Big-Tech Weekly | META at 21x P/E Again? Google's "E-Commerce Space"

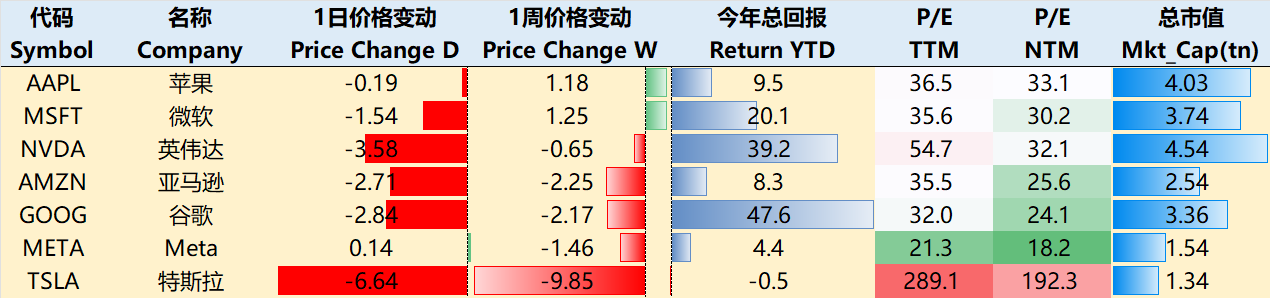

Big-Tech’s Performance

Macro Headlines This Week:

The dominant U.S. macro theme remains the ongoing government shutdown (now in its third week), with impacts broadening further: from disruptions to public services and data releases, to interference in financial regulation and administrative functions, creating systemic shocks to economic expectations. Layoff data has deteriorated sharply—October's job cuts reached 153,074, the highest for any month since 2003, underscoring corporate caution on future demand.

With data gaps widening, the Federal Reserve is adopting an even more cautious policy stance. Hawkish comments from officials have dampened rate-cut expectations, emphasizing that in an environment of incomplete data, policy must proceed "slower and more cautiously." Ahead of the December 9 meeting, a flurry of macro data releases will heighten uncertainty, prompting funds to exit in a "risk-off" manner.

Tech and AI sectors continue to exert primary downward pressure, driven by prior overextended gains prompting valuation resets; slower-than-expected AI-driven earnings realization; rising layoffs and cost pressures; and softening demand. This culminated in a sharp market sell-off on November 13.

Big Tech stocks exhibited continued divergence post-earnings this week. As of the November 13 close, the past week's performance: $Apple(AAPL)$ -0.6%, $Microsoft(MSFT)$ -5.45%, $NVIDIA(NVDA)$ -7.3%, $Amazon.com(AMZN)$ +9.06%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +1.16%, $Meta Platforms, Inc.(META)$ -7.13%, $Tesla Motors(TSLA)$ +1.32%.

Big-Tech’s Key Strategy

Post-Earnings Drop of Over 20%, Yet a Rebound on Market Sell-Off Day—How Are Investors Viewing META at 21x P/E?

META's stock plunged nearly 20% following its Q3 FY2025 earnings release, erasing 50% of its rebound from April 4, 2025. However, on November 13—amid a broad tech sector rout—it bucked the trend with a modest rebound. Some investors may dismiss this as a classic "oversold bounce," but it masks deeper divergences in interpreting META's cash flow value.

The sustained post-earnings decline stems primarily from concerns over AI-driven capital expenditures eroding short-term margins. Q3 results showed capex surging 110.5% year-over-year to 37.8% of total revenue, with full-year guidance raised to $70-72 billion. Management signaled that 2026 capex growth in dollar terms will "significantly exceed" 2025 levels, accelerating operating expense growth. In the days after the October 29 release, shares fell from around $627 to approximately $609 by November 14—a cumulative 3% drop, partially unwinding early gains and resulting in a near-20% decline from earnings day, with trading volume spiking 59%. This reflects investor sensitivity to AI investment pressures: while hefty spending builds infrastructure, it squeezes margins (Q3 operating margin contracted 200 basis points ring-to-ring, largely due to record-high R&D spend). Amid economic slowdown risks, the market views this as an "overinvestment" signal, akin to cases like Anthropic.

Actual free cash flow (FCF) trends have worsened, amplifying short-term financial risks. For the first three quarters of FY2025, FCF declined sequentially, with Q3 down 31.5% year-over-year amid an expanding gap, dragged by aggressive capex. Projections suggest an even steeper 2026 drop, potentially turning negative or near zero, given 2025 capex nearly double 2024 levels. Latest data shows Q3 FCF weakened even after adjusting for a $1.6 billion one-time tax hit, mirroring an industry-wide "AI spending race" seen at Microsoft (Q1 capex $34.9 billion) and Google (FY capex $91-93 billion).

Investor splits center on this: Bears argue FCF deterioration degrades the stock's "quality," fueling narratives of "massive spending without clear products" and "no product returns," intensified by Chief AI Scientist Yann LeCun's planned departure to launch a startup. Hyperscalers' total capex has ballooned from $314 billion to $518 billion, yet unlike Google's clearer cloud monetization path, META's outcomes hinge on profitability conversion.

Bulls, however, emphasize long-term upside, viewing Meta AI as boosting ad efficiency in a "virtuous flywheel." Products lead the industry (surpassing some closed models), but monetization requires a 2-3 year cycle with no immediate revenue anchors; success could sustain +20% ad growth.

While FCF weakness looks ugly, it's not fatal—META's ~$60 billion cash pile provides ample buffer. Accelerated AI monetization (e.g., ad optimization) could reverse it; otherwise, debt issuance might raise leverage risks. Overall, FCF strain acts as a catalyst for sellers but highlights entry opportunities for buyers.

AI product momentum remains robust, though long monetization cycles fuel market skepticism. META's Llama 4 family advanced significantly in 2025, including Scout (multimodal with long-context support) and Maverick (efficient inference), plus the delayed Behemoth release. It also launched the Meta AI app as a personal assistant, with daily active users integrated into the Family of Apps, driving ad demand. Updates highlight Llama 4 enabling multimodal innovations like immersive video and superintelligence at low cost and open-source leadership. In sum, AI products are central to META's pivot, requiring balanced spending and execution to rebuild confidence.

Current valuations embed a risk premium, offering appeal but with volatility caveats. At the November 14 close of ~$609, META's non-GAAP FY2026 P/E is ~21.4x (assuming flat EPS), below its 5-year average of 22.9x and Google's 27.7x—the lowest among the "Magnificent 7." GAAP P/E stands at 27.7x, unexpanded.

Post-earnings selling has reset multiples, with consensus targets around $700. Short-term capex impacts could compress forward P/E to 15-18x lows.

Recent copyright litigation yielded an initial win, but lingering risks could slow AI development. In an LLM training copyright suit, META secured a "fair use" defense, with the judge deeming it "transformative," providing legal cover for Llama models and easing broader industry pressures. However, market harm evidence remains pivotal, and distribution rights are unresolved. A loss could trigger massive settlements (e.g., Anthropic's $1.5 billion). The judge stressed "market harm" as key; stronger future evidence (e.g., quantifying AI's negative sales impact on books) could overturn wins. November updates note a suit from Entrepreneur magazine over AI training infringement, with 59 U.S. AI copyright cases total; parallels include OpenAI's German loss with damages and disclosure of 20 million chat logs. Absent proof of data compliance (e.g., BitTorrent safeguards), risks persist—non-core to selling but potentially escalating costs, impairing FCF, and delaying Llama iterations. Overall, the win bolsters open-source AI legitimacy, but parallel cases warn META to bolster compliance and avoid becoming "the next big legal headache."

Big Tech Options Strategies

This Week's Focus: Google's "E-Commerce Space"?

Google's recent AI shopping updates underscore its shift from search giant to agentic life assistant, smartly targeting holiday-season e-commerce pain points via Gemini-powered conversational queries and agent-based checkout. This enhances conversion efficiency in a closed-loop "flywheel." Early U.S. user tests show response times down to 3 seconds and 95% inventory accuracy, poised to lift Q4 ad click-through rates 10-15% and contribute 5-10% to holiday e-commerce GMV (CNN forecasts $1.2 trillion for U.S. holiday e-commerce in 2025). Sentiment is upbeat, seeing this fortify Google’s 91% global search moat and outpace rivals like Amazon's Rufus and OpenAI's ShopGPT.

That said, the EU probe into Google's search spam policies highlights regulatory risks, though its AI infrastructure and energy partnerships demonstrate strategic resilience—short-term volatility won't derail long-term AI dominance. On November 13, the EU launched an investigation alleging unfair ranking harms publishers, following over €8 billion in past fines. Concurrently, Google inked a 15-year, 1.5 TWh renewable power deal with TotalEnergies for its Ohio data centers and committed $15 billion to a 1GW cluster in India's Vizag.

From an options perspective, the current spot price sits well above key pain points, with near-term levels remaining cautious. Yet for December expiry, open interest in puts above 300 is light, and volumes at 260-280-300 strikes are evenly distributed—overall signaling an upward bias.

Big Tech Portfolio

The "Magnificent Seven" form an equal-weighted investment portfolio ("TANMAMG"), rebalanced quarterly. Backtests since 2015 show it vastly outperforming the S&P 500, with total returns of 3,075.39% versus SPY's 292.13%—an alpha of 2,783.26%, and still trading at elevated levels.

Year-to-date, Big Tech gains have hit new highs at 23.77%, surpassing SPY's 15.37%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- FabianGracie·2025-11-14Solid breakdown mate! Magnificent Seven still printing alpha even in this macro mess [得意]LikeReport