Teach you how to use the Iron Eagle strategy to secure TSMC's fluctuating returns

November 10th,$Taiwan Semiconductor Manufacturing (TSM) $Announced sales data for October 2025, revenue of approximately NT $367.47 billion, an increase of 11% month-on-month and 16.9% year-on-year, which is the slowest growth rate since February 2024. Cumulative revenue in the first ten months of 2025 was NT $3,130.44 billion, an increase of 33.8% compared with the same period last year.

The company expects AI-related demand to continue to be strong and maintains its plan for capital expenditures of up to $42 billion in 2025. Wei Zhejia, chairman and CEO, also reminded that there will still be uncertainties and risks from tariff policy in the future.

Collaboration with Nvidia deepens

Nvidia CEO Jensen Huang visited Taiwan in early November to visit TSMC's 3nm wafer fab and put forward additional demand for AI chip supply.

TSMC subsequently increased Nanke Fab 18B 3nm production capacity from 100,000-110,000 pieces per month to 160,000 pieces, an increase of 45%-50%, of which Nvidia's additional orders accounted for approximately 35,000 pieces per month. The order covers the Blackwell Ultra launched this year and the Vera Rubin platform next year, both using TSMC's N3P process.

Wei Zhejia told analysts in October that the company's production capacity remained "very tight" and it was trying to close the gap between supply and demand. Against this background, Nvidia is actively striving to become one of the main customers of TSMC's 3nm process, which is expected to account for about 30% of total production.

Advanced process price increase strategy

Recently, TSMC announced a comprehensive price increase for 2nm, 3nm and 5nm process wafers, an increase of 8%-10%. The price of 2nm process is expected to be at least 50% higher than that of 3nm. The company emphasized that the 2nm process involves huge investment in R&D and production, so the price is difficult to be favorable.

The price increase will push up the cost of flagship chips such as Apple's A19 Pro and Qualcomm's fifth-generation Snapdragon 8, and is also expected to affect the pricing of high-end products from other manufacturers such as Xiaomi. Analysts believe that this is TSMC's strategy to strengthen its pricing power and cope with high-cost investment in the field of advanced manufacturing processes. It also shows its oligarchy status under technical and capital barriers.

Iron Eagle Options Strategy

1. Strategy structure

Investors build an Iron Condor option portfolio:

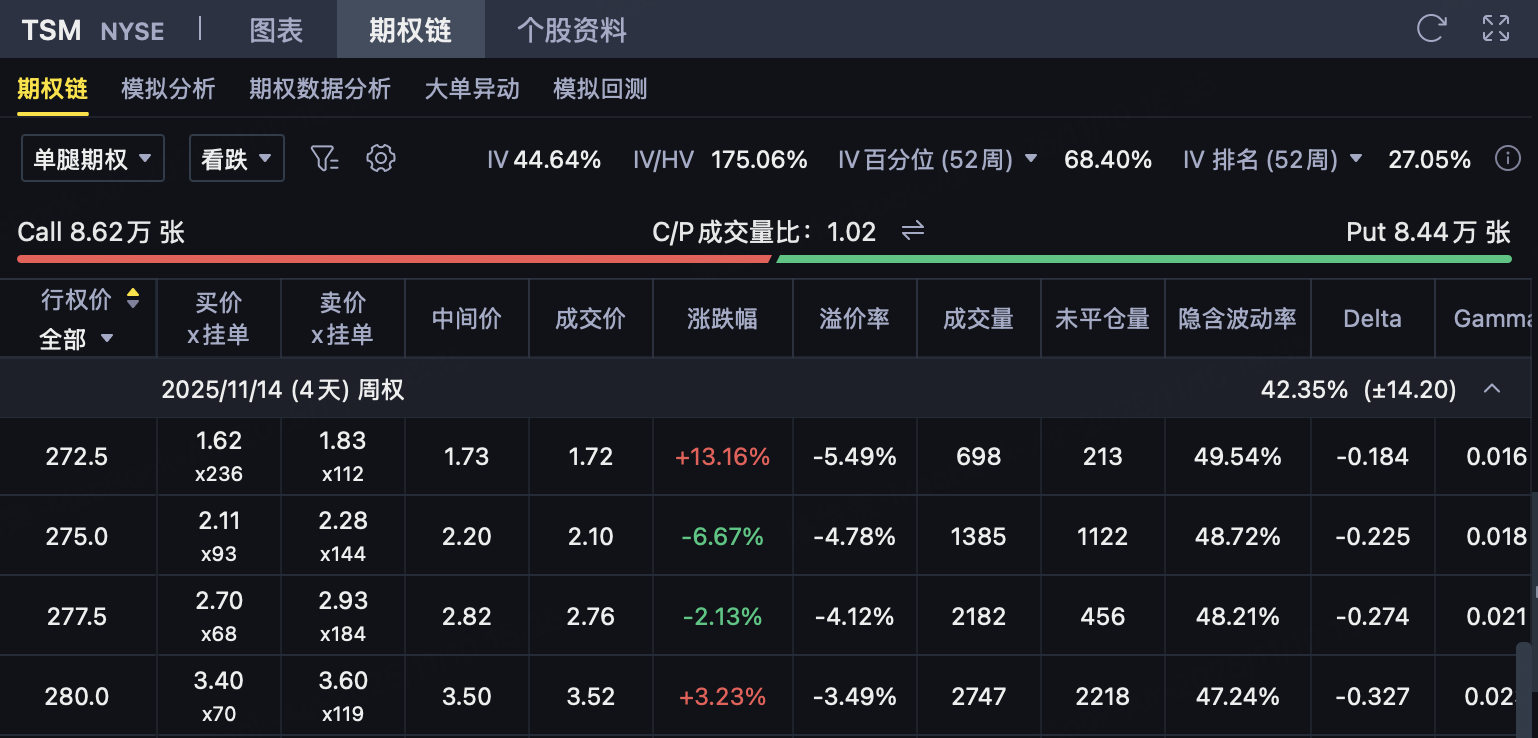

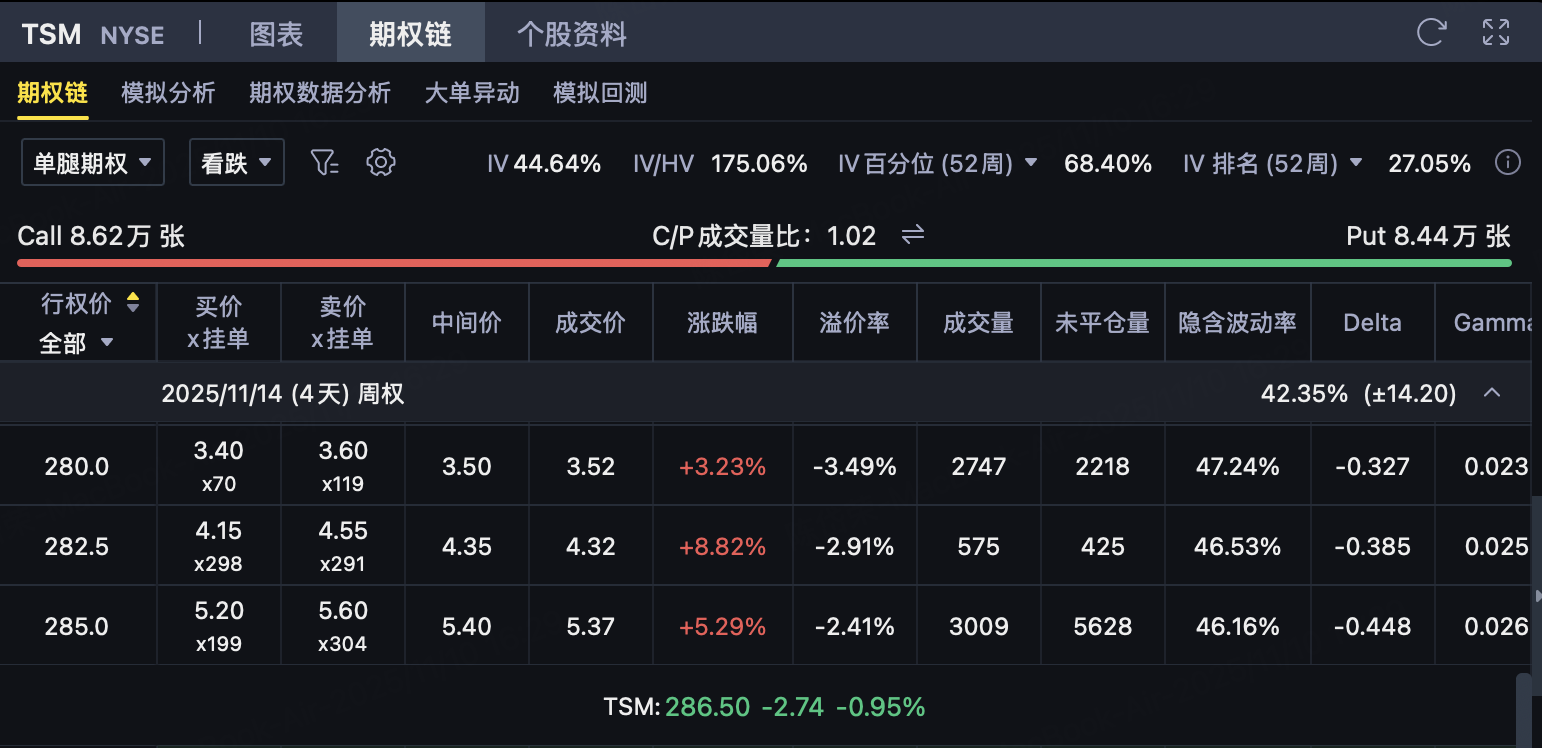

Buy a Put with a lower strike price (Put):K ₁ = 272.5, premium spend $1.72

Sell a Put with a lower strike price (Put): K ₂ = 280, premium earns $3.52

Sell a Call with a lower strike price (Call): K ₃ = 302.5, premium earns $1.31

Buy a Call with a higher strike price (Call): K ₄ = 315, premium spending $0.23

Four options have the same expiration date.

Investors collect premium by selling the middle two options (280 Put and 302.5 Call) and limit the risk with the options bought at both ends (272.5 Put and 315 Call).

This combination makes the biggest profit when the underlying price remains within the range [280, 302.5], which belongs to the "shock neutral strategy".

Initial net income

Net premium income = (income from selling Put + income from selling Call) − (expense from buying Put + expense from buying Call)

= (3.52 + 1.31) − (1.72 + 0.23) =$2.88/Share

Corresponding total revenue = 2.88 × 100 =$288/contractThis amount is when the investor opens a positionMaximum potential profit。

3. Maximum profit

condition: The price of the target at expiration is between 280 and 302.5.

result: All options are not exercisable, and investors retain all net premium.

Maximum profit= Net income = $2.88/share

Corresponding total profit=$288/contract

4. Maximum loss

condition:

If the underlying price is ≤ 272.5: the put spread (280-272.5) is fully exercised

If the underlying price is ≥ 315: the call spread (315-302.5) is fully exercised

Unilateral loss= interval difference − net income

Bearish Range Spread: 280 − 272.5 = $7.5

Bullish range spread: 315 − 302.5 = $12.5

Because the two wings of the iron eagle are usually symmetrical, if calculated on the narrowest side ($7.5), the maximum loss = 7.5 − 2. 88 =$4.62/ShareCorresponding total loss = 4.62 × 100 =$462/contract

5. Break-even point

The Iron Eagle strategy has two break-even points:

Lower equilibrium point= Higher Strike Price Put − Net Income = 280 − 2.88 =$277.12

Upper equilibrium point= Lower Strike Price Call + Net Income = 302.5 + 2.88 =US $305.38

Hence:

When the target price is at277.12 vs. $305.38Within the range, investors are profitable;

The price exceeds this range and starts losing money.

6. Risk and return characteristics

Maximum benefit: $288/contract

Maximum loss: About $462/contract

Profit-loss ratio: about 1: 1.6

Applicable scenarios: Investors expect the underlying price to remain range-bound for some time to come (around $280-$302.5), with little fluctuation.

Strategic positioning: A stable neutral strategy, which obtains stable returns with limited risks, is suitable for the market environment where volatility is expected to fall after high.

Engage and Win Options Rewards!

Share your thoughts on options trading or the market in the comments below.

10 lucky participants will each receive a free copy of the Options Handbook!

Already have one, you’ll get a USD 5 Options Voucher instead!

The Options Handbook takes you from the fundamentals to advanced strategies, helping you gradually build your own trading system. You’ll also gain insights from 10 top traders, and learn how to avoid common options trading pitfalls — making your decisions clearer.

💬 Don’t miss out, drop your thoughts and win your reward!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.