OpenAI joins forces with AMD, is it time to go long?

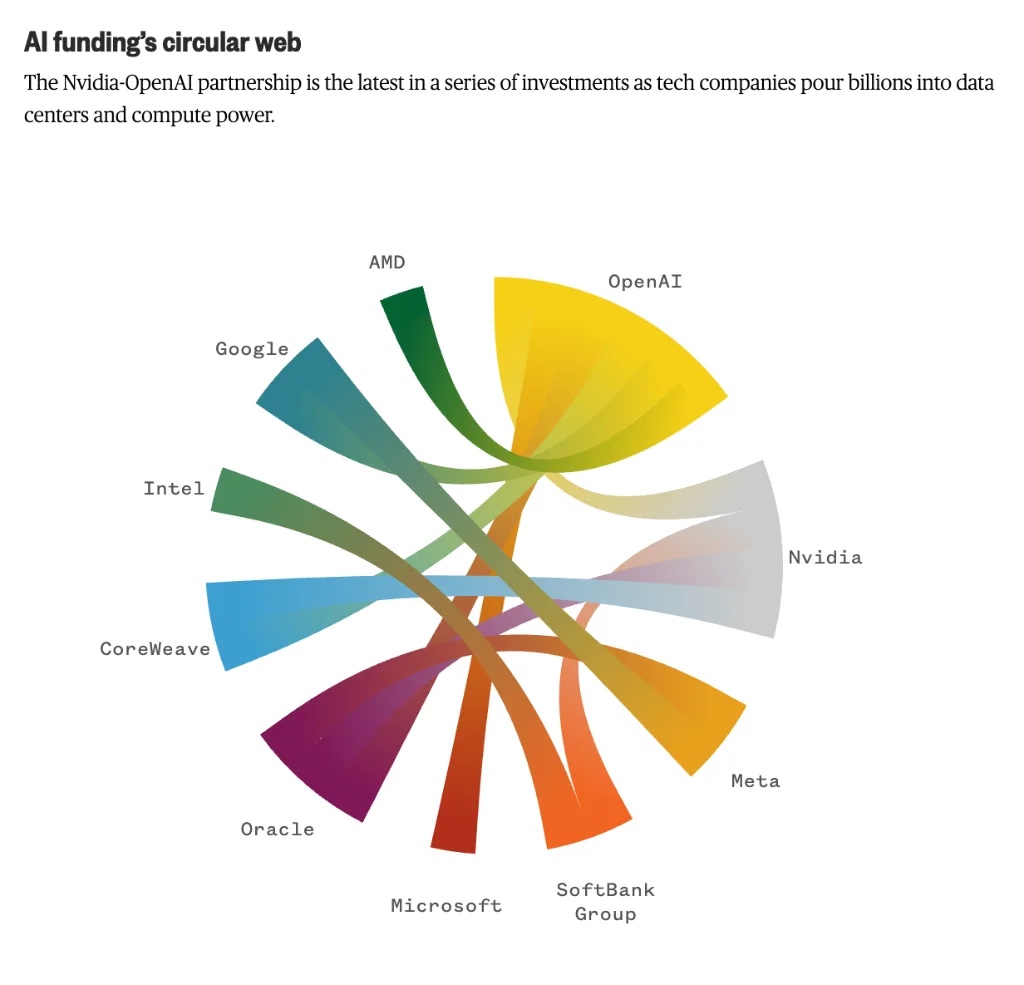

By expanding its "cross-shareholding" network, OpenAI is "deeply binding" itself to the entire AI industry chain.

Recently, John Foley, head of the flagship investment column of the Financial Times, wrote that what Sam Altman is building seems to be not only an AI company, but also a corporate empire deeply bound through interdependence and shareholding relationships. By transforming key suppliers into a community of interests, OpenAI is firmly locking its own success with the fate of the entire AI industry chain.

The latest move is a far-reaching agreement between OpenAI and chipmaker AMD. According to the deal disclosed on Monday, the partnership looks exactly like the deal OpenAI reached with Nvidia last month, which is essentially a long-term customer commitment:OpenAI promises to purchase high-end chips in large quantities, while chipmakers receive stable future income guarantees.

Moreover, AMD also provided warrants to OpenAI, giving the latter the right to 10% of the former's shares. As soon as the news came out, AMD's market value soared by more than 80 billion US dollars in a few minutes. The market used real money to vote confidence in Altman's "bundling" strategy, which also heralded a new "AI chaebol" with OpenAI as the core. It is beginning to take shape.

Create a huge "AI interest community" through "chip marriage"

The article emphasizes that OpenAI's alliance with two major AI chip competitors is a key link in its empire.The core of these two transactions is to use OpenAI's huge computing power demand as a bargaining chip in exchange for deep binding and financial support from chip suppliers.

In the partnership with Nvidia, OpenAI gets cash flow by selling its own equity, and Nvidia has locked in one of its most important customers. While in relation to$Advanced Micro Corporation (AMD) $In the cooperation, OpenAI has obtained more favorable conditions.

Details of the transaction show that as a deepening of cooperation, Nvidia will purchase up to US $100 billion in OpenAI shares over time; AMD provided OpenAI with a generous warrant. If specific performance targets are met, OpenAI has the right to acquire 10% of AMD's shares at a cost of only US $1.6 million. If AMD's stock price can reach $600, the equity will be worth as much as $96 billion.

Market analysts believe that this is not difficult to understand: AMD is still the catch-up in the AI chip competition. By deeply binding OpenAI, AMD is not only expected to achieve chip sales of up to US $200 billion (equivalent to its seven years of total revenue), but also take this opportunity to prove the powerful performance of its new MI450 chip to the market to attract more customers.

The article points out that the network of interests built by Altman goes far beyond chip manufacturers. In fact, looking at the whole picture, a well-designed and intertwined network of relationships has been formed.

The key nodes in this network include:Nvidia is not only a partner of OpenAI, but also holds shares in the data center company CoreWeave, and OpenAI happens to be one of the shareholders of CoreWeave; As an early investor in OpenAI, Microsoft has already been deeply involved in its development; At the same time, OpenAI also maintains a complex cooperative relationship with Google. It is not only a customer of Google Cloud services, but its model is also provided to other users through the Google Cloud Platform, playing the role of a supplier.

This intertwined shareholding and business relationship is forming a huge "AI interest community".

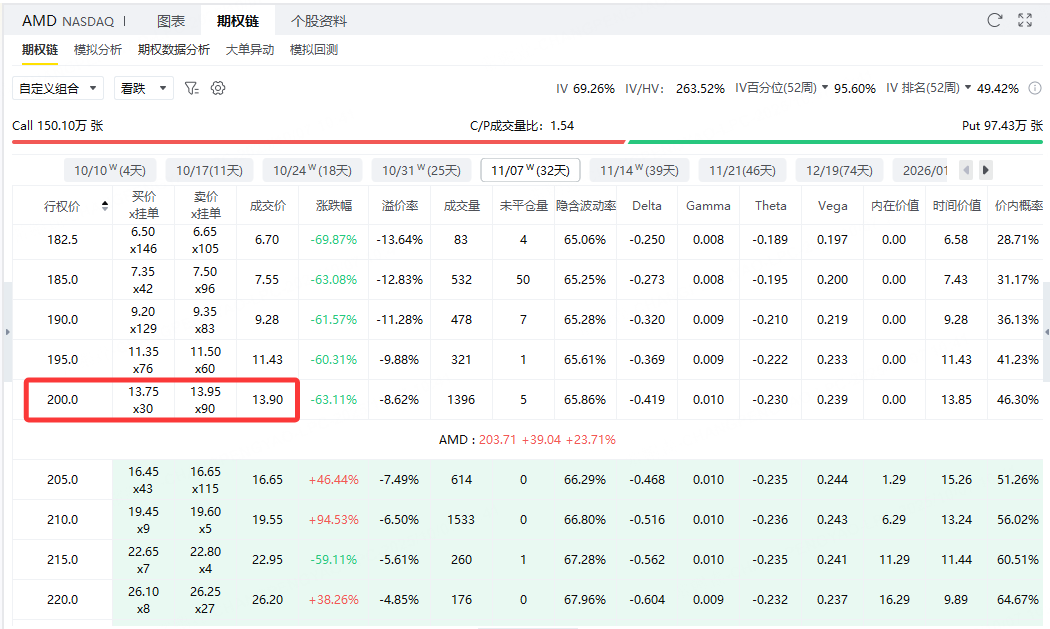

Go Long AMD With Put Options

The current AMD price is $203.71, and we can sell itExpires November 07, 2025, exercise price 200, premium $1390Put Option to go long AMD.

Not only does this strategy make profits when AMD maintains its current price or rises, it can make gains through premium even if the stock price drops slightly.

Current price of underlying asset: $203.71

Option type: Sell Put option

Strike price: $200

Expiration date: November 7, 2025

Premium revenue: $1390 (100 shares per contract)

Maximum benefit:If the AMD stock price is higher than or equal to $200 at expiration, the option will not be exercised and you retain your entire premium. The maximum gain is $1,390.

Maximum loss:If AMD's stock price falls to $0, you need to buy 100 shares of AMD at $200. The total cost is $20,000, minus premium's $1,390, and the maximum loss is $18,610.

Break-even point:$200 (exercise price) minus $13.90 (per premium) = $186.10. If the AMD expiration price is higher than $186.10, the overall strategy is profitable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.