Fed Meeting Approaching: Watch for Opportunities from a Bottoming Gold–Silver Ratio

Next week marks the start of December, and in overseas markets December is usually a fairly quiet month. When there has already been sufficient volatility in the first eleven months, as long as there is no sudden news in December, institutional traders and fund managers generally trade cautiously in order to avoid overtrading and hurting their year-end performance. This year, volatility has already been large due to global trade and tariff headlines, and with the market also expecting a Fed rate cut in December, price swings in December may be smaller than in November. U.S. equity indices might even enter the Christmas season early, meaning light trading and a lukewarm, directionless market.

Over the weekend, an unverified rumor suddenly spread that Fed Chair Jerome Powell would announce his resignation on December 1, U.S. Eastern Time. Since this rumor cannot be confirmed, traders might as well watch the market a bit longer on Monday before making decisions. A surprise resignation by the Fed Chair would be highly unusual, and at this point it is impossible to build a reliable scenario analysis around it, so standing aside for a couple of days is a reasonable choice.

U.S. Equities in a Rate-Cut Environment

If the Fed Chair were to resign suddenly, the new chair would likely be someone who leans toward Donald Trump’s preference for rate cuts. That would raise market expectations that the pace of rate cuts could accelerate, which would naturally support equity indices. Overall, during a rate-cut cycle, this environment is generally favorable for U.S. stock indices to move higher.

From a technical perspective, it has already been emphasized during live sessions that the line connecting the lows of U.S. equity indices (S&P and Nasdaq) in October and November is an important support line. As long as this line is not decisively broken, positions can be held until the Christmas rally finishes; if it does break, hedging or cutting positions would then be necessary. For now, there is no need for extra action—just wait patiently for new developments to emerge.

Watch for Opportunities from the Gold–Silver Ratio

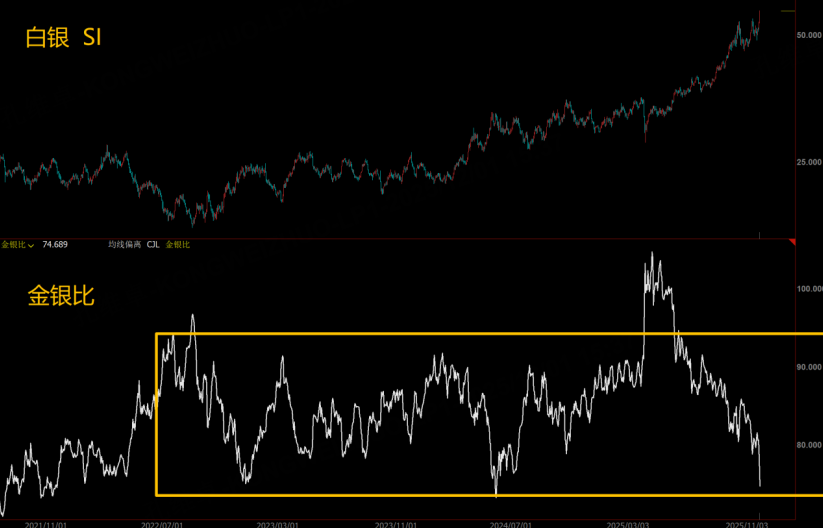

Last week silver continued to make new highs, mainly because its trading profile has shifted somewhat. Historically, silver’s industrial attribute has been much more important than its financial attribute.

However, with the market now expecting the U.S. to possibly impose tariffs on precious metals (an extension of the tariff expectations from copper to silver), silver has seen substantial premium opportunities. Well-capitalized traders have even begun buying large quantities of silver and shipping it to London or the U.S. for delivery to capture the price spread.

As a result, silver has gained an additional layer of financial attributes: purchases by traders are no longer for industrial production, but for cross-market arbitrage.

In principle, the larger the cross-market interest or price differential, the greater the demand for silver, which in turn creates a self-reinforcing dynamic. No one knows when this feedback loop will end, but during its development, shorting silver is dangerous, as a squeeze can easily lead to huge losses in trading accounts. The best strategy is to hold related assets whose price action is correlated but whose gains have not yet caught up, in order to capture the catch-up move.

The most closely related asset to silver is, of course, gold. The gold–silver ratio has now fallen back to the lower end of its range, which suggests that the ratio could sharply reverse and that gold may again start to outperform silver. Even if precious metal prices pull back, gold’s volatility is typically smaller than silver’s. In this environment, it may be better to hold gold and use the 20-week moving average (as stressed in the live sessions) as a trailing indicator, which is a more conservative and prudent approach

$NQ100指数主连 2512(NQmain)$ $SP500指数主连 2512(ESmain)$ $道琼斯指数主连 2512(YMmain)$ $黄金主连 2602(GCmain)$ $白银主连 2603(SImain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- quixy·2025-12-02Gold's stability over silver makes sense now. Using 20-week MA as a trailing stop is smart. [强]LikeReport