History Repeats? What Do Consecutive Margin Hikes in Silver Really Mean

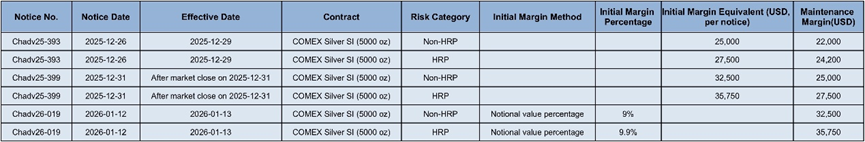

Over the past week, CME has raised margin requirements on precious metals contracts three times in a row, reigniting discussions across the market. Many traders are once again asking whether the exchange is adjusting risk parameters in response to market conditions.

This kind of debate is nothing new. Similar arguments have surfaced repeatedly in past episodes whenever sharp moves in silver prices were followed by rapid margin increases.

Looking back at the silver market in 2011, the pace of margin requirement adjustments and the price action that followed may offer a more sober reference point for today’s market.

Between April and May 2011, silver prices surged rapidly, reaching an all-time high of nearly USD 50 per ounce in late April to early May. The rally was soon followed by a sharp collapse, driven by overheated speculative sentiment and a series of regulatory actions by the exchange.

During the price run-up, volatility spiked significantly, creating an environment in which risk-oriented speculators sought to profit from short-term price swings and widening spreads:

So what else happened in 2011? — Five margin hikes within two weeks

Between April and May 2011, COMEX silver futures experienced an episode of extreme market conditions.

Prices surged rapidly in late April, reaching a peak close to USD 50 per ounce, before suffering a sharp decline in early May.

During this period, CME raised margin requirements on silver futures five times within roughly a two-week window.

These adjustments were not implemented in a single step, but rather introduced in staggered phases, with closely spaced effective dates and a stepwise escalation in margin requirements.

From a market structure and risk-management perspective, these margin changes were not designed to target price direction. Instead, they represented automatic or semi-automatic risk-control responses driven by rising volatility, expanding position size/open interest, and elevated clearing risk.

When price dynamics and margin requirements are examined together, a key fact becomes apparent:

If spot silver prices (XAG) and cumulative margin increases are plotted on the same timeline, a particularly noteworthy pattern emerges:

During the first and second margin hikes:

Silver prices were still trading at elevated levels or had just formed a peak.

From the third to the fifth hike:

Prices were already falling sharply, yet margin requirements continued to rise.

In other words, the latter margin increases were not aimed at interfering with ongoing price movements, but occurred after prices had already entered a downtrend.

This suggests that the exchange’s actions were closer to passive risk management rather than an active judgment on price direction.

At the same time, the practical effect was to raise the cost of holding positions, forcing high-leverage, long-biased capital to reduce exposure. During periods of tight liquidity, this mechanism accelerated price volatility.

A Historical Lesson: Margins Are Not the “Cause,” but They Can Be an “Amplifier”

A review of the 2011 episode leads to a relatively neutral conclusion:

The rally did not originate from margin adjustments:

Silver’s advance was driven by macro liquidity conditions, inflation expectations, and concentrated speculative flows.Margin hikes were not the fundamental cause of the trend reversal:

However, in a high-leverage environment, they significantly amplified the speed and magnitude of the deleveraging process.The exchange’s objective is “default prevention,” not “price stabilization”

Once volatility and position risk approach critical levels, margin increases become almost inevitable.

Now: What Does Three Margin Hikes in One Week Signal?

With CME raising margin requirements three times within a single week, a reasonable institutional interpretation would be:

Market volatility and potential clearing risk are rising rapidly

Leverage concentration in certain contracts is approaching risk-control thresholds

The exchange is proactively stress-testing the system against extreme scenarios

This does not automatically imply that “prices have topped” or that “the rally is over.”

A more appropriate interpretation is that the leverage environment is being actively tightened, making future price movements far more sensitive to capital flows.

What the 2011 silver episode ultimately teaches the market is this:

when exchanges begin to raise margins frequently and within a short time frame, the key question shifts from “Did I get the direction right?” to “Can I survive the volatility?”

So, bringing this back to the reality:

Is your position dependent on high leverage?

And has the market shifted from being trend-driven to liquidity-driven?

$iShares Silver Trust(SLV)$ $Sprott Silver Miners & Physical Silver ETF(SLVR)$ $ProShares Ultra Silver(AGQ)$ $Proshares Ultrashort Silver(ZSL)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jinglese·01-14I've cut leverage since last hike; market's liquidity-driven now lah. [看跌]LikeReport