Tech Weekly: ChatGPT Hits Brakes, Meta Off-Balance Gambit—How AI, and Earnings Bust the Deadlock?

Last week, the $Cboe Volatility Index(VIX)$ (fear index) surged sharply, and gold prices kept pushing to new highs, yet the $NASDAQ 100(NDX)$ managed a solid 2.1% gain. The market was busy digesting a short-term pullback in non-profitable tech stocks (down 8% from Thursday to Friday, but still up a slim 0.5% for the week), while chasing assets with strong long-term AI narratives—like $Broadcom(AVGO)$ announcing a 10GW partnership and Taiwan Semiconductor (TSM) noting that "AI demand is stronger than three months ago," which propelled the semiconductor sector to its best weekly performance since late June.

Behind this divergence, investors' real puzzle is: Will pullbacks in short-term speculative plays derail the long-term main themes?

Investors' "Defense Addiction" and Fading Earnings Season Impact

Over the past 4-5 weeks, the go-to move for U.S. equity TMT investors has been one thing: "defense." Amid a barrage of headline risks, factor rotations, thematic hype, and liquidity squeezes, capital has focused on dodging near-term pitfalls rather than hunting earnings-season opportunities. The clearest sign? Earnings reactions have been far weaker than expected, with traditional "earnings trades" largely absent—for instance, in queries on key industry names, pure earnings-related questions are only now catching up to thematic ones.

The bigger contradiction lies in "quality stocks falling out of favor." In a ramp-up of uncertainty, investors should be flocking to reasonably priced growth names and rock-solid fundamentals for stability—but lately, quality has been a drag. Leaders like $Microsoft(MSFT)$ Meta Platforms (META), $Visa(V)$ / $MasterCard(MA)$ , $Netflix(NFLX)$ , $Walt Disney(DIS)$ $ServiceNow(NOW)$ and $Cadence Design(CDNS)$ have mostly traded sideways over the past few months. Meanwhile, post-2024 Fed rate-cut cycle, "weak balance sheet stocks" have consistently outperformed "strong balance sheet ones"—a trend that screams the market is proactively pricing in a "benign macro environment," not hedging risks.

AI Sector's Soft Close Isn't a Peak—It's a Signal of "Duration Shift"

The AI sector wrapped up the week on an awkward note: Oracle (ORCL) and TSM saw pullbacks, and even AVGO couldn't hold onto gains from its 10GW catalyst. But this isn't a "top" for the AI trade; it's revealing a deeper pivot in the sector's thesis.

Short-term, expect amplified T+1 EPS volatility for AI-linked names—the market's take on AI results is "mixed bag," with unclear near-term profit realization for some, sparking phased profit-taking. Yet the mid-to-long logic is sharpening: As many AI projects pencil in rollouts post-2027, the theme is shifting from "short-term trading fodder" to "long-duration assets." In plain terms, these dips are more about digesting near-term hype than debunking AI's enduring growth story.

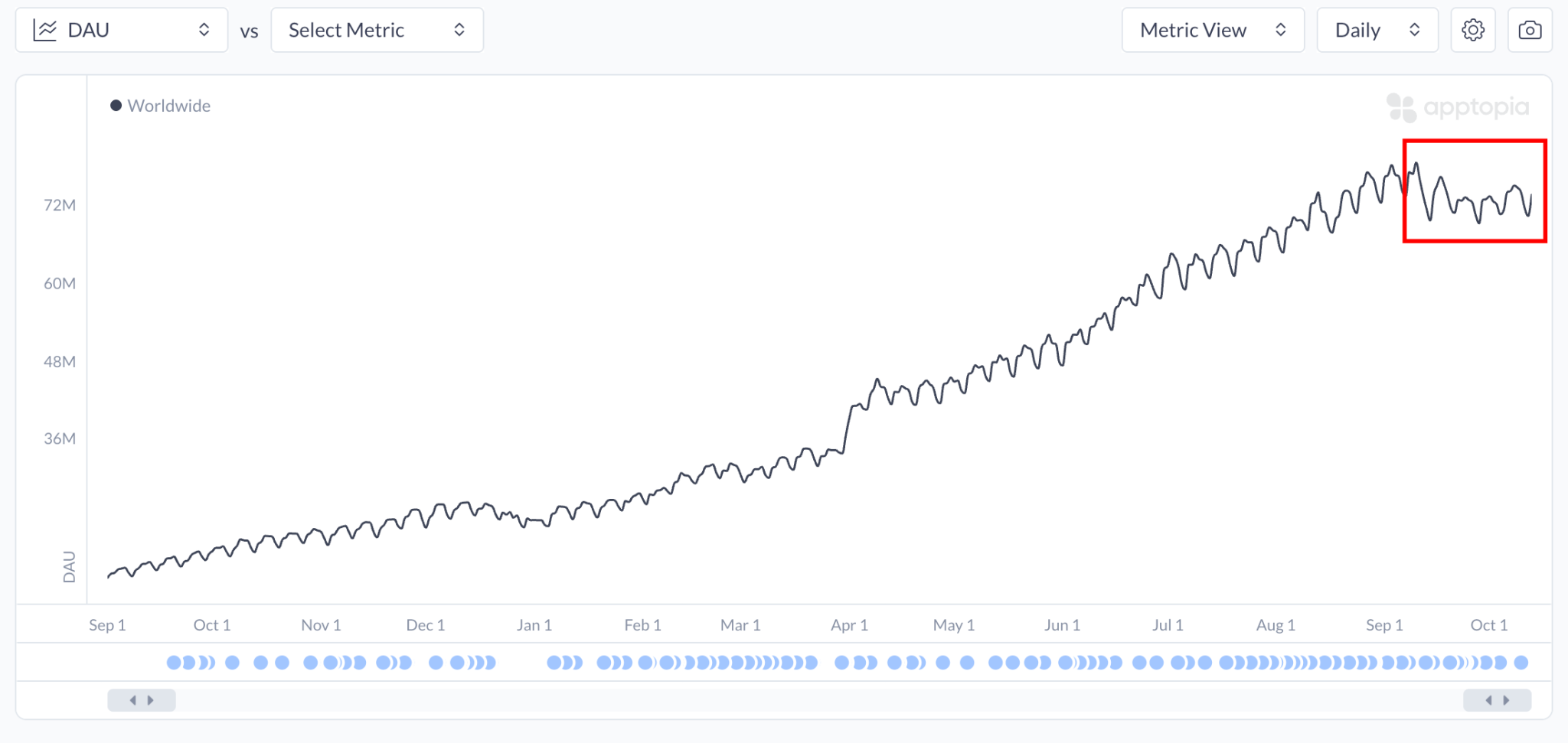

At the same time, headlines screaming "ChatGPT growth has peaked" are everywhere, but the data tells a different story: ChatGPT's slowdown isn't a stall-out—it's a gear shift.

User growth hits the brakes: Apptopia data shows ChatGPT mobile app global downloads decelerating post-April, with DAU flat over the last month and U.S. average session time stalling; Europe feels it more, per DB data, with OpenAI product transaction growth in France, Germany, Italy, Spain, and the UK dipping 3% in February 2025 and 1% in June.

OpenAI's revenue squeeze: ARR rocketed from $5.5B at end-2024 to $13B by August 2025 (wild YoY), but MoM growth is easing. The pivot to ads and adult content is basically a hedge against "existing revenue streams underperforming expectations"—but no need to panic. Andrej Karpathy's interview nails it: AGI is still distant, RL breakthroughs are needed; this is the industry snapping back to reality, not a death knell.

The Dip Isn't Weak Earnings—It's Overcrowded Positions

Last week's drops in TSM, ORCL, and HPE weren't about lousy results—they were position games:

$Taiwan Semiconductor Manufacturing(TSM)$ down 3-4%: Solid beat and positive AI commentary, but shares were already extended, Asian sentiment overheated, and history shows "sell the news" post-earnings. It's classic expectation realization.

$Oracle(ORCL)$ down 7%: Delivered blowout gross margin guidance and $55B in incremental RPO, but pre-earnings was all shorts covering and longs piling in; IR's early leak of positives led to "take profits while ahead." Post-digest, rebound likely—FY30 EPS path to $21 intact.

$Advanced Micro Devices(AMD)$ 's the one to watch: No ORCL-style capex funding worries; late-October earnings likely beat, with Nov. 11 analyst day dropping MI450 specs + new orders. Narrative just kicking off, better value than ORCL.

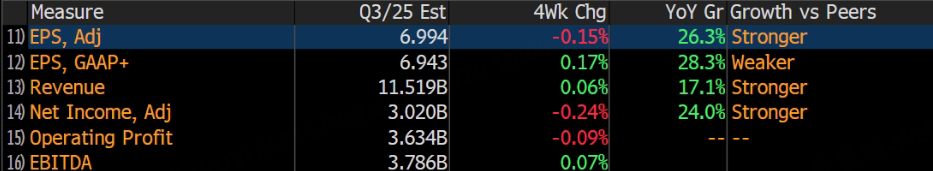

Beyond that, keep eyes on Meta Platforms (META) Q3 revenue growth at 25-26% (vs. street 22%), Alphabet (GOOGL) Cloud holding 32% (could hit 35%+ in Q1 next year if it clears), Microsoft (MSFT) Azure at 40-41% but watch Q1'26 base effects, and Amazon (AMZN)—worst sentiment, AWS needs 18.5-19%, retail data likely soft, tough road short-term.

Meta's $30 Billion SPV: Off-Balance-Sheet Financing Rewrites 2026 Capex Logic

$Meta Platforms, Inc.(META)$ 's $30 billion data center financing last Friday introduced a novel twist using SPVs (special purpose vehicles), directly impacting the entire hyperscaler industry:

Financing Structure Breakdown: Meta holds a 20% stake in the Louisiana data center alongside Blue Owl Capital; Morgan Stanley secured $27 billion in debt financing plus $2.5 billion in equity. Funds are borrowed by a special purpose vehicle (SPV), with Meta serving solely as developer, operator, and tenant. Project completion slated for 2029.

A Double-Edged Sword for Meta: The upside is that at least half of the $30 billion in capex slated for 2026 won't hit the books, likely prompting a downward revision of the market's original $12 billion capex estimate and preserving the balance sheet. The cost is annual rent and service fees of $2.6–3 billion, three times higher than the $1 billion annual depreciation cost of owning the assets outright. If the project is delayed, Meta will need to seek capacity compensation from $CoreWeave, Inc.(CRWV)$ , incurring additional expenses.

Industry Implications: Third-party capital is willing to share data center costs, meaning AWS and GCP's capex growth will slow in the future, but pressure on the expense side will increase—valuation models must be adjusted and can no longer focus solely on capex.

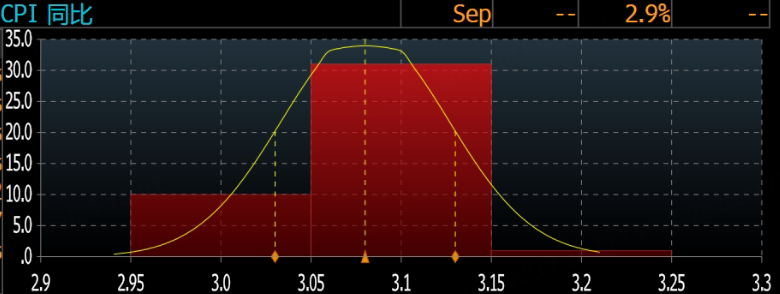

CPI Preview: September Core Inflation Likely Flat at 3.1%, Shelter as the Swing Factor

The U.S. September CPI—originally slated for last week—takes center stage this Friday (Oct. 24). Consensus points to "benign inflation": core CPI MoM up 0.25%, YoY steady at 3.1% (rounded), overall pressures manageable. $iShares 20+ Year Treasury Bond ETF(TLT)$

Key subcomponents to flag:

Autos: Used prices flat (aligning with auction signals), new up 0.2% (more dealer discounts), insurance +0.3% (online premium data).

Services: Airfares down 1.5% (seasonal unwind + online pricing pullback), shelter cooling (primary rents +0.25% MoM vs. Aug's 0.30%; owners' equivalent +0.26% vs. 0.38%).

Tariff ripple: Comms, furnishings, recreation—tariff-sensitive—expected to add 0.07pp to core; limited bite.

Six TMT Titans' Earnings Clash Sets the Week's Tone—Each with a "Make-or-Break" Question

This week, Texas Instruments (TXN), Netflix (NFLX), Amphenol (APH), IBM, Lam Research (LRCX), SAP, and more drop results in a frenzy—each could sway sector flows.

$Texas Instruments(TXN)$ (Oct. 21 after-hours): Can the "down curse" break?

Of the last 12 earnings, TXN fell T+1 nine times—shorts are glued to that streak. Split's on "demand recovery pace": Mgmt's in-quarter commentary stayed cautious ("no quick rebound signs"), but sell-siders still bake in "above-seasonal revenue." Soft guidance? Time to rethink "cyclical rebound" bets.

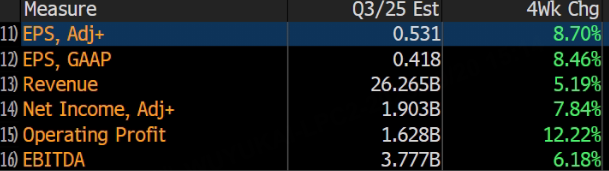

$Netflix(NFLX)$ (Oct. 21 after-hours): Implied vol -7.5%, ads as the breakout?

NFLX is the "least controversial" name: Steady beat, user engagement up expected—but the rub is "2026 vision delivery," especially ad monetization lagging hype. Shares range-bound since summer; no clear ad inflection? That 7.5% implied drop risk materializes.

Implied vol at 7% (below 9.5% avg). Two biggies: Revenue—Q3 consensus 17% growth (bulls 18%); Q4 guide 16%, 17%+ a win. No net adds disclosure anymore, but if full-year guide <13% street, near-term pressure. GenAI: Short-term sugar (AI in pre-viz, VFX, scripting cuts costs/boosts recs), long-term sour (ChatGPT steals time, Sora 2 democratizes content, eroding moat). But next 12 months favor the upside; shares near 150-day MA (5-year buy zone), Q4 bangers like The Witcher and Stranger Things loom—dips = buys.

$Amphenol(APH)$ (Oct. 22 pre-market): Unicorn's AI mettle on trial

APH is unicorn poster child—secular AI/data center tailwinds + cyclical rate-cut boost. Shares +120% past 4.5 years, +115% last 6 months; Q2 IT/data comm rev +133% YoY (+29% QoQ). Key: "AI growth sustainability"—Q2's $150M windfall from "early project deliveries" needs validation as non-one-off.

$IBM(IBM)$ (Oct. 23 after-hours): 5-year returns match MSFT, software the decider

Overlooked gem: IBM's 5-year return rivals Microsoft's. Focus: Can software reclaim double-digit growth? Quantum/genAI upside could juice multiples—short-term sentiment sour, but mid/long money eyes its "tech + value" blend.

$Lam Research(LRCX)$ (Oct. 23 after-hours): After 20-year best run, can high bars hold?

LRCX just nailed "best 24-day streak in 20+ years"—+54% Sept 1-Oct 1, 10/13 prior earnings beat EPS (mid-single digits). But longs are maxed, expectations topped out, bull case eyes H2'26—if Q3 misses the inflated bar, pullback trigger.

$SAP SE(SAP)$ (Oct. 23 after-hours): 9/10 earnings pops, valuation edge shines

SAP's "win rate" crushes: 9/10 T+1 gains last decade. Debate's on "H2 execution," but mid-term, PEG (PE-based) 1.4x, (FCF) 1.3x—mid-pack vs. peers (MSFT 1.5x, Adobe 0.9x). HANA momentum rolls; steady H2 guide = sector stabilizer.

$Tesla Motors(TSLA)$ (Oct. 23 after-hours): Record deliveries mask worries, AI strategy the valuation fork

Q3 deliveries lit a fire—497K units, +7.4% YoY, quarterly record, +12.2% vs. consensus. But lurking: "Policy stimulus front-running demand"—to offset U.S. $7.5K tax credit expiry, TSLA threw $2K discounts, 18-month free Supercharging; Sept alone +20% YoY propped it up. Can this "pulse growth" endure?

Earnings crux: Three tensions—

Delivery quality vs. margin grit: Street sees $26.6B rev (+5.5% YoY), adj. net -24% to $1.89B; auto gross ~15.9%. Shanghai's die-casting cuts hours 35%, per-unit costs -18% vs. '22—but price cuts could cap; sub-15% gross = multiple haircut.

AI/autonomy signals: TSLA's now an "AI play"—Wedbush pegs FSD alone at $1T mkt cap, Trump admin could ease regs. Watch CO/IL Robotaxi operator hires, CyberCab timeline—any wins echo NVDA surge.

Growth pivot: Energy storage 12.5GWh (+81.2% YoY) shows curve #2 promise, but Optimus ramp key—Orient Secs eyes big '26 robot output, 1M units = $500B add. Bulls (600 PT) bet AI pivot; bears (Wells 120 PT) call it legacy auto. Guidance breaks the tie.

Finding the Thread in Divergence: "Unicorns" as Potential Breakout Keys

Last week's TMT crux? Short-term noise vs. long-term logic tug-of-war: Non-profitable tech pullbacks signal hype fade, but semis/AI mains hold; quality's slump prices "macro tailwinds," not risk-off flip.

Next signals:

Friday's CPI confirming "soft inflation" to shape Fed bets.

Earnings clarifying "core themes"—especially unicorns like APH, $Caterpillar(CAT)$ $Flex Ltd(FLEX)$ blending secular AI + cyclical cuts, potentially flipping market from "defense" to "offense."

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-10-20META will go from being the worst to best performing in the mag 7, it already did it once and it will again, just watch the end of the month.LikeReport

- Venus Reade·2025-10-20I’m expecting a good week from TSM up to 320 to 340 before the end of the week and maybe earlierLikeReport

- PhoebeReade·2025-10-20The showdown between short-term hype and long-term fundamentals is fascinating.LikeReport