DB Issues Space Data Center Outlook: How to Trade RKLB, PL, and LUNR After the Rally

$Deutsche Bank AG(DB)$ 's mid-January report suggests that space data center costs will converge with ground-based costs by the early 2030s. The core logic is as follows:

Cost Convergence Pathway:

Current: A 1GW space data center costs 6.7-7.2x more than ground-based ($114bn vs $16bn)

2028: Gap narrows to 4.3x

2032: Drops to 1.2x, essentially reaching parity

Core Drivers: Launch costs plummet from $1,600/kg to below $70/kg, single-satellite power increases to 150kW, and custom AI chips reduce energy consumption

Key Assumptions:

SpaceX Starship achieves full reusability

Satellite iteration reaches V5 version, with unit power cost dropping from $42k/kW to $14.5k/kW

No disruptive cheap energy emerges on Earth (e.g., fusion breakthrough)

$Rocket Lab USA, Inc.(RKLB)$ , $Planet Labs Pbc(PL)$ , $Intuitive Machines(LUNR)$

(Aiming to improve options trading skills lately, practicing technical analysis and paper trading—let's see how it goes.)

1. $Rocket Lab USA, Inc.(RKLB)$ surged +6.10% last Friday: Challenging the $100 mark?

Thesis: The only company with full-stack capabilities in "rocket launch + satellite manufacturing + laser terminals"

Advantages: Neutron rocket handles launch orders, can self-produce satellite platforms, high-efficiency solar cells, and laser terminals

Analyst Price Target: Morgan Stanley analyst raised target price by 56.72% to $105 with "Buy" rating, greatly boosting market confidence

Near-term Price Analysis: Expected to oscillate in $92.4-$99.6 range

If breaks above $99.58 with volume, next target $105-$110

If falls below $92.4, may retest support at $88-$85. Watch for technical correction after RSI overbought

Suitable Options Strategy?

Esther's Thoughts: Given short-term consolidation, high IV, and medium-to-long-term bullish view, strategy design must balance directional exposure (Delta), capture time decay (Theta), and carefully manage volatility risk (Vega). Prioritize volatility selling or protected spread strategies.

In the short term (through Jan 30 expiry), if stock consolidates or pulls back below the strong $100 resistance, unable to break through effectively. Exploit extremely high IV by selling near-term OTM calls.

Strategy 1: Ratio Call Spread (selling strikes 100/105)

Sell 2 RKLB Jan 30 2026 $100 Calls

Buy 1 RKLB Jan 30 2026 $105 Call

2. $Planet Labs Pbc(PL)$ rose 1.77% after hitting all-time highs, targeting $35?

Thesis: Collaborating with Google to develop prototype satellites, testing TPU cooling and formation flying in 2027

Advantages: Has manufactured and operated 600+ satellites, possesses large-scale low-cost production capability

Analyst Price Target: Among 11 institutions covering the stock on Tiger Brokers, 2 rate "Strong Buy," 6 "Buy," and 3 "Hold"—consensus is clearly positive. Average target is $24.53, with high forecast at $35.0. Current price has surpassed average target, indicating extremely bullish sentiment

Near-term Technical Analysis: After reaching new highs, with RSI severely overbought in the short term, expects high-level consolidation in $28.4-$31.0 range to digest profit-taking. If successfully holds above $30.9, next target $33.0-$35.0; if breaks below $28.4 support, may retest $27.0

PL Suitable Options Strategy:

Based on strong fundamental momentum (massive contracts, sector euphoria). Short-term high-level consolidation digesting gains, but medium-term trend remains strong.

Implied Volatility (IV) at 90.21%, at mid-historical level (43rd percentile), but IV/HV ratio of 1.46 indicates options market implies significantly higher volatility than historical realized volatility, creating favorable conditions for volatility selling strategies.

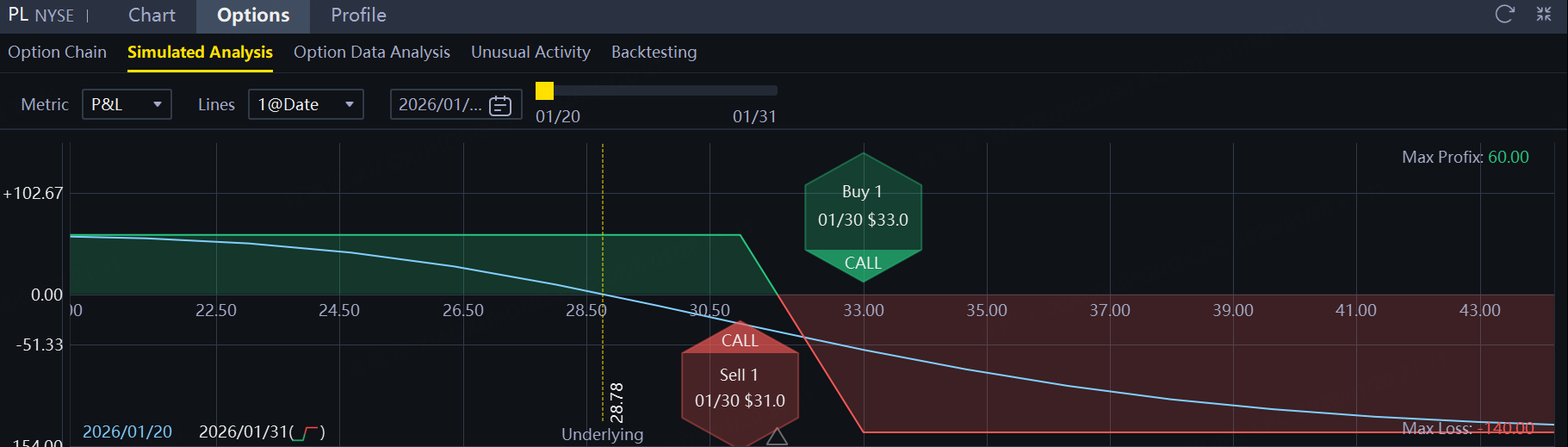

Esther's Strategy 1: Bear Call Spread

Buy 1 PL Jan 30 2026 $33.0 Call

Sell 1 PL Jan 30 2026 $31.0 Call

Profit $60 premium as long as PL stays below $31; if rises above $31, get assigned 100 shares.

Esther's Strategy 2: Ratio Put Spread (Cautiously Bullish)

Buy 1 PL Feb 20 2026 $30.0 Put

Sell 2 PL Feb 20 2026 $25.0 Puts

3. $Intuitive Machines(LUNR)$ soared +10.67% last Friday, breaking consolidation, targeting $22.5 resistance 🔥

Thesis: Planning to acquire Lanteris to gain high-power thermal management satellite platform

Advantages: 1300 GEO series satellites can generate 20kW+ power with advanced thermal management systems

Analyst Price Target: Among 10 institutions covering the stock on Tiger Brokers, 8 rate "Buy," 1 "Hold," and 1 "Underperform"—bullish sentiment dominates. Average target $18.4, high forecast $25.0

Active Trading: Volume surge with ratio at 1.38, far exceeding recent average, confirming breakout validity. Turnover rate hit 10.97%, indicating active position rotation and clear new money inflow

Near-term Price Analysis: Price broke above previous resistance at $21.58 with strong volume, showing strong short-term momentum.

Next week likely to consolidate in $21.5-$23.5 range

If holds above $22.4 (today's high), could challenge previous high at $24.95

If falls below $19.5, may retest support near $18.0

Suitable Options Strategy?

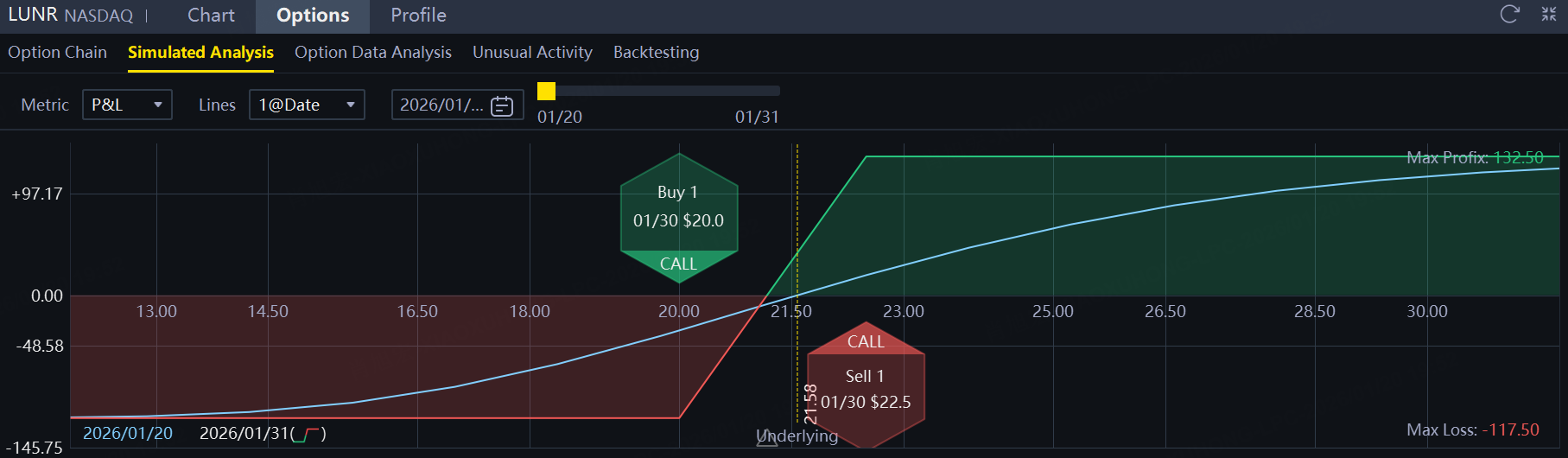

Esther's Strategy 1: Bull Call Spread (Profitable as long as $Intuitive Machines(LUNR)$ stays in $20-22.5 range)

View: Cautiously optimistic, expecting price to stabilize above key support $19.5 after short-term overbought pullback and challenge $22.5 resistance, though momentum to break above $24.95 high is questionable.

Buy 1 LUNR Jan 30 2026 $20.0 Call (Delta: 0.681, Last: $2.67)

Sell 1 LUNR Jan 30 2026 $22.5 Call (Delta: 0.469, Last: $1.49)

Esther's Strategy 2: Bear Put Spread (Earn premium as long as LUNR doesn't break below $19)

Buy 1 LUNR Jan 30 2026 $22.5 Put

Sell 1 LUNR Jan 30 2026 $19 Put

Disclaimer:This content is for informational communication only, all investments carry risk of loss, including principal. Options trading involves substantial risk and is not suitable for all investors. Past performance does not guarantee future results.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.