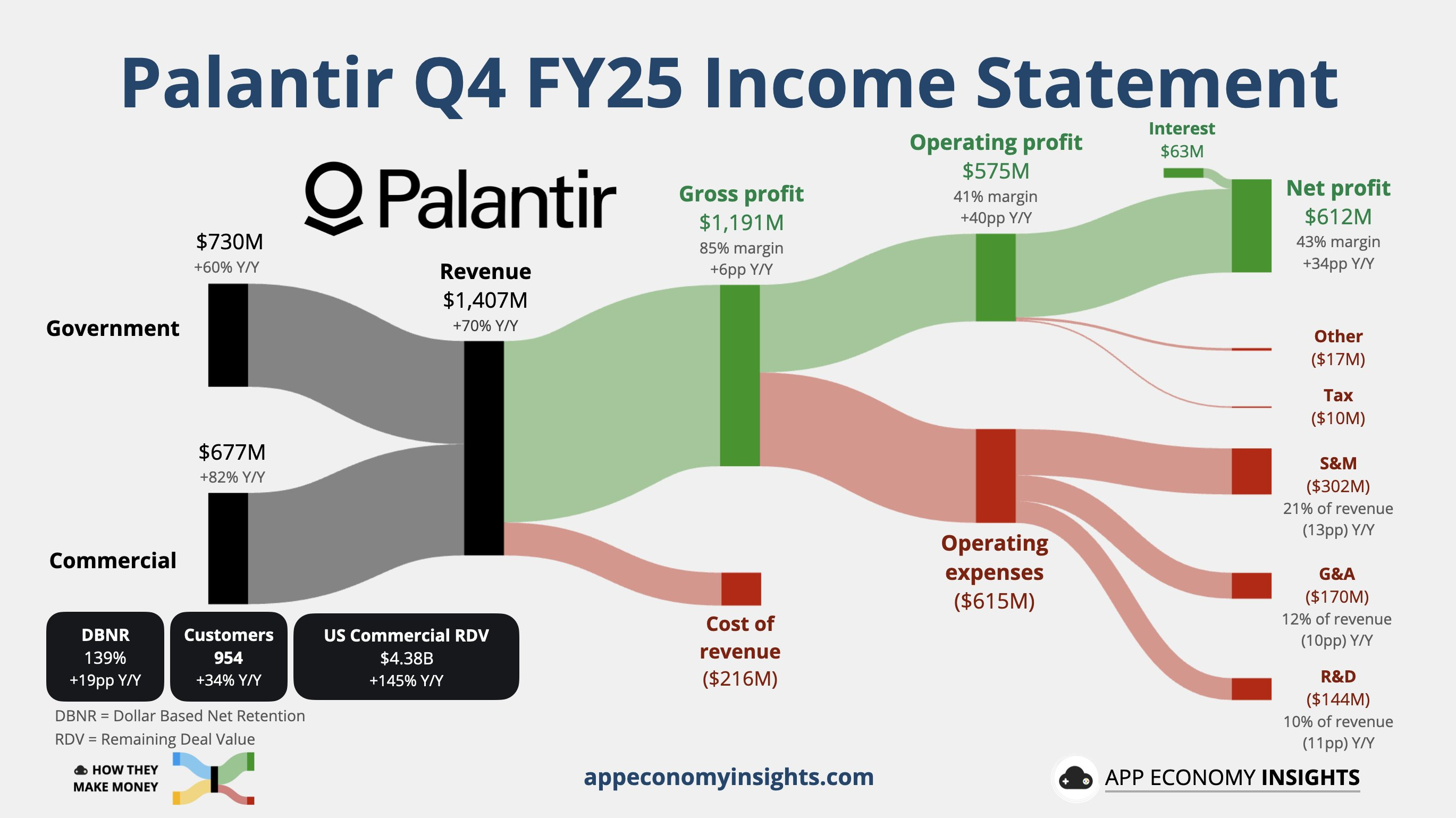

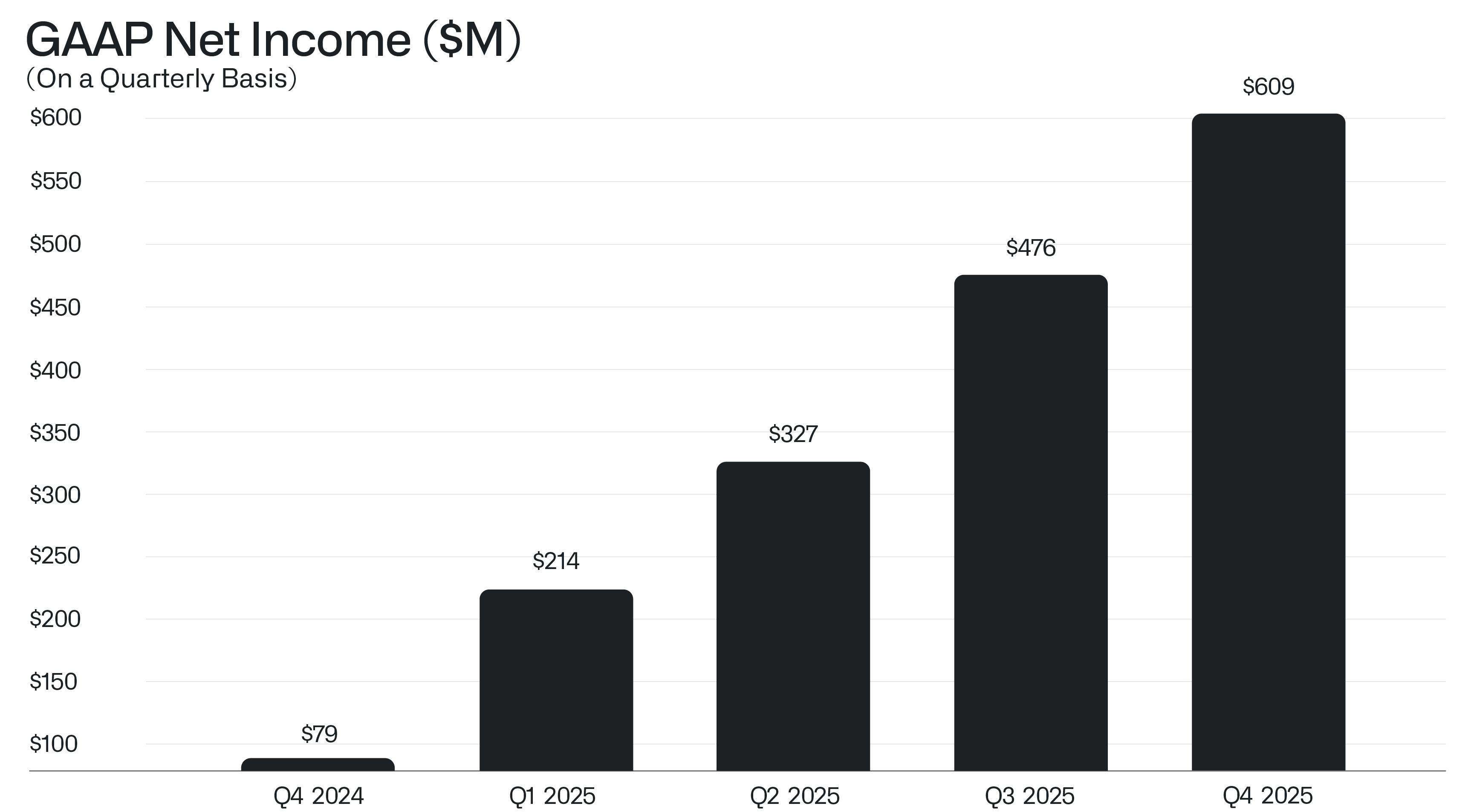

Overall, this was a report with very few real flaws to pick apart. Revenue, profitability, leading indicators, and forward guidance all came in above expectations. More importantly, growth re-accelerated in Q4, directly easing the market’s core concern that Palantir’s premium valuation depends on high growth that might be peaking.

What’s intriguing, however, is the market’s reaction. The stock rose less than 8% post-earnings, noticeably below the 10%+ moves investors had grown accustomed to in recent quarters. So where exactly were the highlights in this “near-perfect” quarter—and what is the market still hesitating about?

The U.S. remains the growth engine — not peaking, but accelerating

Total U.S. revenue surged 93% year over year in Q4, accelerating further despite an already elevated base. This was the most convincing data point in the entire report and a direct rebuttal to the narrative that U.S. demand was topping out.

Government demand: no off-season, moat still intact

Palantir’s U.S. government business has long been viewed as its most defensible core. In Q4, government revenue grew 60% year over year, driven primarily by revenue recognition from previously signed contracts.

A key highlight was the $448 million U.S. Navy contract announced on December 10, under which Palantir is co-developing ShipOS, extending Foundry and AIP into overseas military operations.

Seasonally, the beginning of a fiscal year is typically a slow period for government procurement, with approvals moving more slowly. Yet Palantir still delivered strong growth, reinforcing the view that recent reforms in U.S. government procurement are actually benefiting deeply embedded vendors like Palantir.

In addition, Palantir has increasingly partnered with industrial, defense, and construction companies already involved in government projects, forming a “joint delivery” ecosystem. This has quietly but meaningfully widened the company’s effective moat in government budgets.

Commercial acceleration powered by consulting partners

If government business defines Palantir’s downside protection, U.S. commercial customers define its valuation ceiling.

In Q4, U.S. commercial revenue surged 137% year over year, continuing to accelerate after multiple quarters of hypergrowth—performance that looks distinctly counter-cyclical relative to traditional SaaS dynamics.

The drivers are straightforward. On one hand, Palantir continues to partner with top-tier consulting firms such as KPMG and Accenture, embedding its software modularly into broader enterprise solutions and rapidly accessing their existing client bases. On the other hand, the rollout of AIP has dramatically shortened time-to-value, lowering decision friction for enterprise customers.

International markets: government props up volume, geopolitics matter

Palantir’s global expansion can best be described as “selectively successful.” In Q4, international revenue was driven mainly by government customers in regions such as the UK and the UAE, while enterprise demand remained steady but slow.

This structural issue is not new. It reflects a combination of local protectionism, Palantir’s deep ties to the U.S. Department of Defense, the highly customized nature of its products, and the additional costs and sensitivities created by the evolving relationship between Trump and U.S. allies.

Management’s commentary on the earnings call made it clear that expectations for international acceleration remain cautious, with strategic priority still firmly placed on high-quality U.S. demand.

Leading indicators nearly flawless: fewer deals, but much bigger ones

(1) TCV, RPO, and customer metrics signal rising long-term visibility

Total Contract Value (TCV) reached a record $4.26 billion in Q4, up 137% year over year. Within that, U.S. commercial TCV grew 67.4% YoY, though sequential growth slowed slightly—suggesting that near-term deal flow leaned more heavily toward government contracts.

Remaining Performance Obligations (RPO), representing non-cancellable contracted revenue, surged 144% year over year, indicating that customers are increasingly locking in longer-term, higher-value commitments. Structurally, much of this growth likely came from U.S. domestic and closely aligned government customers.

Customer count increased by 43 net additions in Q4: five from government agencies (on a departmental basis) and 38 from enterprises, almost all in the U.S. While sequential customer growth slowed, revenue and TCV accelerated simultaneously—implying continued increases in revenue per customer.

For a software company that has not explicitly raised prices, rising ARPU typically reflects stronger product stickiness and deeper expansion within existing accounts.

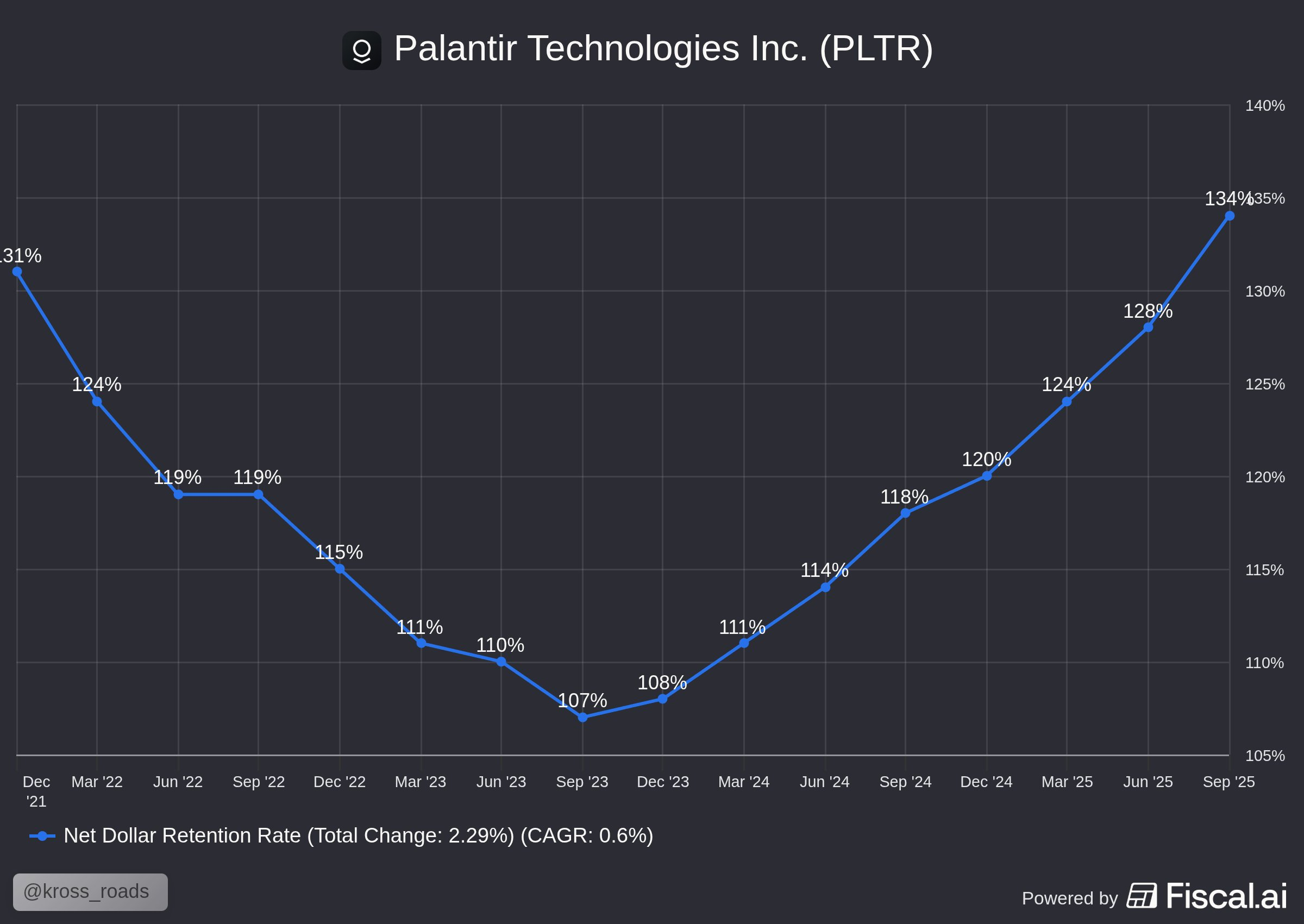

(2) Billings and NDR: existing customers keep spending more

Q4 billings grew 91% year over year, with contract liabilities increasing by roughly $80 million sequentially.

Net Dollar Retention (NDR) rose to 139% and continued to trend upward quarter over quarter, reinforcing the view that customer expansion—not just new logos—is becoming the dominant growth driver.

Guidance: the key question is still how conservative it is

At this point, beating expectations is no longer what investors focus on. The real question is how conservative the new guidance truly is.

Palantir guided Q1 2026 revenue growth of 73% year over year, accelerating further from Q4, with adjusted operating margins holding at 57%.

For the full year 2026, revenue guidance midpoint stands at approximately $7.19 billion, implying 61% YoY growth, with operating margins around 57.5%.

Given Palantir’s history of conservative guidance and its typical 10–20% upside beat, there remains room for upward revisions over the next two to three quarters.

Investment takeaway

Palantir in Q4 2025 is clearly in a phase of monetization acceleration, characterized by steady new customer additions and rapid expansion among existing clients. Current results, forward indicators, and guidance all extend the strong momentum seen over the prior two quarters.

From a marginal perspective, this report arguably deserved a more enthusiastic market response. The roughly 8% post-earnings move instead reflects several factors:

-

Ongoing skepticism around whether AI-native applications could eventually disrupt traditional enterprise software;

-

Investor nitpicking around sequential deceleration in TCV and net customer adds;

-

And the natural fading of incremental buying after Palantir’s inclusion in the S&P 500.

From a valuation standpoint, using 2026 guided operating income of roughly $4.1 billion, and assuming a 10–20% upside beat (i.e., $4.5–4.9 billion in EBIT), Palantir is trading at an implied 76–91x EV/EBIT—well above peers.

In other words, Palantir remains a high-conviction, high-expectation stock, one that requires this level of growth to persist for another two to three years. That is very much a belief-driven trade.

The muted 8% reaction post-earnings reflects both diminishing surprise sensitivity after repeated beats, and a more cautious broader market backdrop.

Still, based on this report alone, Palantir is nowhere near being “disproven.”

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.