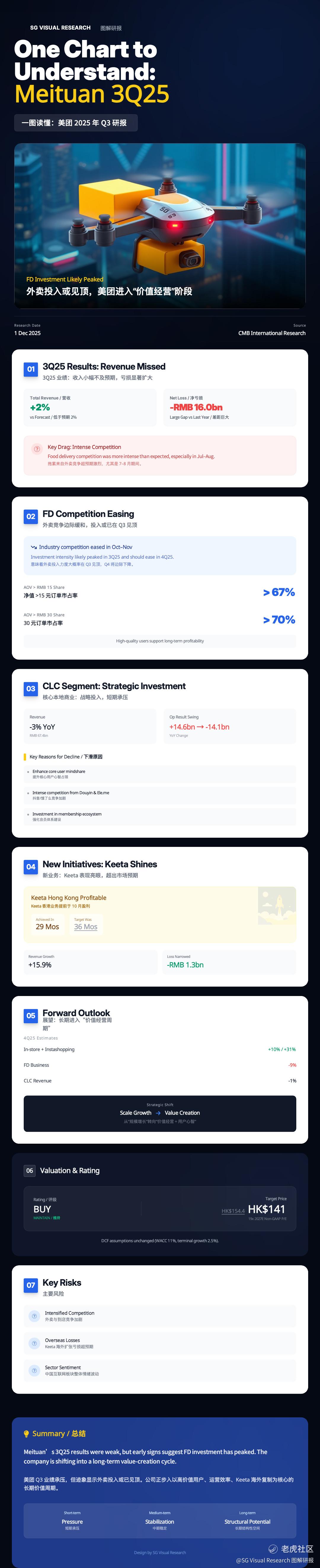

Meituan 3Q25: Massive Loss, FD Spending Peaked — Is a Turnaround Coming?

Meituan’s 3Q25 numbers were messy: revenue missed, and the adjusted loss ballooned to –RMB 16bn — one of the worst quarters since listing.

But here’s the twist:

Analysts believe food-delivery spending may have already peaked in 3Q25, with competition easing in Oct–Nov. If true, 4Q25 could be the start of margin stabilization.

Meanwhile, Keeta Hong Kong turned profitable in just 29 months, much faster than expected — and Meituan is preparing to replicate this model in GCC markets.

So the real question now:

Is Meituan finally shifting from “burning cash” to “creating value”?

Or is the competition (Douyin + Ele.me) still too strong for a real recovery?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.