Binge on Taxes: Netflix's Q3 Earnings Plot Twist

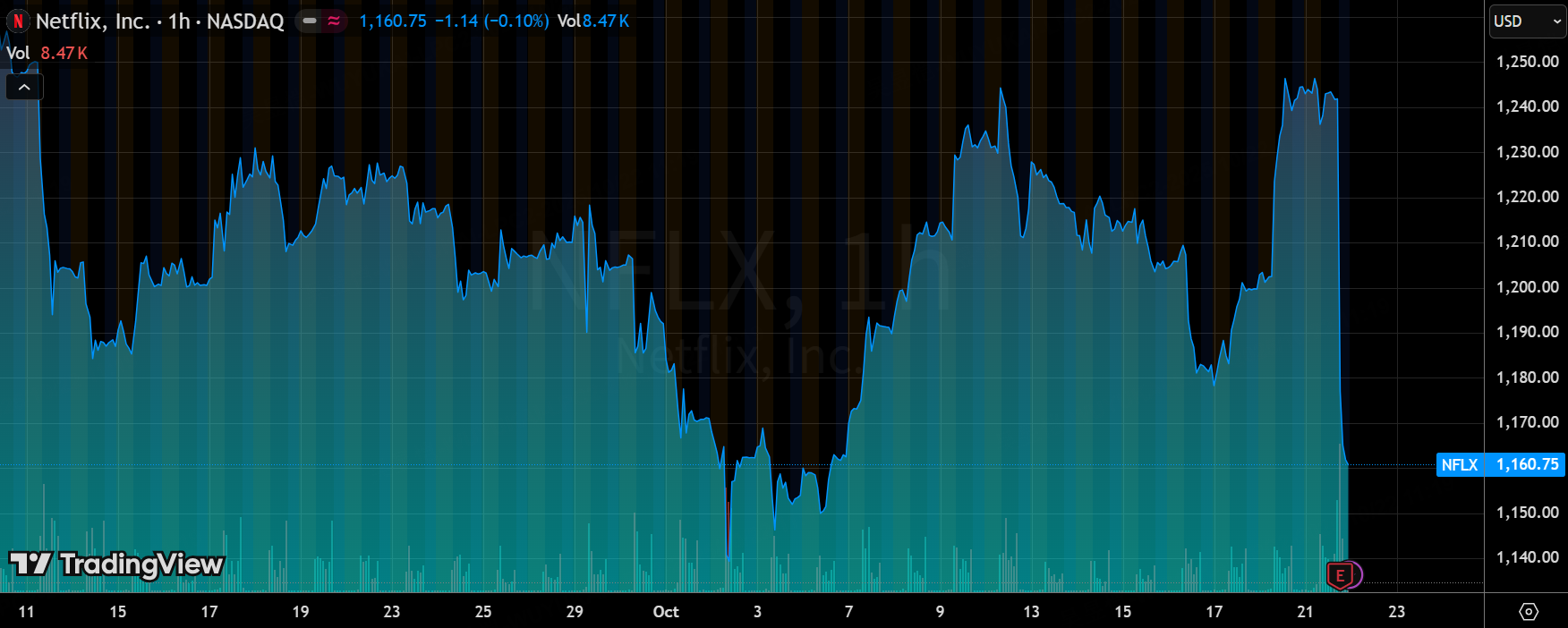

$Netflix(NFLX)$ 's 2025 Q3 earnings delivered a seemingly "chilling" upset—net profit and EPS both missed expectations by a wide margin, sending shares tumbling over 7% in after-hours trading. Yet, the real culprit isn't a business slowdown, but a one-off $619 million hit from Brazilian municipal service taxes accrued since 2022.

Fundamentally, revenue held steady at a double-digit 17.2% YoY growth, ad revenue hit a quarterly record, free cash flow surged 21.2% YoY, and subscriber adds were steady (if unexciting) buoyed by blockbuster IPs. The flaws? Short-term profit distortion, pricing pressures testing user tolerance in core markets, and content spend potentially lagging the year's initial targets.

All told, this quarter's results are "flawed but flawless"—a fleeting emotional jolt that won't derail the steady long-term pivot from subscriptions to ads.

Earnings Core Highlights

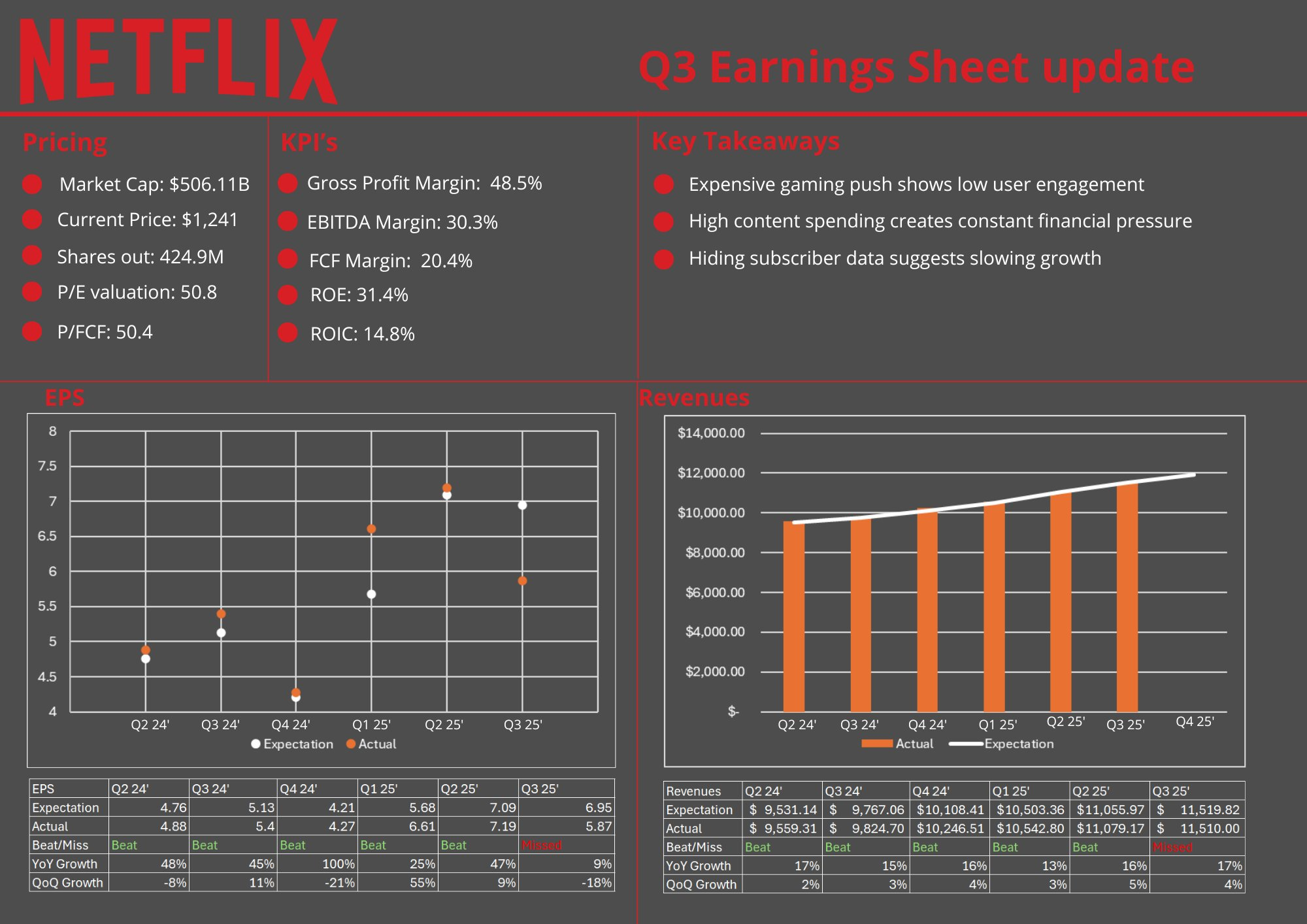

Revenue: $11.51B, +17% YoY, +4% QoQ

Driven by subscriber growth, pricing tweaks, and ad contributions, with neutral forex impacts. It matched consensus estimates (~$11.51B) but didn't beat them. Structural shifts: Regional breakdowns show APAC leading at +21%, while LATAM lagged at +10%, signaling stronger ad and localization pull in emerging markets, with mature regions leaning on price hikes.

Operating Profit: $3.248B, +12% YoY, Operating Margin 28.2%

Powered by content cost discipline and ad efficiencies, but dragged down by over 5pp from the $619M Brazilian tax accrual (spanning 2022-Q3). Strip it out, and the true margin hits 33.6% with +33% YoY growth—beating expectations. It underperformed surface consensus due to the tax not being baked into prior guidance. Structural note: This underscores global tax risks, though management downplays future drags, prioritizing cash flow tweaks

Free Cash Flow: $2.66B, +21% YoY

Fueled by robust operating cash and reined-in content outlays (Q3 spend at $4.6B; full-year now eyed at $17-17.5B vs. $18B target). Beat estimates, with FY guidance bumped to $9B. Shifts: Share repurchases ramped up ($1.9B for 1.5M shares in Q3), signaling valuation confidence; content capex has tightened for two straight years, likely aided by AI efficiencies and a softer competitive landscape.

Subscribers & ARPU

Early-year US/EU price hikes (10-20%) offset ad-tier penetration, yielding ~5% ARPU growth per the latest readouts. With firm ad targets and hits like KPop Demon Hunters and Wednesday S2 exploding, the lack of an upside surprise likely stems from users' ad-experience adjustment phase—missing high market hopes fueled by Squid Game 2 buzz.

Key takeaway: Rising ad-tier share dings near-term sub revenue but unlocks ARPU upside as ads mature.

Ad Revenue: On Track for FY Doubling (~$1.5B)

Q3 marked the first full quarter for the in-house ad platform, hampered by macro tariffs and optimization tweaks. No exact figure disclosed, but hailed as the "best ad quarter ever," aligning with the FY doubling goal (per market ~$1.5B).

Crucial: Q4's Amazon DSP integration could be a spark; US upfront commitments doubled, marking a shift from ramp-up to scale, with outsized future revenue potential.

Signals for the Road Ahead

Guidance remains measured for Q4 and FY: Q4 revenue at $11.96B (+16.7% YoY), op margin 23.9% (+2pp YoY); FY revenue $45.1B (+16%), op margin 29% (down 1pp on Brazil tax), FCF ~$9B (upped). We'd call this conservatively tuned—in line on revenue, buffering profit for tax fog, while the FCF lift highlights spend control; it's pragmatic realism versus the bolder ad-doubling ambition, dodging the trap of overpromising.

On the earnings call, execs noted doubling US upfront commitments: "Now we're on track to double ad revenue in 2025 (albeit from a small base)." This smacks of upbeat soothing—leaning on "record" and "double" for morale boosts, cushioned by the "small base" qualifier to temper risks, striking a balance between grit and glow. CFO Spencer Neumann added: "The Brazil tax dispute won't materially impact the future; our focus is sustainable profit growth and member value." It's a candid pivot: owning the hit but swiftly zooming to the horizon, nixing doomsday spins.

On capex: "Content spend contraction is deliberate, not forced—GenAI is already streamlining production efficiencies." This unpacks the cash strength, nodding to enduring margin tailwinds. Overall, tone is neutral-to-bullish, wielding AI and content wins (e.g., "AI empowering creators with de-aging in Happy Gilmore 2") to soothe frayed nerves.

Investment Highlights / Our Take

The "earnings miss" is smoke and mirrors—adjusted for noise, fundamentals shine. That $619M Brazil tax is the quarter's profit wildcard; sans it, op margins (33.6%) and net growth (+33%) crush consensus, affirming no erosion in core subs + ads profitability. The 7% after-hours plunge? Classic knee-jerk venting, not fundamentals fracturing—expect shares to rebound as tempers cool.

Structural View: Netflix's trajectory splits cleanly. Ads and sports streaming (e.g., NFL Christmas games, boxing bouts) are enduring lanes—the former channeling Hulu's playbook for ARPU premiums post-maturity, the latter gluing viewers via tentpole events like Canelo vs. Crawford's record-breaker. Conversely, sub growth rides content fads (Squid Game S3 vibes), but post-hike adaptation woes expose fragility, echoing last quarter's "high-val miss = penalty" script—perhaps amplified by Musk's "cancel Netflix" crusade.

Cash flow and cost reins scream long-term ballast. FY FCF guidance to $9B marks a 6.7-12.5% hike over prior; even at $17.5B content cap, it blankets spend + buybacks ($1.9B in Q3 alone), no sweat on balance sheet health. Two years of deliberate capex curbs (2024 vs. 2025), plus GenAI production boosts, keep margin expansion alive—just at a gentler clip than the prior 3pp annual pace.

Strategic Call: No glaring missteps in leadership's playbook, but the capex pullback merits a spotlight—perhaps heralding a platform pivot, leveraging GenAI for leaner costs and sideways leaps into gaming/live. That said, downplaying tax pitfalls (Brazil redux) calls for beefier global compliance. Versus yesteryear's burn-for-share frenzy, this feels like a growth-to-value metamorphosis.

Valuation Split: At 35x forward P/E (lagging Mag7), it bakes in 15-20% profit CAGR—pricing feels topped out. Post-peak content jitters (10-15% rev growth implying sub-20% profits) brew bubble vibes; yet versus $Walt Disney(DIS)$ + (25x P/E, sputtering growth) or Amazon's embedded Prime Video (opaque multiple), Netflix's global reach and AI edges (recs, localization) look underbaked—30x ( ~$1,100/share) offers a cozier margin of safety. If rev holds 10-15% and profits ease below 20%, the short-term val-growth sync skews low, flirting with pullbacks.

Ad uplift (ARPU kicker), sports ramp (underinvested), IP extensions (KPop merch tie-ins) harbor untapped juice—the 35x anchor holds firm. For safety's sake, though, we'd eye 30x for sweeter entry odds.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- ElvisMarner·2025-10-22Given the tax hit, it’s wise to remain cautious. Could this impact future content investments?LikeReport

- Valerie Archibald·2025-10-23看起来它停在了200日均线。LikeReport

- Enid Bertha·2025-10-23Overreaction! This will be at ATH by end of year!!LikeReport